Licensed Elliott Wave analyst XForceGlobal (@XForceGlobal) instructed followers on X that “$5+ stays on the horizon,” arguing that the token’s previous 12 months of range-bound buying and selling is validating an Elliott Wave “flat” correction that sometimes resolves with a pointy, ultimate transfer earlier than a continuation increased.

In a 10-minute video shared alongside the publish, the analyst framed XRP’s latest value motion because the late stage of a flat sample, an prolonged interval the place neither bulls nor bears can drive a clear development. “A flat happens when the market fails to development on each side. They’re mainly evenly matched,” he mentioned. “And that’s not an indication of weak spot, it’s an indication of stability.”

XRP Merchants ‘Exhausted’ As Breakout Nears

XForceGlobal positioned the construction as a corrective part inside a bigger bullish sequence, describing the market as forming a brand new flooring relatively than breaking down. “That is the place the consumers and sellers enter a Mexican standoff with one another, creating a brand new value flooring,” he mentioned, including that the sideways really feel is the purpose: “They’re not designed to go anyplace, mainly. And the markets naturally alternate between growth and compression.”

Associated Studying

The analyst emphasised the psychological facet of extended consolidation, arguing that flats are likely to “get rid of even the leverage merchants via time relatively than value” by exhausting each side. “By the point the flat truly resolves, which may be very shut, in my view, most merchants are emotionally already exhausted,” he mentioned. “Positioning has been just about neutralized, and the trail for continuation, to me, turns into very clear.”

In Elliott Wave phrases, XForceGlobal described the flat as a three-part A-B-C construction, with waves A and B unfolding as corrective “three-wave” strikes and wave C finishing as an impulsive “five-wave” transfer. He argued that this ultimate part is the second the market stops drifting and forces a decision.

“Wave C have to be impulsive as a result of it represents the decision of the stability that now we have for waves A and B,” he mentioned. “It’s not the continuation of a bigger construction to the draw back.” He framed impulsiveness as behavioral relatively than directional, attributing it to urgency and follow-through as soon as one facet “decisively provides up,” clearing out the vary that constructed throughout the earlier legs.

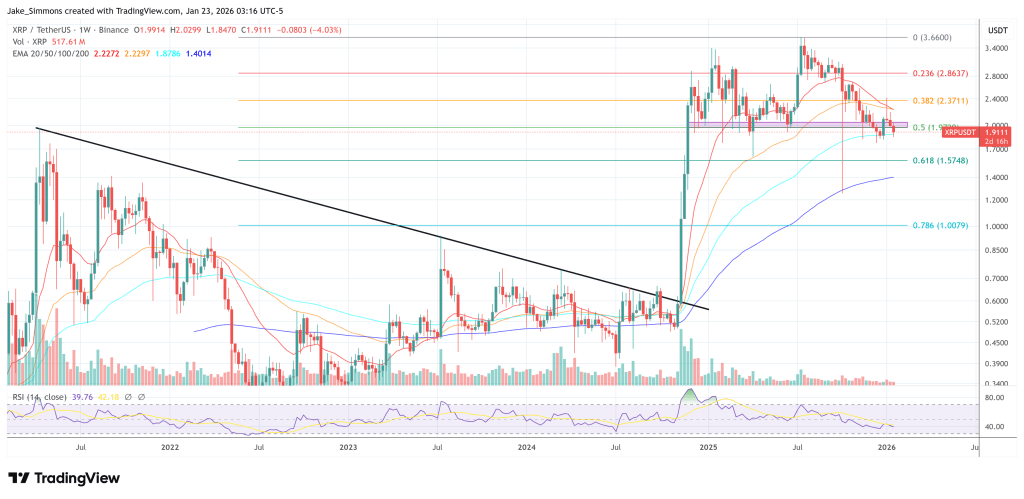

That distinction issues for positioning, as a result of his base case anticipates yet one more decisive shakeout earlier than a transfer increased. He mentioned the market is at present in an “expanded flat” configuration the place wave B pushed above the prior excessive, and he expects a break of native construction “as soon as” earlier than the market turns up. He highlighted $1.70 as a previous low that could possibly be undercut as a part of the method with out invalidating the bigger setup, as long as broader help holds.

Associated Studying

XForceGlobal’s publish leaned closely on conviction constructed over time—“I didn’t spend 2,000+ days accumulating XRP for no purpose!”—whereas additionally stressing that he has already taken some revenue. Within the transcript, he mentioned he “personally took some income across the $2.70 stage” and would proceed to “promote into power.”

On upside expectations, he known as for increased ranges “on this present cycle,” tying potential targets to the period of the consolidation. “The longer that we distribute right here, the upper the targets are going to be,” he mentioned, including that “a minimal of a $6 vary all the best way as much as even the $14 vary is my private goal.”

He additionally flagged situations that may change the commerce administration. If the market reveals “crimson flags” and breaks additional construction than he expects, he urged that’s the place danger administration ought to take precedence.

For XRP merchants, the sensible takeaway from his framework is timing and path, not path: a ultimate, forceful leg decrease may nonetheless be in step with a bullish continuation thesis whereas a deeper structural breakdown would problem it.

At press time, XRP traded at $1.91.

Featured picture created with DALL.E, chart from TradingView.com