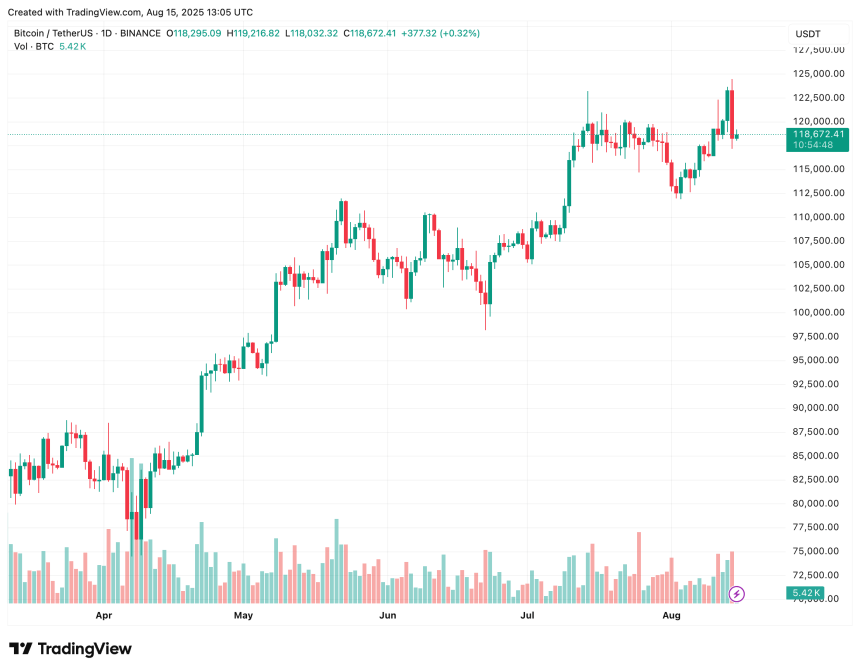

Bitcoin (BTC) staged a light rebound from yesterday’s inflation-driven drop to $117,180, climbing again towards $119,000 on the time of writing. A declining leverage ratio suggests the highest cryptocurrency’s bullish momentum might persist, maintaining it within the working for a brand new all-time excessive (ATH) within the close to time period.

Bitcoin Leverage Ratio Falls, Bulls Rejoice

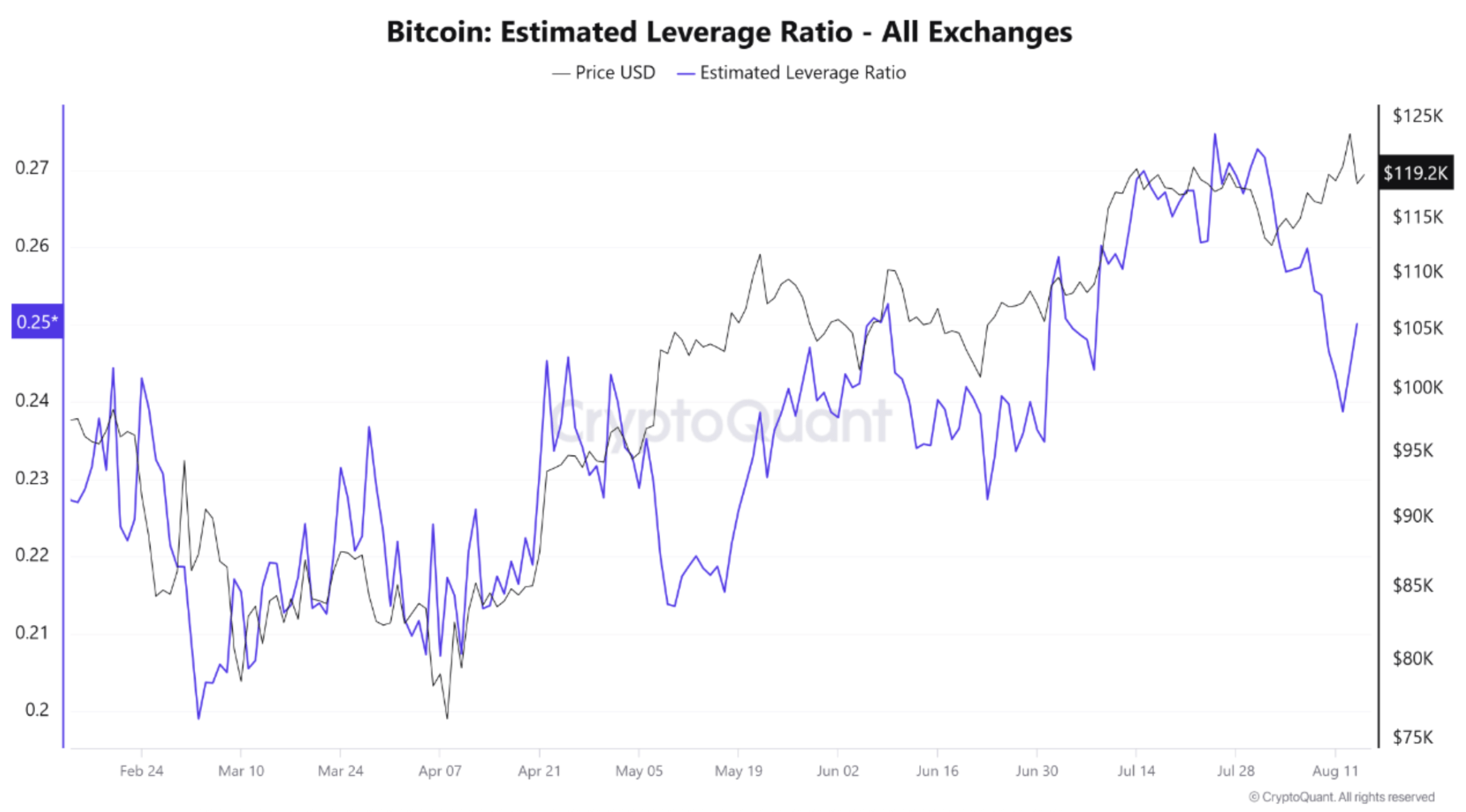

In response to a CryptoQuant Quicktake put up by contributor Arab Chain, Bitcoin’s leverage ratio throughout all cryptocurrency exchanges has sharply declined from its late-July and early-August peak of 0.27.

Associated Studying

Notably, the ratio dropped to 0.25 in early August earlier than a modest rebound. In distinction, the interval from Could to late July noticed each the value and leverage ratio climb in tandem, signaling an inflow of merchants opening bigger positions.

In distinction, this time leverage has fallen with no comparable drop in value – an indication that danger has eased for the reason that current uptrend. Arab Chain notes that this can be the results of high-risk positions being liquidated or merchants exiting the market amid volatility.

With BTC holding round $119,000, the decrease leverage ratio is a bullish signal, suggesting that the newest value positive factors are fueled extra by real liquidity than speculative extra.

A continued decline in leverage might additional cut back the probability of a pointy correction. Conversely, a sudden spike in leverage alongside a value rally would increase the chance of a pullback. The analyst added:

If leverage stays at average or low ranges whereas the value stays secure, this might present a secure base for a brand new uptrend. An estimated leverage ratio (ELR) holding between 0.24–0.25, accompanied by a gradual value break above 120K, might point out a spot-supported upside and a attainable extension towards the July highs, with average funding and slowly rising open curiosity.

Nevertheless, a fast leap within the leverage ratio above 0.27 earlier than or throughout a check of $120,000–$124,000 might sign excessive liquidation danger and the potential for a pointy downward “shakeout.”

On-Chain Information Factors To Potential Promoting Stress

Whereas decrease leverage is encouraging for Bitcoin bulls, on-chain knowledge – significantly rising trade reserves and whale transfers – hints at attainable promoting stress forward.

Associated Studying

As an example, Binance’s BTC reserves have lately surged to 579,000, elevating issues of profit-taking after Bitcoin’s current rally to a recent ATH. Likewise, extra BTC miners are shifting their holdings to Binance, probably getting ready to promote.

Including to the warning, some analysts warn of a attainable pullback to $110,000 to fill excellent honest worth gaps. At press time, BTC trades at $118,672, down 0.1% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com