31 Jan AI, Repricing Threat and the Outlook for Bitcoin in 2026

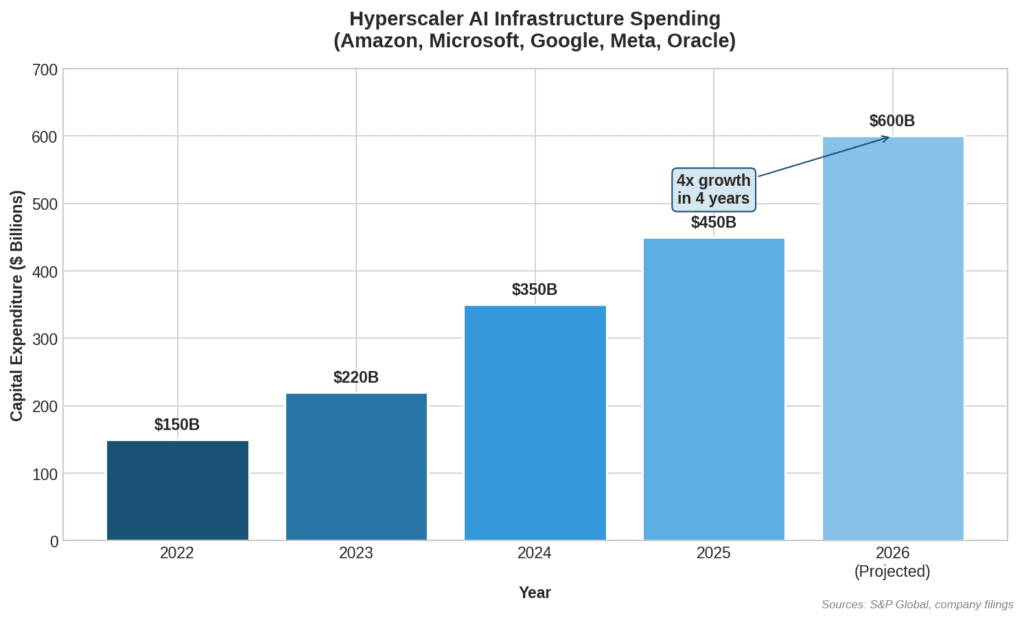

Synthetic intelligence has turn into the dominant narrative in world markets over the previous 18 months. What started as a serious technological breakthrough has developed right into a once-in-a-generation capital-allocation story, with funding now operating into the tons of of billions throughout information centres, superior semiconductors and the facility infrastructure required to help them.

That scale naturally raises a well-known query for markets: is that this a sustainable funding cycle, or have expectations round AI moved forward of what near-term outcomes can realistically ship?

The reply issues for Bitcoin, not as a result of AI essentially modifications Bitcoin itself, however as a result of dominant narratives form how traders value danger, allocate capital and rebalance portfolios.

Whether or not AI optimism finally unwinds or holds could have vital implications for a way Bitcoin and crypto markets behave all through the remainder of the yr.

Bitcoin and the Repricing of Threat

Regardless of its distinct financial properties, Bitcoin continues to be handled as a part of the identical risk-rebalancing assessments that dictate flows throughout world fairness markets.

When traders reassess publicity to growth-heavy, capital-intensive themes, Bitcoin usually strikes in the identical course — not as a judgement on Bitcoin itself, however as a part of broader portfolio rebalancing pushed by liquidity and danger administration.

Current market motion offers a clear reference of this dynamic, with Bitcoin shifting alongside broader danger belongings as traders adjusted publicity elsewhere.

Paolo Ardoino, Bitfinex CTO and CEO of Tether, addressed this tendency in a current episode of Bitcoin Capital, noting {that a} sharp reversal in AI sentiment this yr might spill into US equities and pull Bitcoin down within the close to time period. On the identical time, he argued that Bitcoin’s market construction immediately is meaningfully completely different from prior cycles, with deeper institutional participation starting to supply a extra sturdy base of demand.

What “Repricing Threat” Truly Seems Like

Markets don’t require applied sciences to fail for costs to reset, simply that the hole between expectations and outcomes grows excessively over time.

Durations of exuberance round new technological improvements are inclined to comply with a well-known sample.

Capital concentrates, tolerance for uncertainty rises and traders turn into extra open to holding a number of high-volatility exposures on the identical time. When confidence wanes, that tolerance contracts rapidly. Liquidity thins, leverage is decreased and correlations rise.

The dot-com unwind stays the clearest current instance. The web finally reshaped the worldwide financial system, but between 2000 and 2002 all the Nasdaq fell by practically 80%.

The long-term thesis was appropriate. The near-term pricing was not.

There are echoes of that dynamic immediately with AI. Regardless of monumental and rising funding in AI infrastructure, proof of near-term monetisation stays uneven.

A current Bain & Firm report means that supporting the implied AI infrastructure build-out would require roughly $2 trillion in annual income by the top of the last decade. Even beneath beneficiant assumptions, Bain estimates revenues might fall round $800 billion quick.

That hole between funding and realised returns doesn’t invalidate the know-how’s long-term prospects, nevertheless it has left markets more and more delicate to delays, margin strain or revised steering.

Why Bitcoin Leads Throughout Threat Repricing

Bitcoin’s response in periods of danger repricing is primarily a operate of liquidity.

Bitcoin trades constantly in deep, world markets. Over time, that liquidity is a energy. In moments of stress, it additionally makes Bitcoin a fast and environment friendly supply of danger discount. In contrast to gold, Bitcoin doesn’t but profit from common recognition as a safe-haven asset. As a substitute, it stays extensively held inside discretionary portfolios which might be actively rebalanced as circumstances change.

Even gold, nonetheless, skilled sharp downward strikes throughout the latest market volatility, reinforcing the concept that the repricing was pushed by liquidity and portfolio rebalancing moderately than something inherently associated to Bitcoin.

That helps clarify why Bitcoin moved alongside equities this week regardless of the absence of any Bitcoin-specific catalyst. This newest transfer is a mirrored image of how Bitcoin is at the moment used, not a reassessment of its underlying properties.

That context units the stage for a way Bitcoin would possible behave if AI optimism had been to expertise a serious reversal.

If AI is a Bubble: Implications for Bitcoin into 2026

If AI funding proves to be meaningfully forward of sustainable returns, the quick impression would unlikely be confined to know-how shares alone. A broader repricing of progress expectations would tighten liquidity, scale back leverage and strain danger belongings throughout the board.

In that setting, Bitcoin would possible stay risky within the quick time period. As one of the liquid world danger belongings, it might proceed for use as a supply of danger discount in periods of stress. Additional drawdowns in such a state of affairs wouldn’t replicate a failure of Bitcoin’s fundamentals, however its position inside portfolio building.

The place this cycle differs is what occurs after the preliminary repricing. Institutional possession, regulated funding automobiles corresponding to spot ETFs and longer-duration allocations now anchor a rising share of Bitcoin provide.

Capital rotates moderately than disappears when a dominant narrative unwinds. As confidence in long-duration, infrastructure-heavy tales weakens, consideration traditionally shifts towards belongings which might be liquid, globally accessible and seen as undervalued.

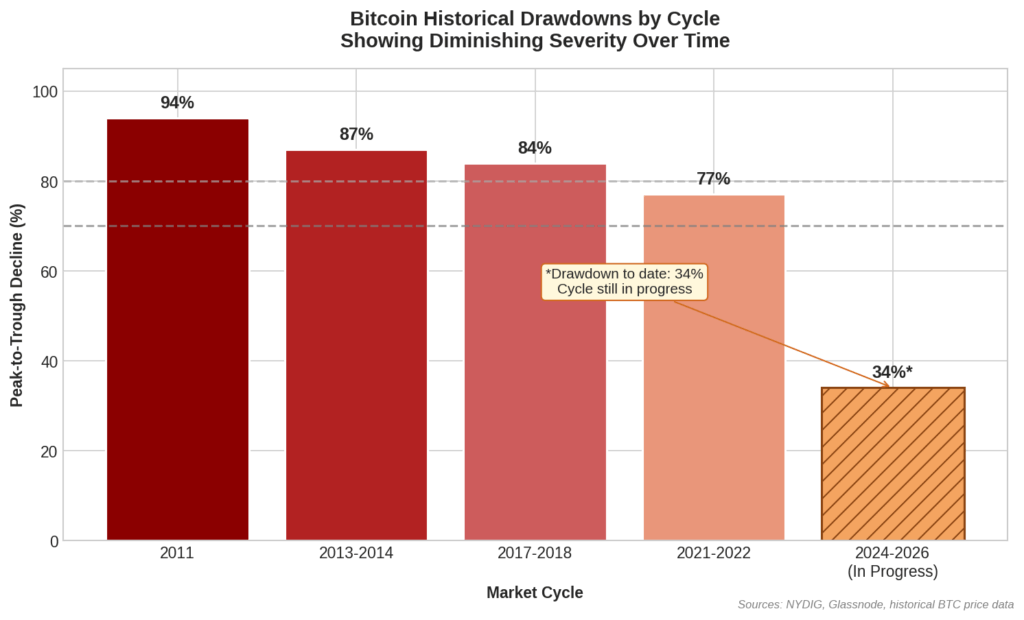

Into 2026, this dynamic suggests a Bitcoin market characterised much less by extended capitulation and extra by volatility adopted by consolidation and restoration. As Paolo notes, drawdowns would stay potential, however the excessive, multi-year 70–80% declines that outlined earlier cycles seem much less structurally embedded than earlier than.

If AI is Not a Bubble: The place We Are within the Cycle

If AI finally delivers on its long-term promise, the present section nonetheless issues. At this time’s market displays an infrastructure-heavy build-out stage, the place capital expenditure is front-loaded and monetisation lags deployment.

Right here, volatility in AI-linked equities can be much less about collapse and extra about timing. Returns would merely take longer to materialise than markets had assumed.

A robust and sturdy AI narrative might additionally crowd out different high-volatility investments, together with Bitcoin, not by way of collapse however by providing a extra seen path for traders to take pleasure in returns. In such an setting, Bitcoin might commerce sideways or grind greater moderately than expertise sharp repricing in both course.

That consequence can be in keeping with Bitcoin persevering with its transition towards a extra macro-oriented allocation, absorbing capital incrementally and responding primarily to modifications in liquidity moderately than to any single dominant narrative. Correlations with danger belongings would persist, however towards a backdrop of bettering market depth, possession and extra secure capital.

What This Means for Bitcoin into 2026

Whether or not AI optimism finally unwinds or endures in 2026, Bitcoin enters the yr with a unique market construction than in earlier cycles.

Whereas it stays delicate to shifts in investor confidence, it now does so towards a backdrop of deeper liquidity, broader possession and extra established institutional infrastructure than in prior durations.

In that sense, the importance of any repricing occasion, together with a large-scale reversal in AI sentiment, lies much less in any quick value motion. What might be extra vital is what such moments reveal about Bitcoin’s ongoing transition from a high-volatility outlier towards an more and more acquainted, if nonetheless imperfect, element of the worldwide monetary system.