Figment, a significant participant in blockchain staking providers, is actively trying to purchase firms in a spree of crypto trade consolidation sparked by renewed optimism over U.S. regulatory readability.

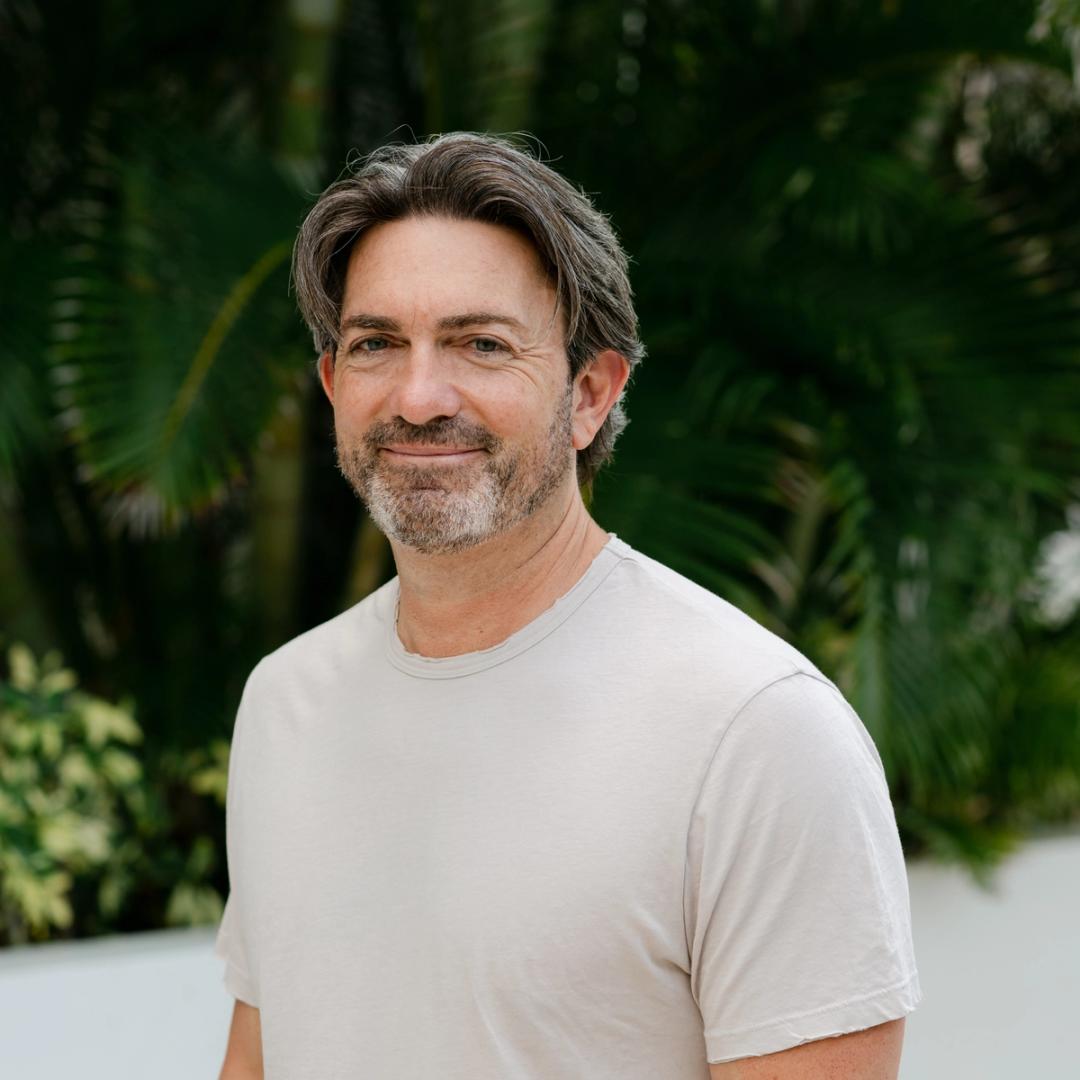

The Toronto-based agency is focusing on acquisitions between $100 million and $200 million, with a powerful regional presence or inside blockchain ecosystems, resembling Cosmos and Solana, CEO Lorien Gabel advised Bloomberg. He stated the agency already has time period sheets out for some offers, the report added.

Figment helps establishments earn yield by staking, whereby tokens are locked to assist safe blockchain networks and validate transactions supported by networks. The corporate at the moment manages round $15 billion in staked property and employs about 150 folks, Gabel stated.

The flurry of crypto offers, which embrace Kraken’s $1.5 billion buy of NinjaTrader and Ripple’s $1.25 billion acquisition of Hidden Street, comes because the Trump administration introduced on a extra crypto-friendly regulatory surroundings. That surroundings noticed the U.S. Securities and Trade Fee drop circumstances in opposition to numerous crypto companies, with crypto ally Paul Atkins just lately taking on the fee.

Regardless of the acquisition technique, Figment isn’t in search of extra funding and has dominated out a sale. Gabel, who co-founded the agency and has launched three prior startups, stated he’s dedicated to constructing Figment for the long run. “I’d fairly go to zero,” he stated.

The corporate has raised $165 million up to now, based on information from TheTie. Its newest Collection C funding spherical was led by Thoma Bravo and noticed participation from giants together with Morgan Stanley, StarkWave, and Franklin Templeton India.

Learn Extra: Kraken to Purchase NinjaTrader for $1.5B to Enter U.S. Crypto Futures Market