Foreign currency trading, also called international trade or FX buying and selling, is without doubt one of the hottest monetary markets on the planet. With over $6 trillion traded every day, it’s an extremely dynamic market that pulls each novice and skilled merchants.

Understanding key Foreign exchange jargon is crucial for efficient buying and selling; it permits merchants to make knowledgeable selections, talk clearly, and keep away from expensive misunderstandings. This information covers important Foreign currency trading time period and ideas, making a complete Foreign exchange starter information to assist each inexperienced persons and seasoned merchants.

Key traits of Forex

Foreign exchange, brief for “international trade,” includes the shopping for and promoting of worldwide currencies. It’s the biggest and most liquid monetary market on the planet, with a staggering every day turnover of round $5.3 trillion—sure, that’s trillion with a “T.”

Forex operates 24 hours a day from Monday morning to Friday night, that means you possibly can commerce at just about any hour throughout the work week. In contrast to different monetary markets, Foreign exchange enables you to revenue from each rising and falling costs, as you possibly can “purchase” should you count on a foreign money’s worth to extend or “promote” should you anticipate a drop. This flexibility opens up distinctive alternatives for merchants to earn no matter market course.

A variety of members fuels Forex: central banks, governments, worldwide firms, insurance coverage corporations, hedge funds, skilled merchants, and hundreds of thousands of newbie retail merchants—together with individuals such as you.

Foreign currency trading’s attraction lies in its accessibility—you can begin with a comparatively small account, and the market’s usually excessive volatility can yield important revenue potential. Nevertheless, this identical volatility additionally makes it a dangerous enterprise, underscoring the significance of talent and technique.

Important Foreign exchange Phrases for Newbies

Right here’s a fast record of important Foreign exchange phrases that function a basis for anybody getting into the world of Foreign currency trading:

-

Pip

-

Lot

-

Leverage

-

Margin

-

Unfold

-

Bid Value

-

Ask Value

-

Foreign money Pair

-

Base Foreign money

-

Quote Foreign money

- Foreign exchange Buying and selling Periods

- Foreign exchange Information

These fundamental Foreign exchange phrases will enable you to talk successfully available in the market and perceive the actions, calculations, and alternatives concerned in buying and selling.

Breaking Down Foreign exchange Terminology

Pip and Pipettes

A pip (proportion in level) is a measurement of motion in Forex, representing the smallest change in a foreign money pair’s value. For many foreign money pairs, a pip is the fourth decimal place (e.g., 0.0001). Nevertheless, for pairs involving the Japanese yen, it’s the second decimal place (e.g., 0.01).

For instance, if the EUR/USD pair strikes from 1.1000 to 1.1001, that’s a motion of 1 pip. Some brokers additionally measure fractional pips, known as pipettes, that are the fifth decimal place (e.g., 0.00001).

Lot

A lot in Foreign exchange refers back to the standardized buying and selling dimension. There are three widespread forms of lot sizes:

- Commonplace Lot: 100,000 items of foreign money

- Mini Lot: 10,000 items

- Micro Lot: 1,000 items

The lot dimension instantly impacts the amount of a commerce and, due to this fact, the potential revenue or loss. A regular lot dimension magnifies each danger and potential return, whereas micro or mini tons enable inexperienced persons to start out with decrease danger.

Realizing about tons is vital with regards to place sizing and danger administration.

Leverage

Leverage permits merchants to manage a bigger place available in the market with a comparatively small quantity of their capital. For example, a leverage of 1:100 signifies that for each $1 of a dealer’s capital, they’ll management $100 available in the market.

Whereas leverage can amplify income, it additionally will increase danger. Efficient danger administration is essential when utilizing leverage, as it could result in substantial losses if the market strikes unfavorably.

Margin

Margin is the amount of cash required to open and keep a leveraged place. It acts as a safety deposit held by the dealer. The margin requirement depends upon the chosen leverage. For instance, if you wish to management a $100,000 place with 1:100 leverage, you’ll want a margin of $1,000.

Understanding margin is crucial as a result of in case your account stability falls beneath the required margin stage, your dealer might shut your place to forestall additional losses (often known as a margin name).

Unfold

The unfold is the distinction between the bid value (value to promote) and the ask value (value to purchase) of a foreign money pair. It’s primarily the price of buying and selling, as brokers revenue from spreads reasonably than charging a direct fee.

For instance, if the EUR/USD bid value is 1.1000 and the ask value is 1.1002, the unfold is 2 pips. Tighter spreads are preferable for merchants as they scale back the buying and selling price, notably for high-frequency or short-term merchants.

Bid Value

The bid value is the worth at which a dealer can promote a foreign money. It’s the utmost value {that a} purchaser is keen to pay for a foreign money pair. In Foreign exchange, costs are at all times quoted in pairs, so should you’re promoting, the bid value is what you’ll obtain to your foreign money.

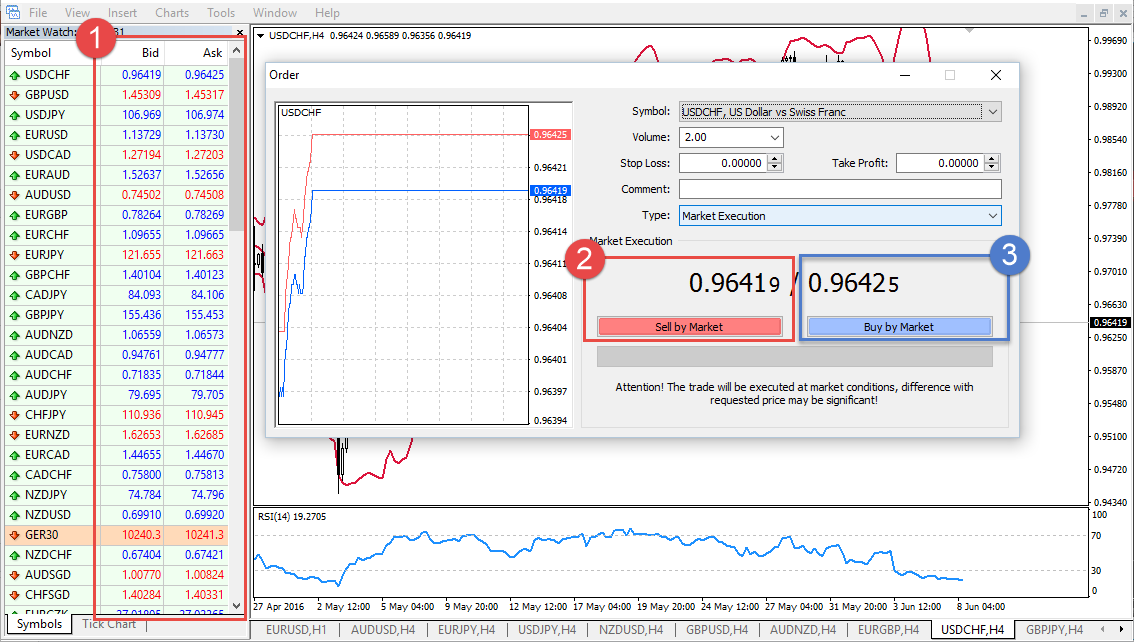

The screenshot beneath reveals an everyday MetaTrader view. On the left at (1) you see a listing of tradable Foreign exchange pairs with their bid and ask value. Within the center you see the order-execution window. You’ll be able to enter a promote commerce for the bid value and a purchase commerce on the ask.

Ask Value

The ask value is the worth at which a dealer can purchase a foreign money. It’s the minimal value a vendor is keen to simply accept. The distinction between the ask value and the bid value is the unfold. Understanding the ask value is vital as a result of it determines the entry value whenever you provoke a purchase order.

Foreign money Pair

A foreign money pair consists of two currencies, the place one foreign money’s worth is quoted in opposition to one other. Foreign currency trading includes shopping for one foreign money whereas concurrently promoting one other, creating paired buying and selling. Frequent foreign money pairs embrace EUR/USD (Euro/US Greenback) and GBP/JPY (British Pound/Japanese Yen).

Base Foreign money

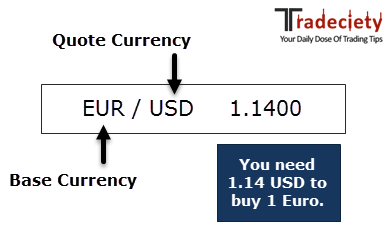

The base foreign money is the primary foreign money in a foreign money pair and serves because the reference foreign money for the commerce. For example, in EUR/USD, the euro is the bottom foreign money. If the EUR/USD charge is 1.1000, one euro equals 1.1000 US {dollars}.

Quote Foreign money

The quote foreign money is the second foreign money in a foreign money pair and signifies how a lot of this foreign money is required to purchase one unit of the bottom foreign money. In EUR/USD, the US greenback is the quote foreign money. If EUR/USD = 1.1000, then every euro prices 1.1000 USD.

Kinds of Foreign money Pairs

What’s a foreign money pair?

The truth that currencies are quoted and traded in pairs introduces distinctive traits to Foreign currency trading, which we’ll discover intimately.

Everytime you take a look at a Foreign exchange quote, you’ll discover that every foreign money is represented by a pair of foreign money codes—this is named a foreign money pair. For instance, within the pair EUR/USD, you might be buying and selling the euro in opposition to the U.S. greenback.

In each foreign money pair, the primary foreign money (euro, on this case) is known as the base foreign money, and the second foreign money (the U.S. greenback right here) is named the quote foreign money. The quote EUR/USD reveals what number of U.S. {dollars} are required to buy one euro. So, if EUR/USD is quoted as 1.1000, it signifies that 1 euro is equal to 1.1000 U.S. {dollars}.

Main Pairs

Main foreign money pairs embrace the US greenback (USD) and are extremely liquid with decrease spreads. Examples are EUR/USD, GBP/USD, and USD/JPY. Buying and selling main pairs is fashionable due to their excessive liquidity and decrease transaction prices.

The desk beneath reveals the 6 Foreign exchange majors ranked by every day exercise.

| Pair | Foreign money Names |

| GBP/USD | British Pound / US-Greenback |

| USD/JPY | US-Greenback / Japanese Yen |

| USD/CAD | US-Greenback / Canadian Greenback |

| AUD/USD | Australian Greenback / US-Greenback |

| EUR/USD | Euro / US-Greenback |

| USD/CHF | US-Greenback / Swiss Franc |

Minor Pairs

Minor foreign money pairs don’t embrace the USD however include different main international currencies just like the euro, British pound, or Japanese yen. Examples embrace EUR/GBP and AUD/JPY. Minor pairs typically have wider spreads than main pairs, making them barely dearer to commerce.

| Pair | Foreign money Names |

| AUD/JPY | Australian Greenback / Japanese Yen |

| EUR/GBP | Euro / British Pound |

| EUR/AUD | Euro / Australian Greenback |

| EUR/NZD | Euro / New Zealand Greenback |

| GBP/JPY | British Pound / Japanese Yen |

| GBP/CAD | British Pound / Canadian Greenback |

| NZD/JPY | New Zealand Greenback / Japanese Yen |

| CHF/JPY | Swiss Franc / Japanese Yen |

| EUR/CAD | Euro / Canadian Greenback |

| AUD/CHF | Australian Greenback / Swiss Franc |

Unique Pairs

Unique foreign money pairs contain a serious foreign money paired with an rising market or smaller foreign money, reminiscent of USD/TRY (US Greenback/Turkish Lira) or EUR/SEK (Euro/Swedish Krona). Exotics have increased spreads and better volatility, presenting distinctive alternatives and dangers for knowledgeable merchants.

| Pair | Foreign money Names |

| USD/TRY | US Greenback / Turkish Lira |

| EUR/SEK | Euro / Swedish Krona |

| USD/ZAR | US Greenback / South African Rand |

| EUR/TRY | Euro / Turkish Lira |

| USD/THB | US Greenback / Thai Baht |

| GBP/SGD | British Pound / Singapore Greenback |

| USD/DKK | US Greenback / Danish Krone |

| EUR/HUF | Euro / Hungarian Forint |

| USD/HKD | US Greenback / Hong Kong Greenback |

| AUD/MXN | Australian Greenback / Mexican Peso |

Foreign exchange Buying and selling Journal

A Foreign exchange buying and selling journal is a private log the place merchants document every commerce they make, together with particulars like entry and exit factors, chart patterns, technique varieties, commerce dimension, causes for taking a commerce, and emotional state throughout the commerce.

Such a buying and selling journal serves as a robust device for analyzing buying and selling efficiency, figuring out patterns, and refining methods. Holding an in depth buying and selling journal helps merchants study from each their profitable and unsuccessful trades, enhancing self-discipline and accountability over time.

A superb journal permits merchants to objectively overview and enhance their decision-making processes, serving to to construct a sustainable edge available in the market. Among the many high options for sustaining a Foreign currency trading journal, Edgewonk stands out as probably the greatest choices. It offers an easy-to-use interface with superior analytical options that enable merchants to trace efficiency metrics, establish strengths and weaknesses, and make data-driven changes to their buying and selling technique.

Edgewonk works for all main Foreign exchange brokers and platforms, making the method of journaling easy.

Foreign exchange Dealer

With the intention to entry Forex, you want a dealer. A dealer offers you with the totally different costs to your foreign money pairs and the dealer is the one who facilitates your trades.

I additionally made a video with a couple of suggestions and tips on methods to use MetaTrader4, one of the vital fashionable buying and selling platforms on the market.

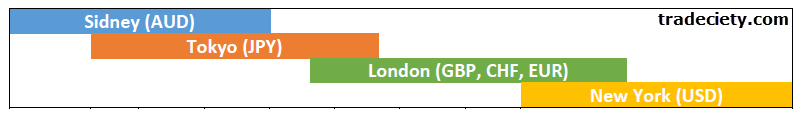

Foreign currency trading classes

Forex doesn’t have the identical open and shutting occasions because the inventory market or different monetary markets. You’ll be able to commerce currencies 5 days every week, 24 hours a day from Monday morning when the Australian monetary markets open, till Friday evening when the American market closes.

With regards to Foreign currency trading, there are 4 major classes all through the day:

Sidney: Australian buying and selling session (AUD, NZD)

Tokyo: Asian buying and selling session (JPY)

London: European buying and selling session (GBP, EUR, CHF)

New York: American buying and selling session (USD, CAD)

When you choose the Foreign exchange pairs that you just commerce, it’s vital to know that the person currencies transfer most throughout their ‘personal’ buying and selling time. Which means that the USD/JPY often strikes most throughout the New York (USD) and the Asian (JPY) session. The AUD/USD is most lively throughout the Australian (AUD) and the New York (USD) session. Typically, the overlap between the European and the American session is essentially the most lively buying and selling session total.

Information and Foreign currency trading

Information and macroeconomic occasions are closely influencing foreign money and Foreign exchange costs. As a Foreign exchange dealer, it’s important to maintain monitor of vital information occasions. Even if you’re a purely technical dealer, realizing when information occasions are scheduled is vital to make the suitable buying and selling selections and keep away from danger components.

Earlier than, throughout and after a information launch a dealer has a couple of selections and listed below are our high suggestions for coping with information as a Foreign exchange dealer:

1) Don’t take new trades forward of vital information occasions.

2) If value is near your take revenue, shut your place forward of excessive affect information and don’t gamble together with your income.

3) Tighten your cease loss if you end up in a commerce. In occasions of excessive volatility, stops may not get executed at their precise value stage. It’d, due to this fact, be safer to shut your current positions earlier than a information occasion.

4) Wait 30 – 60 minutes after a information launch earlier than getting into a brand new commerce. Put up-news value volatility might be very erratic and unpredictable. Let the mud settle earlier than making a decision.

The subsequent query is which information occasions it’s best to observe. ForexFactory has an important information calendar that at all times offers you a very powerful information for the day. In addition they mark the information merchandise primarily based on impact-level and present which foreign money is most impacted. Here’s a record of the largest market movers for Foreign exchange merchants:

- GDP (Gross Home Product)

- Unemployment knowledge and particularly the US NFP

- CPI (Client Value Index) which is a proxy for inflation

- Rate of interest selections – rates of interest are the principle long-term drivers of currencies

- Central Financial institution conferences (FED, ECB, BOE, SNB, BOJ, RBA)