15 Dec Bitfinex Alpha | 2026 WILL BE THE YEAR OF LIQUIDITY

Welcome to our closing version of Bitfinex Alpha 2025. On this version we glance again at what influenced the market in 2025, and what we imagine will decide efficiency in 2026.

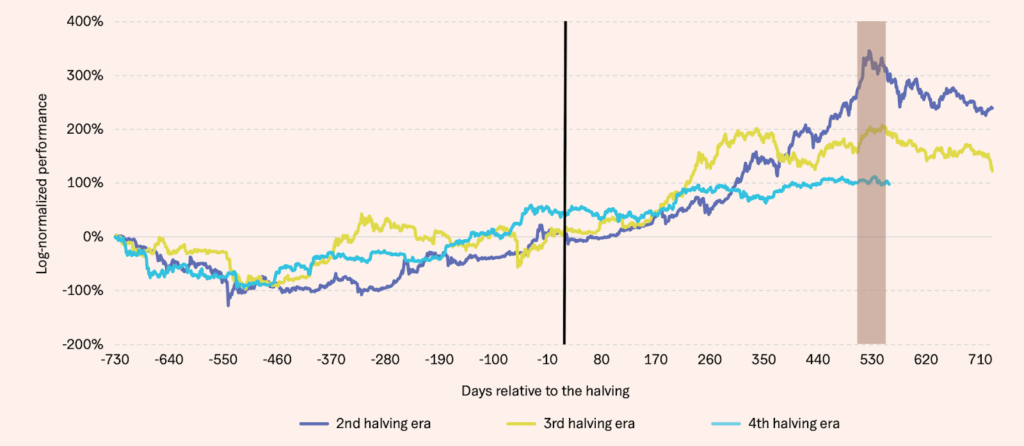

In what was an finish of an period, we noticed a transparent structural break from Bitcoin’s conventional four-year, halving-driven framework. With annual BTC issuance now under 1 %, the marginal provide shock from every halving has diminished, decreasing its potential to dictate market cycles. BTC’s worth behaviour is subsequently more and more formed by demand-side forces and macroeconomic situations quite than mechanical shortage alone.

This shift was evident in 2025. Regardless of halving fashions implying a accomplished cycle, Bitcoin prevented the deep drawdowns of prior eras. Structural inflows from ETFs, corporates, and sovereign-linked entities absorbed multiples of annual mined provide, compressing volatility and accelerating recoveries. Drawdowns since 2024 have remained materially shallower, reflecting a market now dominated by affected person, long-term capital quite than speculative retail flows.

On the macro degree, BTC’s position alongside conventional hedges did nonetheless strengthen. Persistent fiscal deficits, charge cuts amid above-target inflation, and rising sovereign debt dangers revived the hedge narrative. Gold led this transfer in 2025.

So what of 2026? Firstly, in step with historic patterns wherein gold outperforms at macro turning factors, we imagine BTC will observe with a lag.

Secondly, liquidity will more and more drive BTC efficiency. Heavy Treasury issuance in 2025, extended quantitative tightening, and front-loaded fiscal programmes have lengthened the worldwide liquidity cycle. Now as issuance moderates and QT tapers into late 2025 or early 2026, liquidity situations are prone to flip extra supportive for BTC.

Thirdly, Institutional adoption continues to deepen. Crypto ETPs are actually the first entry level for digital property as regulatory boundaries fall and sovereign curiosity grows. With Crypto ETP AUM simply over $200 billion right now, we count on it to exceed $400 billion by end-2026, reinforcing Bitcoin’s shift towards a mature, macro-sensitive asset with longer and fewer unstable cycles.

The US financial system enters 2026 after a chronic adjustment from the post-pandemic inflation shock. In 2025, progress cooled with out breaking, inflation eased however remained sticky, and the Federal Reserve cautiously pivoted towards gradual easing.

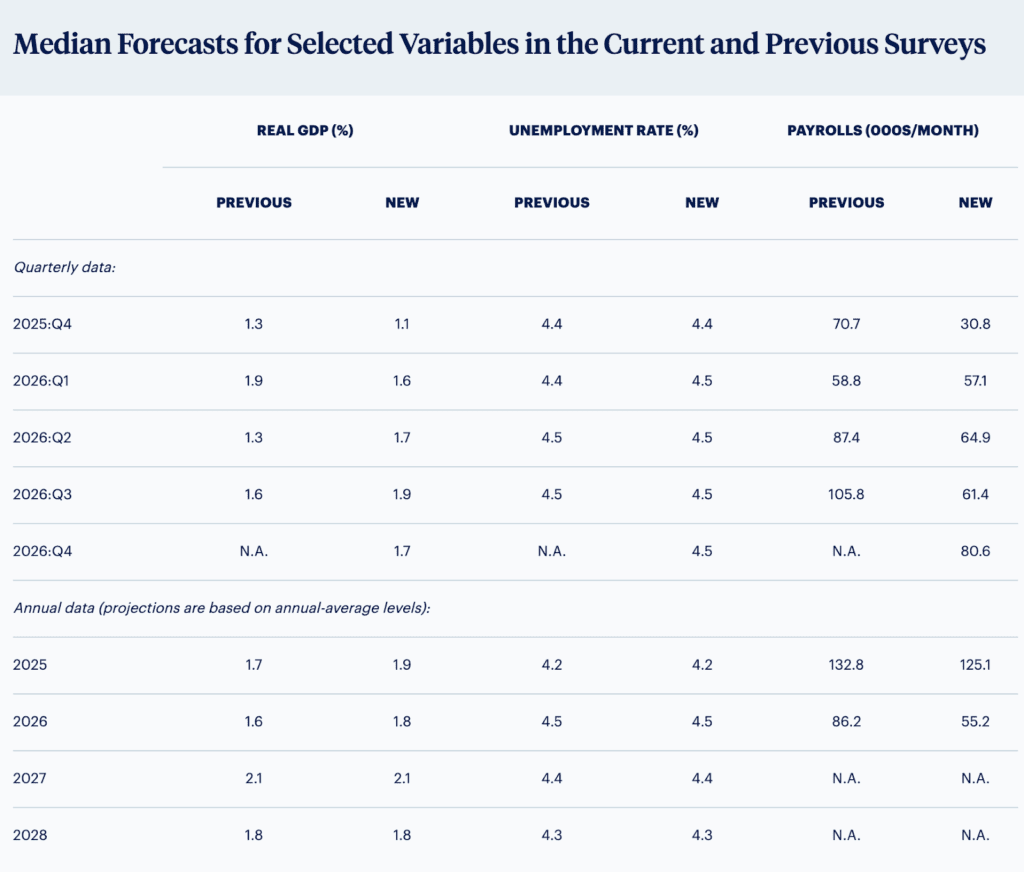

Labour market situations softened meaningfully. Hiring slowed, wage progress eased, and unemployment drifted into the mid-4 % vary, pushed by weaker demand for brand new employees quite than widespread layoffs. Knowledge revisions confirmed weaker-than-initially reported job progress, in step with a late-cycle, low-momentum surroundings. Trying forward, the labour market is predicted to stay tender however secure in 2026, with unemployment broadly holding close to present ranges except client demand weakens extra sharply.

Inflation continued to ease in 2025, however erratically. Items costs cooled, whereas shelter and providers saved headline inflation close to 3 % and core measures above the Fed’s 2 % goal. PCE ran modestly decrease than CPI, although persistent providers inflation and renewed tariff pressures posed upside dangers. We count on inflation to steadily ease in 2026, with potential near-term stickiness earlier than transferring nearer to focus on towards year-end.

Financial coverage adjusted cautiously. After holding charges regular for a lot of 2025, the Fed started easing in September, delivering three quarter-point cuts by December whereas sustaining a data-dependent stance heading into 2026.

On the identical time, the Fed ended its balance-sheet runoff and initiated technical reserve-management purchases to stabilise cash markets, actions aimed toward sustaining monetary plumbing quite than signalling aggressive easing. The present Fed forecast as indicated within the dot plot suggests there’ll solely be yet one more lower in 2026, however we imagine that there’s appreciable room for extra loosening and that strain will construct for extra charge cuts to be carried out. With unemployment drifting increased, job creation slowing, and inflation persevering with to ease, albeit remaining above goal, we see scope for a extra accommodative path. Our base case is 2 to 3 further rate of interest cuts in 2026.

Monetary markets have largely embraced the transition to looser financial coverage, regardless of weakening labour markets and sticky inflation. US equities superior to document highs in 2025, supported by relative disinflation, coverage easing, resilient company earnings, and sustained enthusiasm round AI-driven productiveness beneficial properties. Treasury yields moved decrease, notably on the brief finish, as expectations shifted towards a slower financial system and additional charge cuts, leading to a modest steepening of the yield curve. Trying forward, key dangers embrace inflation surprises, slowdowns in China and Asia, or renewed commerce/coverage shocks. However as of late 2025, markets seem priced for a benign 2026: stable progress (2–2.5 % GDP), easing inflation and continued, however cautious, Fed easing. Below these situations, we count on additional beneficial properties in shares (with S&P targets within the 7,500–8,000 factors vary) and decrease Treasury yields (10-year sub-4 %). Buyers stay watchful of the Fed’s path: a extra aggressive lower cycle may push shares even increased and yields decrease, whereas any signal of inflation stickiness may rebalance expectations.

Overlaying these macro tendencies is a major shift in commerce coverage. The Trump administration’s aggressive tariff regime sharply raised efficient import taxes, compressed commerce volumes, and narrowed the commerce deficit, whereas additionally contributing to cost pressures and international market volatility. Though the tempo of escalation slowed later within the yr, tariffs stay elevated by historic requirements and are prone to persist into 2026, introducing ongoing uncertainty for inflation, company margins, and international progress.

As 2025 attracts to a detailed, we sit up for a brand new yr the place we count on to see BTC re-visiting its all time excessive ($126,110), underpinned by additional loosening financial coverage, rising liquidity and the continuing weight of continued crypto adoption.

Thanks for being with us throughout 2025, and we hope you’ve appreciated all of the insights we’ve got offered in the course of the course of the yr, simply as a lot as we’ve got loved giving them to you. We will probably be again within the New Yr.

Within the meantime, many pleased holidays from Bitfinex.