Technique, Michael Saylor and MSTR have taken over Wall Road. To many individuals’s chagrin, the suitcoiners and corporates are right here: Bitcoin held by firms within the type of bitcoin treasury corporations is hypnotic to have a look at. It has captured kind of everybody’s thoughts — mine, included.

It’s the most recent fad on the world’s capital markets, celebrated by a slim sway of financially savvy Bitcoiners and insiders, but hated by tradfi folks who can’t for the love of humanity perceive why anyone, not to mention an organization, would need bitcoin in any respect. Each odd Bitcoin podcaster has joined a number of bitcoin treasury corporations as buyers or advisors… or, to place their function extra bluntly: as glorified entrepreneurs posing as retail-delivery programs.

Over the previous couple of months, I’ve spent a whole bunch of hours investigating bitcoin treasury corporations. I’ve learn reviews and explainers, bull-ish puff items and in-the-weeds descriptions. I’ve thought deeply concerning the financial-market logic behind them. I’ve edited glorious articles pushing the rationale for treasury corporations, and overseen equally excellent arguments towards them.

In some small methods, I’ve even fallen prey to them; I’m not as aggressively against them as I gave voice to within the June 2025 article (“Are Bitcoin Treasury Corporations Ponzi Schemes?”) that was, by the way, shoved earlier than Michael Saylor on Fox Enterprise final week.

Right here’s what I’ve realized from all of this.

What’s a Sane, Regular, Common Bitcoiner To Do?

The best solution to go about bitcoin treasuries and financialized bitcoin is to easily ignore every part. Earlier than Enlightenment: chop wooden, hodl self-custody bitcoin; after Enlightenment: chop wooden, hodl self-custody bitcoin. Solely time will inform if these monetary autos, loaded with corporate-wrapped bitcoin and soft-spoken CEOs, will succeed or spectacularly blow up.

However in matters of cash and finance (and economics extra broadly), there’s normally no good, impartial alternative, no non-action; my cash and financial savings should go someplace, my consideration and labor be targeted on one thing. New bitcoin treasury corporations are launched weekly; aggressive fund raises or purchases are introduced every day. Being on this area, having an opinion turns into inevitable; having an excellent, well-informed one appears virtually an ethical crucial.

Having spent years diving into the weeds of financial economics, monetary historical past and now the wild monetary frontier of Bitcoin, the mental path to tread right here is sort of slim. One aspect guarantees a fast-track to the hyperbitcoinized future all of us envision, with company charters merely amplifying my sats on the way in which; the opposite, a cesspool of economic engineering and a hive of speculative mania rapidly lining up Bitcoiners to have their fiat contributions repurposed as bitcoin yield.

Why Would a Bitcoiner Get Concerned with These Corporations?

One purpose is leverage. As a typical millennial, I don’t have a home and thus no quick access to low cost debt (mainly the solely purpose to personal a house).

I can collateralize my cash by way of e.g., Firefish (at 6-9% APR), or draw on my bank cards (11% and 19%, respectively). These phrases aren’t nice; they arrive with a hefty price ticket, a fairly small capital pool they usually’re not low cost. Even when bitcoin CAGRs at 30-60%, that’s over longer time durations — not month-to-month or yearly, which is the cadence at which I’ve to service these kinds of debt.

In distinction, Technique and MARA subject convertible debt at 0%. These liabilities come due in a half-dozen years, they usually’re within the nine-figure vary. Stated Pierre Rochard in debating Jim Chanos final month:

“The flexibility to entry the phrases that Saylor has… shouldn’t be accessible to people holding Bitcoin in chilly storage.”

For many Bitcoiners, getting in on this motion is proving too juicy to withstand… even when it’s essential to fork over management and possession, and moreover pay a hefty premium over their present bitcoin stash for the privilege of proudly owning a few of these shares.

As a leverage mechanism, Saylor’s flip into most popular shares appears way more costly — paying 8-10% curiosity is approaching my very own borrowing talents — however they’re method safer.

The prefs safeguard the firm itself, since they take away the chance of margin calls or debt-fuelled chapter considerations, and provides the corporate unprecedented flexibility. Most well-liked shares present a launch valve, since Technique can decide not to pay the dividends for e.g., STRD; doing the identical for STRF “solely” prices them a 1% penalty going ahead. In a pinch, and with out a lot implication for the corporate itself, Technique may even withhold fee for the others (on the threat of zeroing out the bondholder bagholder, and making loads of folks a lot offended).

Right here’s the paradox: Whereas that is monetary leverage for Technique, which will get increasingly more of different folks’s cash to plunge into bitcoin and high up their stash, it isn’t leverage for (new) shareholders of MSTR.

To invoke Jim Chanos’ reply to Rochard in that debate: the purpose of leverage is to have extra than $1 of publicity. If I purchase MSTR at mNAV 1.5, and Technique itself has a leverage ratio of about 20%, I’m not levering up! (1/1.5 x 1.2 = 0.8). Thus, for each $1 I plunge into MSTR, I’m getting about 80 cents of bitcoin publicity. And the company, of which that share is a portion, nonetheless must pay about what I pay my financiers for the pleasure of utilizing another person’s cash.

The calculations for many of the different treasury corporations get even worse, largely due to their extreme mNAV. You’re the yield that the bitcoin treasury corporations are chasing. Once we put money into these corporations, we play fiat video games. And we play them straight in proportion to how costly the mNAV is. I’ve requested many instances:

“How can a bitcoin, wrapped in a company constitution, instantly be value double, triple, or ten instances probably the most liquid, observable and clearly indeniable worth on the planet?”

Certainly,

“What excessive value-added transformation does our orange coin bear the second you’re taking it beneath your financially leveraged wings and promise to subject debt, most popular inventory, and fairness towards it — in “waves of credit score bubbles,” we hear the ghost of Satoshi faintly whisper.“

Technique’s nice discovery — which everyone seems to be now head-over-heels copying — is that wrapping a bitcoin in a company shell, smashing some leverage on high of it, and promoting it on Wall Road in some way makes that very same bitcoin value multiples of its precise market worth.

A lot of the dialog ends there, with tradfi journalists busy dismissing this as a fad or a bubble; per the environment friendly market speculation, or simply widespread sense, nothing ought to commerce above the worth of the one factor it holds.

Not sufficient. Let’s tally some fairly sound causes for why company shares doing nothing however buying bitcoin must be value extra than the bitcoin they maintain:

- Storage. Self custody is less complicated than you assume, however loads of folks nonetheless shrink back from it (see: ETFs). An extra bizarre purpose is the high-profile wrench-attacks on Bitcoiners the world over; it’d be cheap to pay some form of premium for letting another person retailer your cash. Can’t wrench-attack my MSTR shares. Saylor appears to know what he’s doing (although custodying with Coinbase has raised some eyebrows), so let’s “retailer” our bitcoin along with his firm. 10%.

- Futures. Future bitcoin is value greater than current bitcoin. At any given time, there are unannounced treasury firm purchases accruing to shareholders however that aren’t but public data. Everytime you buy shares you’re solely conscious of the offers or acquisitions not but made public… however everyone knows, and might predict, that shares ought to commerce a little bit greater than they presently do: You’re at all times buying and selling shares on current data, understanding full nicely that there are issues behind the scenes leading to extra. That’s presumably worthy of some premium, so: 5% for e.g., Technique; a lot extra for the small and aggressive ones.

- Regulatory arbitrage. Look, says the bulls, there’s all this cash on the market, determined to purchase bitcoin however simply aren’t allowed to. I don’t fairly imagine that: Not that many individuals or establishments are eager on orange, and even when they had been, no matter premium we want to connect to this taxation-mandate-401(okay)–regulatory hurdle, it’ll decay with time and adoption. The identical monetary incentives and legal guidelines of gravity that justify bitcoin treasury corporations working in any respect additionally work to undermine the very regulatory obstacles that give them worth within the first place. 20%.

(For some, similar to Metaplanet in Japan, the place bitcoin buyers face extreme capital beneficial properties taxes, that arbitrage premium is value greater than that.) - Catch-all. I’m in all probability lacking some further purpose — a few of these corporations have residual, real-world companies too — for why a bag of bitcoin must be value greater than the bitcoin contained in the bag… so let’s simply add one other 20% right here.

Sum: 10+5+20+20 is 55… and conveniently about the place MSTR traded after I first handwaved collectively these premium justifications. At a bitcoin worth of $122,500, the 628,791 BTC on Technique’s stability sheet is value about $77 billion, however the market capitalization of the agency is $110 billion (~45% premium).

Technique is a Financial institution: The Financial Imaginative and prescient

Not the sort that takes (bitcoin) deposits and points (bitcoin) mortgages, however one other, extra deeply financial type.

You possibly can consider banking as one in all society’s risk-sharing mechanism. Society advances loans to some dangerous ventures, and capital markets — of which the banking system is one half — distribute the degrees of threat stemming from them. (A monetary “Who Will get What and Why,” mainly.)

A financial institution, economically talking, is an establishment that takes on that threat having some private details about the entities concerned; it distributes a small, assured return to the lender, whereas it, itself, beneficial properties from any profitable enterprise — although not by as a lot because the fairness proprietor themselves. If the financial institution does this efficiently, i.e., it on common picks profitable ventures and earns extra in curiosity on credit-worthy loans than it pays on curiosity to depositors, it makes earnings for itself.

That is what Technique is doing, utilizing the undiscovered zone between the bitcoin world and the fiat world.

Tradfi establishments, pension funds or retirees are the bank-financing part of the construction. They “deposit” cash in Technique, with returns and phrases decided by the particular tranche they select (STRK, STRD, STRF, STRC, or residual claimant in widespread inventory, MSTR).

The financial institution invests these funds in belongings: Technique sits within the center, guaranteeing the payouts to those financial entities by predicting that the belongings will repay greater than the acknowledged curiosity on the “financial institution deposits.” Slightly than a financial institution lending on mortgages and bank cards and to small companies, Technique’s “lending” aspect consists of a single consumer: the world’s best-performing asset. What Technique is doing is making the (very smart) gamble that bitcoin will enhance in greenback phrases sooner than the 8-10% it has to pay tradfi fiat establishments for the privilege of utilizing their cash.

Any middle-schooler with a calculator can determine that infinite riches await should you’re borrowing at 10% per 12 months to carry an asset that appreciates by 40% a 12 months.

Naturally, bitcoin doesn’t do good, cozy, 40%-a-year. If that had been the case, per Michael Saylor’s personal phrases, Warren Buffett would have snatched up aaaaall the bitcoinz way back:

“If bitcoin was not unstable, folks with more cash than you, extra energy than you, would outbid you for the bitcoin; you couldn’t have it… On the level that it turns into utterly predictable, Warren Buffet will say ‘oh yeah; we get it; we simply purchased all of the bitcoin’… and your alternative is gone.”

All that Technique want to make sure is that the financing gained’t bankrupt it; that the issuance is nicely beneath its management and discretion; that dividend funds are conservatively sufficient in comparison with the online capital it holds (i.e., bitcoin); and, most significantly, that the liabilities aren’t callable such that they’d pressure the corporate firm to promote bitcoin at inopportune moments.

Mainly, Saylor created a automobile exceedingly suited to make his method by way of excessive downturns. Even 80% falls in bitcoin — the worst of its type, and it’s definitely questionable whether or not these will ever occur once more, given the dimensions and public availability of the asset — gained’t stifle the corporate. The important thing to a profitable Ponzi is that the cash should maintain rolling in. Extra exactly, Technique is conservatively Ponzi-like in its financing (not like basic — fraudulent — Ponzis schemes, Saylor isn’t working a fraud; the optics simply overlap, and no one is defrauded… unwillingly, anyway).

What neither tradfi journalists nor treasury company-skeptic Bitcoiners have formulated nicely is how precisely these schemes collapse. For “Financial Forces,” economist Josh Hendrickson outlines exactly the related obstacles: “If markets are segmented and there’s an expectation that the worth will proceed to expertise fast appreciation, this makes the current discounted worth of a future liquidation may exceed the present liquidation worth. If the inventory is promoting at its present liquidation worth, it’s underpriced.” And:

“what MicroStrategy has completed is flip itself right into a bitcoin financial institution by issuing dollar-denominated liabilities and buying bitcoin. The corporate is explicitly engaged in monetary engineering to use regulatory arbitrage.”

Technique’s mannequin, however extra so the opposite copy-cats given their respective jurisdictional moats, can thus break if:

- Traders are mistaken concerning the future trajectory of bitcoin

- No matter mandates, tax guidelines and authorized obstacles that presently stop buyers from shopping for bitcoin straight loosen up

The flywheel impact, so imaginatively dubbed by the Twitteratis of the Bitcoin world, is the flexibility to use regulatory arbitrage, which, in flip, “is contingent upon buyers sustaining this expectation that bitcoin goes to be value significantly extra sooner or later,” in Hendrickson’s very tutorial, economistic phrases.

Shareholders and consumers of the preferreds gained’t be blissful within the occasion of nonpayment of the dividend. Shareholders of MSTR itself might be sad in the event that they’re diluted merely to fulfill bondholders (or worse, and Ponzi-like) pay the curiosity to preferreds. However so what? It doesn’t break Technique.

What is going to break the mannequin is the disappearance of those tradfi-to-bitcoin obstacles. It’s the regulatory hurdles that propelled so many of those corporations ahead; turned them to monetary bridges between the brand new world and the outdated; made them vacuum up unproductive, low-yielding capital from all around the world and suck it into bitcoin.

If fund managers or treasury departments or household workplaces routinely stack bitcoin as an alternative of assorted Technique merchandise (or securities of Technique copy-cats, because the case could also be in several components of the world), the first purpose for bitcoin treasury corporations go away.

The existence of bitcoin treasury corporations, in brief, hinges on the inertia of the current system. It relies upon, crucially, on household funds and pension funds, sovereign wealth funds and conventional buyers not doing the arduous work of determining precise bitcoin publicity (plus some protected, conservative leverage). In the event that they don’t do this, and as an alternative desire to overpay 50% for the privilege, then… sure, the bitcoin treasury corporations’ enterprise fashions are endlessly sustainable.

What Else Can Go Unsuitable?

There’s a custodian threat for Technique, definitely, with its cash with varied custodians, and in options which are purposefully stored fairly opaque. What occurs to Technique’s enterprise if e.g., Coinbase goes bankrupt? Or worse, new political winds usher in confiscation and/or aggressive taxation metrics?

Honest sufficient, these are tail dangers however dangers nonetheless.

And — it’s virtually trivial to level this out — if Bitcoin in some way fails, clearly Technique fails with it. If bitcoin stays a $118,000 stablecoin endlessly, most of Technique’s opportunistic use of plentiful monetary capital turns into virtually moot, and it’ll commerce just like the pot of bitcoin most journalists and lots of analysts assume it’s, its extraordiary progress (largely) evaporated.

And I feel that’s what journeys up so many journalists and analysts when this treasury firm phenomenon: When you can’t see how or why bitcoin would ever have worth or use, not to mention a spot in the way forward for cash and finance, then clearly a company dedicated to buying as a lot bitcoin as it may possibly is mindless in any respect.

When you do see a use and future for bitcoin, its worth ever-growing towards an ever-declining fiat, a company automobile devoted to buying extra by wielding capital markets cash flows turns into an entire different proposition.

The Hedge and The FOMO: What If I’m Unsuitable?

Mental humility forces us to appreciate that perhaps, simply perhaps, we received one thing mistaken.

Diamond palms are frequently cast… and mine stay fairly weak. It normally actually troubles me when the bitcoin worth drops precipitously. (It’s the sudden excessive of it, I imagine, that’s a giant deal… and I discover it arduous to account for it even in hindsight). I act recklessly, lash out — and never occasionally YOLO into lows with lease cash or different swimming pools of spare money that basically shouldn’t go into bitcoin.

In bull markets, that form of conduct normally works to my profit… however in the future it gained’t. Morgen Rochard, on one in all these limitless appearances on the Bitcoin podcast circuit, hammered dwelling this level. (I generally say that Morgen has, paradoxically, satisfied me to carry much less bitcoin than I do… sleep calmly at night time, be stoic within the face of worth strikes, and so forth, and so forth.)

The extra I study Technique, the extra I’m warming as much as its many specifically catered merchandise. It makes some semblance of sense for me to personal e.g., STRC for short-term money and STRK for muted bitcoin publicity with money circulation. STRK, financially talking, is like holding bitcoin twice financially eliminated; short-term actions in short-term worth can be a lot much less excessive and it could pay me a little bit of further fiat aspect earnings.

On condition that my web value {and professional} engagements are largely tied to bitcoin and correlated to bitcoin worth, having barely much less of my web value on this one-stop-shop space is sensible.

Why Not Simply Maintain Money in a Excessive-Yield Financial savings Account?

Good query. Two causes: they don’t yield very a lot… checks notes… 4.05% on my “high-yield” greenback account. Saylor’s equal product, STRC, targets a fee a whole bunch of foundation factors above that; and STRK, which within the medium time period approximates bitcoin itself, discounted or amplified by adjustments in MSTR’s mNAV (since at MSTR = $1,000, ten STRK converts), presently yields over 7%. Second, understanding myself, I’m fairly positive I’ll simply plunge money balances held in a fiat checking account into bitcoin on the first signal of a major worth dump; holding STRC or STRK in a brokerage account would not less than elevate the limitations to that form of imprudent conduct.

Hedges… Hedges All over the place

Since I’m already structurally brief fiat — per the unique Speculative Assault, I maintain debt and bitcoin, so I’m leveraged lengthy — it is sensible to… deep breath… diversify, just a bit bit!

I already routinely max out the pension contribution that my jurisdiction native mafia already forces me to pay into. The funds inside that permissioned wrapper make investments broadly in shares and bonds (roughly 75:25 proportion); in comparison with any form of bitcoin comparability, these after all carry out awfully, however in case I’m in some way — for some unimaginable purpose — mistaken about this entire money-printing, central banking-end-of-an-era factor, not less than I gained’t starve in outdated age:

Second, contributing to it comes with huge tax perks: Maxing out the contribution offers me some 1.5x the cash proper off the bat. Whereas these further funds might be outgrown by bitcoin’s routine ~40% CAGR in lower than two years, in addition they include tax-free mortgage perks; ought to I need to get myself a home real-world shitcoin sometime, I can use this pot of cash for the event.

The bitcoin-opportunity value is actual, and over time fairly debilitating, however this isn’t a matter of conviction. Actual-world practicalities rule: It makes a world of distinction for a way you dwell your life if hyperbitcoinization occurs in per week or in 100 years.

What has any of this received to do with bitcoin treasury corporations?!

Lots: as a result of the hedging mentality of “what if I’m mistaken about this” prevails right here as nicely.

For all of the fluff and fancy verbiage, all the brand new metrics and futuristic moon goals, I nonetheless can’t get previous why a bitcoin when wrapped in a company constitution needs to be value extra than a bitcoin. Sure, sure, net-present-value of future progress, yield, capital arbitrage, speculative assault, and guess on hyperbitcoinized banking however… actually?!

OK, so what if I’m mistaken? Lots of individuals I belief within the Bitcoin area vouch for these items — extra by the minute, it seems like — and there is some logic to them. Low cost leverage, speculative assault, tapping into (learn: tricking) fiat swimming pools of cash to circulation into bitcoin.

…so I FOMO’d into two treasury corporations lately: Two Technique merchandise (MSTR and STRK) and the Swedish small newcomer H100.

It’s Good to Have Shares Once more…

A decade or extra in the past, I used to carry loads of shares — giant, well-diversified portfolios, meticulously tracked. For years now, and for apparent causes, I haven’t held any.

I made a decision on Technique’s stuff as a result of they’re the least financially insane on this area; the second as a result of I had quick access by way of my old-time Nordic financial institution accounts — and I wasn’t going to hassle with discovering a handy brokerage, signal papers and switch funds, with the intention to perhaps play with just a few hundred bucks of bitcoin treasury funds. There’s sufficient ridiculous paperwork on the planet.

On the off probability that these items quantity to something, Technique might be there, working the present: MSTR is “amplified bitcoin,” as their advertising and marketing says. Since most of my financial savings are orange-clad and my skilled life is deep orange, as soon as extra, that form of diversification is sensible. (Plus, the mNAV for MSTR is rapidly approaching one… 1.42 as I’m scripting this.)

With Emil Sandstedt’s phrases ring in my ears — I perceive that I am the BTC yield they’re after — however at 25%-ish BTC yield and 20% (protected) leverage by way of the prefs and convertibles, I’ll be again at even publicity about this time subsequent 12 months: My ~150 {dollars}’ value of MSTR shares presently present about 120 {dollars}’ value of bitcoin publicity; I’m blissful to throw within the further $30 bucks for the monetary empire Mr. Saylor is erecting (and the potential progress in bitcoin-per-share).

Second, H100. The mNAV right here was additionally fairly acceptable for a small, nimbly, fast-moving and uniquely jurisdictionally dominant participant — at 2.73, ugh — however its low days-to-cover fee makes me really feel that I gained’t get too shafted.

My first realization after shopping for some: I’d forgotten how a lot enjoyable it’s!

Instantly, I’m monitoring a number of totally different asset costs as an alternative of only one. Instantly, I’m financially in cahoots with actual corporations doing actual issues (…ish, anyway), moderately than simply probably the most moveable, world and simply accessible cash there ever was. Psychologically, I felt half of one thing — vested within the enterprise, the speculative assault and bitcoin yield-curve development challenge that’s treasury corporations. How thrilling!

Second realization: Bitcoin has messed with clarified the which means of possession.

None of those devices are mine; they’re wrapped in layers of permissioned custody. I can promote them on the press of a button (from 9 to 5, Mondays by way of Fridays…), however I solely ever see any of that worth if

a) the brokerage cooperates

b) the financial institution that receives the payout cooperates, and

c) the federal government doesn’t block the transactions.

It’s one step worse than what Knut Svanholm elegantly remarks on in Bitcoin: The Inverse of Clown World:

“A financial institution is akin to a 2-of-3 multi-sig pockets the place you, the financial institution, and the federal government maintain one key every. In different phrases, cash within the financial institution shouldn’t be actually yours. Neither is it actually cash in any respect.”

…Or Not So Good to Have Stonks

I rapidly received myself just a few reminders of the intransparent, altogether ridiculous and bureaucratic nightmare inventory “possession” is. After I had transferred funds to the brokerage final month, discovered STRK and pressed “purchase,” I obtained an error message: “This safety shouldn’t be accessible to you.”

Seems I wasn’t eligible to personal American securities by way of that brokerage.

Tradfi belongings are so intransparent and so darn permissioned. And the reminders of this out of date value-technology stored coming. Clearly, it took a day or two for that “funding” to go -11%, reminding me that I nonetheless know nothing about honest valuation or timing the market. (Then once more, bitcoin puked off 5% from its then 2-week 118,000 stablecoin sample, so the chance value was considerably muted.)

It received worse when trudging by way of the lower-level sludge of bitcoin treasury corporations: the 2 Swedish penny shares which have made noise (H100, and K33; I had to purchase one thing with the cash meant for STRK) immediately fell 10% and 20% respectively — mainly from the second I touched them. Some experiment.

To paraphrase an outdated Wall Road adage, an fool and his sats are quickly separated… and the current fool doesn’t even have any new, shiny issues to point out for it as a result of — newsflash! — shares are custodial and immaterial! They reside in a brokerage agency’s database, and by extension, an organization ledger someplace. They’re not bodily… they usually’re not even actually mine! I can’t spend them, transfer them, again them up or recuperate them to a distinct pockets. They’re caught the place they’re, useless inventory in Adam Smith’s well-known phrasing relating to cash.

As an alternative, I put aside another fiat funds in my common banking app and impulse-bought MARA (MSTR is offered there, however no different Technique devices); whereas MARA is issuing shares and convertible debt to stack sats like one more treasury firm, not less than it’s an underlying working enterprise (mining) — and their mNAV is round 1, so I don’t pay a premium for his or her financial-market, cost-of-capital arbitrage-ish play.

How, Simply HOW, will Bitcoin Treasury Corporations Fail?

“There’s an actual chance we’ve got, like, a dot-com type boom-and-bust cycle on this public fairness world.”

Danny Knowles, Might 28, “What Bitcoin Did”

Technique is bulletproof.

As Lyn Alden’s query within the Technique Q2 earnings name illustrated, even in an 80% bitcoin drawdown, Technique might be nice. The corporate was in a a lot worse place through the 2022 bear market when its bitcoin was straight tied to margin loans and collateral for financial institution debt. That’s not the case in 2025 when preferreds run the present.

Wanting previous the occasional tradfi analyst or journalist obsession with mNAV, or why an organization needs to be valued above the bitcoin it holds, and the pearl-clutching, inside and out of doors Bitcoin over utilizing debt for buying extra bitcoin, Technique is unbelievably conservatively financed. The corporate holds bitcoin value some $77 billion; the convertible debt quantities to about $5 billion ($8 billion, actually, however a few of them are deep within the cash and commerce as fairness, not debt, at this level). There’s a little bit over $6 billion of most popular inventory excellent throughout STRK, STRD, STRF and STRC. (That makes the corporate about 15% levered, which means bitcoin must drop by over 85% for the corporate to have any form of solvency issues.)

One other avenue for issues is that if tradfi cash market capital dries up. Technique’s capacity to overperform bitcoin by producing growing bitcoin per share is determined by some mixture of decrease/safer value of capital (or higher phrases on its debt) or tapping the above-1 mNAV (immediately accretive because it lets Saylor purchase bitcoin at low cost). Within the absence of that — say, no one buys the treasury firm issuances, and monetary capital flows someplace else; cash printing stops; rates of interest on (safer?) authorities securities shoot up, and so forth — I don’t see how Technique’s mNAV doesn’t simply collapse again right down to 1.

Lastly, there’s a custodian threat for Technique particularly. Being the most important participant round, with some 3% of the full provide, honey-pot dangers abound. (This in all probability gained’t be a problem for the smaller ones, distributed throughout very totally different jurisdictions.) Technique retains its gigantic pile of cash with Coinbase custody — in options which are purposefully stored fairly opaque.

What occurs to Technique’s enterprise if Coinbase goes bankrupt? Or worse, new political winds usher in confiscation and/or aggressive taxation metrics? These are good questions, however very out-there tail dangers nonetheless. Do we actually have to fret that a lot about them?

Whether or not bitcoin treasury corporations are right here to convey bitcoin to the middle of worldwide capital markets, or whether or not this all ends in catastrophe, we’ve got but to see.

Closing Ideas: Promote-Out? Ponzi Acquired to Your Head?

Have I intellectually offered out? Am I a company slave? Has David Bailey’s musings — and the truth that Nakamoto, loosely affiliated with Bitcoin Journal by way of shared possession and advertising and marketing companies — rubbed off on me, now that NAKA is merging with KindlyMD and might unleash its flywheel/“Ponzi” scheming in full?

First, it could be a deep betrayal of journalistic integrity and — tells me our in-house authorized counsel — unlawful to make use of a media platform to pump securities owned by its proprietor. (Although within the age of Trump, who can inform?). However I definitely wouldn’t be doing my job if I weren’t severely investigating the professionals and cons of those entities mushrooming up in all places.

Second, and as an illustration of my very low conviction in all of this: I maintain about as a lot in treasury firm shares as I do in custodial Lightning wallets for zapping and comfort spending — ergo, not a lot.

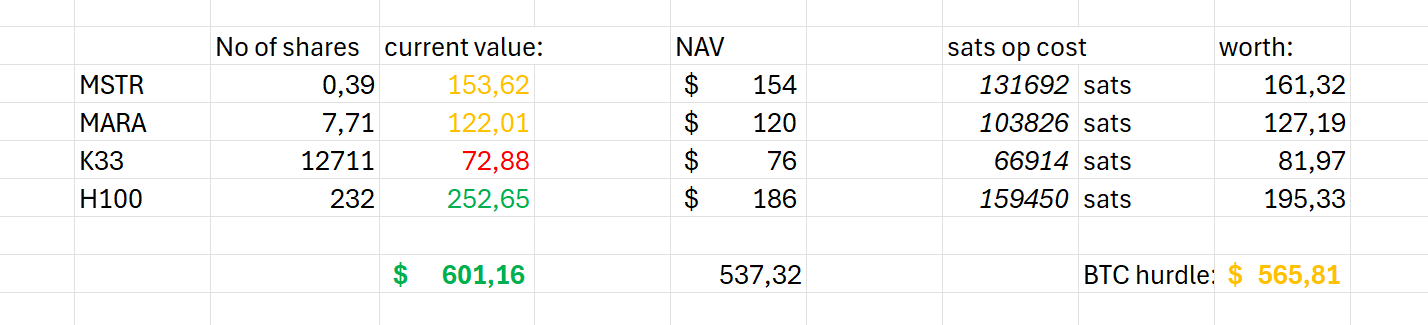

Third, for full transparency (once more, on recommendation of counsel), right here’s the expertise detailed so far (notice: calculated at costs earlier than Treasury Secretary Scott Bessent’s feedback yesterday shoved all these costs downward):

A couple of issues stand out.

- Select your bitcoin treasury corporations rigorously: H100 and Sander Andersen appear fairly devoted to the stacking effort, and the corporate retains shifting up the bitcoin treasuries listing. For now, monetary markets reward such corporations for his or her efforts. In distinction, the K33 crew strikes a lot slower, and their share worth expertise since their first bitcoin launch months in the past has been basic, short-term pump earlier than steadily declining again to the place the inventory began. MARA and Technique are hovering round the place they’ve been for months.

- My wonderful ~5% extra return over bitcoin is just too meagre to hassle with — and one-off fortunate. Over longer time durations, this would possibly change… however actually, simply don’t hassle.

- I’ll in all probability get uninterested in this newest fiat monetary engineering fad quickly sufficient. It’s solely a lot enjoyable to carry permissioned, brokerage-limited, old-fashioned belongings.

Come hell or excessive water, celebration or catastrophe, glory or tears… it appears a lot simpler to simply maintain chopping wooden and stacking sats into chilly storage than to hassle with any of those bitcoin securities.

Treasury fever is working excessive on Wall Road and amongst hyped-up Bitcoiners. Perhaps the financialization of bitcoin is upon us… however actually, I feel I’ll largely simply sit this one out.

—

BM Huge Reads are weekly, in-depth articles on some present subject related to Bitcoin and Bitcoiners. Opinions expressed are these of the authors and don’t essentially mirror these of BTC Inc or Bitcoin Journal. You probably have a submission you assume suits the mannequin, be happy to succeed in out at editor[at]bitcoinmagazine.com.

The opinions expressed on this article are the creator’s alone and don’t essentially mirror the opinions of BTC Inc, BTC Media, Bitcoin Journal or its employees. The article is offered for informational functions solely and shouldn’t be thought of monetary, authorized or skilled recommendation. No materials private data was utilized in writing this text. Opinions, and monetary actions taken as a consequence of these opinions, are these of the creator’s and don’t essentially mirror BTC Inc, BTC Media, or Bitcoin Journal.

Nakamoto has a advertising and marketing partnership with Bitcoin Journal’s father or mother firm BTC Inc to assist construct the primary world community of Bitcoin treasury corporations, the place BTC Inc supplies sure advertising and marketing companies to Nakamoto. Extra data on this may be discovered right here.