Bitcoin dangers a additional drop towards the $70,000 space if the Financial institution of Japan follows by means of with an anticipated interest-rate rise on Dec. 19, analysts targeted on macro forces warned.

Associated Studying

Based on a number of macro-focused voices, the transfer might sap international liquidity and put recent downward stress on danger belongings, with some merchants already bracing for a pointy pullback.

Japan’s coverage shift issues as a result of larger charges are likely to strengthen the yen and lift the price of borrowing. When that occurs, merchants who beforehand borrowed cheaply in yen to take a position elsewhere are sometimes compelled to unwind these positions.

That course of can pull cash out of world markets in a brief time period, and Bitcoin has usually felt that affect as buyers lower publicity throughout risk-off stretches.

BOJ Tightening Drains World Liquidity

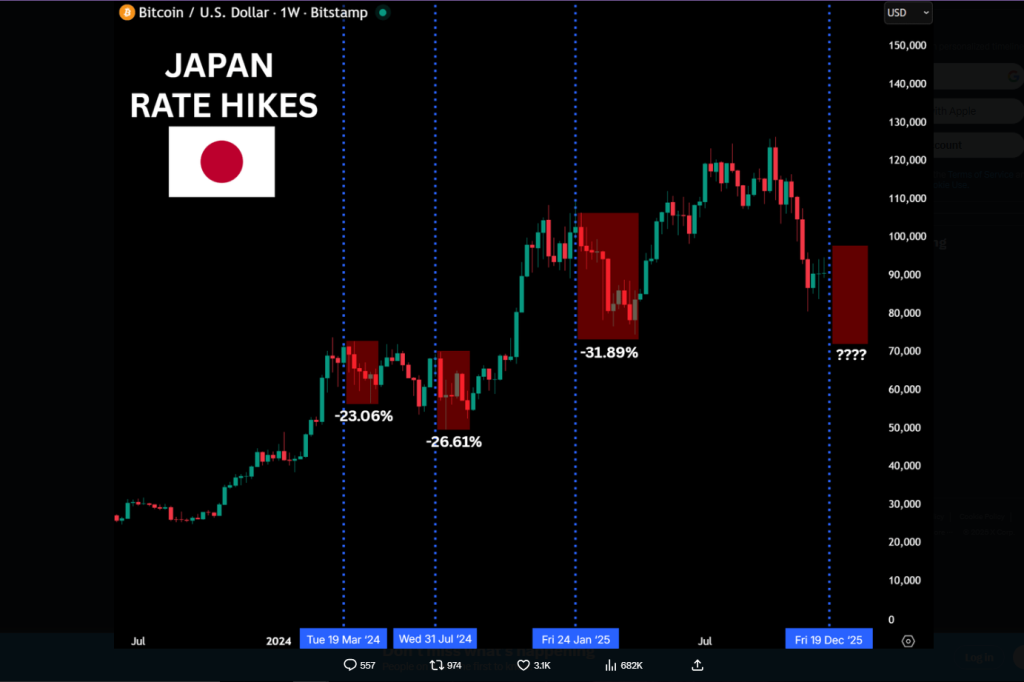

Based on AndrewBTC, each BOJ hike since 2024 has coincided with Bitcoin drawdowns of greater than 20%. Based mostly on experiences, the analyst pointed to declines of roughly 23% in March 2024, 26% in July 2024, and 31% in January 2025.

🚨 BREAKING: JAPAN WILL CRASH $BTC

Financial institution of Japan is about to hike charges +25 bps on Dec 19. Japan = largest holder of US authorities debt 🇯🇵

📉 Have a look at the $BTC chart:

Each BoJ fee hike → Bitcoin dumps over 20%+👇

• March 2024 → -23%

• July 2024 → -26%

• January 2025 →… pic.twitter.com/grN3QRNUg4— AndrewBTC (@cryptoctlt) December 13, 2025

Merchants aren’t solely watching central financial institution calendars. Bitcoin’s day by day chart additionally flashed a basic bear flag formation after a steep fall from the $105,000–$110,000 space in November.

Market Positioning Widens Forward Of Key Information

Bitcoin slipped beneath $90,000 in skinny buying and selling on Sunday, a transfer that merchants took as a cautionary signal slightly than a definitive set off. Based mostly on experiences, Ether held up higher than many altcoins, suggesting selective danger taking out there.

Merchants are positioning earlier than a busy slate of US knowledge and central financial institution occasions that would sway flows. Analyst EX bluntly warned BTC will collapse “beneath $70,000” below the said macro situations, a stark forecast that highlights how crowded bets can amplify strikes when liquidity is pulled.

EVERY TIME JAPAN HIKES RATES, BITCOIN DUMPS 20–25%

NEXT WEEK, THEY WILL HIKE RATES TO 75 BPS AGAIN.

IF THE PATTERN HOLDS, $BTC WILL DUMP BELOW $70,000 ON DECEMBER 19.

POSITION ACCORDINGLY. pic.twitter.com/IWU8JbXjn3

— ΞX (@rektbyEX) December 13, 2025

Associated Studying

What This Means For Traders

The story tying BOJ coverage to Bitcoin’s swings is easy in define: when funding prices in Japan rise, international borrowing turns into pricier, and danger belongings will be bought as positions are decreased.

That dynamic helps clarify why previous BOJ strikes lined up with 20-30% declines in Bitcoin. Nonetheless, markets usually attempt to worth occasions forward of time; a hike that’s already constructed into costs could have a smaller impact than one which comes as a shock.

Featured picture from Nikkei Asia, chart from TradingView