If buying and selling appears irritating and troublesome to you, don’t fear, you aren’t alone. Many merchants, if not most, start their buying and selling careers with lofty targets and a full tank of hope, however these issues can fade in a short time in case you aren’t approaching the market from the fitting ‘angle’.

If buying and selling appears irritating and troublesome to you, don’t fear, you aren’t alone. Many merchants, if not most, start their buying and selling careers with lofty targets and a full tank of hope, however these issues can fade in a short time in case you aren’t approaching the market from the fitting ‘angle’.

At Study To Commerce The Market, we take the view that whether or not or not a retail dealer (such as you or I) achieves constant success out there relies upon closely on which methodology the dealer makes use of. That’s to say, we consider in case you are buying and selling with the mistaken methodology, there isn’t a method you’ll ever earn cash, even in case you’re doing every part else proper.

Buying and selling success is the top results of getting the “3 M’s” proper; Methodology, Mindset and Cash Administration. You can not succeed with solely two of the three; you could have all three down pat.

On this lesson, I need to concentrate on the primary M; the Methodology that will provide you with the perfect likelihood to succeed at buying and selling. It’s essential perceive which methodology is the perfect, why it’s the finest and how one can grasp it, so let’s get began…

Swing Buying and selling: The retail dealer’s solely actual likelihood

I received’t mislead you; as a retail Foreign exchange dealer, or a retail dealer of any market actually, there are a number of ‘forces’ working in opposition to you, which you’ll or not have been conscious of till now. To be sincere with you, you’re a one-man (or girl) crew while you’re a dealer, and except you’ve got entry to extraordinarily giant sums of cash / the flexibility to face up to giant drawdowns, you aren’t going to final very lengthy in case you don’t make use of the correct buying and selling methodology.

The large gamers out there, like banks, hedge funds, and so on. know the place smaller retail merchants place their orders and what they sometimes ‘do’ out there (purchase breakouts, day-trade, and so on.). They know all of the small-timer methods and consider it or not, they take pleasure in taking your cash on daily basis out there. You’ll be able to’t survive with out a cease loss, however they’ll, or at the very least they’ll for for much longer than you or I and that is why day buying and selling is harmful; as a result of merchants put very small / tight cease losses on their positions they typically get stopped out by regular each day value fluctuations out there.

I’m not going to say that your dealer ‘needs you to lose’, however I believe saying they need you to day-trade is a good evaluation. Why do they need you to day-trade you ask? Nicely, for one you’ll generate quite a lot of charges within the type of unfold funds or commissions, and two, you’ll lose quite a lot of trades for the explanation I mentioned within the earlier paragraph. Briefly, day-trading is a idiot’s sport that sucks individuals in by interesting to their grasping / impatient need to make ‘quick cash’.

On the alternative finish of the buying and selling scale, we’ve got place buying and selling or investing, that is mainly long-term purchase and maintain methods that while they could repay if you find yourself able to retire, they don’t seem to be appropriate for anybody seeking to make a dwelling as a dealer, such as you and I.

That brings us to what I name the buying and selling ‘candy spot’; swing buying and selling. For those who don’t already know, right here’s what swing buying and selling is: Swing Buying and selling is a technique of technical evaluation that can assist you spot robust directional strikes out there that final on common, two to 6 days. Swing buying and selling permits particular person merchants like us to take advantage of the robust short-term strikes created by giant institutional merchants who can’t transfer out and in of the market as rapidly.

What’s a ‘swing level’ out there?

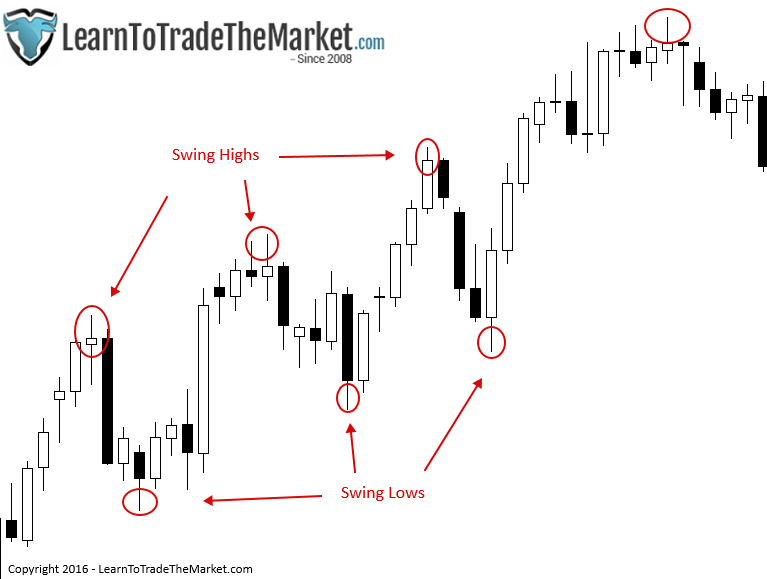

To place this in just a little easier phrases, I’m assuming you’ve got checked out a primary value chart earlier than. You probably have, you in all probability seen that markets don’t transfer in straight traces for very lengthy. As a substitute, value will ‘swing’ from excessive to low factors out there. Particularly in a trending market, these chart swing factors are vital factors on a value chart the place we will anticipate a value motion sign to type at, and that always present high-probability entries simply earlier than a development is on the point of resume.

The chart under exhibits us what swing excessive factors and swing low factors appear like. This market was trending larger, in order swing merchants we’d have seemed for an entry close to the swing lows…

Swing buying and selling is the artwork and ability of studying a value chart to anticipate the subsequent ‘swing’ out there. I exploit value motion buying and selling methods to seek out high-probability entries out there at these swing factors, you may even see me check with this as ‘shopping for weak point’ or ‘shopping for the dips’ in a rising market and ‘promoting energy’ or ‘promoting the rallies’ in a falling market. This terminology refers back to the common strategy {that a} swing dealer makes use of; shopping for as a market falls down and hopefully shopping for the swing low level (or near it) inside an up-trending market, the alternative can be the case for a down development in fact.

Different the reason why you need to grow to be a swing dealer

Now that we’ve mentioned what swing buying and selling is and the primary motive why you might want to be taught it and make it your buying and selling methodology, let’s focus on among the different advantages of it.

Day by day charts

As I’ve written about at size in different articles; while you commerce the each day chart timeframe as a swing dealer does, you’re reaping many advantages in comparison with these poor souls who nonetheless consider scalping a 5-minute chart is the important thing to success.

One of many the reason why swing buying and selling is such an enormous benefit to the retail dealer, is that it means that you can skip all of the market ‘noise’ of brief time frames, like these below the 1-hour chart. Brokers and the massive institutional merchants WANT smaller retail merchants to commerce brief time frames and day-trade / scalp, as a result of they know they are going to get your cash simply in case you do.

Swing buying and selling on larger time frames just like the 4 hour and each day means that you can piggy again off the massive strikes created by the larger gamers out there, and it additionally means that you can place your cease loss outdoors of their attain, thus providing you with larger ‘endurance’ to be able to keep out there longer and enhance your possibilities of getting aboard a giant, worthwhile transfer.

Match buying and selling in round your schedule

Swing buying and selling means that you can match buying and selling in round no matter busy schedule you’ll have, or in case you don’t have a busy schedule it is going to will let you earn cash buying and selling and nonetheless take pleasure in your free time. There’s nothing extra boring than having to take a seat in entrance of the charts all day, to not point out that it’s unhealthy in your buying and selling and your well being.

Swing buying and selling means that you can analyze the markets in your schedule, for brief durations of time, since you are specializing in larger time frames as talked about above. Additionally, since you are holding your trades for a day or extra most often, you may enter a commerce on a Tuesday let’s say, then fall asleep and get up a day later and test in your commerce. You do not want to take a seat there all evening worrying about your trades, nor must you. An virtually ‘magical’ factor occurs while you cease paying a lot consideration to your trades; you begin to see higher buying and selling outcomes.

Individuals over-complicate their buying and selling by merely being too concerned. Swing buying and selling is the perfect methodology as a result of it’s complementary to how you need to behave out there as a result of it rewards you for being much less concerned and taking much less trades over time, which is strictly what you might want to do if you wish to have any likelihood at success. The take residence message right here is, swing buying and selling will assist you keep away from over-trading, and over-trading is the most important motive why individuals lose their cash buying and selling.

Conclusion

Don’t be fooled by the advertising and gimmick buying and selling programs on the market. For those who’ve been across the buying and selling block a number of occasions already you in all probability know what I’m speaking about right here. There are quite a lot of guarantees and ensures on the market within the buying and selling world, however the query try to be asking will not be about ensures however concerning the methodology itself. Is the strategy truly going to show me to grasp a value chart and how you can catch large strikes out there? Is it truly going to show me how you can commerce correctly? These are the varieties of questions you need to ask your self about any buying and selling system or training you’re contemplating, as a result of these are ones that matter. Don’t fall prey to large claims of quick cash and fully-automated buying and selling robots; keep in mind, if it sounds too good to be true, it in all probability is.

In my value motion foreign currency trading course I train my college students the identical swing buying and selling methods I’ve used to commerce with for the previous decade… strategies which have stood the take a look at of time throughout a spread of various markets and circumstances.