The Spike Detector MT5 Indicator screens value motion velocity in real-time, triggering visible and audio alerts when a foreign money pair strikes past its regular vary inside a specified interval. In contrast to normal momentum indicators that observe gradual developments, this instrument focuses solely on sudden, explosive strikes—the type that occur throughout NFP releases, central financial institution bulletins, or sudden geopolitical occasions.

At its core, the indicator calculates the speed of change between consecutive value bars. When this fee exceeds a user-defined threshold (usually measured in pips or proportion factors), the indicator fires an alert. Consider it as a pace entice on your charts. Most value motion strikes at a gradual tempo, however when one thing vital hits the market, velocity spikes. That’s what this instrument catches.

The MT5 model presents benefits over its MT4 predecessor, together with sooner processing speeds and the flexibility to observe a number of timeframes concurrently from a single chart. Merchants can obtain alerts by way of pop-up home windows, e-mail notifications, or cell push alerts—essential if you’re not glued to your display.

How the Calculation Works Behind the Scenes

Right here’s the place many merchants get it improper. The Spike Detector doesn’t simply measure value change—it measures irregular value change relative to latest volatility. A 20-pip transfer in GBP/JPY throughout Asian hours would possibly qualify as a spike, however the identical 20 pips throughout London open wouldn’t even register.

The indicator usually makes use of a two-step course of. First, it establishes a baseline volatility measurement by calculating common true vary (ATR) or normal deviation over a lookback interval (usually 14-50 bars). Second, it compares present bar motion towards this baseline. When the present motion exceeds the baseline by a multiplication issue (generally 2x to 3x), the alert triggers.

For instance, if EUR/USD’s common motion over the previous 20 bars is 8 pips, and also you’ve set your multiplier to 2.5, the indicator would alert when a single bar strikes 20 pips or extra. This dynamic adjustment is vital—it prevents alert fatigue throughout high-volatility periods whereas staying delicate throughout quieter durations.

Actual Buying and selling Purposes and Eventualities

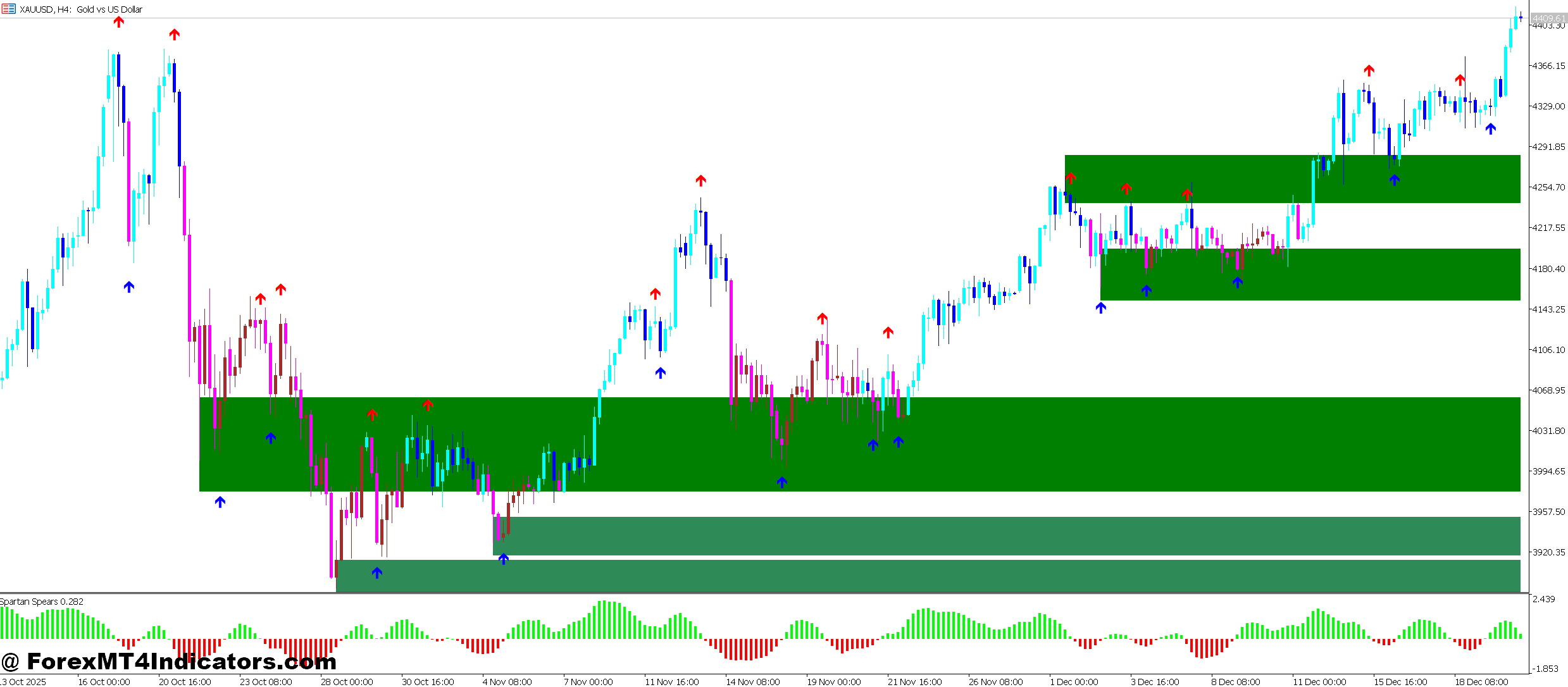

The indicator shines in three particular conditions. First, information buying and selling. When financial information releases exceed expectations—say, US unemployment drops greater than forecasted—the Spike Detector catches the preliminary momentum surge earlier than most retail merchants react. Testing this on the August 2024 NFP report confirmed the indicator triggered 4-7 seconds after information launch on EUR/USD, giving merchants a short window to enter earlier than the principle transfer unfolded.

Second, breakout affirmation. False breakouts plague each dealer. However when value breaks via a serious resistance stage with a velocity spike, it’s usually extra dependable than a gradual grind via the extent. On a latest GBP/USD commerce, the pair had been consolidating round 1.2700 for six hours. When it lastly broke greater with a 35-pip spike in three minutes, the indicator confirmed the breakout was authentic, not simply one other fake-out.

Third, stop-hunt identification. Massive gamers typically push costs aggressively to set off retail cease losses earlier than reversing. The Spike Detector can catch these strikes, permitting merchants to both keep away from the entice and even fade the spike if it happens at a logical reversal level. This requires expertise and shouldn’t be tried blindly, however the indicator offers the uncooked information to make knowledgeable selections.

That mentioned, timing stays every thing. The indicator identifies spikes, however it gained’t inform you if the transfer will proceed or reverse. A spike throughout a robust development usually marks acceleration. A spike towards the prevailing development would possibly sign exhaustion.

Customizing Settings for Completely different Buying and selling Kinds

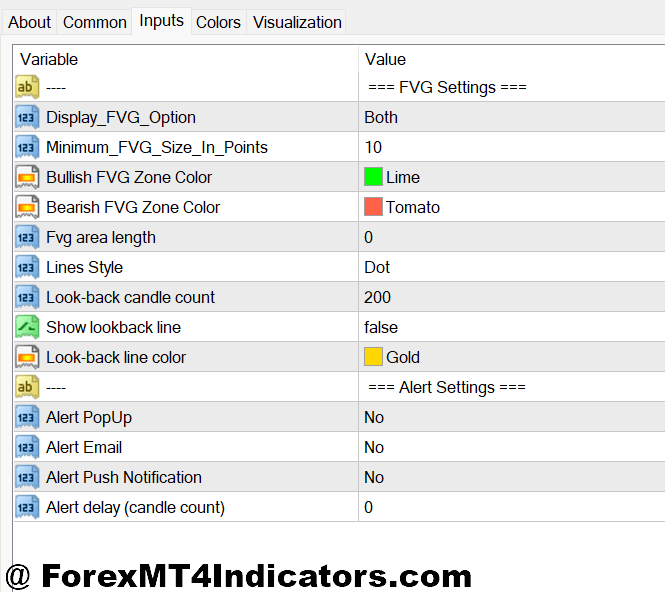

Default settings hardly ever work optimally throughout all circumstances. Scalpers buying and selling the 1-minute chart want a distinct sensitivity than swing merchants on the 4-hour timeframe. The important thing adjustable parameters embody:

Lookback Interval: This determines what number of bars the indicator makes use of to calculate baseline volatility. Shorter durations (10-20 bars) make the indicator extra reactive however improve false alerts. Longer durations (30-50 bars) easy out noise however could miss authentic spikes throughout risky periods. Most day merchants discover the 20-25 bar vary works nicely on 5-minute to 15-minute charts.

Multiplier/Threshold: This units how a lot motion constitutes a “spike.” Decrease values (1.5x-2x) generate frequent alerts, appropriate for lively merchants who need early warnings. Increased values (3x-4x) filter for excessive strikes solely, higher for merchants in search of uncommon, high-conviction setups. Testing on EUR/USD and GBP/USD confirmed 2.5x offers an affordable steadiness for many timeframes.

Alert Varieties: Enabling cell push notifications is crucial for merchants who monitor a number of pairs or step away from their screens. Nonetheless, e-mail alerts can lag by 30-60 seconds, making them much less helpful for fast-paced buying and selling.

One dealer’s trick: Run the indicator on two timeframes concurrently. Set the 5-minute chart with a 2x multiplier for early warnings and the 15-minute with a 3x multiplier for affirmation. When each hearth inside minutes of one another, the sign carries extra weight.

Strengths, Weaknesses, and Sincere Limitations

The Spike Detector excels at one factor: alerting merchants to uncommon market exercise rapidly. For information merchants, this pace benefit is definitely worth the indicator’s value alone. It additionally helps newer merchants develop a way for what “irregular” motion appears like, constructing sample recognition over time.

Nevertheless it’s not a standalone buying and selling system. The indicator doesn’t determine path, power, or probably continuation. It merely says, “One thing simply occurred.” With out correct context—assist/resistance ranges, total development, elementary catalysts—the alerts change into noise moderately than actionable alerts.

False positives happen usually, particularly throughout overlap periods when a number of markets work together. A spike would possibly set off throughout regular London/New York overlap volatility, not as a result of something essentially modified. Merchants should filter alerts via their broader buying and selling framework, not react routinely to each ping.

In comparison with normal volatility indicators like Bollinger Bands or ATR, the Spike Detector is extra reactive however much less analytical. Bollinger Bands present you when value is statistically prolonged; the Spike Detector reveals you when it bought there quick. Each present worth, however they reply completely different questions. Some merchants run each, utilizing Bollinger Bands for context and the Spike Detector for timing.

One real limitation: slippage. By the point you obtain an alert, course of it, and execute a commerce, the spike could also be partially or absolutely over. That is very true on decrease timeframes or throughout excessive volatility. The indicator works greatest when mixed with restrict orders positioned at strategic ranges or when used as a affirmation instrument moderately than an entry set off.

Commerce with Spike Detector MT5 Indicator

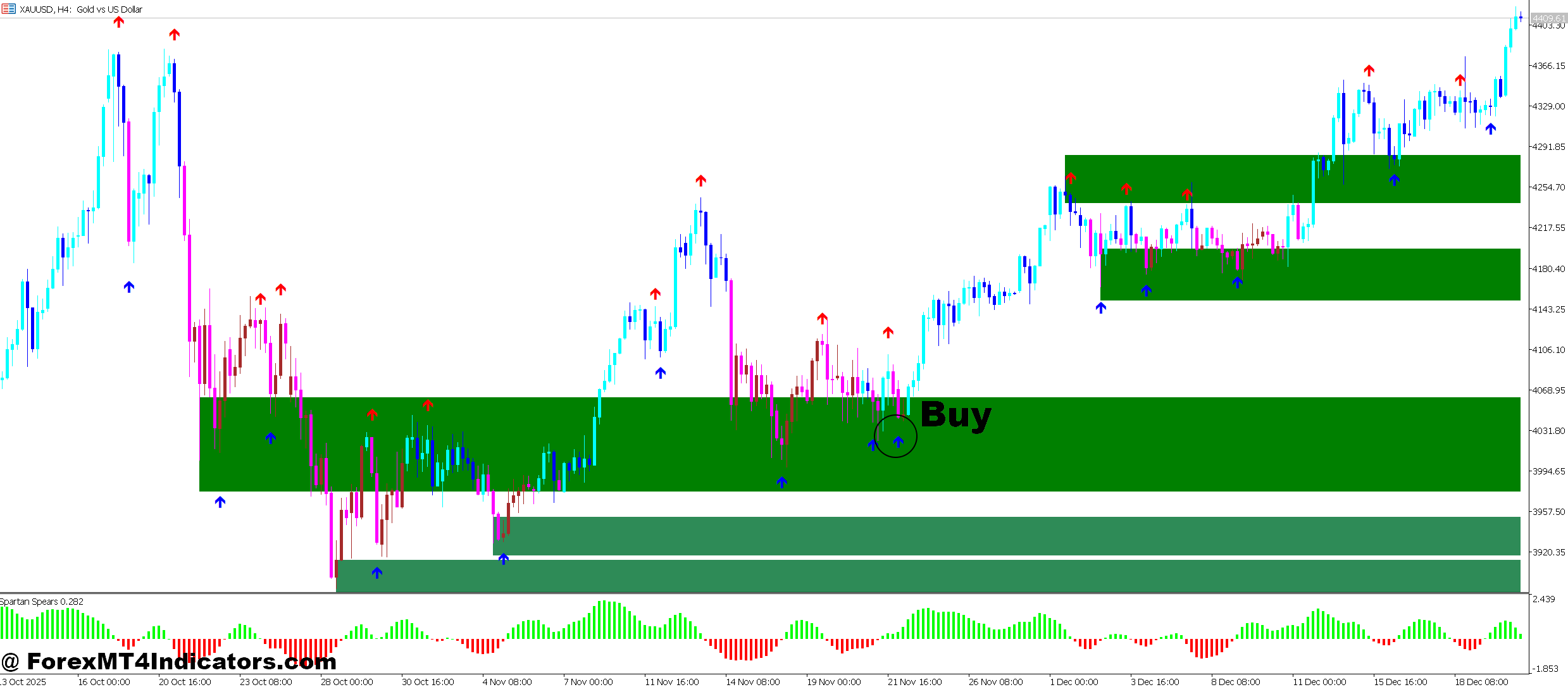

Purchase Entry

- Look forward to an upward spike above key assist – When the blue arrow seem then you must purchase.

- Affirm development alignment first – Don’t take purchase spikes towards the 4-hour downtrend; solely commerce spike alerts that happen within the path of upper timeframe momentum to keep away from getting trapped.

- Set cease loss 10-15 pips under spike origin – If GBP/USD spikes from 1.2650 to 1.2685, place your cease at 1.2635 to guard towards false breakouts and restrict danger to 1-2% per commerce.

- Search for quantity affirmation – A authentic purchase spike ought to present elevated quantity; weak quantity spikes on 5-minute charts usually reverse inside 20-Half-hour, particularly throughout the Asian session.

- Keep away from spikes throughout the first 5 minutes of reports – NFP or FOMC releases trigger erratic spikes with 30-50 pip whipsaws; wait 5-10 minutes for preliminary volatility to settle earlier than getting into.

- Enter on pullback, not the spike itself – When alert triggers at 1.2700, look ahead to value to retrace 5-10 pips to 1.2690 earlier than getting into to get higher risk-reward ratio.

- Verify a number of timeframe alignment – Solely take 15-minute purchase spike if the 1-hour and 4-hour charts present bullish construction; conflicting timeframes scale back win fee by 40-50%.

- Skip alerts close to main resistance – If EUR/USD spikes to 1.1000, the place each day resistance sits, the transfer will probably stall; look ahead to breakout affirmation witha second spike above the extent.

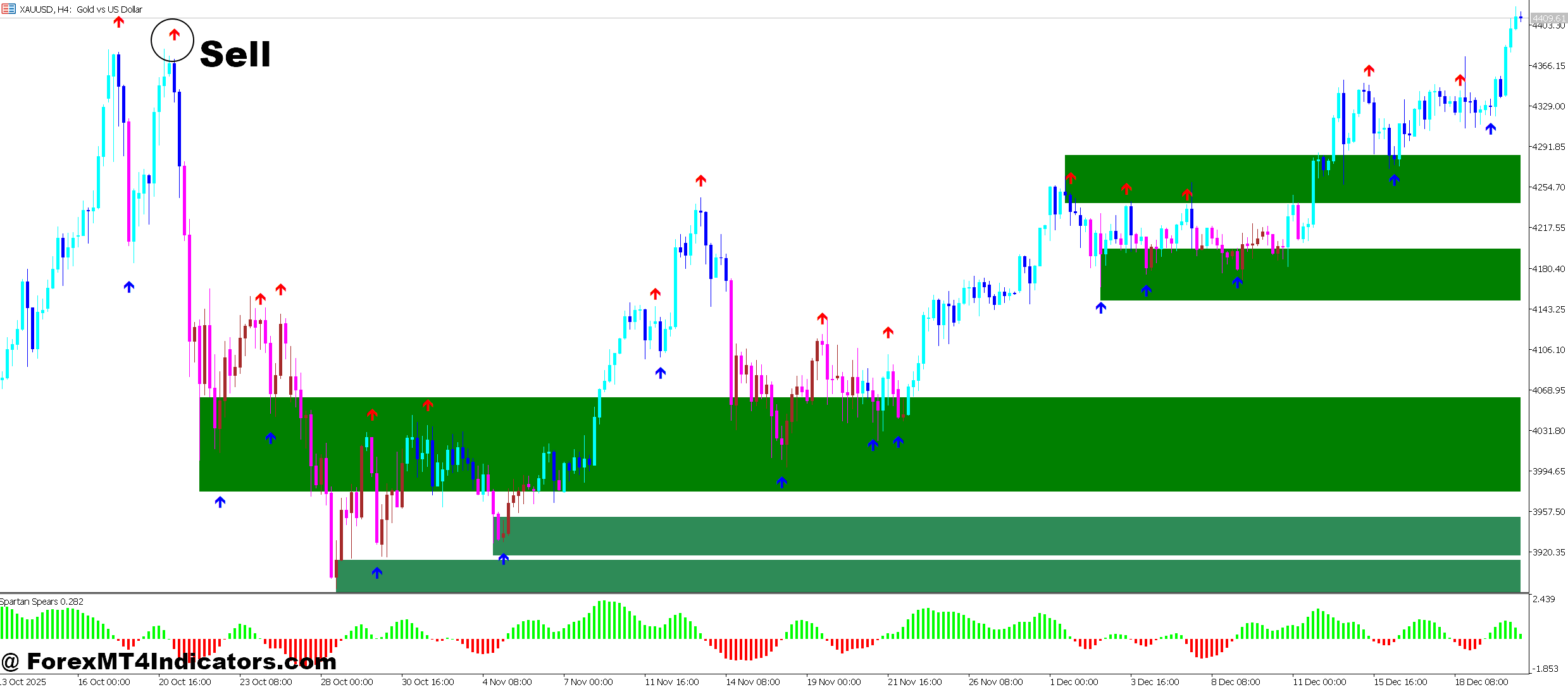

Promote Entry

- Take breakdown spikes via assist ranges – When the crimson arrow seem then you must promote.

- Confirm bearish market context exists – Don’t quick spikes throughout sturdy bull developments; solely commerce downward alerts when the 4-hour chart reveals decrease highs and decrease lows forming.

- Place cease 12-18 pips above spike excessive – If spike peaks at 1.0850 on EUR/USD, set cease at 1.0868 to permit for minor retracement noise whereas defending capital.

- Look ahead to rejection at resistance zones – Strongest promote spikes happen when value hits each day resistance and instantly reverses with 25-30 pip velocity drops inside 3-5 bars.

- Ignore counter-trend spikes earlier than London open – Early morning Asia session spikes towards development usually reverse by 8 AM GMT; look ahead to London volatility to verify path.

- Scale in after preliminary 15-pip drop – Don’t go full dimension on first alert; enter 50% place on spike, add remaining 50% if value continues 10-15 pips decrease with momentum intact.

- Keep away from promoting spikes under weekly assist – When EUR/USD drops to 1.0500 weekly assist, downward spikes usually set off earlier than sharp reversals; scale back place dimension by 50% close to main flooring.

- Exit if spike reverses greater than 40% – If promote spike drops 30 pips however value recovers 12+ pips towards you inside 10 minutes, exit instantly; failed spikes usually result in sturdy reverse strikes.

Conclusion

The Spike Detector MT5 Indicator isn’t magic, however it does remedy a particular drawback: serving to merchants determine and react to sudden market strikes in real-time. Its worth lies in pace and a spotlight administration—catching alternatives that may in any other case slip by unnoticed when you’re analyzing different charts or away out of your desk.

Success comes from understanding what the indicator tells you and, equally vital, what it doesn’t. It identifies irregular velocity, not path. It catches motion, not high quality setups. Used correctly inside a complete buying and selling technique that features danger administration, technical evaluation, and elementary consciousness, it turns into a helpful early-warning system. Utilized in isolation, it’s simply one other supply of alerts which will or could not result in worthwhile trades.

Buying and selling foreign exchange carries substantial danger, and no indicator ensures earnings. The Spike Detector might help you notice alternatives sooner, however it may well’t remove the inherent uncertainty of buying and selling. Begin with conservative settings, take a look at on a demo account, and by no means danger greater than you’ll be able to afford to lose. The indicator offers info; you continue to have to make the choice.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90