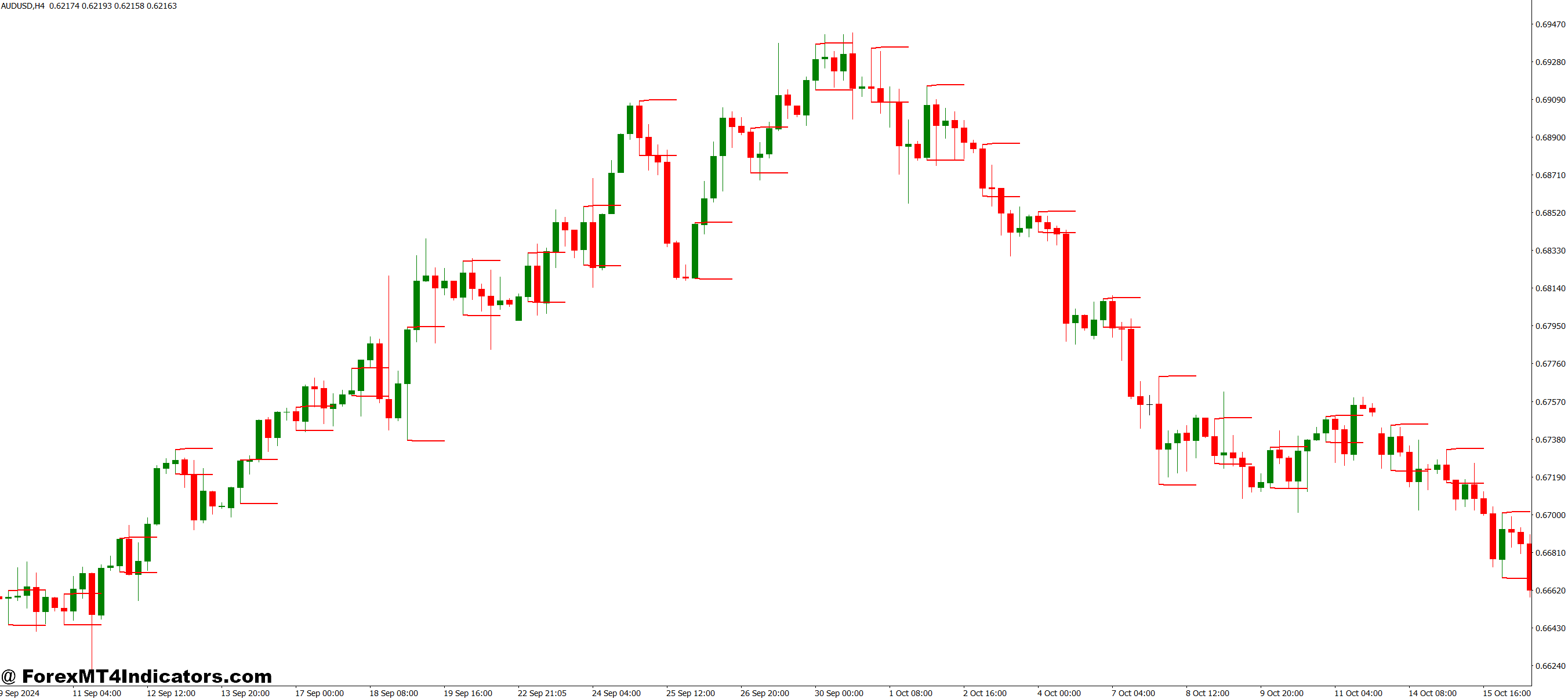

The Breakout Chance MT4 Indicator analyzes worth compression and volatility to assign a share probability to potential breakouts. In contrast to easy help and resistance indicators, this software calculates the statistical likelihood of worth breaking by means of an outlined vary based mostly on present market situations.

The indicator shows likelihood percentages above consolidation zones, sometimes starting from 0% to 100%. A studying above 70% suggests favorable situations for a breakout, whereas readings under 30% point out the vary could maintain. However right here’s the factor—these aren’t ensures. They’re statistical edges based mostly on sample recognition.

Most variations present twin chances: one for upside breaks and one other for draw back. On EUR/USD through the London session, you may see 65% upside and 35% draw back likelihood when the value checks resistance after a bullish pattern.

How the Calculation Works

The indicator combines three major inputs: Common True Vary (ATR), worth deviation from a shifting common, and consolidation period. The ATR part measures volatility—increased volatility will increase breakout likelihood since explosive strikes want gasoline.

Worth deviation seems at how far the present worth sits from its imply. When worth compresses tightly round a 20-period shifting common, rigidity builds. The indicator acknowledges this coiling motion and raises likelihood scores.

Consolidation period issues too. Breakouts from 3-hour ranges don’t carry the identical weight as these from multi-day consolidations. The indicator sometimes weighs longer consolidations extra closely. A triangle sample that’s been constructing for 2 weeks on the every day chart scores increased than a 15-minute vary.

The system isn’t publicly disclosed by most builders, however the logic follows this sample: (ATR growth + Worth compression + Time issue) / Historic success charge = Chance rating. Some variations incorporate Bollinger Band width or commonplace deviation bands for added affirmation.

Actual-World Buying and selling Software

Testing this on USD/JPY through the Tokyo-London overlap produced fascinating outcomes. The pair fashioned a symmetrical triangle over eight buying and selling periods. The indicator confirmed 72% upside likelihood as the value approached the apex. When the break occurred, it ran 85 pips earlier than the primary pullback—a strong risk-to-reward setup.

However not each high-probability sign delivers. Throughout uneven NFP (Non-Farm Payroll) periods, the indicator flashed 68% likelihood on a EUR/USD vary breakout. Worth did break increased initially, however whipsawed again by means of the vary inside 20 minutes. The lesson? Chance isn’t certainty, particularly throughout information occasions when algorithms dominate order move.

For swing merchants, the indicator works greatest on 4-hour and every day timeframes. Brief-term noise impacts likelihood calculations much less while you zoom out. One dealer reported utilizing it on every day GBP/JPY charts, solely taking setups above 75% likelihood. His hit charge improved from 51% to 64% over six months—statistically vital for breakout buying and selling.

Scalpers can apply it to 5-minute charts, however anticipate extra false alerts. The indicator wants ample knowledge to calculate dependable chances. On a 1-minute chart through the Asian session, with low volatility, the readings turn into practically meaningless.

Settings and Customization

The default settings sometimes embody a 14-period ATR, 20-period shifting common, and a consolidation lookback of 30 bars. These work decently on 1-hour charts for main pairs like EUR/USD or USD/CAD.

For unstable pairs like GBP/JPY or cryptocurrency crosses, merchants usually scale back the ATR interval to 10. This makes the indicator extra aware of sudden volatility spikes. The tradeoff? Extra sensitivity means extra false alerts throughout ranging markets.

Conservative swing merchants enhance the consolidation lookback to 50 or 60 bars. This filters out short-term ranges and focuses on extra established patterns. A dealer specializing in every day timeframe breakouts may use: ATR 21, MA 50, and Lookback 60.

The likelihood threshold is adjustable, too. Some merchants set alerts solely when readings exceed 75%, whereas aggressive merchants act on something above 60%. There’s no magic quantity—it will depend on your threat tolerance and win charge necessities.

Colour-coding choices assist visible merchants. Inexperienced zones point out excessive upside likelihood, pink reveals excessive draw back likelihood, and yellow alerts uncertainty (roughly 50/50 odds). When each instructions present low likelihood, the indicator’s mainly saying “keep out—this vary isn’t prepared to interrupt.”

Benefits and Sincere Limitations

The first benefit is objectivity. As a substitute of guessing whether or not a spread will break, merchants get a calculated likelihood. This removes some emotional decision-making from breakout entries. It additionally helps with place sizing—increased likelihood setups may warrant bigger positions inside your threat parameters.

The indicator excels at filtering out weak consolidations. These tight 10-pip ranges that type throughout lunch hour on EUR/USD? The indicator normally reveals low likelihood, saving merchants from getting into uneven, directionless worth motion.

However let’s handle the restrictions head-on. No indicator predicts black swan occasions. When the Swiss Nationwide Financial institution unpegged the franc in 2015, no likelihood calculation would’ve helped. The indicator additionally lags throughout fast-moving markets. By the point it calculates a excessive likelihood, the breakout could already be 20 pips gone.

False breakouts stay a threat, particularly throughout low-liquidity intervals. The indicator may present 70% likelihood, but when there’s skinny order move, market makers can simply set off stops and reverse the value. This occurs incessantly throughout vacation weeks or in a single day periods in skinny pairs.

In comparison with the Donchian Channel breakout system, this indicator provides a likelihood layer quite than simply signaling when worth hits new highs or lows. Towards the Common Directional Index (ADX), it’s extra particular to breakout situations, whereas ADX measures general pattern energy. Merchants usually mix this indicator with ADX—a excessive ADX plus a excessive breakout likelihood creates a robust affirmation.

Tips on how to Commerce with Breakout Chance MT4 Indicator

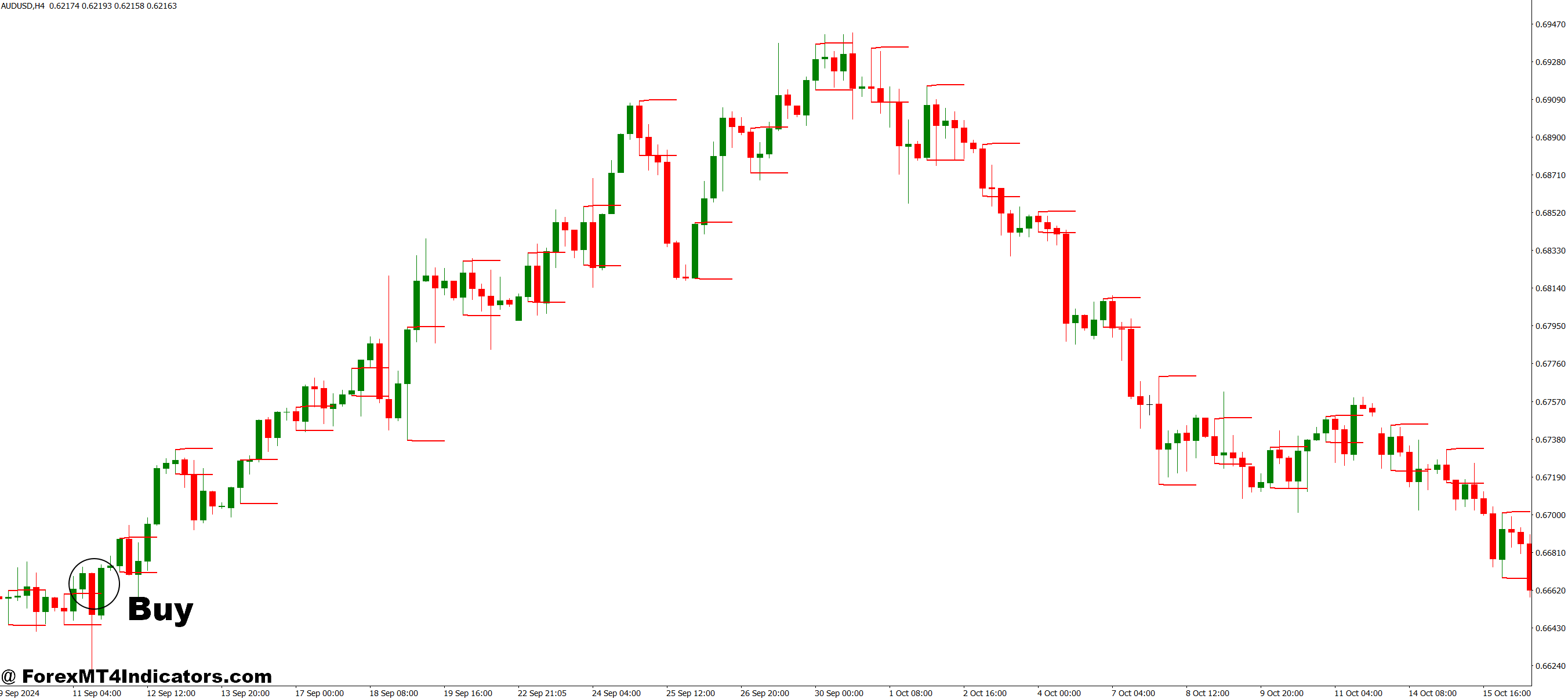

Purchase Entry

- Watch for 70%+ upside likelihood – Solely take lengthy breakout trades when the indicator shows 70% or increased likelihood on the upside; something under 65% on EUR/USD 4-hour charts sometimes leads to false breaks.

- Affirm with worth shut above resistance – Enter purchase positions solely after a 4-hour or 1-hour candle closes at the least 5-10 pips above the consolidation excessive; don’t chase wicks with out physique affirmation.

- Verify ATR for volatility growth – The 14-period ATR must be increasing when likelihood exceeds 75%; if ATR is contracting throughout a breakout sign, worth lacks the momentum to maintain the transfer.

- Set stop-loss under consolidation low – Place stops 5-10 pips under the vary’s lowest level, not slightly below entry; on GBP/USD, this sometimes means 30-50 pip stops relying on the consolidation dimension.

- Keep away from throughout main information releases – Skip purchase alerts inside half-hour earlier than or after NFP, FOMC, or central financial institution choices; likelihood calculations break down when algorithms dominate order move.

- Goal 1.5:1 minimal risk-reward – In case your cease is 40 pips, goal for at the least 60 pips revenue; high-probability setups above 80% can justify targets of two:1 or increased on every day timeframes.

- Scale in on pullbacks to breakout stage – Add to profitable positions if worth retests the damaged resistance (now help) with likelihood nonetheless above 65%; this improves common entry worth on EUR/USD and GBP/USD swing trades.

- Exit if likelihood drops under 50% – Shut partial or full place if the indicator recalculates and reveals declining likelihood; this usually alerts weakening momentum earlier than a reversal entice.

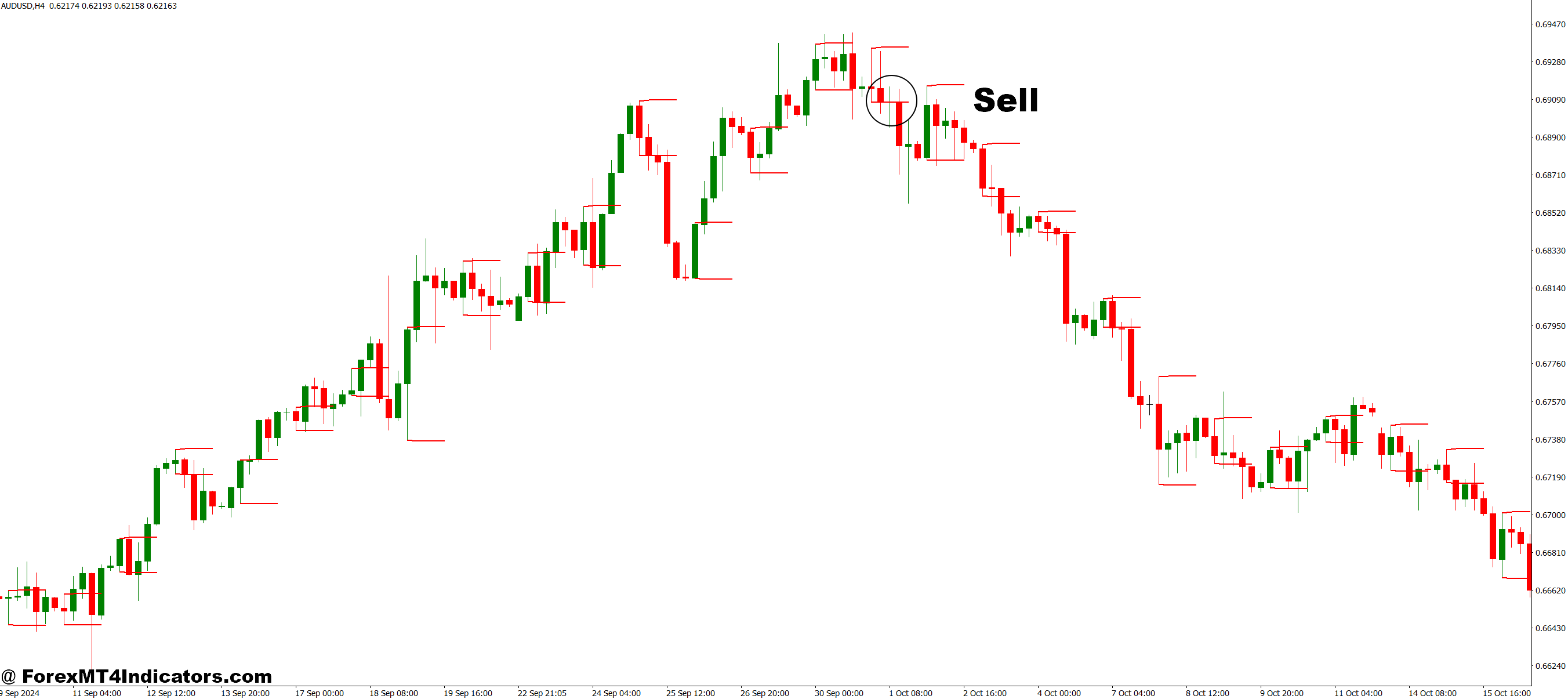

Promote Entry

- Require 70%+ draw back likelihood studying – Solely brief when the indicator reveals 70% or increased likelihood for downward breakouts; readings between 50-65% on 1-hour USD/JPY charts incessantly fail.

- Enter on candle shut under help – Watch for a full 4-hour or every day candle to shut 5-10 pips beneath the consolidation’s lowest level; by no means promote on the preliminary spike down.

- Confirm growing volatility (ATR rising) – The breakout wants gasoline; if ATR is flat or declining whereas likelihood reveals 75%, the vary will doubtless entice sellers and reverse increased.

- Place stops above vary excessive plus buffer – Place stop-losses 5-15 pips above the consolidation’s highest level; GBP/JPY breakouts usually want wider stops (50-70 pips) as a consequence of increased volatility.

- Skip setups throughout skinny liquidity hours – Keep away from brief alerts through the Asian session (00:00-03:00 GMT) or Friday afternoons; low quantity permits market makers to set off stops and reverse false breakouts simply.

- Path stops as likelihood strengthens – If a brief commerce strikes 30+ pips in revenue and likelihood will increase to 85%+, transfer stops to breakeven; defend capital on EUR/USD every day chart breakdowns.

- Don’t promote into sturdy help zones – If the breakout approaches weekly or month-to-month help ranges, exit earlier than contact; likelihood indicators don’t account for institutional order clusters at main zones.

- Shut trades if upside likelihood exceeds 60% – When the indicator flips and reveals a stronger likelihood for upward motion, exit instantly; this alerts the breakdown is dropping conviction and reversal threat is excessive.

Conclusion

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and the Breakout Chance MT4 Indicator isn’t any exception. Chance scores above 70% nonetheless fail roughly 30% of the time by definition. Place sizing and stop-loss placement stay crucial no matter indicator readings.

The indicator works greatest as a filter, not a standalone system. Combining it with worth motion evaluation, help and resistance ranges, and broader market context improves outcomes. A 75% likelihood studying means extra when it aligns with a every day pattern, institutional order ranges, and optimistic threat sentiment.

For merchants uninterested in getting faked out on breakouts, this software gives a scientific method. It received’t get rid of losses, nothing does, however it may shift the percentages in your favor when used correctly. The hot button is treating likelihood scores as one piece of proof, not the ultimate verdict. Take a look at it on a demo account throughout completely different timeframes and pairs. Observe which settings and likelihood thresholds work on your buying and selling type.

In breakout buying and selling, an fringe of simply 5-10% can imply the distinction between constant income and sluggish account erosion. If this indicator supplies even half that edge, it’s definitely worth the studying curve.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90