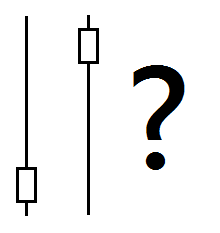

The pin bar is maybe essentially the most highly effective worth motion sign that has ever existed. If I might choose just one worth motion sample to commerce with for the remainder of my life, I’d in all probability choose the pin bar. Nonetheless, regardless of its easy construction, the pin bar could be very difficult to commerce if you happen to don’t know the right way to distinguish a superb pin bar from a nasty one.

The pin bar is maybe essentially the most highly effective worth motion sign that has ever existed. If I might choose just one worth motion sample to commerce with for the remainder of my life, I’d in all probability choose the pin bar. Nonetheless, regardless of its easy construction, the pin bar could be very difficult to commerce if you happen to don’t know the right way to distinguish a superb pin bar from a nasty one.

I see many merchants making the identical errors again and again with pin bars; they commerce each pin they see, they offer no consideration to the market context the pin bar fashioned inside, they continually attempt buying and selling counter-trend pin bars and plenty of different errors.

The very fact of the matter, is that there are lots of subtleties to buying and selling pin bars that it’s essential to perceive if you happen to ever hope to commerce them efficiently. So, with out additional ado, let’s a number of the greatest errors merchants make with pin bars…

1. Not studying to commerce pin bars in trending markets first

The very first thing I inform my college students to do with regard to pin bar buying and selling, is to study the right way to commerce pin bars in trending markets. The easy purpose for this, is that any worth motion setup or sign goes to have a greater likelihood of figuring out with the ability and momentum of a market pattern behind it.

There are quite a few the reason why markets pattern, however the actual causes don’t actually matter. All we care about is {that a} market is (or isn’t) trending and whether or not or not we will bounce aboard that pattern to make the most of the ability of it. To disregard the ability and ‘weight’ behind a pattern and assume that you’ll start being profitable buying and selling pin bars towards the pattern earlier than you’ve realized to commerce with the pattern, is solely ignorant. To today, I nonetheless search for pin bars with the pattern first, and people are the pin bar indicators that I choose as choice primary.

2. Not studying to commerce pin bars on the every day charts first

Should you can’t commerce pin bars efficiently on the every day chart time frames, you gained’t have the ability to commerce them efficiently on any decrease time-frame both. For causes you possibly can learn right here, the every day chart is solely one of the best time-frame to commerce, and I don’t consider that to be a subjective view level both, I see it’s a truth of buying and selling.

Typically talking, the decrease in time-frame you go, the lesser likelihood any given worth motion sign (or different sign) has of figuring out. This is because of market noise or random worth fluctuations that merely imply nothing, and inside this market noise there inevitably arises pin bar setups that will look good to the untrained eye, however in actuality they’re meaningless.

Thus, a pin bar on the every day chart time-frame has a significantly better likelihood of being significant, just because it’s on the every day chart the place there’s much less random market fluctuations. The every day chart reveals essentially the most pertinent view of a market, together with what has occurred in it, what is going on and what may occur subsequent. As you go down in time-frame, this view turns into hazier and fewer significant, as does any worth motion sign.

3. Not buying and selling pin bars with confluence – market context.

A pin bar is a really highly effective worth motion sign, however provided that it happens on the proper place on the chart and on the proper time. As I train my college students in my buying and selling programs, one of the best pin bar indicators sometimes happen at a confluent degree or space on the chart. Primarily, there are lots of pin bars that you simply may spot on any given worth chart, however they don’t seem to be all equal, and it’s the kind and quantity of confluence that makes one pin bar higher (or worse) than one other.

I like to inform my college students {that a} good pin bar sign ought to “make sense” within the context of the present market situations which are occurring on the every day chart. That goes for a 1 hour or 4 hour pin bar too; if it doesn’t “make sense” with both the pattern, key chart ranges or each, on the every day chart time-frame, it’s in all probability not a superb pin bar to commerce.

4. Placing your cease loss too near entry

One other massive mistake I see merchants making with the pin bar reversal technique, is placing their cease losses too near their entry. As I mentioned in a latest article, good trades usually take longer to play out than we count on, and with that comes the truth that markets fluctuate throughout time, usually meaninglessly, and so that you don’t wish to get stopped out of a superb pin bar commerce prematurely simply because your cease loss was too shut.

What you wish to do, is use essentially the most logical level on the chart that may invalidate your pin bar commerce if worth strikes past it. Typically, this level or degree is additional away than most individuals need it to be or assume it ought to be. The troublesome factor about having wider cease losses, is that if you wish to handle threat correctly, it means it’s important to cut back your place measurement down as your cease loss distance grows. This isn’t one thing it is best to view as ‘slowing’ your buying and selling progress or as a ‘hindrance’, as a result of within the long-run it would result in extra features / earnings as a result of you may be buying and selling correctly and constructing correct buying and selling habits.

Take a look at this lesson for perception into the right way to obtain protected cease losses on pin bar trades.

5. You’re not truly buying and selling a pin bar.

Many instances merchants assume they’re buying and selling a pin bar setup and it’s truly not even a pin bar. This can be a mistake that folks make sometimes from not being correctly educated on the right way to commerce pin bars or precisely what makes a superb pin bar, and it’s one thing that’s straightforward to repair. By correct pin bar buying and selling schooling and coaching you’ll shortly study what a high-quality pin bar setup truly appears like, the right way to determine them and the right way to commerce them correctly.

I belief from this lesson you’ve realized about a number of the commonest errors merchants make when buying and selling pin bars and a few steps to be sure you keep away from them. If you wish to find out about all of the subtleties of pin bar buying and selling, try my worth motion buying and selling course for extra info.