Bitcoin surged above $117,500 at the moment, recovering from an area backside of $114,278 simply yesterday, in response to information from Bitcoin Journal Professional. The sharp rebound comes after President Donald Trump formally signed a landmark government order that might permit cryptocurrencies equivalent to Bitcoin to be included in 401(ok) retirement accounts.

The order directs the Division of Labor to revisit its present steerage on fiduciary obligations in ERISA-governed plans and make clear the suitable course of for providing diversified funds that embrace different investments.

Moreover, the order instructs collaboration between the Division of Labor, the Treasury Division, the Securities and Trade Fee (SEC), and different federal regulators to find out whether or not broader regulatory updates are wanted to help the coverage shift. The SEC can also be particularly ordered to revise its personal guidelines to assist facilitate this entry, signaling a big transfer towards modernizing retirement funding choices for tens of millions of People.

“President Trump needs to present American staff extra funding choices with a view to attain stronger and extra financially safe retirement outcomes,” the White Home truth sheet acknowledged. “Various property, equivalent to non-public fairness, actual property, and digital property, provide aggressive returns and diversification advantages.”

Galaxy Digital CEO Mike Novogratz underscored the impression of this, stating {that a} “monster pool of capital” will get publicity to Bitcoin and crypto on account of Trump’s government order. “Tons of cash” shall be pouring in, he added.

“President Trump promised to make the US the ‘crypto capital of the world,’ emphasizing the necessity to embrace digital property to drive financial development and technological management,” the actual fact sheet concluded.

Bitwise’s Head of Analysis Ryan Rasmussen confirmed how a lot worth this government order may convey into bitcoin, stating, “If crypto captures X% of the $8 trillion 401k market:

1% … $80 billion

2% … $160 billion

3% … $240 billion

4% … $320 billion

5% … $400 billion

6% … $480 billion

7% … $560 billion

8% … $640 billion

9% … $720 billion

10% … $800 billion”.

This coverage shift is poised to develop into one of the crucial vital catalysts for Bitcoin adoption, including gas to an already sturdy wave of institutional curiosity that has been constructing for years. In line with asset supervisor Bitwise, whereas Bitcoin miners mined 217,771 BTC in 2023, establishments bought a staggering 913,006 BTC. The pattern has accelerated in 2025, with miners producing 97,082 BTC up to now this yr, whereas establishments have scooped up 545,579 BTC.

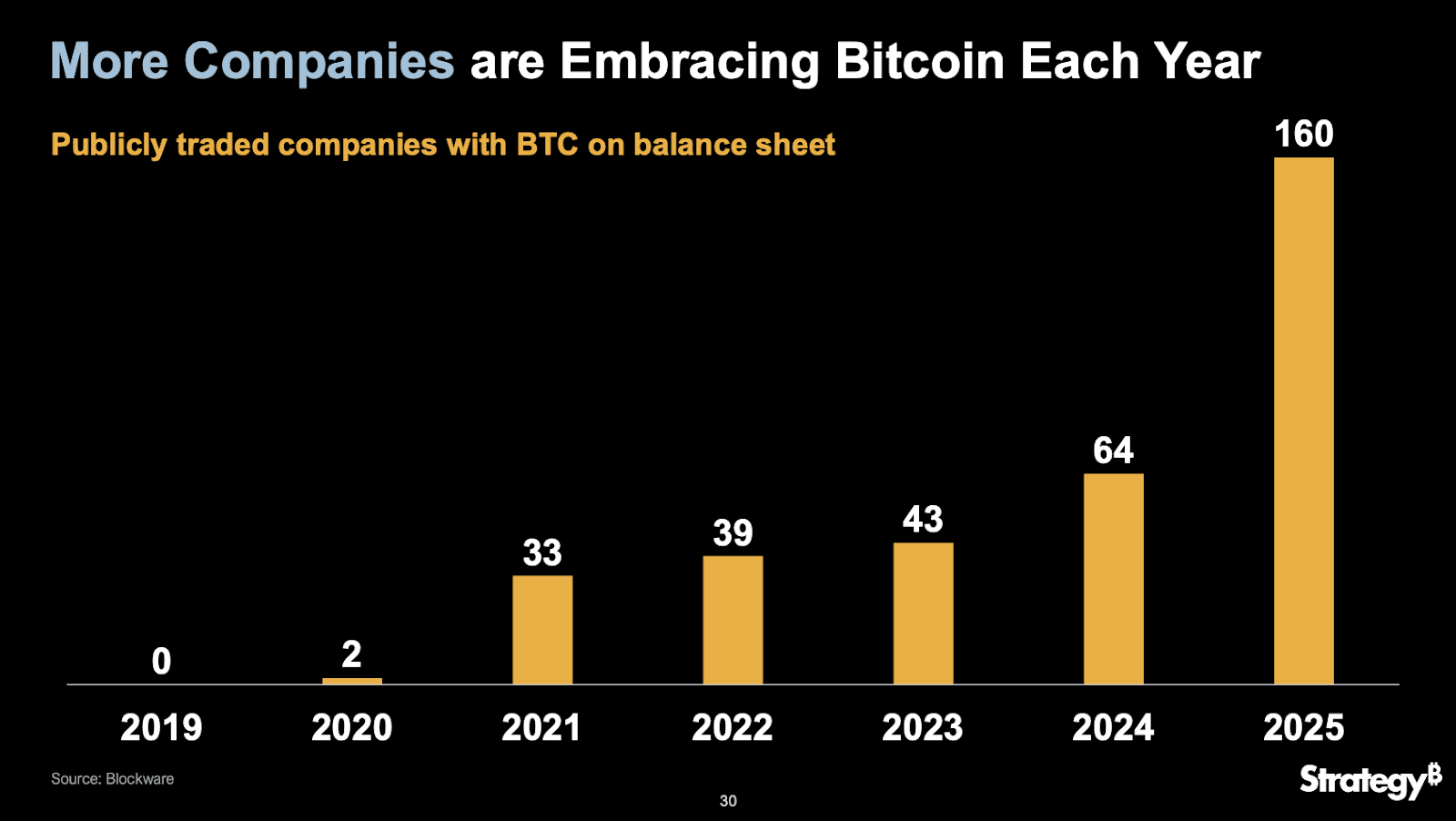

Institutional adoption continues to interrupt information. In 2023, simply 43 publicly traded firms held Bitcoin on their steadiness sheets. That quantity rose to 64 in 2024 and has now surpassed 160 in 2025, in response to Blockware.

Two firms main the brand new company Bitcoin treasury race are David Bailey’s Nakamoto and Jack Mallers’ Twenty One Capital. Nakamoto’s deliberate merger with KindlyMD—set for approval by Monday, August 11—would allow it to accumulate a whole lot of tens of millions in bitcoin, after elevating $763 million to buy BTC for its reserves. Twenty One Capital, in the meantime, already holds 43,514 BTC, making it the third-largest company Bitcoin holder worldwide.

Disclosure: Nakamoto is in partnership with Bitcoin Journal’s mum or dad firm BTC Inc to construct the primary international community of Bitcoin treasury firms, the place BTC Inc offers sure advertising companies to Nakamoto. Extra info on this may be discovered right here.