Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Research #186. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. Each week the Research will spotlight the technical adjustments of the 16 cryptocurrencies that I observe in addition to highlights on noteworthy strikes in particular person Cryptocurrencies and Indexes. As at all times, paid subscribers will obtain this week’s unabridged Market’s Compass Crypto Candy Sixteen Research despatched to their registered e mail. In celebration of the Easter Vacation, free subscribers can even obtain the total model (in a thinly veiled try and lure them into turning into paid subscribers). Previous publications together with the Weekly ETF Research will be accessed by paid subscribers through The Market’s Compass Substack Weblog.

A proof of my goal Particular person Technical Rankings go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose “crypto candy 16”. What follows is a Cliff Notes model of the total clarification…

”The technical rating system is a quantitative strategy that makes use of a number of technical concerns that embrace however will not be restricted to development, momentum, measurements of accumulation/distribution and relative power. The TR of every particular person Cryptocurrency can vary from 0 to 50”.

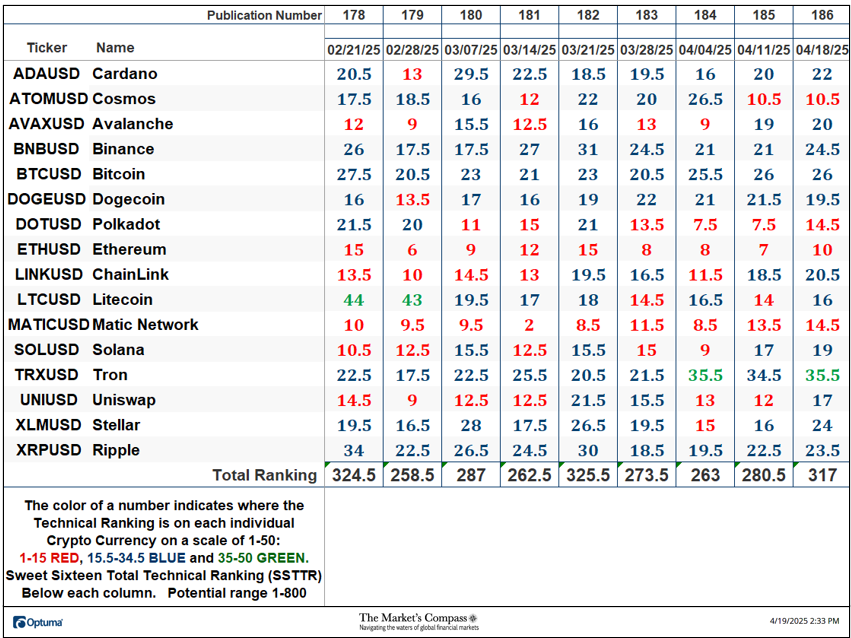

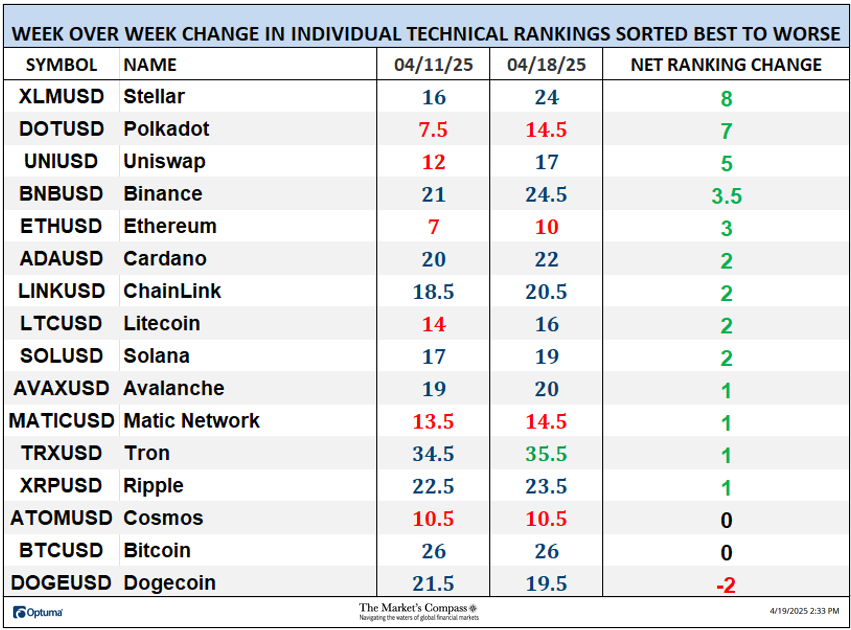

The Excel spreadsheet beneath signifies the weekly change within the goal Technical Rating (“TR”) of every particular person Cryptocurrency and the Candy Sixteen Complete Technical Rating (“SSTTR”).

*Rankings are calculated as much as the week ending Friday April 18th

The Candy Sixteen Complete Technical Rating or “SSTTR” rose +13.01% to 317 from the earlier week’s studying of 280.5 which was up 6.63% from the week earlier than studying of 263. For the previous ten weeks the SSTTR has ranged between 258 and 330 because it continues to trace sideways.

The lengthy interval of stasis within the SSTTR that I referred to above is mirrored by the de minimis WoW change in Particular person TRs apart from Stellar (XLM) and Polkadot (DOT). Final week, 13 of the Crypto Candy Sixteen TRs rose, two have been unchanged, and one fell. The typical Crypto TR acquire final week was +2.28, vs. the earlier week’s common TR acquire of +1.09. Solely one of many sixteen crypto currencies TRs I observe ended the week within the “inexperienced zone” (TRs between 35 and 50) and that was Tron (TRX), eleven TRs have been within the “blue zone” (TRs between 15.5 and 34.5), and 4 have been within the “pink zone”. That was a slight enchancment versus the earlier week when, ten have been within the “blue zone”, and 6 have been within the “pink zone”.

*The CCi30 Index is a registered trademark and was created and is maintained by an impartial crew of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general progress, every day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding steady cash (extra particulars will be discovered at CCi30.com).

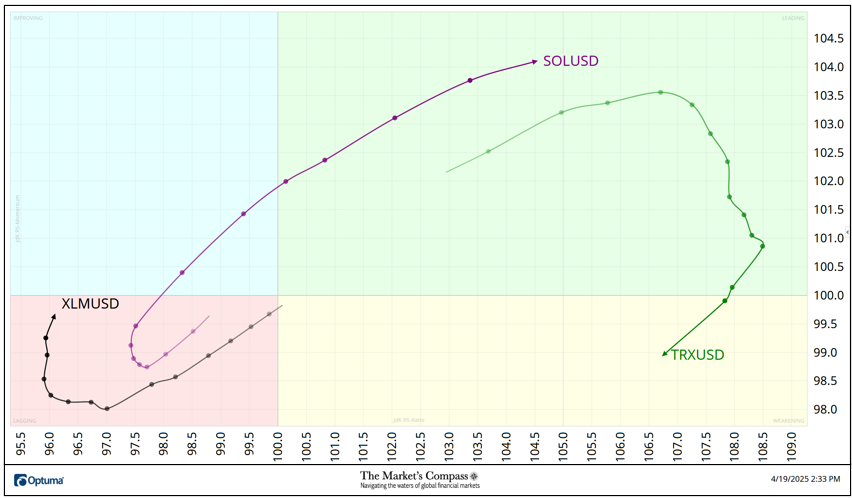

A short clarification of interpret RRG charts will be discovered at The Market’s Compass web site www.themarketscompass.com Then go to MC’s Technical Indicators and choose Crypto Candy 16. To study extra detailed interpretations, see the postscripts and hyperlinks on the finish of this Weblog.

The chart beneath has two weeks, or 14 days, of knowledge factors deliniated by the dots or nodes. Not all 16 Crypto Currencies are plotted on this RRG Chart. I’ve achieved this for readability functions. These which I consider are of upper technical curiosity stay.

In final week’s dialogue of the Relative Power and Relative Power Momentum (or lack of it) I introduced consideration to Tron which was rolling over and was dropping Relative Power Momentum within the Main Quadrant. That continued into the latter half of final week, dropping Relative Power as properly vs. the CCi30 Index. because it dropped into the Weakening Quadrant. Solana (SOL) hooked greater two weeks in the past and gathered a tempo greater by way of the Bettering Quadrant and into the Main Quadrant final week displaying superior Relative Power Momentum and Relative Power. Stellar continues to wrestle within the Lagging Quadrant however it turned excessive final week and is on track to enter the Bettering Quadrant.

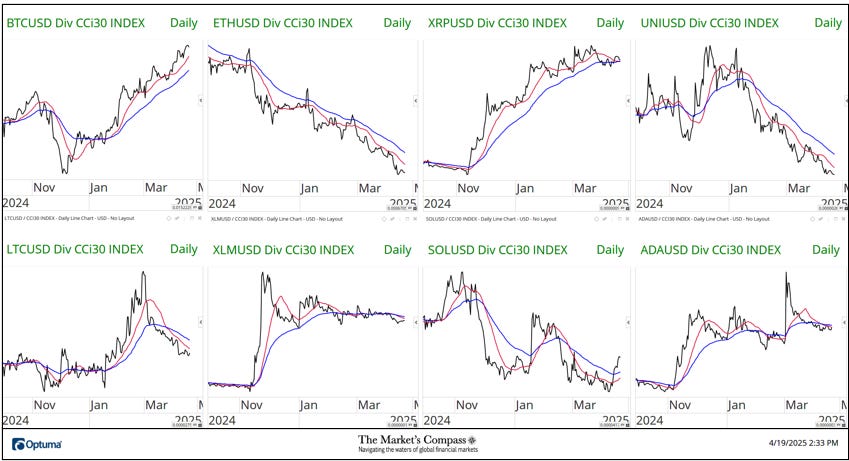

The 2 panels beneath comprise long run line charts of the Relative Power or Weak spot of the Candy Sixteen Crypto Currencies vs. the CCi30 Index which are charted with a 55-Day Exponential Shifting Common in blue and a 21-Day Easy Shifting Common in pink. Development path and crossovers, above or beneath the longer-term shifting common, reveals potential continuation of development or reversals in Relative Power or Weak spot.

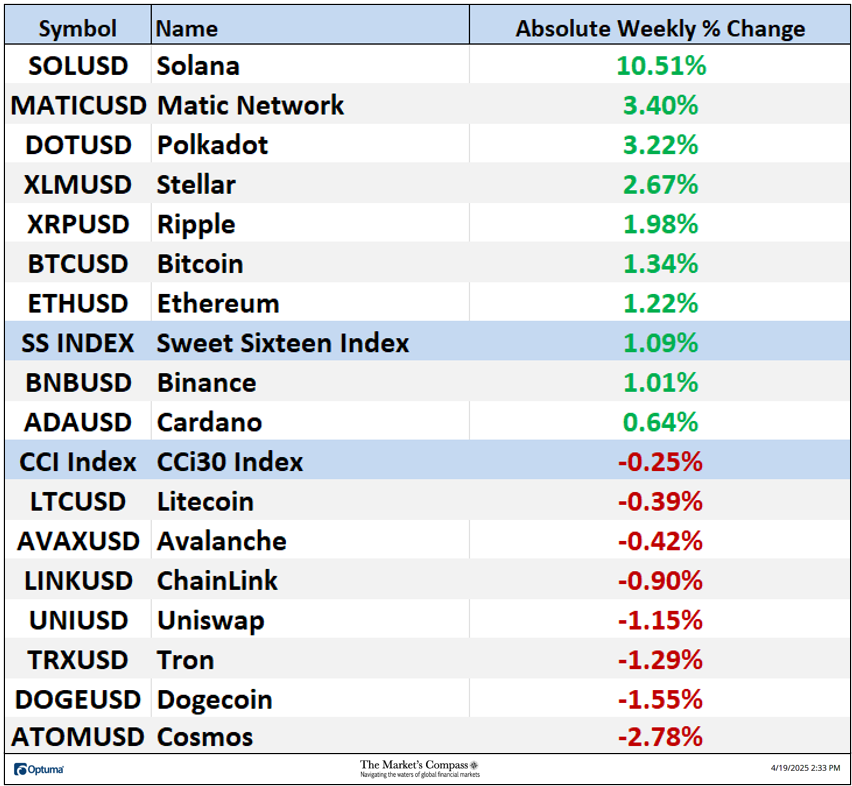

*Friday April eleventh to Friday April 18th.

9 of the Candy Sixteen gained absolute floor over the seven-day interval ending Friday and 7 fell. The seven-day common absolute value acquire was 1.09%, reversing the earlier week’s common absolute lack of -5.75% when solely two gained absolute floor over the seven-day interval ending the earlier Friday and fourteen fell on an absolute foundation. If it was not for Solana’s (SOL) outsized absolute acquire final week, the common absolute acquire would have been +0.47%

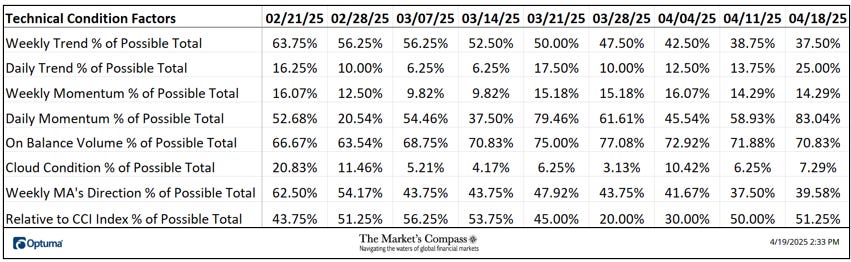

*A proof of my Technical Situation Elements go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

The DMTCF rose final week from a studying of 58.93% or 66 the week earlier than to 83.04% or 93 out of a doable 112.

As a affirmation instrument, if all eight TCFs enhance on per week over week foundation, extra of the 16 Cryptocurrencies are enhancing internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on per week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week 5 TCFs rose nominally (apart from the bounce within the DMTCF), one was unchanged and two fell.

For a short clarification on interpret the Candy Sixteen Complete Technical Rating or “SSTTR” vs the weekly value chart of the CCi30 Index go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

Final week costs moved little or no however did handle to carry above key value assist on the 13,700 stage and stay within the confines of the value channel (yellow dashed strains). The shorter-term Stochastic Momentum Index is “making an attempt to show greater from oversold territory however I might be exhausting pressed to declare it as technically vital. The unfold between MACD and its sign line is closing however the oscillator continues to trace decrease. Each technical options lack a directional clue. Solely a rally by way of value resistance at 17,695 and the Median Line (gold dotted line) of the Commonplace Pitchfork (gold P1 by way of P3) would counsel that possibly a sustainable low is in place.

The Every day Chart of the CCi30 Index is as inconclusive because the Weekly Chart. All three secondary indicators are nothing greater than mushy (not a bone fide technical time period I do know). The bane of each market technician’s existence is that, each now and again one has to attend and watch. Repeating myself (as soon as once more), solely a rally above the Higher Parallel (stable violet line) and the Cloud would counsel that the correction from the December highs might have run its course.

Most charting software program affords some type of RRG charts, however nothing comes near Optuma’s, and I urge readers to make the most of them each day. The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

An in-depth complete lesson on Pitchforks and evaluation in addition to a fundamental tutorial on the Instruments of Technical Evaluation is out there on my web site…