US Senate debate over a invoice referred to as the Readability Act has reignited dialogue about XRP and different crypto merchandise, and the way they could be handled below US guidelines.

Associated Studying

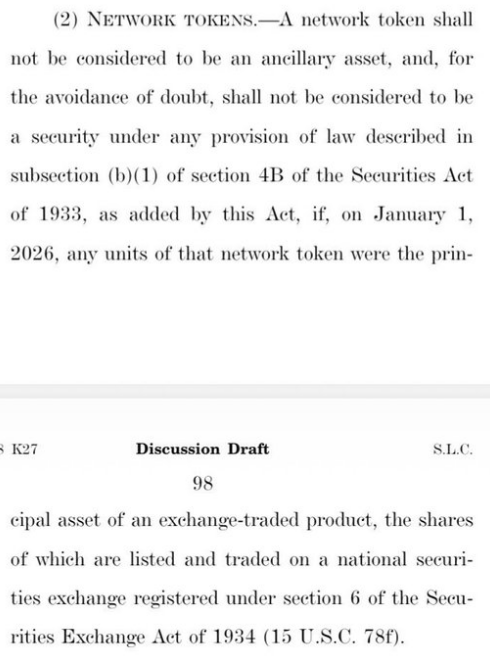

Experiences have disclosed that the invoice may give clearer standing to tokens that again US-listed ETFs, transferring them nearer to commodity-style therapy.

XRP spot ETFs have additionally drawn massive capital, with inflows reaching about $1.37 billion since their November 2025 launch — a determine that underlines why lawmakers and market watchers are paying consideration.

How It Works

Creation and redemption in ETFs can occur “in sort,” which implies the fund can settle for the precise asset as a substitute of money.

That mechanism is actual, nevertheless it doesn’t let unusual consumers load tokens instantly right into a fund. Licensed individuals — large broker-dealers and market makers — are those that hand tokens to ETFs and obtain shares again.

On a regular basis traders purchase or promote ETF shares on exchanges. That hole is central to the talk about whether or not an ETF may ever perform like a financial institution.

The XRP ETF’s are additionally In-Form Funds, so you’ll be able to deposit XRP instantly into the fund in alternate for the precise worth in shares.

Most usually will select this feature put up legislation. There are lots of benefits to this, it is possible for you to to make use of the ETF like a “financial institution”. https://t.co/2G49kxUpGc pic.twitter.com/4fyeOkEYTC

— Chad Steingraber (@ChadSteingraber) January 13, 2026

What Neighborhood Voices Are Saying

Based on posts from XRP group figures, some see a future the place ETFs act like a regulated parking spot for token holders.

Chad Steingraber has been vocal about in-kind mechanics, arguing that traders may swap XRP for matching ETF shares and deal with the funds as a safer place to carry worth till they should transfer tokens once more.

These feedback have helped popularize the concept that ETFs might be utilized in a bank-like means.

What Taxes May Look Like

Experiences and investor guides present that ETF construction issues for taxes. ETFs typically use in-kind creation and redemption to keep away from routine capital positive aspects distributions on the fund stage, which helps make ETFs tax-efficient in lots of circumstances.

However tax penalties for token holders rely on how transactions are carried out and on the product’s authorized construction.

Below present US guidelines, transfers that change the type of an asset can create taxable occasions for the particular person handing over the asset, and fund-level distributions can nonetheless produce tax payments for traders.

Associated Studying

Based on Chad Steingraber, the in-kind construction offers XRP holders a regulated place to park their tokens when they need security and oversight.

Traders, Steingraber believes, might favor ETFs as soon as the Readability Act clarifies guidelines. The attraction will not be the technical steps however the confidence of holding XRP in a regulated, organized product. For him, ETFs provide a safer option to handle tokens whereas nonetheless protecting entry to them when wanted.

Featured picture from Unsplash, chart from TradingView