Let’s begin with a scene that’s most likely acquainted. It’s the tip of the month, and a mountain of invoices has piled up on somebody’s desk—or, extra doubtless, of their inbox. Each must be opened, learn, and its knowledge manually keyed into an accounting system. It is a gradual, tedious course of, liable to human error, and it’s a quiet bottleneck that prices companies a fortune in wasted time and assets.

For years, this was simply the price of doing enterprise. However what if invoices might simply… course of themselves?

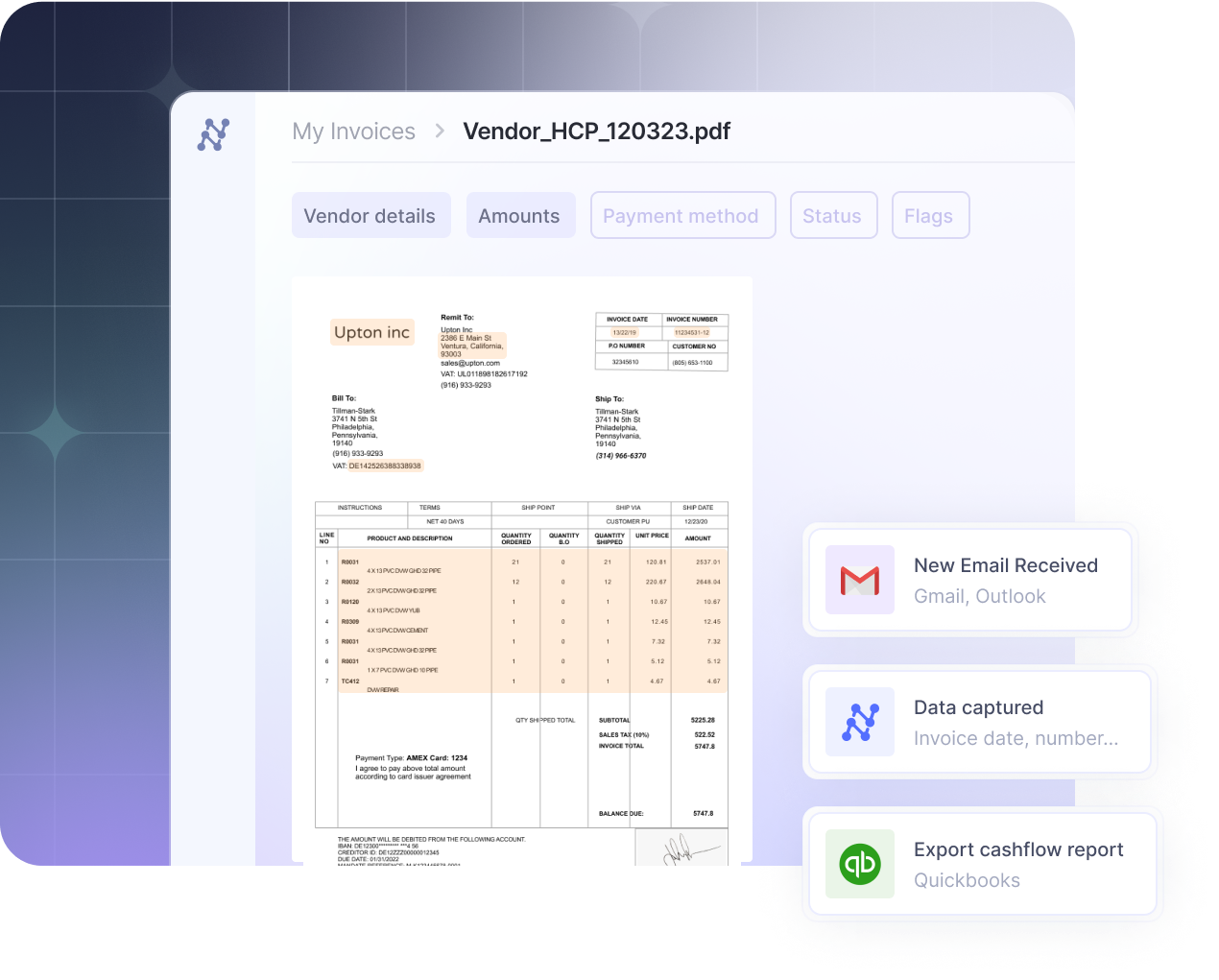

That’s the promise of recent bill knowledge extraction. It’s not about simply scanning a doc; it’s about educating a machine to learn, perceive, and course of an bill, in order that your AP workforce can deal with extra strategic actions. On this information, we’ll break down how this expertise works, what to search for in an actual resolution, and present you the way we at Nanonets have been serving to firms around the globe course of invoices quicker and effectively.

What’s bill knowledge extraction?

At its core, bill knowledge extraction is the method of pulling key info like vendor names, bill numbers, line gadgets, and totals from an bill and structuring it for an accounting system or ERP. It’s the essential on-ramp for automating accounts payable, and its accuracy units the inspiration for all subsequent monetary record-keeping.

An in depth take a look at the bill knowledge you may extract

Once we speak about “key info,” we’re referring to a variety of information factors which are essential for accounting and operations. A contemporary extraction instrument can seize dozens of fields, sometimes organized into these classes:

- Vendor info: Consists of the seller’s title, deal with, contact particulars, and tax identification quantity (TIN).

- Bill specifics: This covers the distinctive bill quantity, the difficulty date, the cost due date, and any related buy order (PO) quantity.

- Line gadgets: An in depth, row-by-row breakdown of every services or products, together with its description, amount, unit worth, and whole price.

- Totals and monetary knowledge: The subtotal earlier than taxes, a breakdown of tax quantities (like VAT or GST), transport costs, and the ultimate grand whole due.

- Fee phrases: Particulars on pay, together with cost technique, phrases like “Web 30,” and any accessible early cost reductions.

Why your present bill course of might be costing you a fortune

The issue with guide bill processing is not simply that it is tedious; it is that it is an extremely inefficient use of expert human capital like finance professionals. When an individual has to deal with every bill manually, the method is gradual and costly.

Augeo, an accounting providers agency and considered one of our purchasers, discovered that their workforce was spending 4 hours per day on guide entry. After automating, that point was lower to only half-hour.

The prices related to a guide course of go far past simply the time spent on knowledge entry:

- The hidden prices of errors: Guide knowledge entry is liable to errors—research present error charges will be as excessive as 4%. A single misplaced decimal or incorrect vendor ID can result in overpayments, duplicate funds, or missed early cost reductions. The time your workforce spends discovering and fixing these errors is a hidden operational price that drains productiveness.

- Excessive labor prices: Your workforce’s time is a worthwhile useful resource, and guide knowledge entry is a major time sink. Business knowledge reveals that workers can spend almost half their workday on repetitive duties like this. Each hour spent manually keying in knowledge is an hour not spent on strategic monetary evaluation, vendor administration, or figuring out cost-saving alternatives.

- It does not scale effectively: As what you are promoting grows, the amount of invoices grows with it. With a guide course of, your solely resolution is so as to add extra headcount, straight rising your payroll prices. This linear relationship between development and overhead creates a significant bottleneck and prevents your finance operations from scaling effectively.

- Vulnerability to fraud: Guide techniques lack the automated checks to simply spot suspicious exercise. A fraudulent bill, whether or not from an exterior phishing rip-off or an inside supply, can look legit to a busy worker. With out automated validation towards buy orders or vendor grasp recordsdata, these can slip by way of, resulting in direct monetary loss.

How bill knowledge extraction really works

Automating bill extraction is not a brand new thought, however the expertise has developed considerably. Getting your knowledge from a PDF into an ERP system should not really feel like making an attempt to navigate the asteroid area in The Empire Strikes Again.

The outdated manner: the world of templates and guidelines

The primary technology of automation relied on template-based, or Zonal OCR. Right here’s the way it works: for each vendor, an worker has to manually create a template, drawing fastened packing containers on a pattern bill. The rule is easy: “the bill quantity is at all times on this field, the date is at all times on this field.”

This class consists of options from open-source libraries like invoice2data, which makes use of manually created templates, to legacy enterprise platforms like ABBYY and Tungsten.

When a brand new bill arrives from that very same vendor, the system applies the template and extracts textual content from these predefined coordinates.

The way it works: For each vendor, a developer creates a template by defining fastened coordinates or guidelines (like common expressions) for every area on a pattern bill. The system applies this inflexible template to extract knowledge from subsequent invoices from that particular vendor.

This method is best than guide entry, however it’s extremely brittle.

- It breaks with any change: If a vendor updates their bill format even barely—strikes the date, provides a emblem—the template breaks, and the method fails.

- It requires huge upkeep: You want a separate, manually-created template for each single vendor. As an example, within the case of considered one of our clients, Suzano Worldwide, a number one Brazilian pulp and paper firm with over 70 clients, it will imply creating and sustaining over 200 totally different automations to deal with all their doc codecs.

- It will probably’t deal with variation: It struggles with tables which have a variable variety of rows or elective fields that are not at all times current.

The LLM experiment: Can a basic LLM deal with invoices?

With the rise of highly effective Giant Language Fashions (LLMs) like ChatGPT, Claude, or Gemini, a standard query is: “Cannot I simply use that?” The reply is sure, you may add an bill picture to a basic LLM and immediate it to extract the important thing fields right into a JSON format. It’ll typically do a surprisingly respectable job.

The way it works: With a subscription to a service like ChatGPT Professional, a person can add an bill picture and write a immediate like: “Extract the invoice_number, invoice_date, vendor_name, and total_amount from this doc and supply the output in JSON format.”

Nonetheless, this isn’t a scalable enterprise resolution. Utilizing a general-purpose LLM for a selected, high-stakes enterprise course of like accounts payable has a number of essential flaws:

- It is a instrument, not a workflow: An LLM can extract knowledge from a single doc, however it may well’t automate the end-to-end course of. It will probably’t routinely ingest invoices out of your electronic mail, run validation guidelines (like checking a PO quantity towards your database), handle a multi-stage approval course of, or export knowledge on to your ERP. It is a single, guide step that also requires a human to handle your entire workflow round it.

- Inconsistent output: Whilst you can immediate an LLM to supply structured output, consistency is not assured. One time it’d label a area invoice_id, the following it may be invoice_number. This lack of a hard and fast schema makes it unreliable for automated downstream integration, an issue customers have famous when making an attempt to construct dependable options.

- Information privateness considerations: For many companies, importing delicate monetary paperwork containing vendor particulars, pricing, and financial institution info to a public, third-party AI mannequin is a major knowledge safety and compliance threat.

- It does not study out of your knowledge: A specialised instrument will get higher and extra correct in your distinctive use case over time as a result of it learns out of your workforce’s corrections. A basic LLM does not create a fine-tuned mannequin that’s constantly enhancing based mostly in your particular wants.

Utilizing ChatGPT for bill processing is like utilizing a superb Swiss Military knife to construct a home. It will probably lower some wooden and switch some screws, however it’s no substitute for a devoted set of energy instruments designed for the job.

The efficient manner: Goal-built AI for context-aware extraction

Clever Doc Processing is the fashionable, purpose-built resolution that mixes superior AI with a full suite of workflow instruments.

The way it works: IDP platforms are designed to be template-free. They use AI educated on tens of millions of paperwork to know the context and construction of an bill, whatever the format. Here is how they work:

- Doc seize and pre-processing: The method begins by receiving an bill from any supply. The system then routinely cleans the doc picture, utilizing methods like noise cleansing and skew correction to organize it for evaluation.

- Contextual evaluation: That is the place the actual intelligence is available in. An AI mannequin does not simply learn phrases; it analyzes your entire doc’s DNA. It seems to be at dozens of alerts concurrently: the precise place of a quantity on the web page, the sample of characters in a line, and the way totally different textual content blocks are aligned. This enables it to know context. For instance, the date on the high proper is the invoice_date, whereas a date in a desk is a service_date.

- No-template studying: This wealthy contextual knowledge is fed right into a deep studying mannequin that has been educated on tens of millions of invoices. It learns the widespread patterns of invoices normally, which permits it to precisely extract knowledge from a doc it has by no means seen earlier than while not having a pre-defined template.

- Validation and integration: After extraction, the information is routinely validated. The verified knowledge is then seamlessly built-in into your accounting or ERP system.

That is typically enhanced with Zero-Shot Extraction, a cutting-edge functionality the place you may instruct the AI to discover a new area with a easy textual content description, while not having to coach it on labeled examples.

When evaluating an answer, look previous the buzzwords and deal with these 4 core capabilities. A really efficient platform is rather more than simply an OCR engine; it’s a whole operational instrument.

1. True AI, not simply old-school OCR

Probably the most essential characteristic is the power to deal with any bill format while not having customized templates. That is the core promise of AI. A template-less system dramatically reduces setup time and eliminates the upkeep nightmare of updating templates each time a vendor adjustments their bill design.

2. A whole, customizable workflow

Information extraction is just one piece of the puzzle. An actual resolution automates your entire accounts payable workflow. This implies it should embody sturdy options for every stage:

- Import: Versatile choices to get paperwork into the system, resembling by way of electronic mail, cloud storage, or API.

- Information actions: Instruments to scrub, format, and enrich the information after extraction.

- Approvals: The power to construct multi-stage approval processes based mostly in your particular enterprise guidelines.

- Export: Seamless integration to ship the ultimate, authorized knowledge to your accounting or ERP system.

3. Seamless integrations

The instrument should combine together with your current techniques. Search for pre-built connectors for widespread software program like QuickBooks and SAP, and a versatile API and webhooks for customized techniques.

4. Steady studying and enchancment

The very best AI techniques incorporate a “human-in-the-loop” studying mechanism. Which means that any correction a person makes is used as coaching knowledge to enhance the mannequin. The platform ought to get progressively smarter and extra correct over time, decreasing the necessity for guide evaluation.

5. Assist agentic workflows

That is probably the most superior evolution of IDP. As an alternative of a passive instrument, an agentic platform is an autonomous system of specialised AI brokers that collaborate to execute your entire enterprise course of. Right here, a workforce of digital brokers handles the workflow. A Classification Agent types incoming paperwork, an Extraction Agent pulls the information, a Validation Agent performs duties like three-way matching towards buy orders, an Approval Agent routes it to the best individual, and a Posting Agent enters the ultimate knowledge into the ERP. The purpose is to realize a excessive Straight-Via Processing (STP) charge, the place invoices move from receipt to payment-readiness with zero human intervention.

A sensible information: Organising your first automated bill workflow

Getting began with automation can really feel daunting, however it does not must be. Right here’s a extra detailed take a look at how one can arrange a robust workflow in Nanonets.

Step 1: Select your mannequin

Step one is to pick out the best AI mannequin. You may both use a pre-trained mannequin or prepare a customized mannequin. For invoices, our pre-trained mannequin is the most effective place to begin, because it has been educated on tens of millions of various invoices and may acknowledge the most typical fields proper out of the field. The platform additionally intelligently identifies the doc kind—distinguishing an bill from a purchase order order—and routes it to the proper workflow.

Step 2: Arrange your import channel

Subsequent, you might want to inform Nanonets the way it will obtain invoices. The most typical technique is to arrange an automatic electronic mail import. Nanonets gives a novel electronic mail deal with for every workflow you can auto-forward invoices to, so that they’ll be processed routinely.

Step 3: Configure your knowledge actions

Uncooked extracted knowledge typically wants refinement. That is the place “knowledge actions” are available. For instance, you may add a “Date Formatter” motion to routinely standardize all extracted dates to a single format required by your ERP system. For our shopper ACM Providers, we arrange an motion to routinely lookup a vendor’s GL code from a grasp file and add it to the extracted knowledge.

Step 4: Construct your approval guidelines

That is the place you embed your organization’s enterprise logic. For instance, you could possibly construct a two-stage approval:

- Stage 1 (PO Match): Use the “Match in Database” rule to verify if the PO quantity on the bill exists in your grasp checklist. If not, the bill is routinely flagged for evaluation.

- Stage 2 (Quantity Threshold): Add a second rule that states if the invoice_amount is bigger than $5,000, the bill additionally requires approval from a finance supervisor.

Step 5: Configure your export

The ultimate step is to get the clear, authorized knowledge into your system of report. You may configure the export to attach on to your accounting software program, like QuickBooks, and map the extracted fields to the corresponding fields in your system.

What actually units a contemporary platform aside is its capability to deal with your organization’s distinctive enterprise guidelines. At Nanonets, we developed a characteristic referred to as AI Agent Pointers that lets you give the AI broad, plain-English directions to deal with context-specific situations. For instance:

- Vendor-specific logic: “If the seller is XYZ, then the invoice_amount doesn’t embody taxes.”

- Regional guidelines: “If an bill is from Europe, the total_tax ought to embody the sum of all VAT charges.”

Do not simply take our phrase for it: the proof is within the numbers

We’ve helped a whole lot of firms rework their accounts payable processes. Listed below are only a few examples:

- Asian Paints, one of many largest paint firms in Asia, lowered its doc processing time from 5 minutes to about 30 seconds, saving 192 person-hours each month.

- Suzano Worldwide automated the processing of buy orders from over 70 clients, chopping the turnaround time from 8 minutes to only 48 seconds—a 90% discount in time.

- Hometown Holdings, a property administration agency, saved 4,160 worker hours yearly and noticed a $40,000 enhance in Web Working Earnings (NOI) after automating its property bill administration.

- Professional Companions Wealth, an accounting and wealth administration agency, achieved a straight-through processing charge of over 80% and saved 40% in time in comparison with their earlier OCR instrument.

Closing ideas

The transition from guide bill processing to an automatic, AI-powered workflow is not a luxurious—it is a strategic necessity. By leveraging AI to deal with the tedious, error-prone activity of information extraction, you unlock your finance workforce to deal with higher-value actions like monetary evaluation and money move administration.

Trendy platforms like Nanonets present the instruments to not solely extract knowledge with unbelievable accuracy however to automate your entire end-to-end course of. In the event you’re able to cease the paper chase and construct a extra environment friendly finance operation, it is time to discover what AI-powered automation can do for you.

Discover how this integrates into scalable AI workflows in our information on – Automated Information Extraction for Enterprise AI.

FAQs

How is an Clever Doc Processing (IDP) platform totally different from a typical OCR instrument?

A typical OCR (Optical Character Recognition) instrument is only a digital transcriber that turns a picture into uncooked textual content, typically requiring inflexible templates. In distinction, an Clever Doc Processing (IDP) platform like Nanonets is a whole resolution that provides a layer of AI to know the doc’s context, eliminating the necessity for templates. It additionally manages your entire end-to-end enterprise course of—together with automated validation, multi-stage approvals, and seamless ERP integrations—all whereas studying from person corrections to change into extra correct over time.

What sort of accuracy and Straight-Via Processing (STP) charges are sensible?

These are the 2 key metrics for measuring the success of an automation venture. For accuracy, trendy AI-based techniques can obtain 95-98%, which is a major leap from the 80-85% typical of older, template-based OCR. At Nanonets, we see this in follow with purchasers like ACM Providers, who’ve achieved 98.9% extraction accuracy on their invoices.

For Straight-Via Processing (STP)—the proportion of invoices processed with zero human intervention— goal for a well-implemented system is over 80%. This implies 8 out of 10 invoices can move straight out of your electronic mail inbox to your ERP, prepared for cost, with out anybody in your workforce touching them. Our shopper Hometown Holdings, for instance, achieved an 88% STP charge.

How does the system deal with invoices in numerous languages and from totally different nations?

That is the place a contemporary, AI-driven platform actually shines. Not like template-based techniques that require a brand new algorithm for each format, an AI mannequin learns the basic patterns of what an “bill” is, whatever the format.

- Dealing with totally different codecs: The AI’s capability to know context and analyze the doc’s construction means it may well adapt to totally different vendor layouts on the fly. This was a essential issue for our shopper Suzano Worldwide, who needed to course of paperwork in a whole lot of various codecs.

- Dealing with totally different languages: Superior IDP platforms are educated on world datasets. The Nanonets platform, for instance, can course of paperwork in over 50 languages. Our work with JTI Ukraine, processing paperwork in Ukrainian, is a transparent instance of this world functionality in motion.

How is my delicate monetary knowledge stored safe throughout this course of?

Safety for delicate monetary knowledge is dealt with by way of a multi-layered method. All knowledge on a platform like Nanonets is protected with encryption each in transit (utilizing TLS) and at relaxation. To make sure our processes meet the very best requirements, our platform is compliant with certifications like SOC 2 and HIPAA, that are verified by unbiased audits. That is all constructed on safe, licensed infrastructure, and your knowledge is rarely used to coach fashions for different clients. For organizations requiring most management, we additionally provide an on-premise deployment possibility by way of a Docker occasion, making certain no knowledge ever leaves your personal setting.

Can this expertise automate different paperwork moreover invoices?

Completely. Whereas invoices are a major use case, the underlying AI and workflow expertise is designed to be document-agnostic. A key characteristic of the Nanonets platform is a Doc Classification module that may routinely establish and route totally different doc varieties to their distinctive workflows. Our shopper SafeRide Well being, for instance, makes use of this functionality to course of 16 several types of paperwork, together with car registrations and insurance coverage kinds, not simply invoices. This identical expertise will be simply configured for different widespread enterprise paperwork like buy orders, receipts, and payments of lading.