08 Sep Bitfinex Alpha | BTC Consolidates Forward of Potential This fall Energy, as Bond Markets Contort

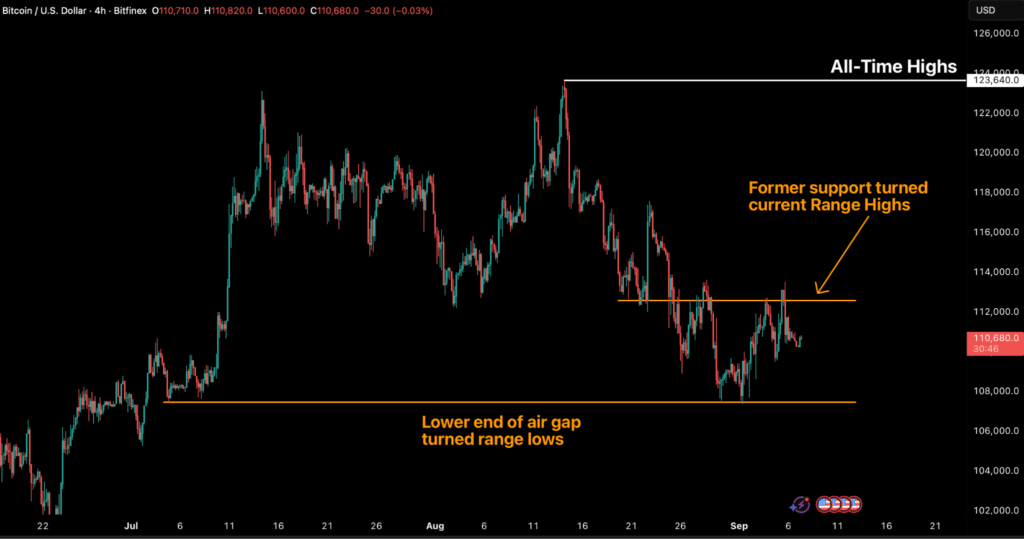

Bitcoin is holding regular between $108,000 and $112,000, with consumers defending key assist zones and filling the air hole left by July’s fast rally. Whereas a deeper correction stays doable, the extra probably consequence is time-based consolidation, particularly with September traditionally appearing as a cyclical low level forward of a traditionally sturdy This fall. Quick-term holder profitability has normalised, rebounding from 42 % to now 58 % of this cohort remaining in revenue, whereas ETF inflows have slowed sharply for each BTC and ETH. This cooling institutional demand highlights the market’s dependence on recent catalysts, although we see stronger spot conviction for BTC, in contrast with the combo of directional flows and arbitrage exercise that characterises ETH.

Seasonality provides weight to the present consolidation narrative. August closed with a 6.5 % decline, in keeping with its traditionally weak profile, whereas September is historically the softest month with a median −3.3 % return. That stated, the “purple September” impact has weakened lately, and This fall seasonality is traditionally highly effective, with October and November averaging outsized positive factors.

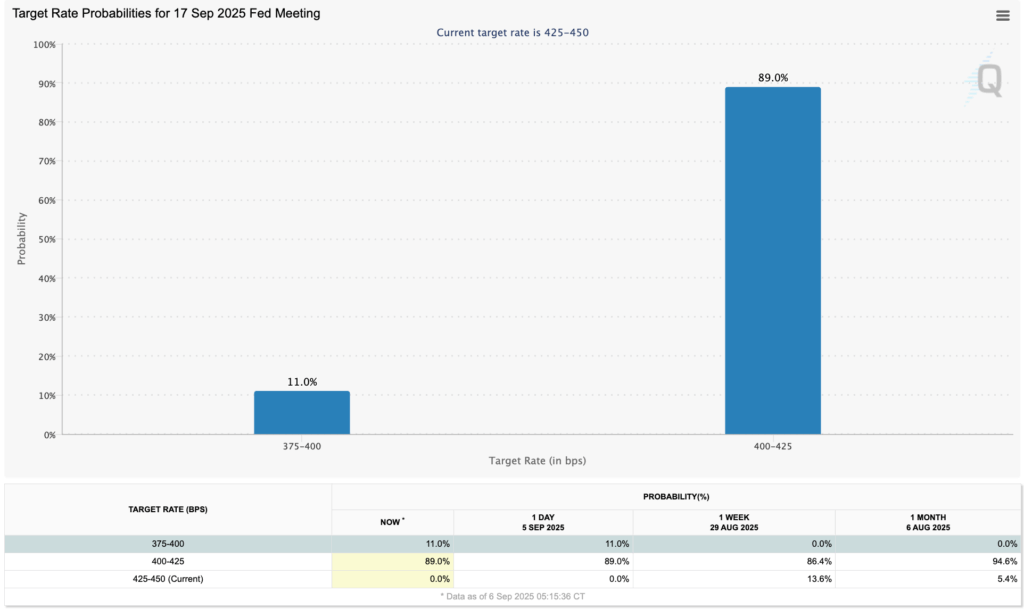

If the Fed confirms a September charge reduce, falling actual yields and a weaker greenback may amplify BTC’s seasonal upside, setting the stage for renewed momentum. Till then, consolidation stays the bottom case, with ETF flows, macro coverage shifts, and derivatives positioning appearing because the crucial alerts to observe.

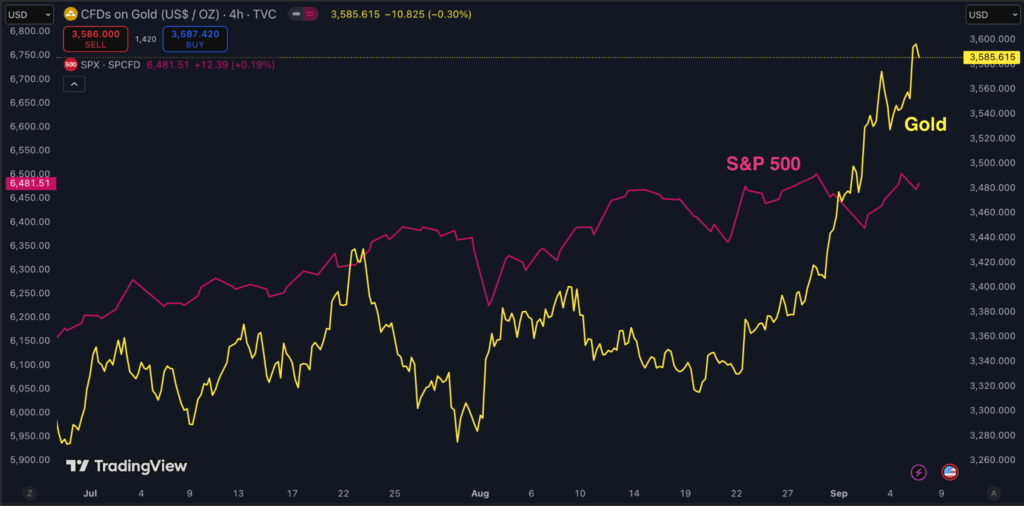

The US financial system is underneath mounting strain as weak labour information, bond market pressure, and political machinations across the Fed converge. The August jobs report on Friday, September fifth, revealed payroll development of simply 22,000 with heavy downward revisions, pushing unemployment to 4.3 %, its highest in almost 4 years. The softness strengthens expectations for a Fed charge reduce on the September sixteenth–seventeenth assembly, although sticky inflation complicates the choice. Bond markets mirror the pressure: short-term yields have dropped on expectations of a charge reduce, however the 30-year stays close to 5 %, signalling investor concern over deficits and financial credibility. This disconnect has steepened the curve, elevating long-term borrowing prices and fuelling a flight to gold, which surged to document highs close to $3,600 per ounce. Political dangers compound the problem as President Trump strikes to dismiss Fed Governor Lisa Cook dinner and threatens new tariffs on the EU, leaving traders to weigh not simply financial fundamentals but in addition rising uncertainty over Fed independence and US coverage course.

Within the meantime, the worldwide crypto panorama is shifting as regulators and markets transfer towards clearer frameworks. Within the US, the Securities and Alternate Fee and Commodity Futures Buying and selling Fee issued a uncommon joint pledge on Friday, September fifth, to coordinate extra carefully on digital asset oversight, concentrating on clearer guidelines for spot crypto merchandise, perpetual contracts, portfolio margining, and DeFi.

A joint roundtable on September twenty ninth will advance this agenda, and is additional buttressed by the Accountable Monetary Innovation Act of 2025, which requires the creation of a Joint Advisory Committee on Digital Property and mandating public responses to its suggestions. The invoice additionally introduces a measure of safety and clarification of the standing of DeFi builders, Decentralised Bodily Infrastructure Networks, airdrops and staking rewards. It additionally directs a examine on tokenised real-world property. Collectively, these strikes present Congress and regulators working in tandem to strengthen US competitiveness in digital markets.Institutional confidence in Solana can be rising. Final weekend, SOL Methods introduced it had secured approval to uplist to the Nasdaq underneath the ticker STKE, a milestone for the Solana-focused agency that has surpassed CAD $1 billion in delegated property and holds a treasury of almost 400,000 SOL. In the meantime, South Korea’s Monetary Providers Fee unveiled sweeping lending guidelines on September fifth, 2025, capping rates of interest, banning overcollateralised loans, and limiting eligible tokens to top-tier property, underscoring a proactive push to safeguard traders and stabilise home markets.