KEY

TAKEAWAYS

- The Bullish P.c Index for each the Nasdaq 100 and S&P 500 have made strikes much like earlier swing lows.

- A protracted-term overview of those indicators yields combined outcomes, particularly throughout sustained bearish market regimes.

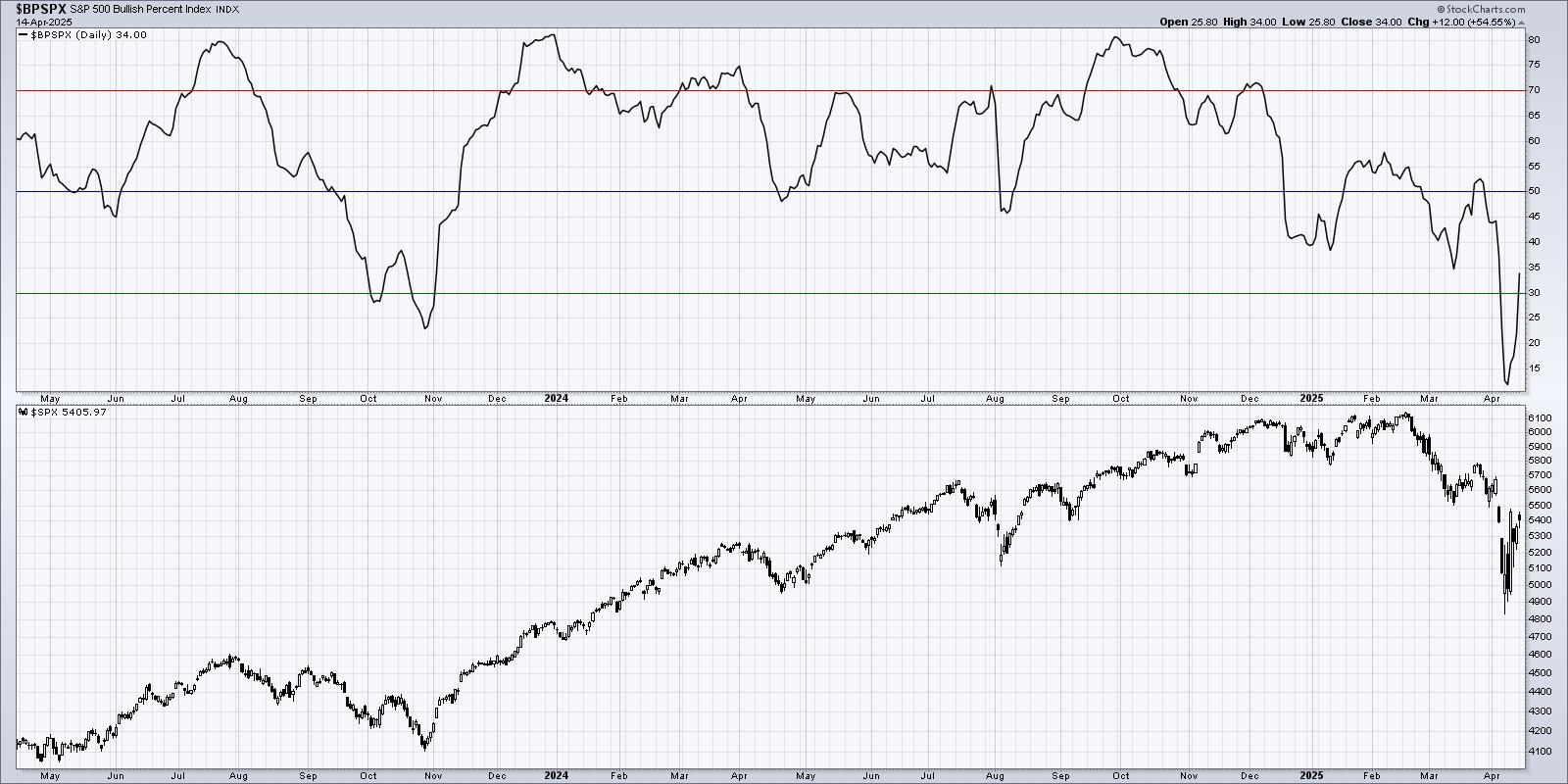

Considered one of my favourite market breadth indicators remained in an excessive bearish studying by means of the top of final week, standing in stark distinction to rising optimism after final Wednesday’s sudden spike larger. Monday’s session noticed the Bullish P.c Indexes cross above the essential 30% stage for each the S&P 500 and Nasdaq 100. Whereas I stay skeptical of significant upside with out additional affirmation, this bullish rotation does appear to verify a short-term tactical rally for shares.

Bullish P.c Index Reveals Improved Breadth for S&P 500

The Bullish P.c Index makes use of level & determine charts to investigate the share of shares in a universe which are in uptrends. By the newest purchase or promote sign on every particular person level & determine chart, the indicator may also help validate when a essential mass of shares have rotated from a bearish section to a bullish section.

On the finish of September 2024, the S&P 500 Bullish P.c Index confirmed a studying simply above 80%. By early December, the indicator was right down to round 70%, and on the February 2025 excessive had reached 55%. Final week, the S&P 500 Bullish P.c Index was simply above 10%. Certainly, nearly the entire S&P 500 members have been in confirmed level & determine downtrends.

Breadth Surge Just like Earlier Lows

The Bullish P.c Index for the Nasdaq 100 in addition to the S&P 500 each spiked larger by the top of final week following the newest modifications to US tariff coverage. As of Monday’s shut the Nasdaq 100 Bullish P.c Index had reached 39%, up from 6% every week earlier.

We are able to see 4 different occasions within the final two years the place the Bullish P.c Index has touched the 30% stage, and in three of the 4 occasions this reversal marked a big low for the Nasdaq 100. The latest statement was final month, which noticed a quick upswing earlier than the newest downturn for the main fairness averages.

So for each the Nasdaq 100 in addition to the S&P 500, a transfer again above the 30% threshold seems to point an honest probability at a tradable transfer larger. However will that upswing essentially result in sustainable beneficial properties?

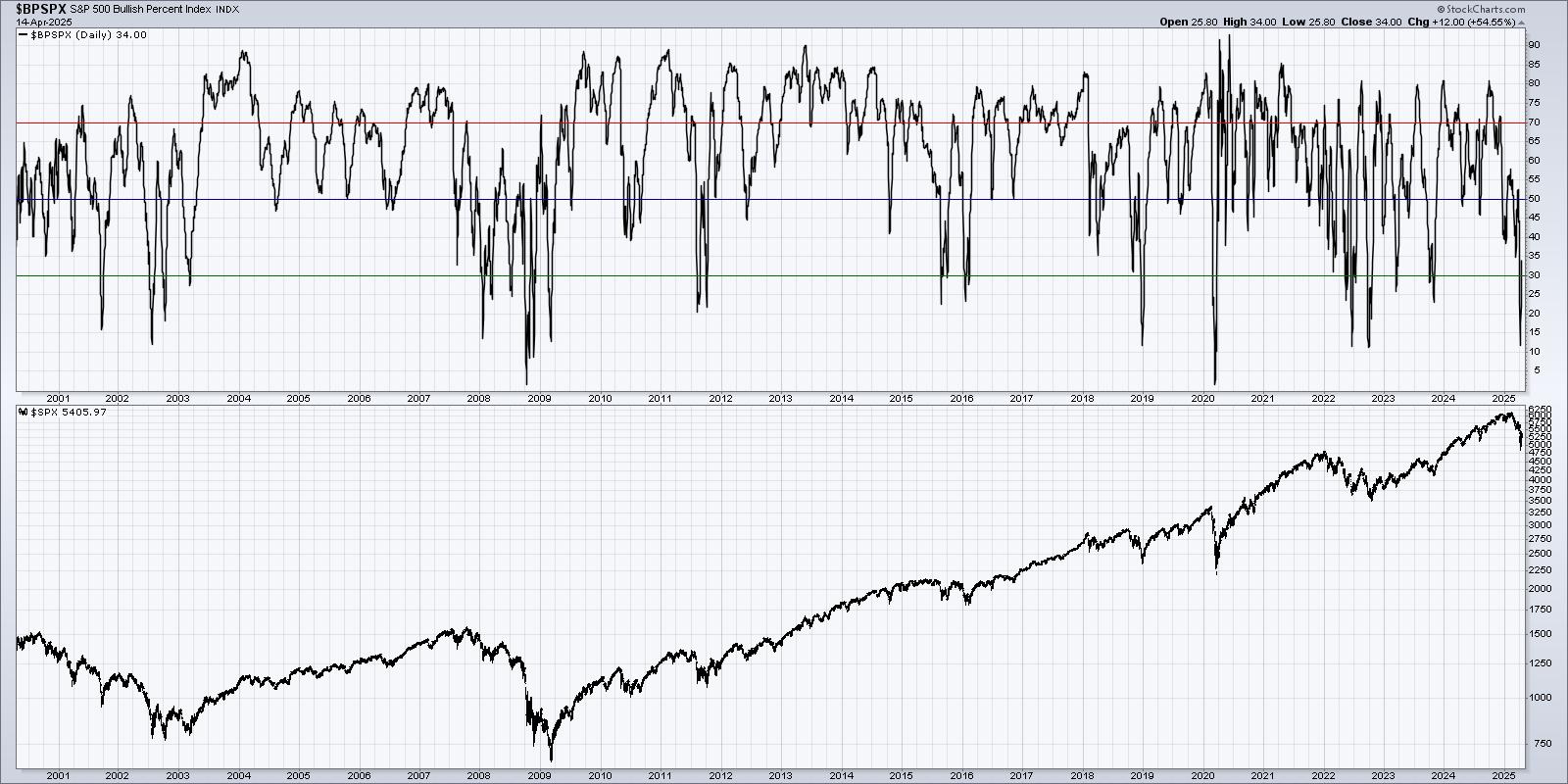

Lengthy-Time period Assessment Yields Blended Outcomes

Let’s take an extended look again to the yr 2000 and see what has occurred following a transfer under the 30% stage for the S&P 500 Bullish P.c Index. Now we will see that whereas main lows typically coincide with the indicator shifting again above 30%, we will additionally see loads of occasions the place an preliminary bounce larger was finally met with additional promoting.

Observe the acute low readings in June 2022, August 2015, and January 2009. Despite the fact that there was an preliminary swing larger in all three circumstances, the market made a brand new swing low earlier than attaining an eventual backside for the bear cycle.

With the Bullish P.c Indexes rotating again to a extra impartial studying this week, we’re seeing loads of indicators of a tactical rally. We could even see our Market Pattern Mannequin flip bullish on the short-term timeframe as early as this Friday. However with the main averages nonetheless making a transparent sample of decrease lows and decrease highs, we really feel additional affirmation is critical earlier than declaring any kind of “all clear” for US shares.

RR#6,

Dave

PS- Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any manner signify the views or opinions of every other individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps energetic traders make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main specialists on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra