Analytics agency Glassnode says that enormous Bitcoin traders are gobbling up BTC, fueling the crypto king’s ascent above $100,000.

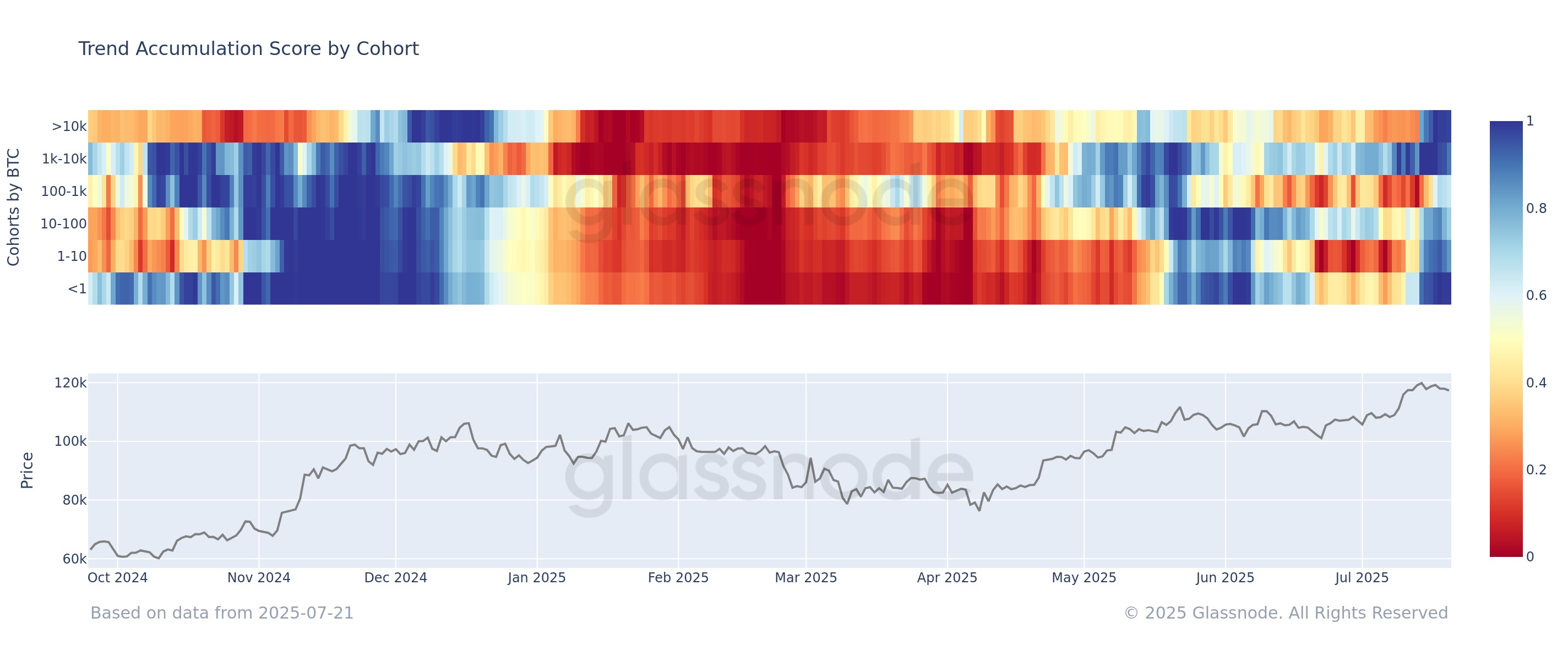

In a submit on the social media platform X, Glassnode says that every one main Bitcoin cohorts by pockets measurement are actually again in “near-perfect” accumulation mode.

The analytics agency launched a Pattern Accumulation Rating chart by cohort, revealing that wallets holding lower than one BTC to these with over 10,000 BTC present scores of 1 or close to 1, signaling robust accumulation throughout all investor segments.

“Even >10,000 BTC whales are taking part at ranges final seen in Dec 2024. The alignment throughout pockets sizes suggests broad-based conviction behind the present BTC uptrend.”

At time of writing, Bitcoin is buying and selling at $117,412.

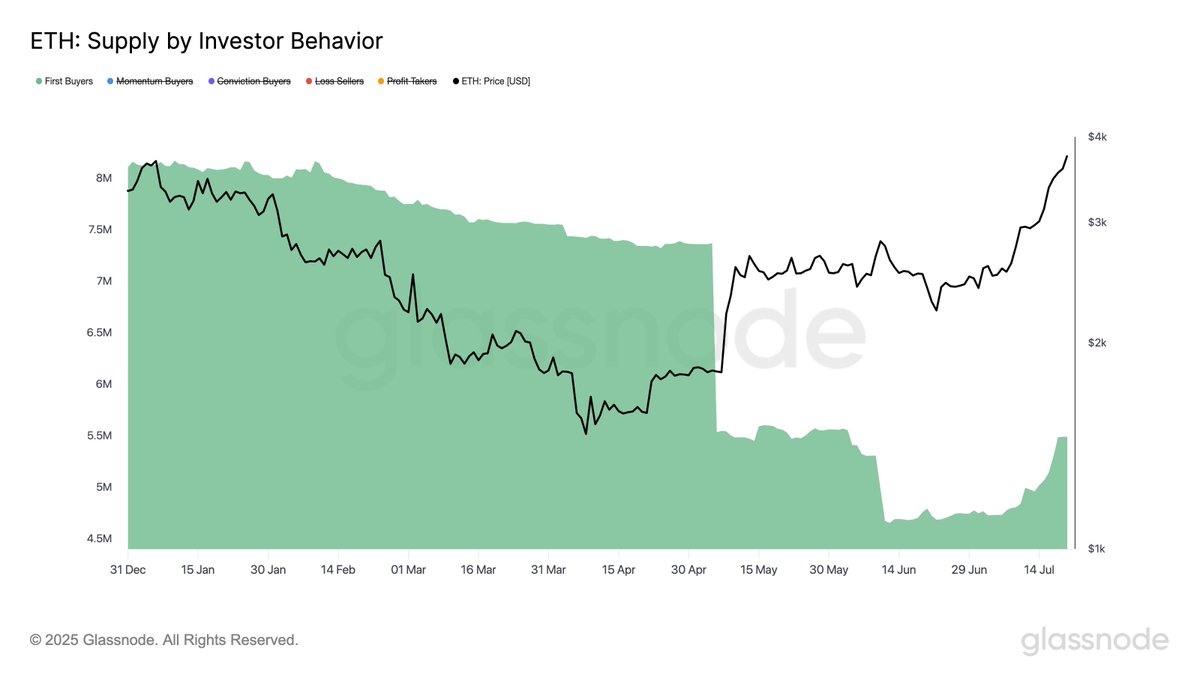

Turning to Ethereum, Glassnode notes a renewed inflow of first-time ETH traders following a protracted interval of declining curiosity from the group.

“We’re seeing the primary indicators of a development reversal in ETH purchaser habits. Since early July, the provision held by first-time patrons has elevated by ~16%, suggesting renewed curiosity and inflows from contemporary market individuals.”

At time of writing, Ethereum is price $3,765.

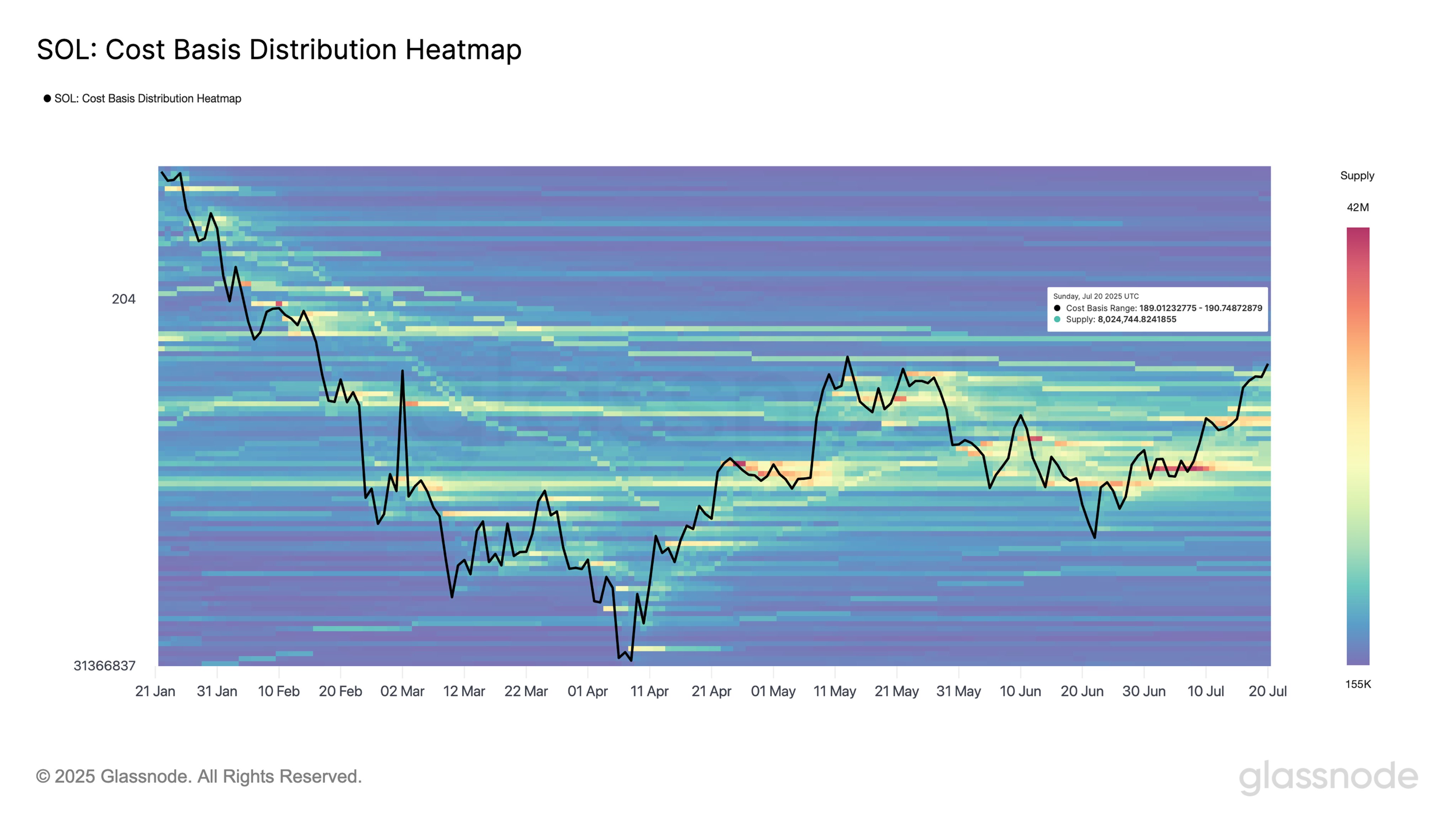

As for the layer-1 protocol Solana, Glassnode says that SOL could also be poised for an enormous upside burst after taking out a key resistance space.

“The following main resistance for SOL could sit round $190, the place traders have accrued over 8 million SOL. Above this degree, provide turns into much less dense – suggesting that, if demand persists, the uptrend may speed up as a consequence of diminished overhead resistance.”

At time of writing, SOL is buying and selling at $197, effectively above Glassnode’s resistance level.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney