KEY

TAKEAWAYS

- High 5 sectors stay unchanged, with minor place shifts

- Main sectors displaying indicators of dropping momentum

- Each day RRG reveals high sectors in weakening quadrant

- Communication companies liable to dropping out of high 5

Communication Companies Drops to #5

The composition of the highest 5 sectors stays largely secure this week, with solely slight changes in positioning. Shopper staples proceed to guide the pack, adopted by utilities, financials, actual property (transferring up one spot), and communication companies (dropping to fifth). This defensive lineup persists regardless of a rallying market, presenting an fascinating dilemma for sector rotation methods.

- (1) Shopper Staples – (XLP)

- (2) Utilities – (XLU)

- (3) Financials – (XLF)

- (5) Actual-Property – (XLRE)*

- (4) Communication Companies – (XLC)*

- (6) Healthcare – (XLV)

- (7) Industrials – (XLI)

- (8) Supplies – (XLB)

- (11) Expertise – (XLK)*

- (10) Power – (XLE)

- (9) Shopper Discretionary – (XLY)*

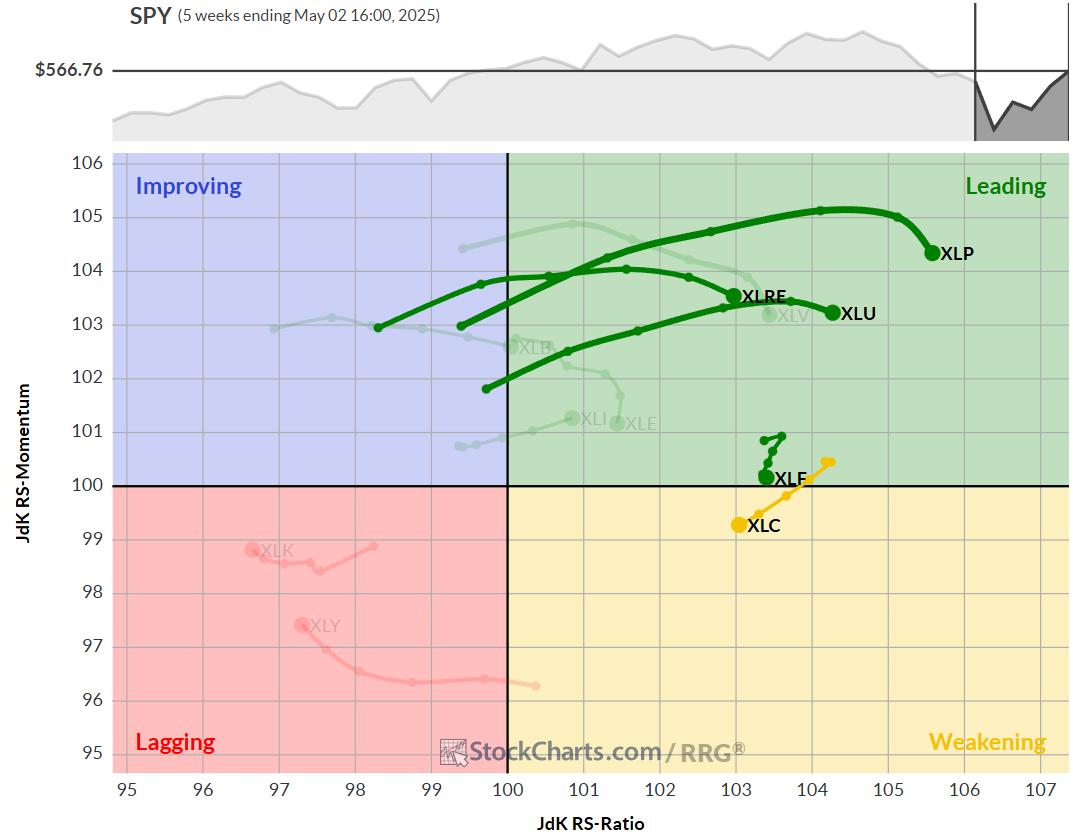

Weekly RRG

The weekly Relative Rotation Graph (RRG) paints an image of potential change on the horizon.

Whereas staples, utilities, actual property, and financials keep their positions within the main quadrant, they present indicators of dropping relative momentum over the previous few weeks.

Financials, significantly, are teetering on the sting of rolling into the weakening quadrant.

Communication companies have already shifted, now firmly within the weakening quadrant and touring on a detrimental RRG heading. This motion explains its drop to the fifth place in our sector rankings.

Each day RRG

Switching to the every day RRG, we see a barely completely different image for our high sectors.

Staples, utilities, actual property, and financials are all positioned within the weakening quadrant, touring on detrimental RRG headings.

This short-term view signifies that we should carefully monitor these sectors to find out if they’ll regain momentum earlier than probably dropping out of the highest 5.

Curiously, communication companies is displaying indicators of life on the every day chart. Regardless of falling to the fifth place general, its tail is now within the bettering quadrant and transferring towards main.

The caveat? It is a very brief tail, near the benchmark—basically transferring in keeping with the market. This makes communication companies the sector most liable to dropping its top-five standing within the close to time period.

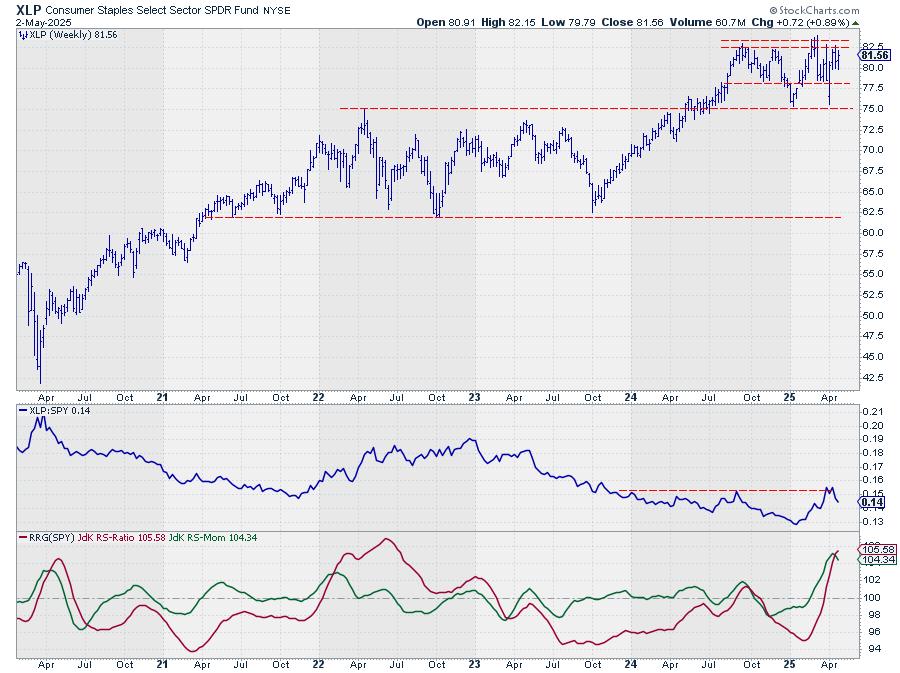

Shopper Staples

Shopper staples is bumping up towards overhead resistance between $82.50 and $83.

This hesitation in upward worth motion is inflicting weak spot within the RS line, which has began to dip.

Consequently, the RS momentum line is rolling over. Nevertheless, the excessive RS ratio—indicating a powerful relative development—is retaining staples on the high of our record for now.

Utilities

Utilities has been flirting with a breakout because the begin of 2025, pushing towards overhead resistance round $80 about 4 instances already.

When it breaks, we’ll seemingly see an acceleration in direction of the all-time excessive simply above $82.50.

Like staples, the shortcoming to interrupt resistance is inflicting a stall within the RS line and a rollover in relative momentum.

Financials

After a powerful rally off the $42 assist degree, beforehand resistance (the previous technical adage holds true), financials is now dealing with a problem.

The rally is approaching the previous rising assist degree that marked the uptrend channel. This might trigger some hesitation in each worth and relative power.

The RS line stays inside its rising channel, however momentum has waned, inflicting the inexperienced RS momentum line to roll over.

Actual-Property

Actual property moved up one place to fourth and continues to be rising from an extended relative downtrend that started in April 2022.

The RS ratio line has picked up the relative power rally that began in early 2025 however is now stalling.

This has resulted within the inexperienced RS momentum line rolling over. On the worth chart, actual property is mid-range with room to maneuver greater.

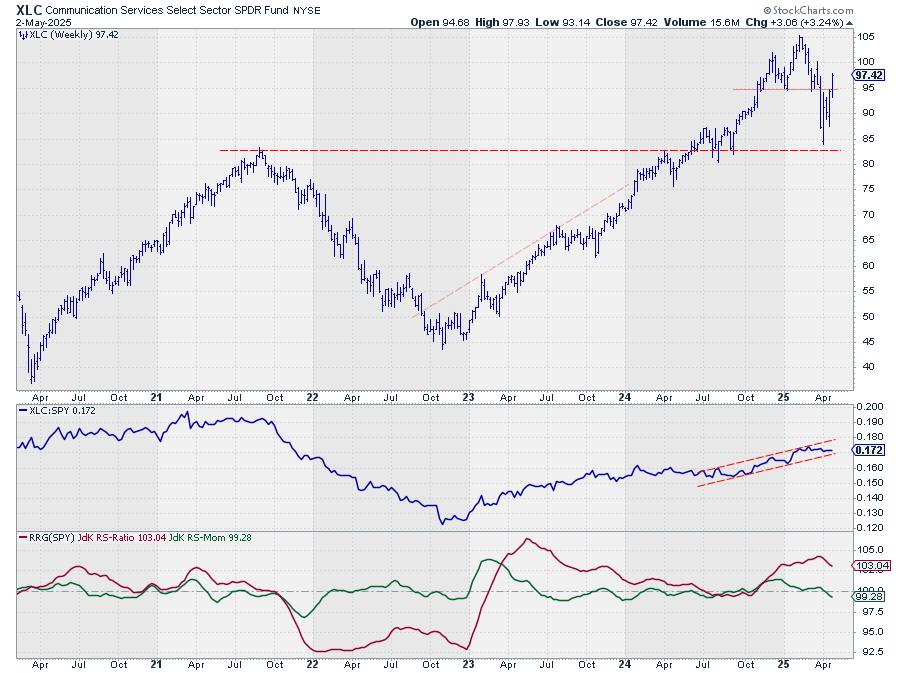

Communication Companies

Communication companies have dropped to the fifth place, however the worth chart has an fascinating growth.

Final week, the worth broke again above the previous neckline of a small head-and-shoulders sample. The truth that we’re now rallying above this neckline might point out a failed head-and-shoulders sample—normally a really robust bullish signal.

Nevertheless, current weak spot in relative power has pushed the sector deeper into the weakening quadrant on the RRG.

This sector should choose up quickly within the coming weeks to take care of its place within the high 5.

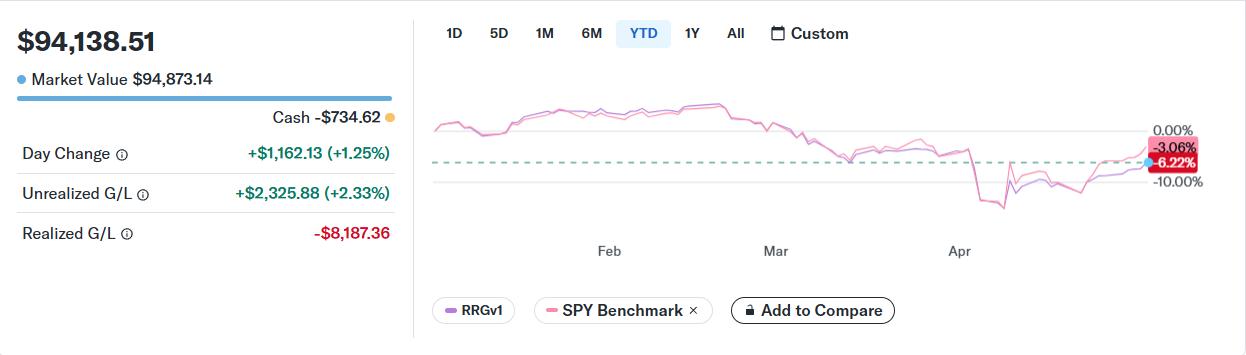

Portfolio Efficiency

The defensive positioning of our high 5 sectors is resulting in underperformance because the broader market rallies.

At present, we stay at roughly a 3% underperformance in comparison with SPY identical to final week.

Nevertheless, from the attitude of sector rotation, we should nonetheless contemplate this rally within the S&P 500 to be momentary.

The underlying message continues to emphasise protection.

It is essential to recollect that there’s all the time a lagging component in RRGs and this technique.

If the market has actually turned, we’ll see that shift mirrored in our sectors, and in some unspecified time in the future, we’ll begin to make up the distinction.

These efficiency gaps can change very quickly in favor of the RRG portfolio when the market comes below strain and our defensive sectors begin to lead once more.

#StayAlert and have a fantastic week — Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll actually learn them and, the place fairly doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.