Bitcoin stays in a good consolidation vary after setting a brand new all-time excessive above $123,000 simply 10 days in the past. The present vary, between $117,000 and $120,000, displays a pause in momentum because the market digests latest good points and prepares for its subsequent main transfer. Whereas volatility has cooled, underlying metrics counsel that the broader development should have room to run.

Associated Studying

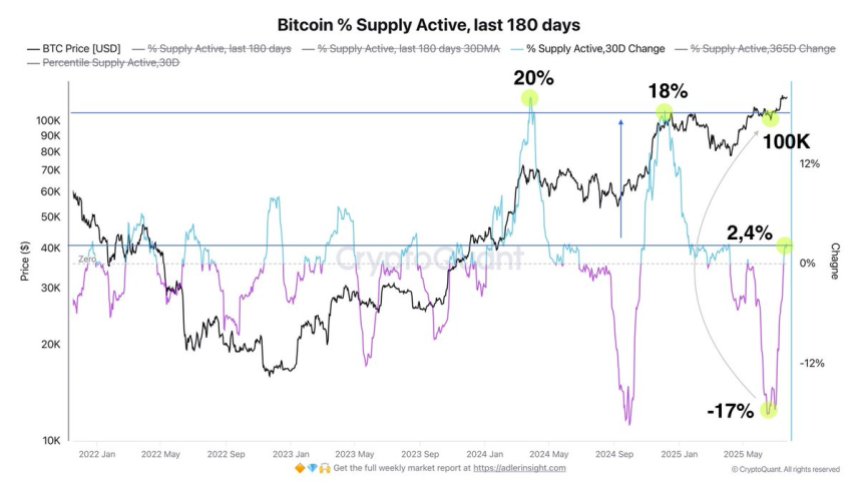

One key indicator drawing consideration is the proportion of provide lively prior to now 180 days (% Provide Energetic). This metric has traditionally surged throughout main macro turning factors. In spring 2024, as BTC approached $70,000, % Provide Energetic climbed to twenty%. It rose once more to 18% in December 2024, when Bitcoin first broke by way of the psychological $100,000 barrier. These spikes mirrored long-dormant cash transferring out of storage—usually interpreted as early alerts of broader distribution phases starting.

At the moment, the market is exhibiting solely preliminary indicators of renewed provide exercise, suggesting that we should be within the early levels of this cycle’s distribution section. As long-term holders stay comparatively inactive and Bitcoin trades close to file ranges, the stage could also be set for additional upside if accumulation resumes and new capital enters the market.

Provide Exercise Indicators Early Stage Of Bitcoin Macro Enlargement

High analyst Axel Adler lately shared key insights pointing to a possible early section in Bitcoin’s ongoing macro cycle. In accordance with Adler, provide exercise started rising in June 2025 as BTC crossed the $100,000 mark. Over the previous 30 days, this metric has climbed from unfavorable territory to +2.4%, signaling the start of a shift in holder habits. Whereas the rise confirms early indicators of distribution, it stays modest in comparison with earlier cycle peaks.

Traditionally, main bull markets see this 30-day % Provide Energetic rise dramatically. Adler highlights that the present tempo lags behind prior peaks—like these seen when BTC reached $70,000 in spring 2024 or when it breached $100,000 in December 2024—suggesting that the market nonetheless has a substantial buffer earlier than getting into a heightened distribution section. This delayed spike in exercise implies that the majority long-term holders stay dedicated and aren’t but prepared to dump their cash.

As Bitcoin consolidates close to the $120,000 stage, this rising but restrained exercise signifies a wholesome cycle construction. Adler predicts that if BTC continues to climb and maintain above $120,000, the 30-day % Provide Energetic will doubtless transfer into the 8–10% vary. Finally, it might revisit the 18–20% zone seen at previous distribution tops.