KEY

TAKEAWAYS

- The inventory market is consolidating, leaving buyers unsure about its subsequent transfer.

- The Know-how sector has regained management, however is not exhibiting sufficient momentum to observe by way of.

- The upcoming non-farm payrolls might decide whether or not the market breaks greater or pulls again.

Quite a bit has occurred within the inventory market since Liberation Day, holding us on our toes. Volatility has declined considerably, shares have bounced again from their April 7 low, and the economic system has remained resilient.

Quite a bit has occurred within the inventory market since Liberation Day, holding us on our toes. Volatility has declined considerably, shares have bounced again from their April 7 low, and the economic system has remained resilient.

Should you’re nonetheless feeling unsure, although, you are not alone. The inventory market’s in a little bit of a “wait and see” mode, going by way of a interval of consolidation because it figures out its subsequent transfer.

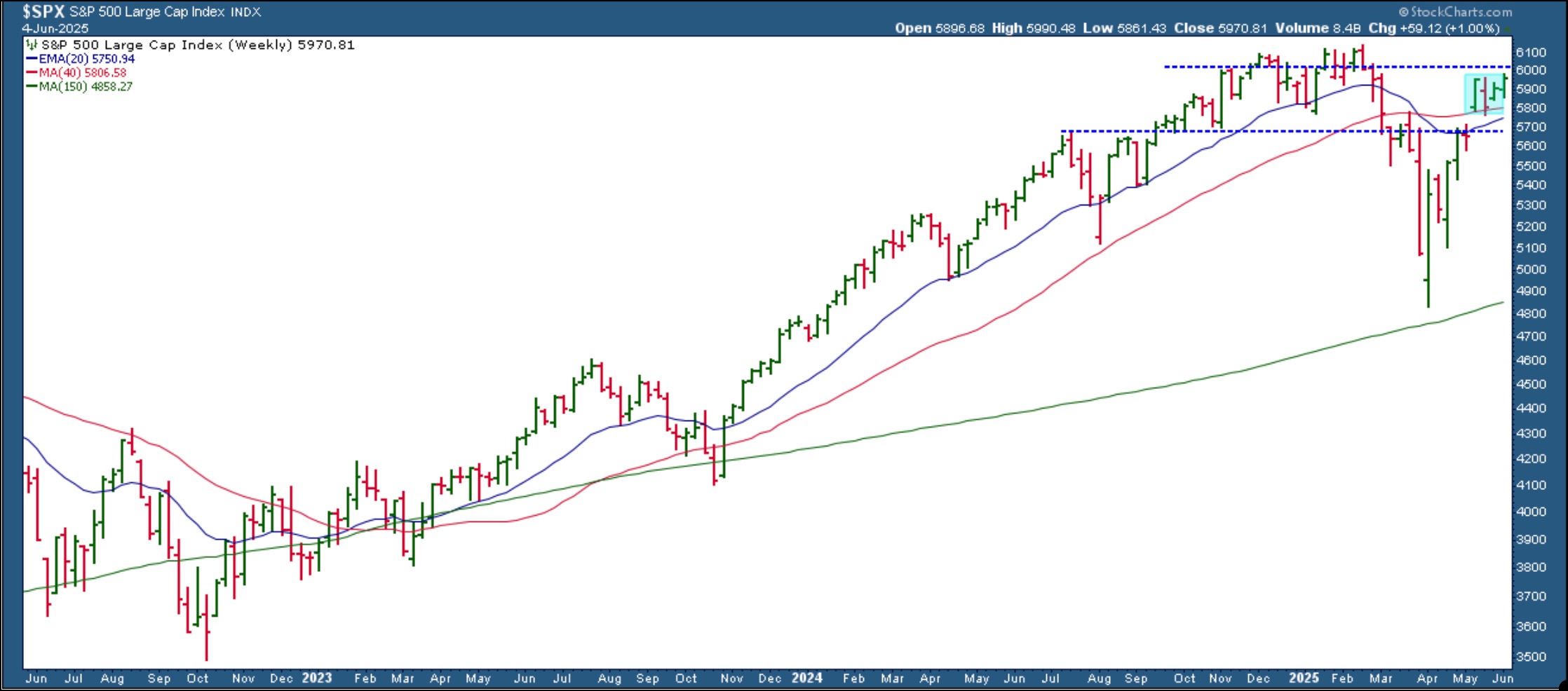

The S&P 500 ($SPX) is hesitating to hit 6000 regardless of reclaiming its 200-day easy shifting common (SMA). This indecision can depart buyers feeling caught in “no man’s land.” And it is not simply the S&P 500, both; most main indexes are in an identical situation, aside from small caps, which have been left behind. This might be as a result of the market has priced in a delay in rate of interest minimize expectations.

Tech Is Taking the Lead

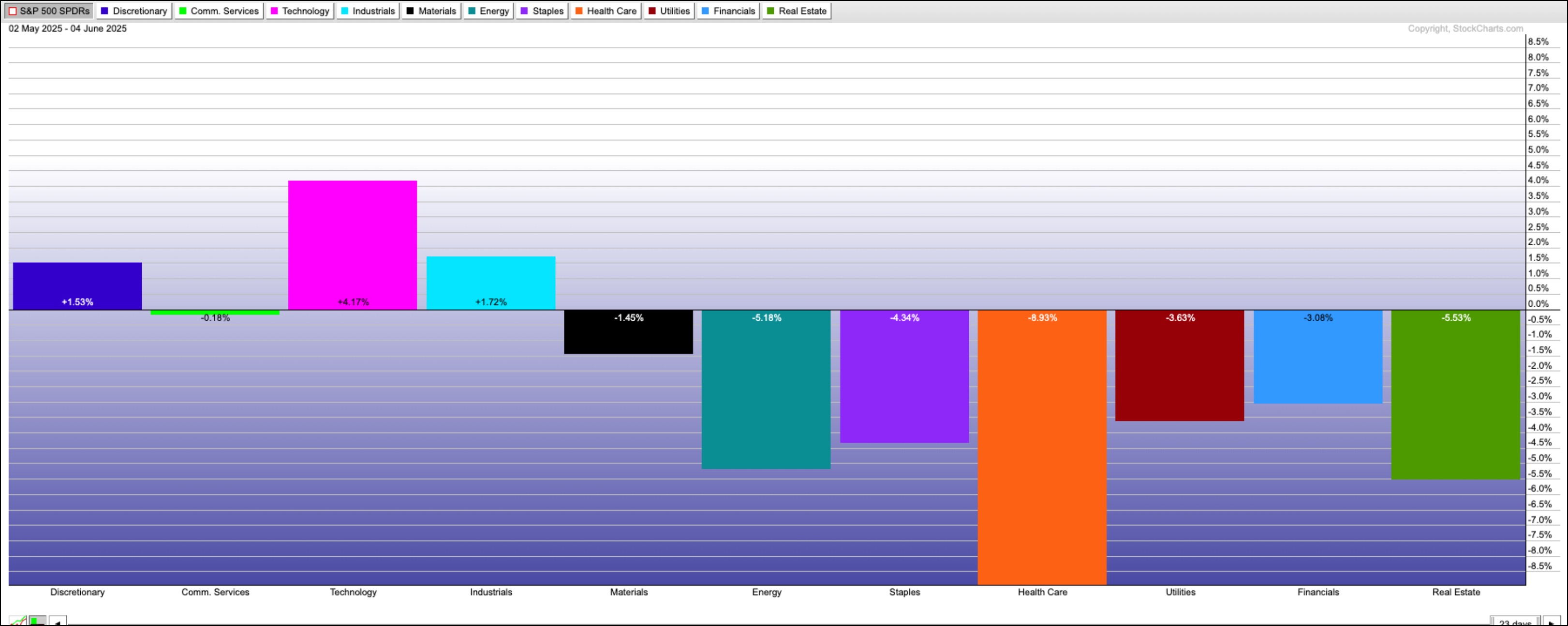

Should you drill down into the key indexes, there may be some motion you should not ignore. Tech shares have began to take the lead once more, though momentum has been missing. Over the previous month, the Know-how sector has been up over 4%.

FIGURE 1. S&P SECTOR ETF PERFORMANCE OVER THE LAST 30 DAYS. Know-how is the clear chief with a acquire of over 4%.Picture supply: StockCharts.com. For instructional functions. It is encouraging to see tech shares regain their management place. Tech is a significant pressure behind the S&P 500 and Nasdaq Composite ($COMPQ). The day by day chart of the Know-how Choose Sector SPDR Fund (XLK) exhibits the ETF has been making an attempt to interrupt above a consolidation vary it has been caught in since mid-Might.

FIGURE 2. DAILY CHART OF XLK. Though the ETF has barely damaged above its consolidation vary, we have to see higher momentum to substantiate a observe by way of to the upside.Chart supply: StockCharts.com. For instructional functions.Nothing is standing in the best way of XLK reaching its all-time excessive, however the momentum is not fairly there but. The 14-period relative power index (RSI) is under 70 and appears to be stalling, just about in keeping with the general inventory market’s value motion.

So, what is the market ready for? Possibly a catalyst, like Friday’s non-farm payrolls report. This week’s JOLTS, ADP, and ISM Companies information did not transfer the needle a lot, however the NFP report might be the sport changer.

S&P 500 Technical Forecast

The place might the S&P 500 go from right here? Let’s dive into the weekly chart.

FIGURE 3. WEEKLY CHART OF THE S&P 500. The index is spitting distance to its all-time excessive. A break above the November excessive would clear the trail to new highs.Chart supply: StockCharts.com. For instructional functions.

The S&P 500 broke above its 40-week SMA on the week of Might 12 and has held above it. Nevertheless, it has been in a consolidation for the final month, much like that of XLK.

The S&P 500 is approaching its November excessive of 6017. A break above it might push it towards new highs. On the flip aspect, if it slides under the 40-week SMA, it might be a trigger for concern and will imply the Might 12 gap-up might get crammed. Control the 5688 stage. If the S&P 500 pulls again near that stage and turns round, it might be a wholesome correction — a possibility to purchase the dip. An extra draw back transfer would imply exercising persistence or unloading a few of your positions.

What’s Going On With Gold and Bonds?

Whereas shares are grinding sideways, gold costs are rising, and bond costs are exhibiting inexperienced shoots. This value motion tells us that buyers might be bracing for slower progress forward. It is not one thing to panic about — simply one thing to look at.

You may get a fast have a look at what gold, bonds, and all the key indexes are doing by testing the StockCharts Market Abstract web page and Your Dashboard.

So, what do you have to do?

Maintain, add, or fold? That is the massive query. The market wants time to digest loads, from financial information to geopolitical dangers and coverage headlines. Maintain checking in and monitor the sectors, observe index efficiency, and word how different areas of the market, reminiscent of treasured metals and bonds, are reacting.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra