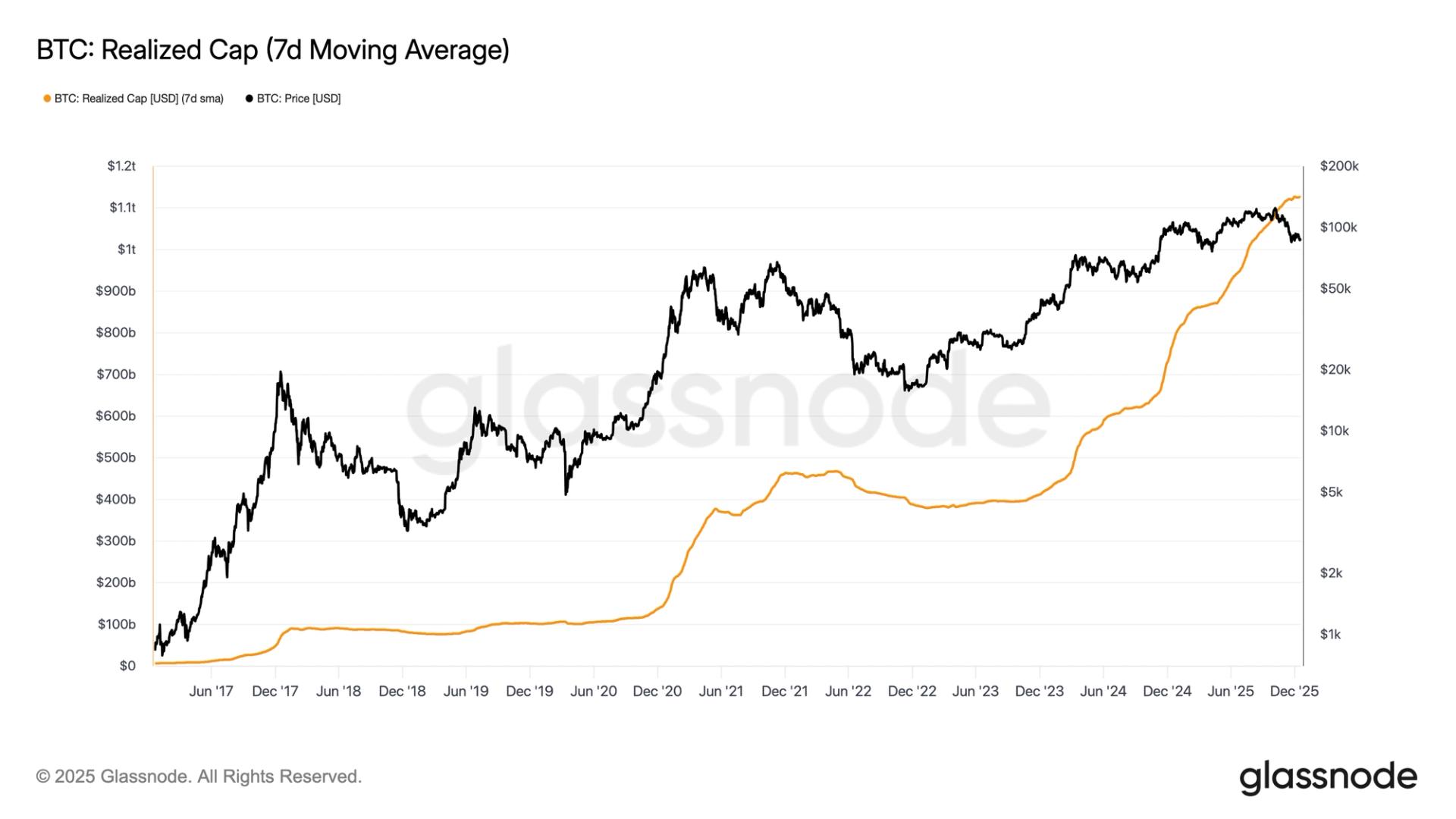

Bitcoin’s “realized capitalization” is at an all-time excessive of $1.125 trillion, suggesting that BTC stays in a bull market regardless of the near-40% plunge in costs over the previous 10 weeks.

This on-chain metric, which values every bitcoin on the worth it final moved, highlights precise capital inflows relatively than speculative worth motion like complete market capitalization.

Glassnode knowledge exhibits realized cap continued to rise by means of the 36% correction from the October all-time worth excessive, even because it’s stalled of late within the $1.125 trillion space. An identical pause was seen in the course of the tariff tantrum in April 2025, when bitcoin bottomed close to $76,000 earlier than happening to make new highs.

Through the 2022 bear market, realized cap fell from round $470 billion to $385 billion as traders capitulated and cash have been offered at decrease value base — this type of response just isn’t being seen in the mean time.

4-year cycle narrative questioned

Andre Dragosch, European head of analysis at Bitwise, advised CoinDesk that bitcoin may defy the four-year cycle narrative, with upside surprises in 2026. Dragosch pointed to resilient world development combining with ongoing price cuts to steepen the yield curve and develop liquidity — all circumstances that would weaken the U.S. greenback which is an surroundings that has traditionally been supportive for bitcoin.

“In my opinion, bitcoin is materially underpricing the prevailing macro backdrop, to a level final seen in the course of the Covid recession and the FTX collapse, regardless of no indicators of a U.S. recession and proof of re-accelerating development,” mentioned Dragosch.