On-chain information exhibits the Bitcoin Puell A number of has gone by way of a decline not too long ago, an indication that miner income has gone down relative to its baseline.

Bitcoin Puell A number of Has Dropped To 0.67

In a brand new put up on X, analyst Ali Martinez has talked in regards to the newest pattern within the Bitcoin Puell A number of. The “Puell A number of” refers to a well-liked on-chain indicator that retains observe of the ratio between the day by day BTC mining income (in USD) and 365-day transferring common (MA) of the identical.

Miners earn their revenue by way of two sources: block subsidy and transaction charges. Within the context of the metric, nevertheless, solely the previous a part of their income is related.

Block subsidy is a hard and fast BTC-denominated reward that miners obtain once they add the following block to the chain. Often, it makes up for the dominant and secure a part of miner revenue.

When the worth of the Puell A number of is bigger than 1, it signifies that the community validators are incomes a better income from block subsidy than the common for the previous 12 months. Then again, the metric being beneath the mark implies miners are making lower than regular.

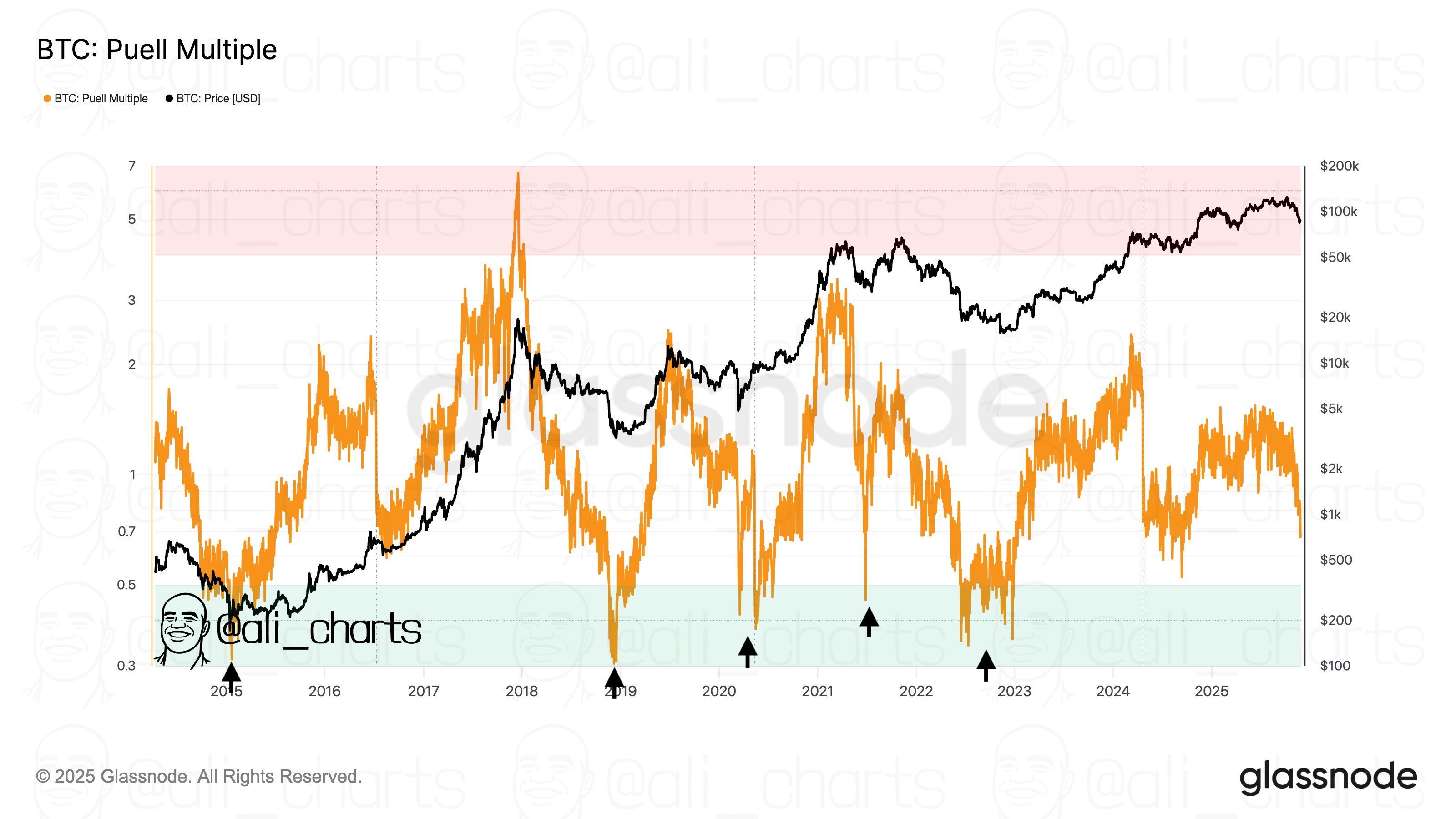

Now, right here is the chart shared by Martinez that exhibits the pattern within the Bitcoin Puell A number of over the previous decade:

As displayed within the above graph, the Bitcoin Puell A number of has witnessed a speedy decline not too long ago that has taken its worth under the 1 stage. This drop within the metric is a results of the bearish value motion that the cryptocurrency has confronted.

The block subsidy is fastened in BTC worth and is more-or-less additionally fastened in charge of time, so the day by day BTC revenue from it’s about fixed for miners. The USD worth of the reward, nevertheless, relies on the asset’s spot value, which is certainly variable.

The sooner bull run resulted within the Puell A number of rising above the 1 mark as miner income from block subsidy surged. Equally, the market downturn has led to a decline within the USD miner revenue.

As we speak, the metric’s worth is 0.67, that means that the chain validators are making simply 67% of the common income from the final twelve months. Traditionally, miners being beneath a excessive quantity of strain has made bottoms extra possible for Bitcoin.

Because the analyst has highlighted within the chart, the key bottoms since 2015 have typically shaped when the Puell A number of has dipped under 0.50. If the present cycle can also be going to comply with an identical sample, then miner ache will not be sufficient for a backside but.

BTC Worth

The most recent rebound within the Bitcoin value has sustained for now as its value continues to be buying and selling round $91,600.