01 Dec Bitfinex Alpha | BTC Backside Ought to Be Close to

Bitcoin staged a notable restoration final week, rising over 15 % from its latest lows to $93,116 after enduring the sharpest correction of the cycle, a 35.9 % drawdown from its all-time excessive. Nevertheless, promoting stress stays as BTC moved 4.1 % decrease instantly after the present weekly open.

This rebound aligns with our earlier view that the market is approaching a neighborhood backside from a time perspective, though it’s but to be seen whether or not now we have seen a backside by way of worth. Nevertheless, with excessive deleveraging, capitulation amongst short-term holders, and rising indicators of vendor exhaustion, we imagine the groundwork is in place for a stabilisation section to start.

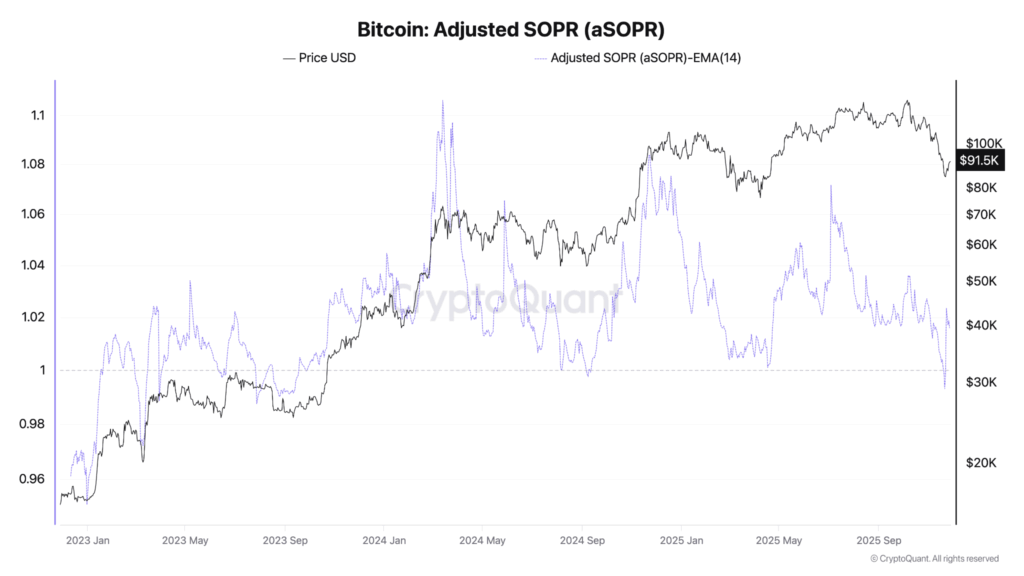

On-chain metrics additional reinforce this thesis: the Adjusted Spent Output Revenue Ratio has fallen under 1 for less than the third time since early 2024, matching the identical loss-realisation dynamics noticed at prior cyclical lows in August 2024 and April 2025.

The depth of present loss-taking can be evident in Entity-Adjusted Realised Losses, which have surged to $403.4 million per day, exceeding the losses measured by this metric at earlier main lows.

This stage of realised losses sometimes indicators that capitulation is nearing completion, relatively than the beginning of a deeper decline. In the meantime, derivatives information paint an analogous image of a managed reset: whole BTC futures open curiosity (OI) has declined to $59.17 billion, nicely under its $94.12 billion peak, indicating that leverage has been flushed out in an orderly vogue.

The continued contraction in OI alongside rising spot costs suggests quick overlaying relatively than renewed speculative risk-taking, reinforcing the view that the market is transitioning right into a extra secure consolidation regime, with decreased fragility and the potential for a sustained restoration base to determine itself in This fall.

Current US macroeconomic information revealed a rising divergence between softening client exercise and robust enterprise funding. Retail gross sales slowed sharply in September, rising solely 0.2 %, whereas the GDP-relevant management group slipped into unfavourable territory. Elevated costs, many influenced by tariffs, and fading earnings development weighed on households. On the identical time, wholesale inflation firmed, with PPI up 0.3 % on the month and vitality prices surging 3.5 %, indicating that upstream worth pressures stay sticky. Client sentiment has in the meantime deteriorated, with the Convention Board’s Confidence Index dropping to 88.7, as households develop extra cautious concerning the job market and pull again from big-ticket purchases.

In distinction, US companies are accelerating spending. Core capital items orders, an essential gauge of enterprise funding, rose 0.9 % in September, matching August’s momentum and much surpassing expectations. Corporations are ramping up investments in AI, automation, and productivity-enhancing tools, whilst tariff uncertainty weighs on elements of the manufacturing sector. This surge in enterprise funding has helped underpin a sturdy development outlook, with the Atlanta Fed’s GDPNow mannequin estimating 3.9 % annualised GDP development for Q3. The distinction between cautious customers and assured firms highlights a widening divide in financial behaviour, leaving the Fed to navigate December’s coverage assembly with restricted visibility and more and more uneven indicators throughout the financial system.

The previous week highlighted a transparent shift towards deeper institutional integration of Bitcoin. BlackRock’s newest SEC submitting confirmed its Strategic Earnings Alternatives Portfolio elevated its IBIT holdings by 14 %, bringing whole publicity to 2.39 million shares. The transfer underscores how even historically conservative bond funds at the moment are utilizing Bitcoin ETFs as diversification instruments, coinciding with rising structural help for IBIT, together with a proposed enhance in choices place limits to accommodate bigger institutional methods.

On the identical time, ARK Make investments continued to lean into crypto regardless of sector-wide liquidity pressures. ARK executed greater than $93 million in single-day purchases, including to positions in Coinbase, Circle, Block, and its personal ARK 21Shares Bitcoin ETF. With Coinbase now over 5 % of ARKK, the agency’s aggressive accumulation displays long-term confidence in digital property whilst crypto equities face sharp month-to-month declines.

Reinforcing this institutional momentum, Texas turned the primary US state to publicly put money into Bitcoin, allocating $5 million to IBIT as a part of its new state-level Bitcoin reserve program. Whereas modest in dimension, the transfer is symbolically important and marks the start of a transition towards direct BTC custody as soon as infrastructure is prepared.