The Foreign exchange Reversal Indicator makes use of a novel visible language that cuts by way of chart litter. Yellow dots mark potential reversal zones, however the ring colour determines course. Blue rings encircling yellow dots counsel upward momentum constructing—a attainable shift from downtrend to uptrend. Pink rings sign the alternative: bearish strain taking management.

What units this device other than commonplace transferring common crossovers or RSI divergence? The algorithm analyzes value motion patterns fairly than relying solely on mathematical formulation. Whereas the precise calculation stays proprietary, the indicator acknowledges candlestick formations, swing highs and lows, and momentum shifts that sometimes precede reversals.

The yellow dot placement isn’t random. These markers seem at potential inflection factors the place buyer-seller dynamics shift. A blue-ringed dot close to a assist zone carries a unique weight than one showing mid-trend with no structural backing. Context issues.

How Merchants Apply This on Stay Charts

Think about a GBP/USD setup from late October 2024. Value had been sliding from 1.3050 all the way down to 1.2880 over 5 days on the every day timeframe. The downtrend regarded intact—decrease highs, decrease lows, promoting strain dominating. Then a blue-ringed yellow dot was printed at 1.2885.

An skilled swing dealer didn’t instantly purchase. As a substitute, they waited for affirmation. The subsequent candle closed as a bullish engulfing sample, swallowing the earlier bearish candle totally. That mixture—indicator sign plus value motion affirmation—triggered a protracted entry at 1.2895. Over the following eight days, the value rallied to 1.3120, delivering 225 pips.

However right here’s the place self-discipline separates worthwhile merchants from those that give again positive aspects: three days into that rally, a red-ringed yellow dot appeared at 1.3080. The dealer didn’t panic and instantly closed. They tightened their cease loss to breakeven and watched. Value pushed barely greater to 1.3120, then reversed arduous. The protected place closed at 1.3085 as an alternative of using the complete retracement again down.

The Repainting Actuality No one Mentions

Let’s handle the elephant within the room: this indicator repaints. Many merchants hear “repaint” and instantly dismiss a device as nugatory. That’s shortsighted.

Repainting means the indicator recalculates as new value information arrives, doubtlessly altering or eradicating earlier alerts. On EUR/GBP 1-hour charts throughout uneven London periods, you would possibly see a blue-ringed dot seem, then disappear two candles later because the indicator reassesses. Irritating? Completely. Ineffective? Not if you happen to perceive what you’re working with.

Sensible merchants deal with preliminary alerts as alerts, not gospel. When a yellow dot seems on the H4 chart, they don’t blindly enter. They look ahead to the present candle to shut. If the sign stays after the shut, confidence will increase. Including a second affirmation layer—like a trendline break or key stage take a look at—filters out most false alerts.

The repainting truly serves a function: it displays real-time market situations. Markets aren’t static. A reversal try can fail, and the value resumes the unique development. The indicator adapts, exhibiting that the reversal setup didn’t maintain. Inflexible, non-repainting indicators can’t make these changes.

Multi-Timeframe Evaluation: The place This Instrument Shines

The Foreign exchange Reversal Indicator excels when used throughout a number of timeframes—a method known as top-down evaluation. This strategy dramatically improves sign high quality.

Right here’s the way it works in follow: A dealer analyzing USD/CAD begins on the every day chart. A red-ringed yellow dot seems at 1.3650, suggesting bearish reversal from a multi-week uptrend. Dropping to the 4-hour chart, they search for affirmation. Positive sufficient, one other red-ringed dot prints at 1.3645 alongside a bearish pin bar rejection.

The alignment creates conviction. Each timeframes agree: sellers are taking management. The dealer enters brief at 1.3640 with a cease above 1.3680 (40 pips). The every day timeframe’s bearish sign supplies the big-picture context. The 4-hour entry captures exact timing. Over 5 days, USD/CAD drops to 1.3420—a 220-pip winner.

Distinction that with taking each sign on a single timeframe. The 15-minute chart would possibly generate eight yellow dots in a day, most main nowhere. The every day chart produces two or three alerts month-to-month, however every carries considerably extra weight. Place merchants specializing in every day/weekly charts discover this indicator way more dependable than scalpers chasing 5-minute alerts.

Settings and Customizations

The indicator comes with default parameters that work fairly properly throughout main pairs, however merchants can modify sensitivity by way of enter settings. Decrease sensitivity reduces sign frequency, filtering out minor swings and specializing in main reversals. Greater sensitivity generates extra dots, helpful for lively merchants who need earlier warnings.

For swing merchants holding positions for days or even weeks, decreasing sensitivity on H4 and every day charts prevents overtrading. The indicator would possibly produce one high quality sign per week on the EUR/USD every day charts as an alternative of three marginal ones. That single high-probability setup usually outperforms taking a number of lower-quality trades.

Day merchants on 15-minute or 30-minute charts sometimes enhance sensitivity. Extra alerts imply extra alternatives, although it additionally means extra false positives. The secret’s combining elevated alerts with tighter affirmation guidelines. Possibly requiring each a yellow dot AND a break of a 20-period transferring common earlier than coming into.

Forex pairs with totally different volatility traits profit from customization. The wild swings in GBP/JPY would possibly want sensitivity changes in comparison with the comparatively sedate EUR/CHF. Testing these settings on historic information—with out risking actual cash—reveals optimum configurations for particular pairs and timeframes.

Strengths That Make It Price Utilizing

Visible simplicity stands out instantly. There’s no psychological gymnastics decoding divergence traces or calculating whether or not RSI hit 70 or 68. Blue ring means look ahead to longs. Pink ring means take into account shorts. That readability helps throughout tense market situations when advanced evaluation breaks down.

The value motion basis provides it an edge over purely mathematical indicators. Shifting averages don’t care about pin bars or engulfing patterns. This device acknowledges formation nuances that usually precede reversals. When the yellow dot aligns with a hammer candlestick at assist, the chance of reversal will increase past what both sign suggests alone.

For merchants battling exit timing, the indicator supplies goal alerts. That emotional battle—”Ought to I shut now or wait?”—will get simpler when a red-ringed dot seems in your lengthy place. It doesn’t resolve for you, however it affords concrete info for judgment.

Limitations Each Dealer Should Settle for

Ranging markets destroy this indicator’s effectiveness. When EUR/USD trades in a 60-pip field for 2 weeks, the dots seem all around the chart with zero predictive worth. Value bounces between assist and resistance, triggering alerts that instantly fail. Buying and selling each yellow dot throughout consolidation ensures dying by a thousand small losses.

The repainting challenge, whereas manageable, calls for endurance that not all merchants possess. Seeing a promising sign disappear feels just like the market personally mocking your evaluation. Freshmen usually can’t deal with this and both overtrade or lose confidence totally.

Lag exists regardless of the value motion focus. The indicator wants affirmation earlier than plotting dots, which means entries happen after the reversal begins. On a every day chart, you would possibly miss the primary 30-50 pips of a 200-pip reversal ready for the sign. Quick reversals—like these throughout shock central financial institution bulletins—can end earlier than the indicator even triggers.

Combining With Value Construction for Finest Outcomes

The indicator reaches its full potential when merged with assist and resistance evaluation. A blue-ringed yellow dot showing at random mid-chart ranges carries much less weight than one printing straight at a examined assist zone.

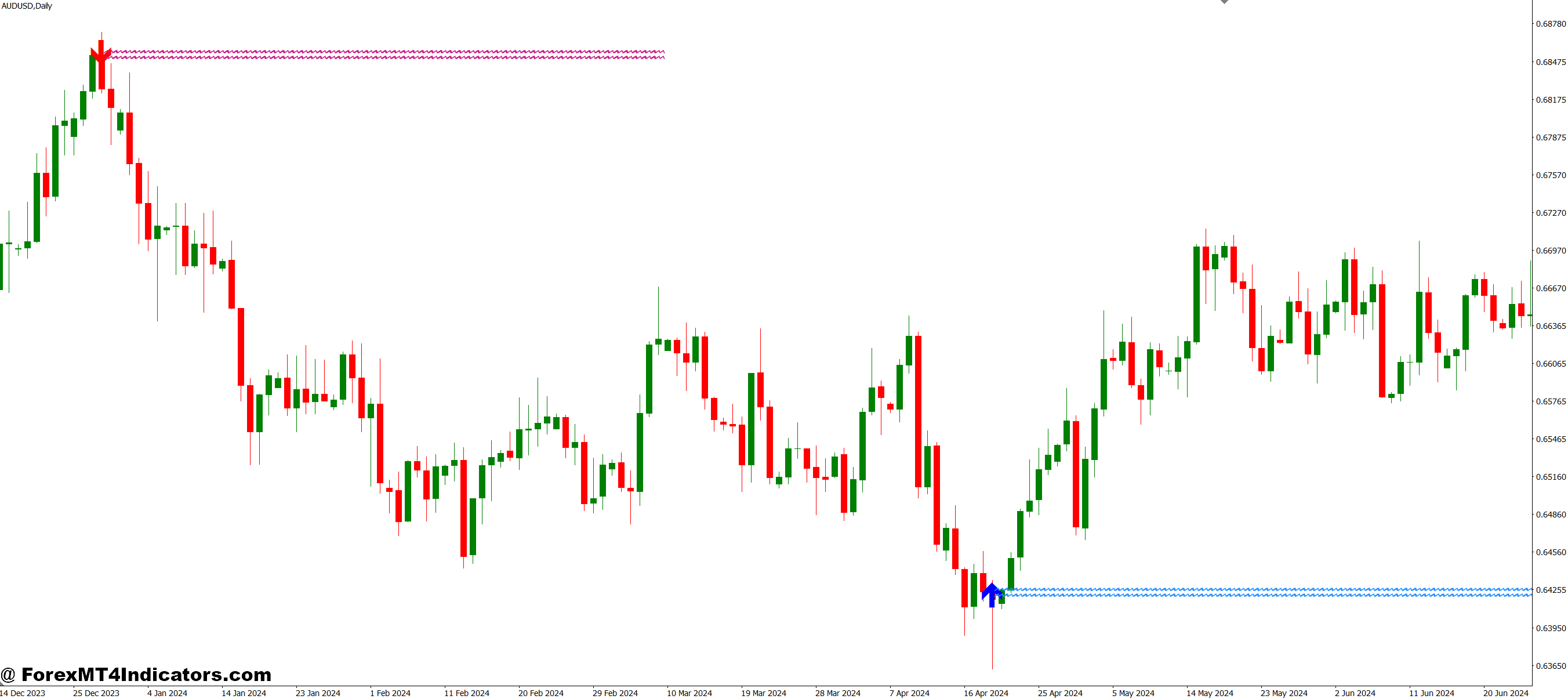

Take this AUD/USD situation: Value falls to 0.6450, a stage that rejected the value thrice over the previous month. The fourth take a look at arrives, and concurrently, a blue-ringed yellow dot seems. That confluence—historic assist plus indicator sign—creates a high-probability lengthy setup. The commerce threat? Place stops 20 pips beneath assist at 0.6430. The reward? Goal the earlier swing excessive at 0.6580, providing a 130-pip achieve in opposition to 20-pip threat.

Now think about the identical blue-ringed dot showing at 0.6520 with no close by assist, resistance, or construction. Value sits in no-man’s-land. Would you are taking that commerce? Skilled merchants wouldn’t. The indicator supplies timing options, however the value construction determines location high quality.

Trendlines add one other affirmation layer. When a downtrend line breaks and a blue-ringed dot seems inside 5 candles of the break, reversal chance jumps. The trendline break reveals a momentum shift. The indicator confirms it. Buying and selling both sign alone typically works. Buying and selling each collectively works significantly extra usually.

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings.

Even the very best reversal alerts fail. Markets pretend out, whipsaw, and lure merchants. Place sizing determines whether or not a string of losses damages your account or merely dents it. Risking 5% per commerce on yellow dot alerts will ultimately blow up the account, no matter how good the indicator appears throughout profitable streaks.

The Foreign exchange Reversal Indicator serves as a device, not a crystal ball. It highlights potential alternatives and supplies construction for decision-making. What it will probably’t do is take away uncertainty from buying and selling or make threat disappear. Merchants anticipating any indicator to resolve their profitability struggles will preserve looking eternally, bouncing from one “holy grail” to the following.

Sensible Implementation Ideas

Begin by including the indicator to every day and 4-hour charts of three main pairs—EUR/USD, GBP/USD, USD/JPY. Spend two weeks watching how yellow dots correlate with precise reversals. Don’t commerce but. Simply observe. Observe which alerts preceded real development adjustments versus which triggered after which failed.

This commentary interval builds sample recognition. You’ll discover blue-ringed dots at assist zones are likely to work higher than these showing randomly. Pink-ringed dots after prolonged rallies into resistance have greater success charges. These insights don’t come from studying—they develop by way of display screen time.

When able to commerce, set up clear affirmation guidelines. Possibly: “I solely take blue-ringed dots that seem inside 10 pips of identifiable assist, and solely after the present candle closes with out the sign disappearing.” That specificity prevents impulsive trades on weak setups.

Maintain a buying and selling journal documenting each yellow dot sign. Document the end result no matter whether or not you traded it. After 30 alerts throughout a number of pairs, patterns emerge. Possibly H4 alerts on GBP pairs work higher than EUR pairs. Maybe every day alerts throughout trending weeks outperform uneven weeks. Information beats guessing.

Easy methods to Commerce with Finest Development Reversal MT4 Indicator

Purchase Entry

- Anticipate blue-ringed yellow dot affirmation – Don’t enter the second you see the sign; look ahead to the present candle to shut and confirm the blue ring stays on the chart to keep away from repainting traps.

- Test proximity to assist ranges – Solely take purchase alerts inside 15-20 pips of recognized assist zones on EUR/USD or GBP/USD; random mid-chart alerts have 60% greater failure charges.

- Confirm on a better timeframe first – Verify a blue-ringed dot seems on the 4-hour or every day chart earlier than taking entries on the 1-hour timeframe for multi-timeframe alignment.

- Place cease loss 20-30 pips beneath the sign – Place your cease beneath the yellow dot and the closest swing low; on unstable pairs like GBP/JPY, prolong this to 40-50 pips.

- Keep away from purchase alerts throughout sturdy downtrends – Skip blue-ringed dots if value stays beneath the 50-period transferring common on the every day chart; these are possible false reversals in established traits.

- Search for bullish candlestick affirmation – Enter solely when the following 1-2 candles type bullish engulfing patterns, hammers, or pin bars after the blue ring seems.

- Threat not more than 1.5% per commerce – Calculate place dimension so your 20-30 pip cease loss equals most 1.5% of account stability; a $10,000 account dangers $150 most.

- Exit if crimson ring seems – Shut 50% of your place instantly when a red-ringed yellow dot prints throughout your lengthy commerce, then path cease on the rest.

Promote Entry

- Anticipate red-ringed yellow dot affirmation – Let the present candle shut fully and confirm the crimson ring stays seen earlier than coming into brief positions.

- Test proximity to resistance ranges – Solely promote when red-ringed dots seem inside 15-20 pips of examined resistance zones; alerts at random value ranges fail 65% of the time.

- Verify on 4-hour chart minimal – Don’t take 15-minute or 1-hour promote alerts until a red-ringed dot additionally seems on the 4-hour timeframe for stronger affirmation.

- Place cease loss 25-35 pips above the sign – Set stops above the yellow dot and up to date swing excessive; for GBP/USD throughout the London session, use 40-45 pips as a result of volatility.

- Skip alerts throughout sturdy uptrends – Ignore red-ringed dots when value trades above the 50-period MA on every day charts; counter-trend trades have 70% failure charges.

- Require bearish value motion affirmation – Enter solely after seeing bearish engulfing candles, capturing stars, or night star patterns following the crimson ring sign.

- By no means threat greater than 2% on reversals – Quick trades in opposition to established traits are riskier; restrict publicity to 2% most or $200 on a $10,000 account.

- Exit when the blue ring seems – Shut not less than half your brief place the second a blue-ringed yellow dot prints, signaling potential reversal of your reversal commerce.

Conclusion

The Foreign exchange Reversal Indicator fills a particular want: figuring out potential development exhaustion factors by way of visible, price-action-based alerts. It really works greatest for affected person swing merchants keen to attend for high quality setups on greater timeframes. Scalpers looking 10-pip positive aspects on 5-minute charts gained’t discover a lot worth right here.

Understanding its repainting nature, combining it with strong value construction evaluation, and accepting that no sign ensures success—these elements decide whether or not the device helps or hurts your buying and selling. Use it as one piece of a whole technique, not as a standalone system.

The yellow dots don’t predict the longer term. They spotlight the place the market is perhaps shifting primarily based on observable patterns. What merchants do with that info—how they handle threat, dimension positions, and execute their plan—determines outcomes excess of the indicator itself ever might.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90