What you could know

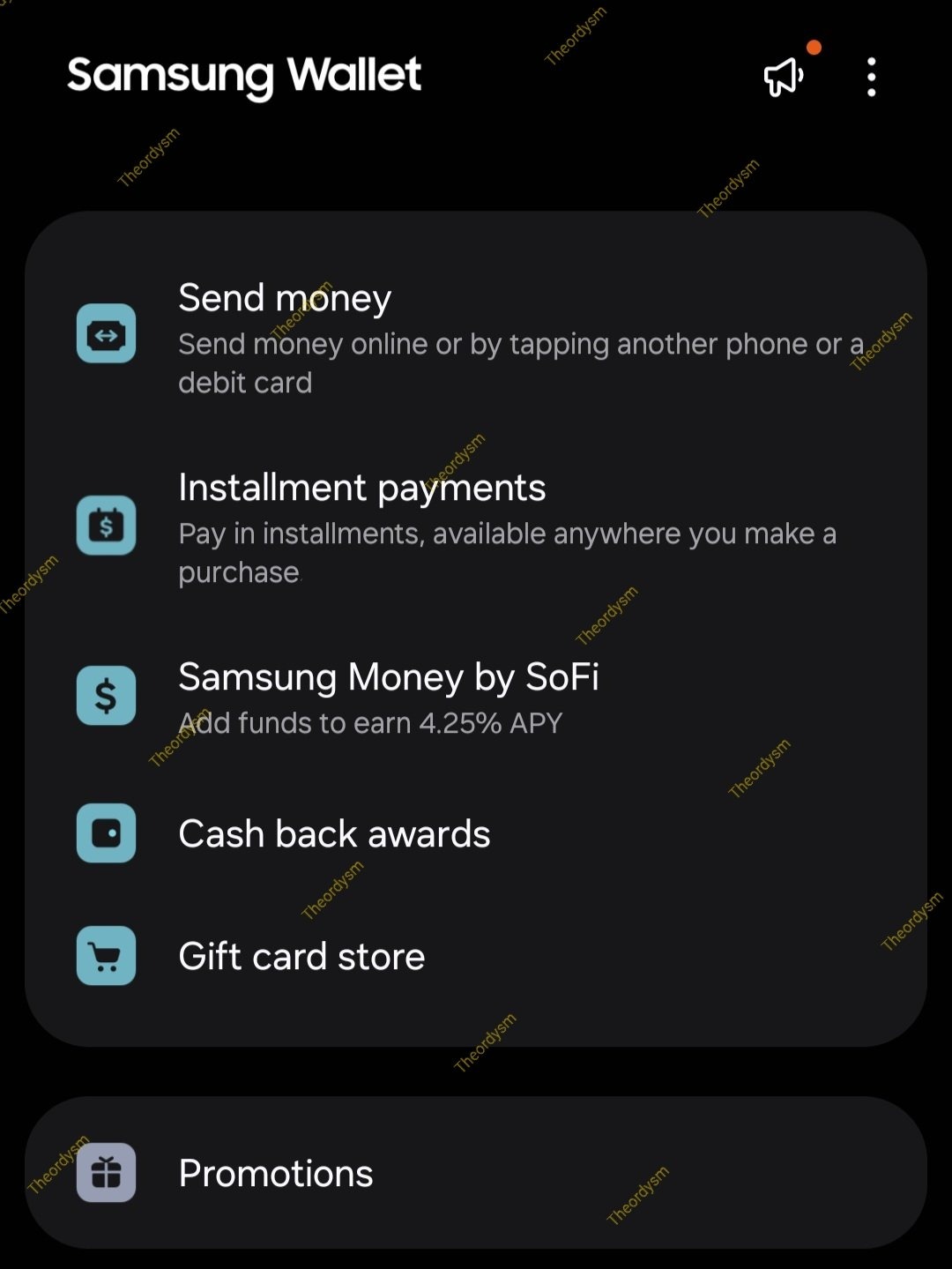

- Samsung Pockets is testing out two thrilling options: ‘Purchase Now, Pay Later’ and ‘Faucet to Switch,’ with a possible U.S. launch on the horizon.

- The ‘Instantaneous Installment’ characteristic enables you to break up funds for purchases, whereas ‘Faucet to Switch’ works like Apple’s Faucet to Money however with extra flexibility for different digital wallets.

- The BNPL characteristic, powered by Splitit, will allow you to use Visa or Mastercard with out a credit score examine, although activation might require approval and will have further charges.

A contemporary beta construct has given us a sneak peek at Samsung Pockets’s “purchase now, pay later” and tap-to-send choices, and though these usually are not official but, all indicators level to those options rolling out quickly.

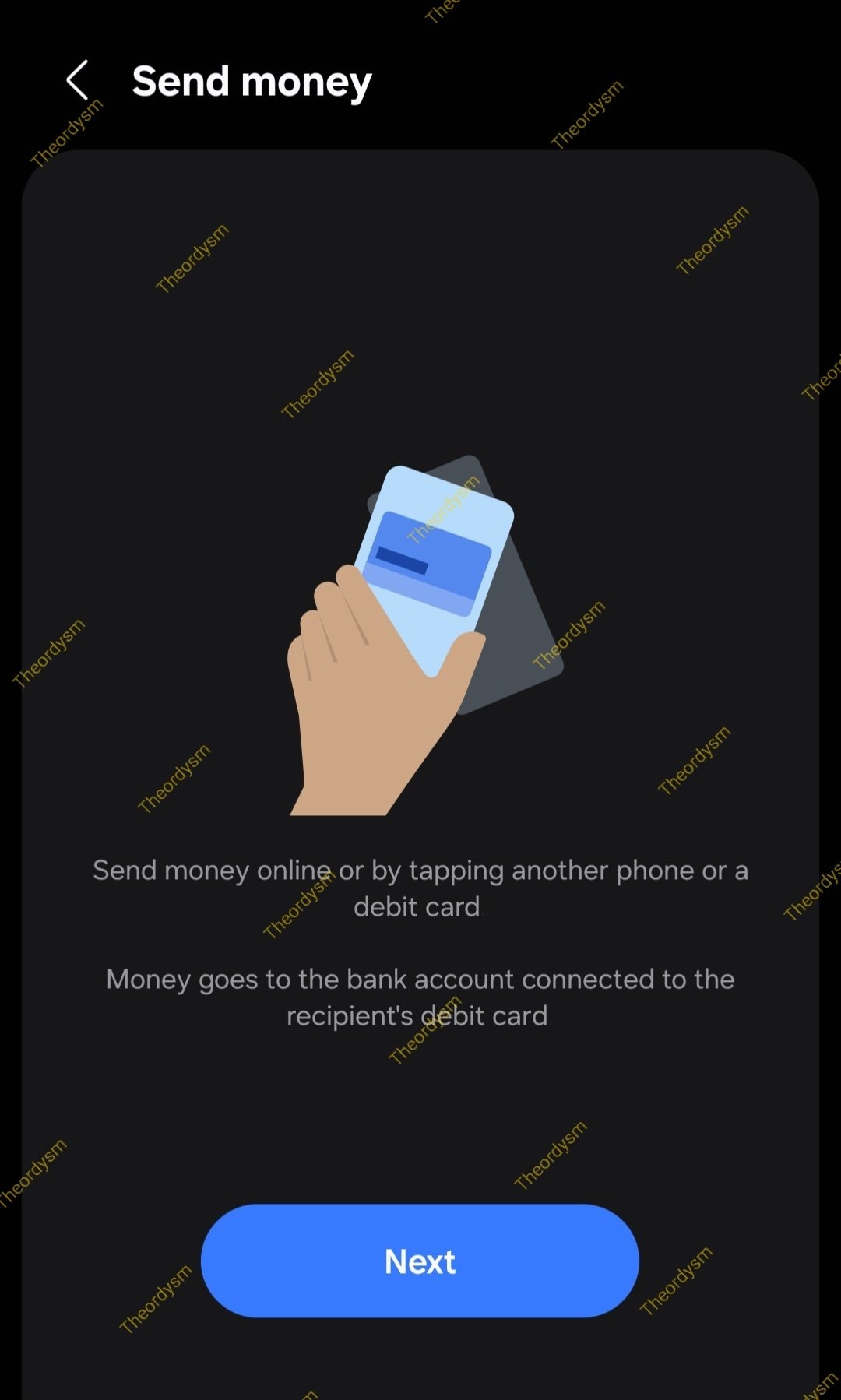

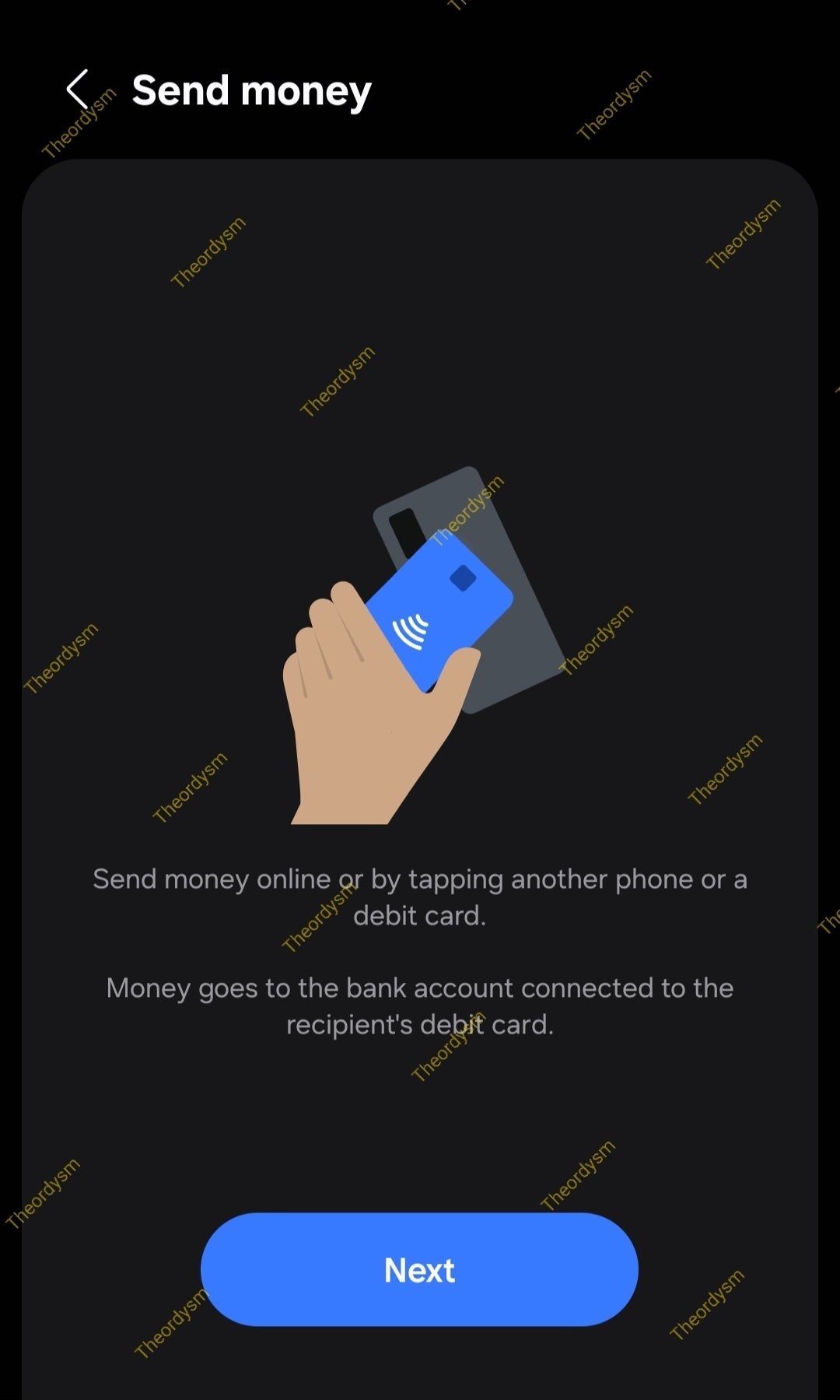

When the Galaxy S25 sequence made its debut in January, Samsung additionally snuck in some software program updates that flew below the radar. Two standout options had been “Instantaneous Installment” for breaking apart funds and a peer-to-peer cash switch choice that Samsung calls “Faucet to Switch.”

Samsung’s Faucet to Switch works rather a lot like Apple’s Faucet to Money—simply bump telephones to ship cash. Nonetheless, whereas Apple retains issues locked in its ecosystem, Samsung is presumably taking part in good with different digital wallets. Meaning you may not want a Galaxy telephone to obtain money, giving it a flexibility Apple doesn’t supply.

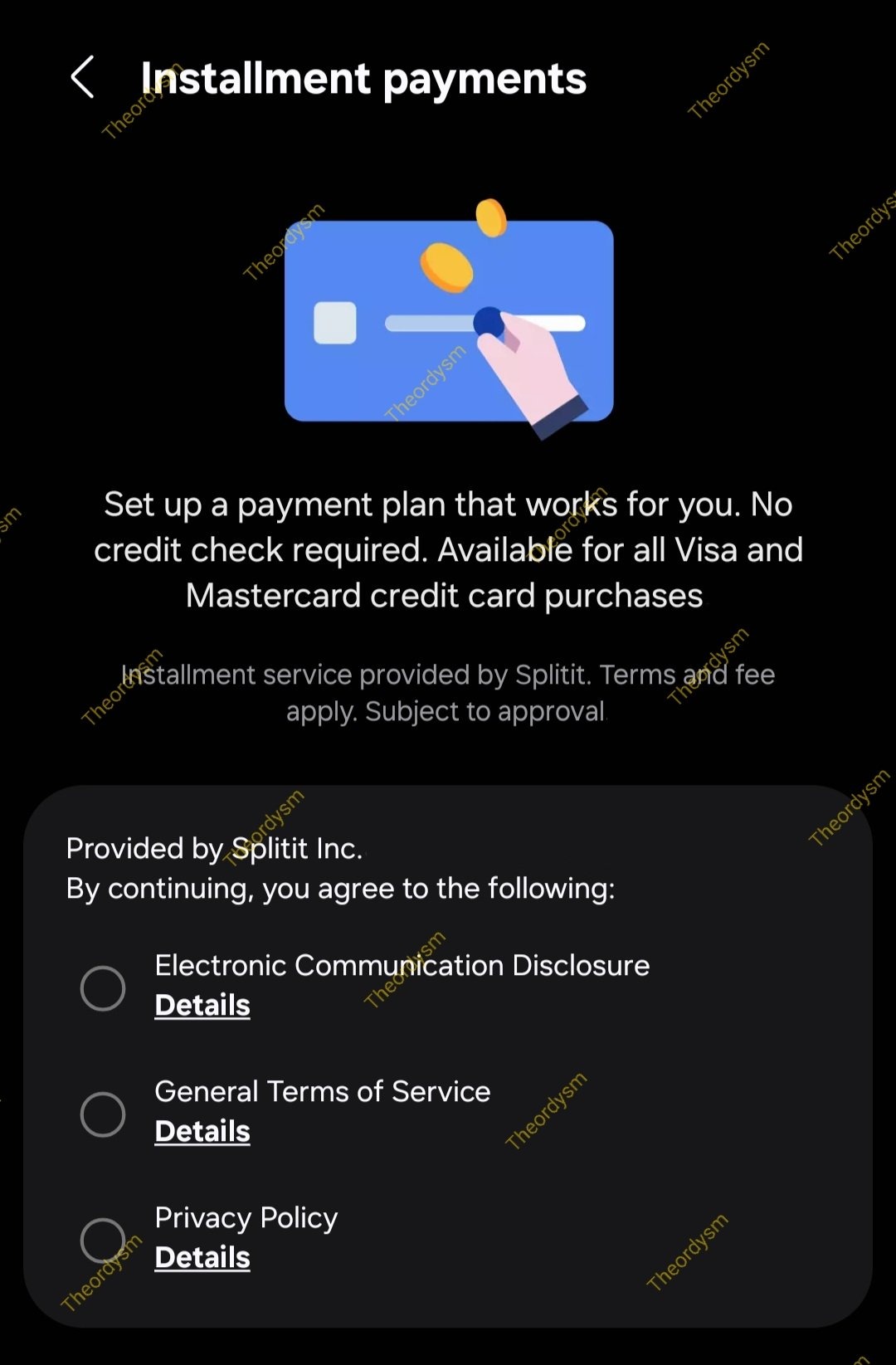

Purchase now, stress later

Now, leaked screenshots of Samsung Pockets, shared by @theordysm on X, present a “Purchase Now, Pay Later” characteristic within the works, powered by Splitit (through 9to5Google). It appears to be like prefer it’ll work with Visa and Mastercard, with no credit score examine wanted. That mentioned, activation nonetheless wants approval, and there may be some further charges within the combine.

Each options are nonetheless within the testing section, going by means of inside checks and restricted beta runs. Phrase on the road is Samsung may launch them first within the U.S. as soon as they’re prepared for primetime.

From the screenshots, it appears to be like just like the Installment Funds characteristic will let customers break up their purchases into weekly funds. This selection ought to be accessible for just about any transaction made by means of Samsung Pockets.

Slice your payments

Samsung’s installment funds aren’t about providing credit score or loans. Consider it as turning your common purchases right into a pay-over-time plan, whether or not you’re trying out on-line or in a bodily retailer.

The funds switch characteristic lets customers ship cash both by means of a digital community or by tapping an NFC-compatible gadget or fee card. The recipient’s checking account, linked to their debit card, will get the funds immediately.

Whereas we don’t know precisely how briskly the transfers shall be, the flexibility to ship cash simply by tapping a debit card is certainly a sport changer.