Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Having surged about 22.5% over the previous 30 days, Bitcoin (BTC) has sparked considerations within the crypto market that its rally could also be nearing exhaustion, with a possible value correction on the horizon. Nevertheless, the newest on-chain knowledge reveals that regardless of elevated unrealized income, there are nonetheless no indicators of elevated promoting stress for the main cryptocurrency.

Bitcoin Unrealized Income Stay Excessive However No Panic Promoting But

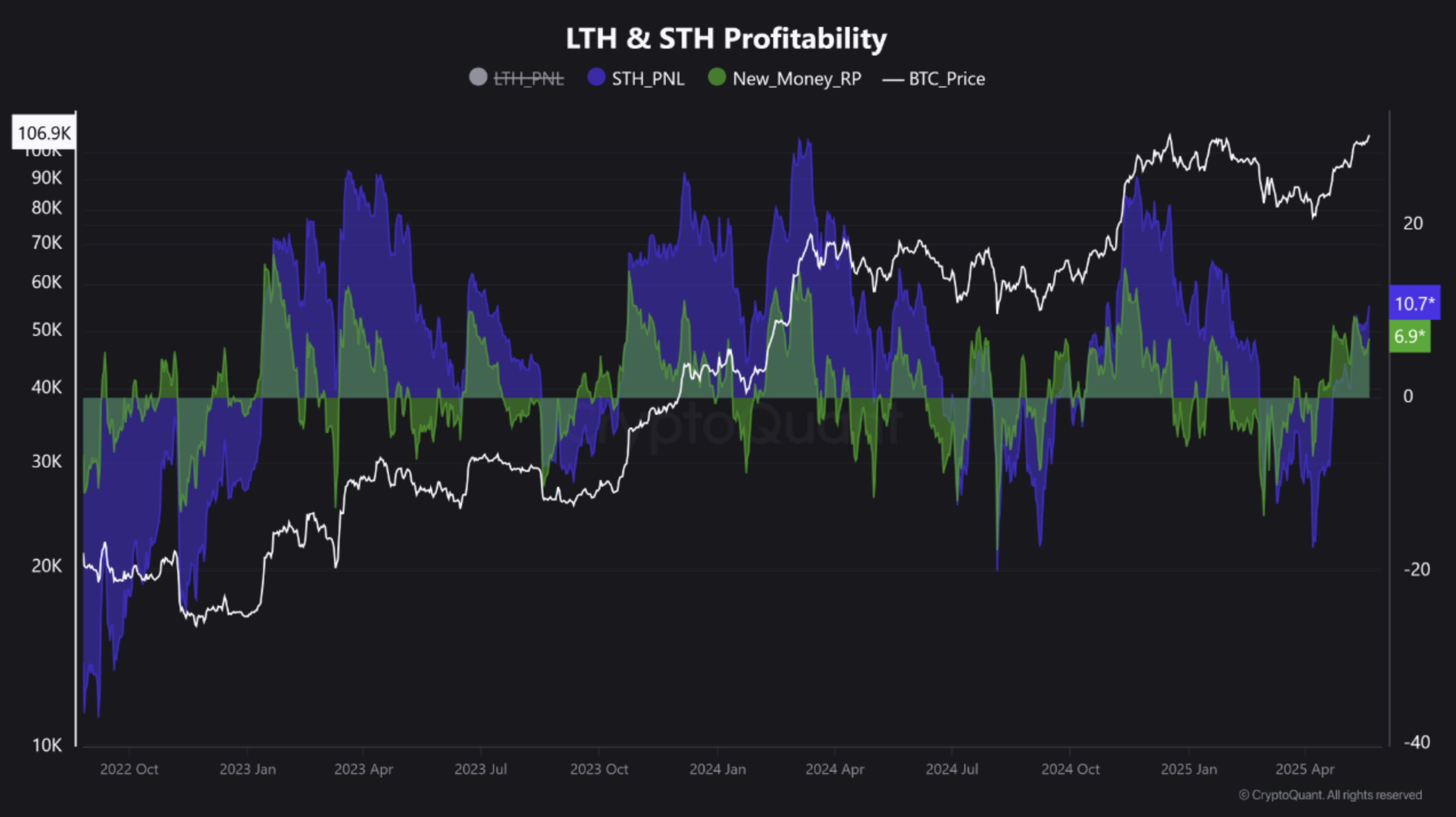

In line with a current CryptoQuant Quicktake put up by Bitcoin analyst Crazzyblockk, the cohort of latest buyers – those that have held BTC for lower than one month – is at present sitting on unrealized income of 6.9%.

Associated Studying

In the identical vein, short-term buyers – holders who’ve held Bitcoin for lower than six months – are sitting on unrealized income of 10.7%. These figures spotlight that the unrealized revenue/loss ratio stays elevated, with unrealized income far outweighing unrealized losses.

Crazzyblockk famous that whereas traditionally, a excessive share of unrealized income throughout the community tends to precede sharp value corrections, the present setup seems completely different. They added:

Previous cycles have proven that excessive revenue focus tends to precede volatility; nonetheless, present market construction reveals no outsized focus of threat in a single participant group.

The comparatively slim unfold in unrealized income between new and short-term holders signifies that revenue distribution is balanced. Moreover, though revenue ranges are excessive, loss ranges stay compressed, suggesting restricted stress from distressed sellers. The contributor remarked:

Whereas macro circumstances and volatility threat stay elevated, and a value correction can’t be dominated out, there isn’t a robust behavioral sign suggesting a excessive willingness to set off main distribution or promoting.

Additional Upside For BTC?

In the meantime, seasoned crypto analyst Ali Martinez just lately predicted additional upside for Bitcoin. In a put up on X, Martinez famous that BTC has undergone one other bullish breakout, with the potential to achieve a brand new all-time excessive (ATH) round $111,500.

The present momentum has additionally drawn in retail buyers. In line with CryptoQuant contributor Carmelo Aleman, wallets holding lower than $10,000 price of BTC are steadily returning to the market – an indication of rising retail participation.

Associated Studying

That stated, some warning indicators should dampen BTC’s present bullish trajectory. For example, regardless of the current encouraging value motion, Bitcoin’s Demand Momentum stays subdued.

Equally, Bitcoin’s “provide shortage” narrative nonetheless lacks significant energy, as Aleman just lately pressured that regardless of depleting change reserves, BTC is just not more likely to face real provide shortage within the close to time period. At press time, BTC trades at $106,528, up 1.8% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com