19 Feb US Macro Panorama: Cooling Inflation, Steady Labour, Increasing Liquidity

TLDR; US headline inflation eased to 2.4 % YoY in January, prompting measured liquidity growth from the Fed and renewed optimism throughout threat property.

While cooling inflation has supplied tactical assist for bitcoin, persistent providers inflation and ongoing spot distribution sign the market stays in a transitional section.

The newest US knowledge presents a blended macro backdrop. Headline inflation eased to 2.4 % year-on-year in January, down from 2.7 % beforehand, whereas month-to-month CPI rose 0.2 %. At first look, this means continued disinflation progress. Nevertheless, the underlying image is much less decisive.

Core inflation elevated 0.3 % month-on-month and stays at 2.5 % yearly. The moderation in headline CPI was largely pushed by falling power costs, notably gasoline. In distinction, providers inflation rose 0.4 % on the month and stays elevated at 3.2 % year-on-year. Provided that providers account for roughly two-thirds of the CPI basket, this persistence limits how rapidly the Federal Reserve (the Fed) can pivot towards aggressive easing.

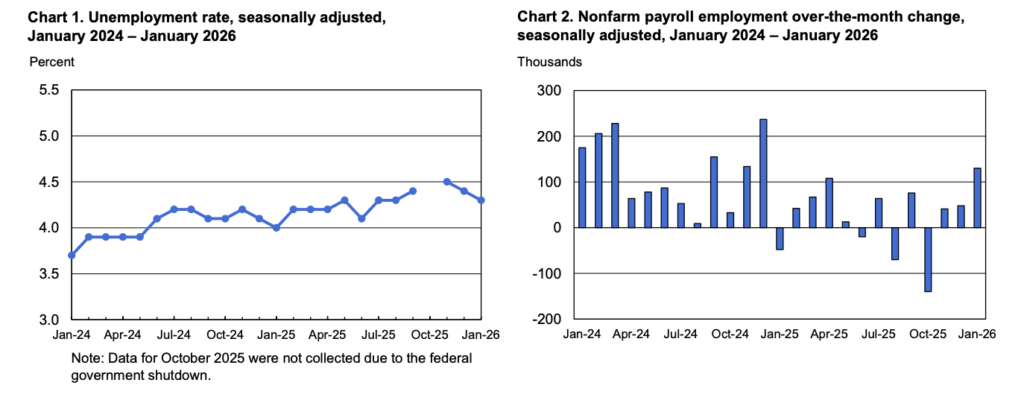

The labour market reinforces this “gradual stabilisation” narrative. Nonfarm payrolls rose by 130,000 in January, and the unemployment fee sits at 4.3 %. While prior job figures have been revised decrease by 898,000 via benchmark changes, current hiring traits recommend a low-growth however non-recessionary atmosphere. Wage progress stays agency at 3.7 % yearly, contributing to continued providers inflation stress.

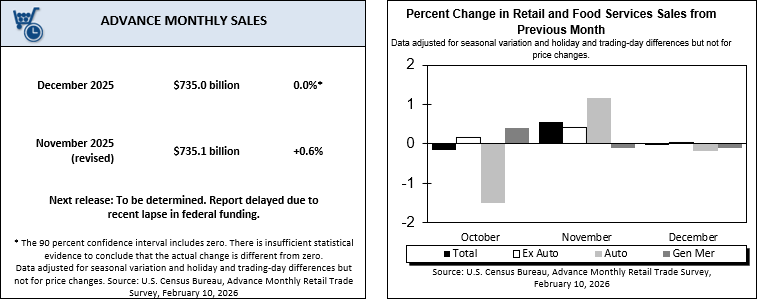

On the identical time, client demand has softened. Retail gross sales have been flat in December, with the management group declining barely. This divergence between secure employment and weaker consumption displays an economic system transitioning into slower, extra productivity-driven progress somewhat than one pushed by aggressive hiring.

Financial coverage stays affected person. Markets assign significant chance to fee cuts later within the yr, however persistent providers inflation and secure employment cut back urgency. Importantly, the Fed has shifted from steadiness sheet contraction to measured growth with a view to preserve ample reserve ranges within the monetary system. While this isn’t a disaster stimulus section, it does symbolize structural liquidity returning to the system.

The broader implication is obvious: the US economic system will not be overheating, however it isn’t weak sufficient to power rapid easing. Development is moderating, inflation is bettering inconsistently, and liquidity situations are steadily turning into extra supportive.

Crypto markets are extremely delicate to marginal modifications in liquidity, fee expectations, and greenback dynamics.

The cooling in headline inflation, mixed with a rising chance of fee cuts, has supplied psychological assist to threat property. Nevertheless, the stickiness of providers inflation retains the Fed in a cautious stance. This creates a backdrop the place rallies can develop, however sustained breakouts require both clearer disinflation or stronger liquidity acceleration.

The extra structural growth is the Fed’s steadiness sheet growth. Although this transfer is operational somewhat than stimulative, the return of reserve progress reduces the chance of systemic liquidity stress. Traditionally, increasing base liquidity tends to assist scarce property akin to bitcoin, notably when paired with a steadily weakening US greenback.

That mentioned, this isn’t an aggressive easing cycle. Liquidity is constructing incrementally, not explosively. In consequence, crypto strikes are more likely to unfold in waves somewhat than in a straight-line development.

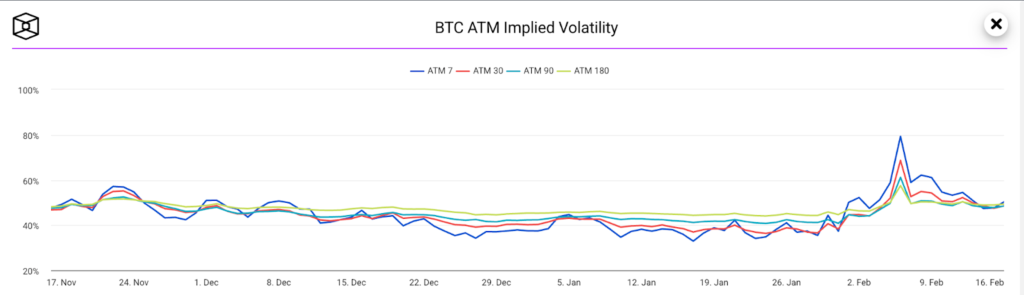

Main into the CPI launch, Bitcoin positioning was defensive. Shorts have been constructed while giant spot sellers distributed provide in dimension. On the identical time, choices markets have been pricing elevated draw back safety, reflecting excessive implied volatility and risk-off sentiment.

Following the CPI launch, value dynamics shifted rapidly. Aggressive spot shopping for — albeit for a really restricted time — and a wave of brief masking in perpetual futures drove bitcoin roughly 9 % larger, at the same time as open curiosity (OI) declined round 7 %. The drop in OI throughout a value advance means that the transfer was largely pushed by brief liquidations and compelled closures somewhat than recent speculative positioning coming into the market.

Funding charges moved into adverse territory over the weekend, and near-term implied volatility declined, indicating that choices merchants have been decreasing expectations of rapid draw back. This marked one of many first clear enhancements in derivatives sentiment in a number of months.

Nevertheless, the restoration has not been with out friction. Aggressive spot sellers returned early this week, offloading a cumulative billions price of BTC. Importantly, the market absorbed this provide extra successfully than throughout prior distribution phases, suggesting improved bid depth and extra balanced higher-timeframe order circulate. Even so, sustained upside will possible require both a reversal in spot promoting flows or renewed structural demand.

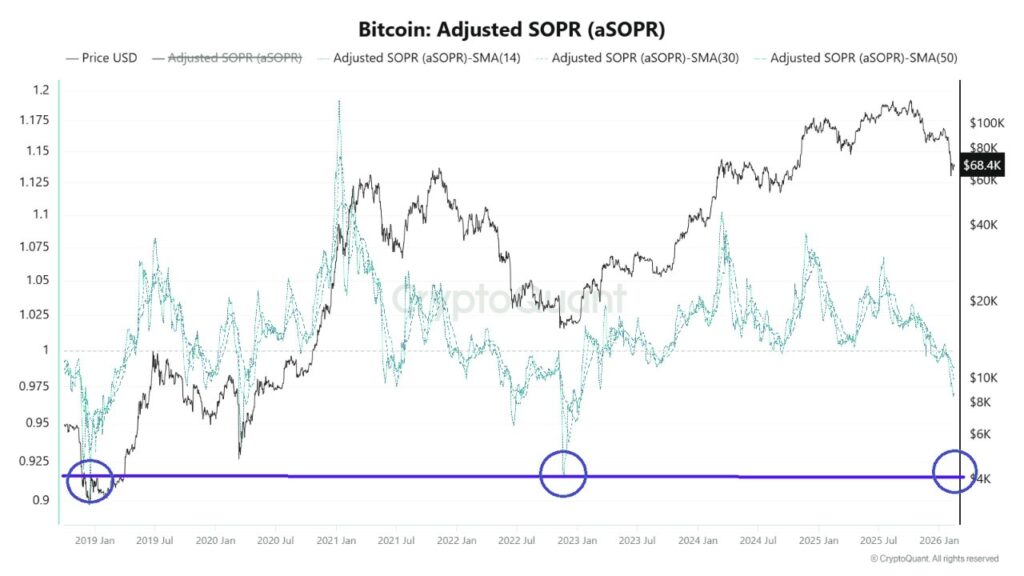

On-chain knowledge provides a observe of warning to the image. Adjusted SOPR has fallen towards the 0.92–0.94 zone, a degree traditionally related to bear-market stress the place a majority of cash are being spent at a loss. Not like mid-cycle pullbacks the place SOPR rapidly reclaims 1.0, the present construction displays sustained loss realisation. While this doesn’t affirm a full bear regime, it alerts structural fragility somewhat than outright power.

The US macro backdrop helps persistence. Inflation is cooling however not decisively subdued. The labour market is secure however now not accelerating. Client demand is softening. In the meantime, the return of steadiness sheet growth gives a liquidity cushion that reduces systemic threat.

For bitcoin, the current rally was technically constructive, pushed by brief masking and improved derivatives sentiment. Nevertheless, ongoing spot distribution and stress alerts from on-chain metrics point out that the market should be in a transitional section somewhat than a confirmed expansionary cycle.

On this atmosphere, volatility stays possible. Tactical upside strikes can happen when positioning turns into overly defensive, however a sturdy structural advance would require clearer affirmation from each macro disinflation traits and sustained spot demand.