Yesterday, Bitcoin (BTC) as soon as once more confronted rejection across the $120,000 resistance degree after briefly reaching a excessive of $119,760. On the time of writing, the highest cryptocurrency is buying and selling barely decrease at $118,900. Nonetheless, a pointy enhance in whale inflows to Binance threatens to set off additional draw back strain for the digital asset.

Binance Whales Ramp Up Bitcoin Deposits

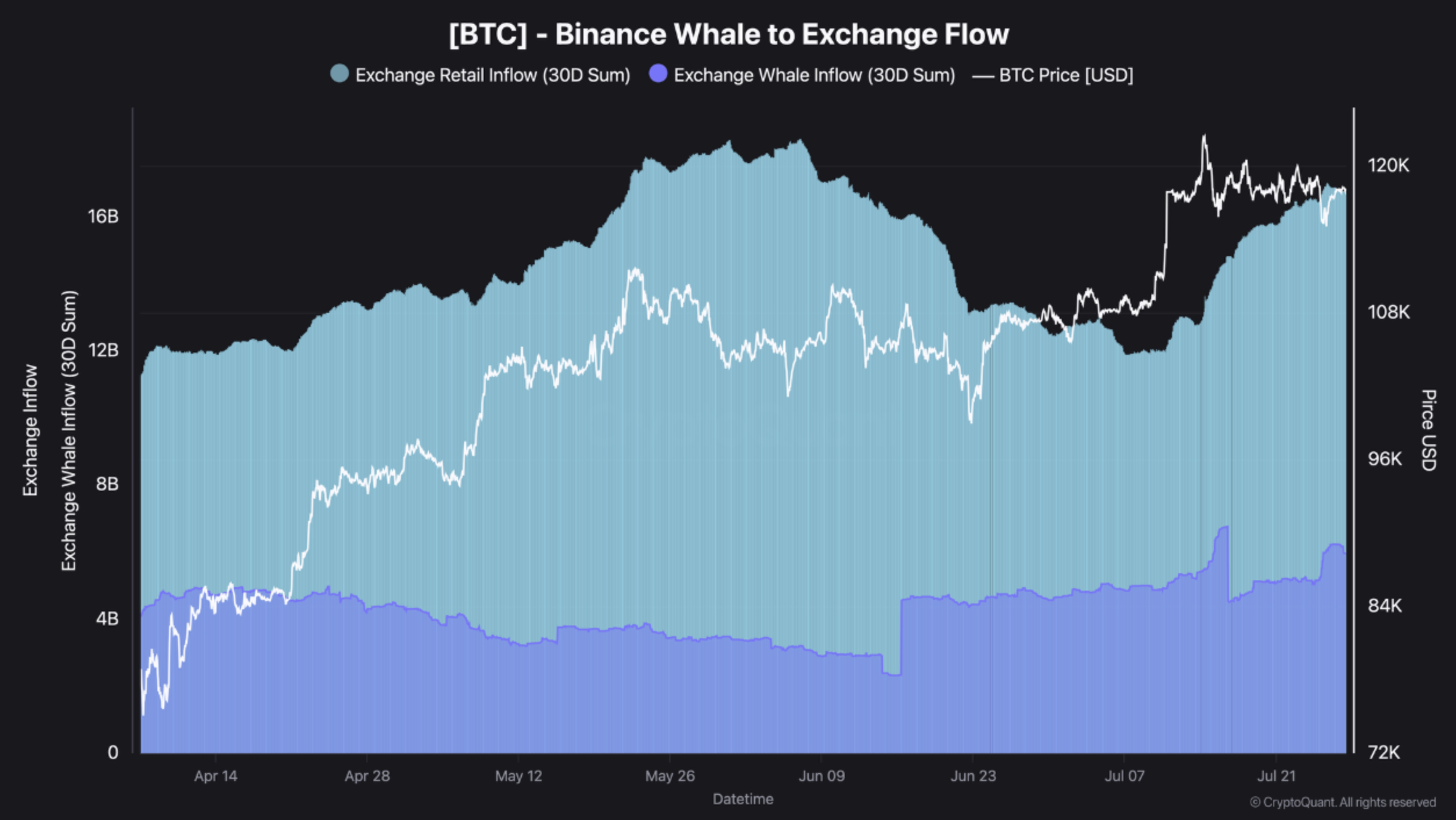

In accordance with a latest CryptoQuant Quicktake publish by contributor BorisVest, Bitcoin whale exercise on Binance has elevated considerably in latest days. Particularly, the Binance Whale Influx metric recorded a notable spike on July 25, signalling rising institutional participation in change deposits.

Associated Studying

On that day alone, the 30-day cumulative influx to Binance surged by $1.2 billion, fuelling short-term promoting strain throughout the market. Knowledge from CoinGlass reveals that between July 24 and July 25, roughly $141 million price of BTC lengthy positions had been liquidated in consequence.

It’s price noting that alongside this spike in whale deposits, retail traders have additionally been shifting their holdings to exchanges. Nonetheless, their participation stays comparatively low compared, hinting that latest promoting strain is predominantly whale-driven.

The next chart illustrates that whereas retail inflows have been trending upward for weeks, the sudden enhance in whale deposits has launched further fragility into Bitcoin’s worth construction.

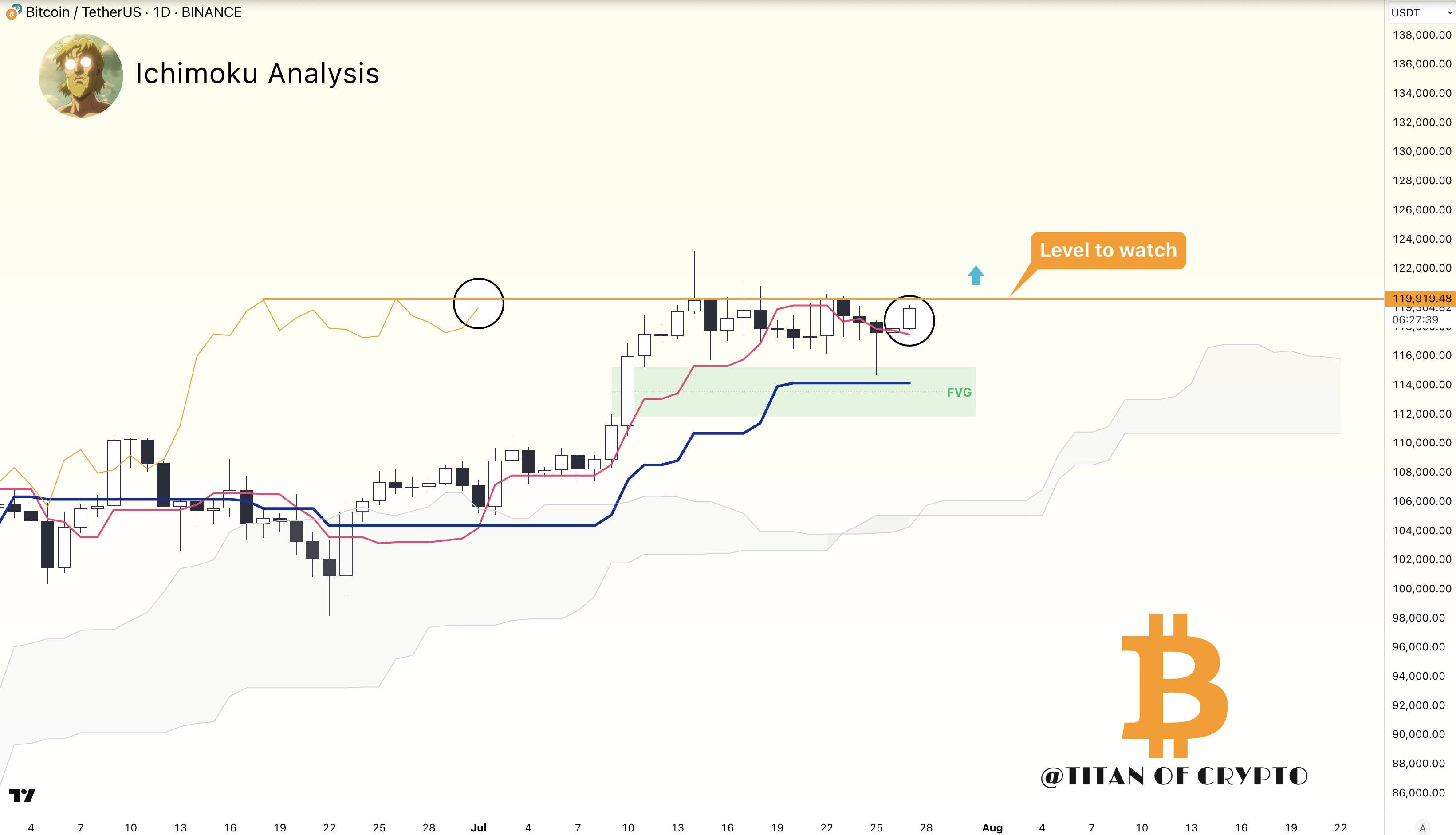

The surge in Binance whale inflows got here simply earlier than Bitcoin was rejected on the essential $120,000 degree. Following this rejection, BTC retraced to the $115,000–$116,000 vary, which is now performing as short-term assist. The analyst famous:

This space is now performing as a short-term assist zone. If it fails to carry, a transfer towards the $110K degree turns into more and more seemingly. Alternatively, if Bitcoin can bounce strongly from this area, there may be nonetheless potential to retest $121K and even try a brand new all-time excessive.

BorisVest concluded that BTC’s near-term worth trajectory will likely be decided by how effectively the market absorbs whale sell-off. In the meantime, fellow crypto analyst Titan of Crypto remarked that if BTC decisively breaks by means of the $119,900 degree, then it may eye new all-time highs (ATH).

What Else Does Change Knowledge Counsel?

Whale inflows aren’t the one issue spooking traders. BTC reserves on centralized exchanges additionally just lately reached a one-month excessive, suggesting that some holders could also be anticipating a short lived pullback or consolidation section earlier than resuming the uptrend.

Associated Studying

That stated, Binance’s share of BTC spot buying and selling quantity just lately noticed a pointy rise, suggesting {that a} rally could also be on the horizon for the world’s main cryptocurrency. At press time, BTC trades at $118,926, up 0.4% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com