The STC MT4 indicator was designed to resolve precisely this downside. Quick for Schaff Pattern Cycle, this device combines the trend-following nature of MACD with cycle evaluation to supply quicker, smoother alerts. In contrast to indicators that watch for traits to completely develop, the STC goals to catch strikes earlier whereas filtering out the noise that plagues oscillators. For merchants uninterested in coming into traits too late or getting stopped out on false breakouts, this indicator deserves a more in-depth look.

What the Schaff Pattern Cycle Really Is

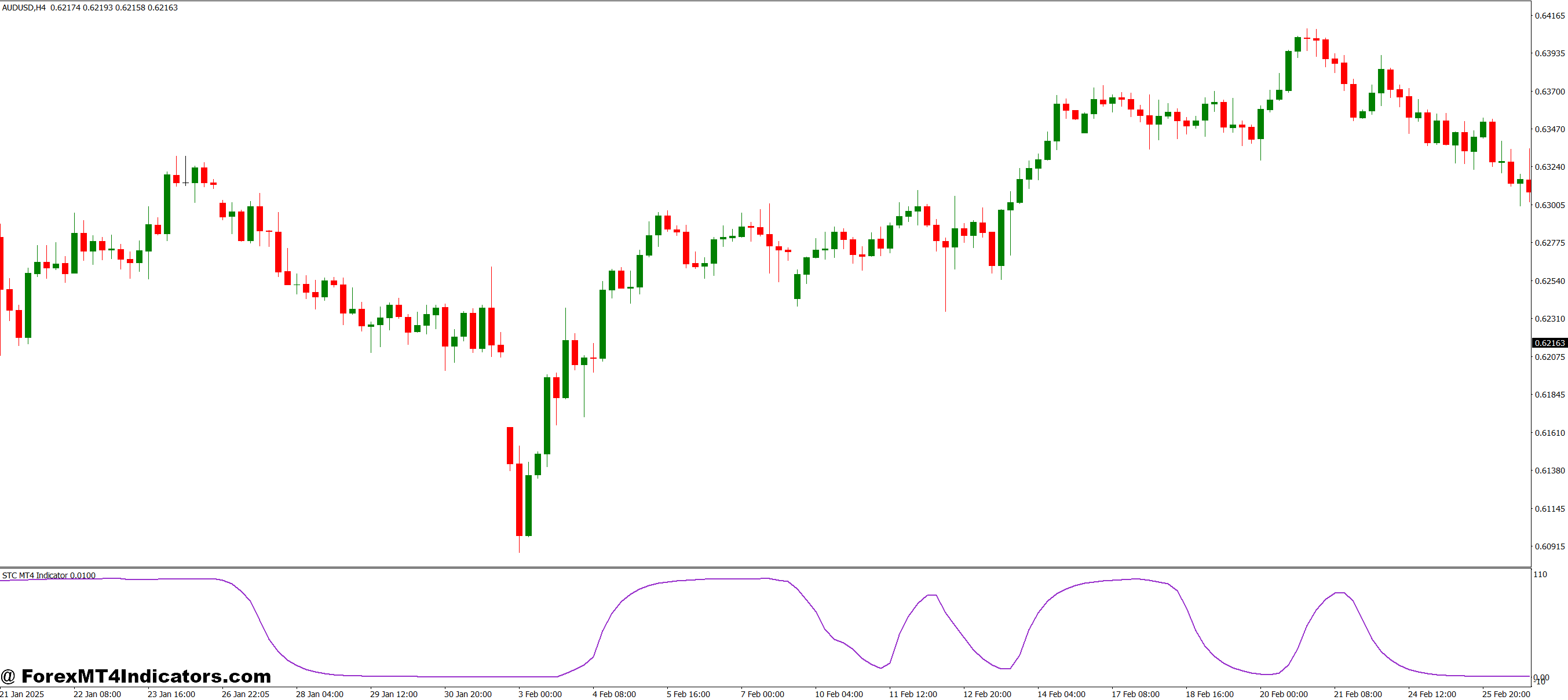

The STC indicator is a forward-looking oscillator that measures each pattern path and momentum cycles. Created by Doug Schaff within the Nineteen Nineties, it builds on MACD’s basis however provides a layer of cycle evaluation borrowed from stochastic calculations. The consequence? An indicator that oscillates between 0 and 100, giving merchants clearer entry and exit factors.

Right here’s what units it aside: whereas MACD can pattern indefinitely and produce unclear alerts throughout ranging markets, the STC stays bounded. When the road crosses above 25, that’s usually a purchase sign. Under 75 suggests it’s time to think about exits or shorts. The bounded nature makes it simpler to identify overbought and oversold circumstances at a look.

Most merchants show the STC as a single line with horizontal reference ranges at 25 and 75. Some variations embody a sign line, however the usual setup retains issues clear and simple.

How the STC Calculates Sooner Indicators

The mathematics behind the STC entails a two-step stochastic calculation utilized to MACD values. Don’t fear—understanding the precise system isn’t needed to make use of it successfully. However realizing the logic helps.

First, the indicator calculates a MACD worth utilizing exponential transferring averages (usually 23 and 50 durations). Then it applies a stochastic calculation to that MACD, smoothing it with a cycle interval (normally 10). A second stochastic calculation follows, creating the ultimate STC line. This double-smoothing course of filters out the false alerts that plague uncooked MACD whereas sustaining responsiveness.

The cycle part is what makes this work. By incorporating value cycles into the calculation, the STC adapts to market rhythm fairly than simply following value mechanically. When examined on GBP/JPY throughout the London session, this turns into apparent—the indicator picks up momentum shifts quicker than customary MACD, typically by 2-4 bars on a 15-minute chart.

Placing the STC to Work: Actual Buying and selling Eventualities

Concept means nothing with out sensible utility. Right here’s how merchants really use this factor.

- Pattern Following with Affirmation: On a 4-hour USD/JPY chart, watch for the STC to cross above 25 after a pullback in an uptrend. That’s the entry set off. The secret is context—this works finest when value is respecting a rising 50 EMA. One dealer famous catching a 90-pip transfer in October 2024 utilizing this actual setup when the pair bounced off help at 149.50.

- Early Exit Indicators: When the STC crosses under 75 throughout a worthwhile lengthy commerce, it’s a warning that momentum is fading. This doesn’t all the time imply reverse the place, however it’s time to tighten stops. EUR/USD merchants discovered this notably helpful throughout NFP releases, the place the preliminary spike typically reverses inside half-hour. The STC regularly topped out round 85-90 proper earlier than these reversals hit.

- Vary Buying and selling: In uneven circumstances on pairs like AUD/NZD, the STC turns into an overbought/oversold indicator. Crosses above 75 sign quick alternatives close to vary highs, whereas crosses under 25 recommend longs close to help. The 1-hour chart works effectively for this, particularly throughout Asian session consolidation.

That stated, ranging markets require tight danger administration. The STC may give a number of alerts that don’t pan out if the vary is just too slender. Cease losses matter much more right here.

Adjusting Settings for Completely different Markets

The usual settings are 23, 50, and 10 (MACD quick, MACD sluggish, and cycle interval). However these aren’t carved in stone.

For scalpers working 1-minute or 5-minute charts, shortening the MACD durations to 12 and 26 (customary MACD settings) with a cycle of 5 produces extra alerts. The tradeoff? Extra noise. It really works on extremely liquid pairs like EUR/USD throughout peak hours, however the false alerts multiply throughout sluggish Asian periods.

Swing merchants typically lengthen all the things—attempt 34, 89, and 15 for every day charts. This smooths out intraday volatility and focuses on important pattern adjustments. When backtesting this on GBP/USD every day charts, the alerts decreased from 40-50 per yr to about 12-15, however the win price improved noticeably.

Foreign money-specific changes assist too. Risky pairs like GBP/JPY profit from barely longer cycle durations (12-15) to keep away from getting chopped up. Secure pairs like EUR/CHF can deal with shorter settings with out producing an excessive amount of noise.

The Good, The Dangerous, and The Real looking

- Benefits: The STC reacts quicker than MACD whereas staying smoother than a uncooked stochastic. It really works throughout a number of timeframes and fits each pattern and vary buying and selling. The bounded scale makes interpretation simple—no guessing whether or not a studying is “excessive sufficient” like with unbounded oscillators. Plus, it combines moderately effectively with value motion ideas like help and resistance.

- Limitations: No indicator is ideal, and the STC has its share of flaws. Throughout violent breakouts, it might probably keep pegged close to 100 or 0 for prolonged durations, making entries inconceivable to time. The lag, whereas lowered in comparison with MACD, nonetheless exists—this isn’t a crystal ball. Whipsaws occur, particularly on decrease timeframes or throughout main information occasions.

The larger problem? Over-reliance. Some merchants deal with any cross above 25 as an automated purchase sign with out contemplating pattern context, close by resistance, or risk-reward ratios. That’s a recipe for frustration and losses.

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and the STC is not any exception. It’s a device, not a system. With out correct danger administration, cease losses, and place sizing, even the very best alerts lead nowhere good.

How It Compares to MACD and Stochastic

Merchants typically marvel: why not simply stick to MACD or stochastic individually?

MACD’s power is pattern identification, however it lags considerably and offers unclear alerts in ranges. The STC addresses each points by including cycle evaluation and bounding the output. In side-by-side exams on EUR/GBP 1-hour charts, the STC generated entry alerts a median of 3-5 bars sooner than MACD crossovers.

Stochastic oscillators react shortly however produce too many false alerts in trending markets. They’ll present overbought circumstances for weeks throughout robust traits, leaving merchants on the sidelines or worse, preventing the pattern. The STC’s trend-following part helps filter these out. When gold rallied in late 2024, customary stochastics stayed overbought for days whereas the STC continued producing legitimate lengthy alerts.

The STC sits within the candy spot between these two indicators—quicker than MACD, extra trend-aware than stochastics. But it surely’s not essentially “higher” in absolute phrases. Some market circumstances favor pure MACD or stochastics. Understanding when to make use of which device separates skilled merchants from novices.

The way to Commerce with STC MT4 Indicator

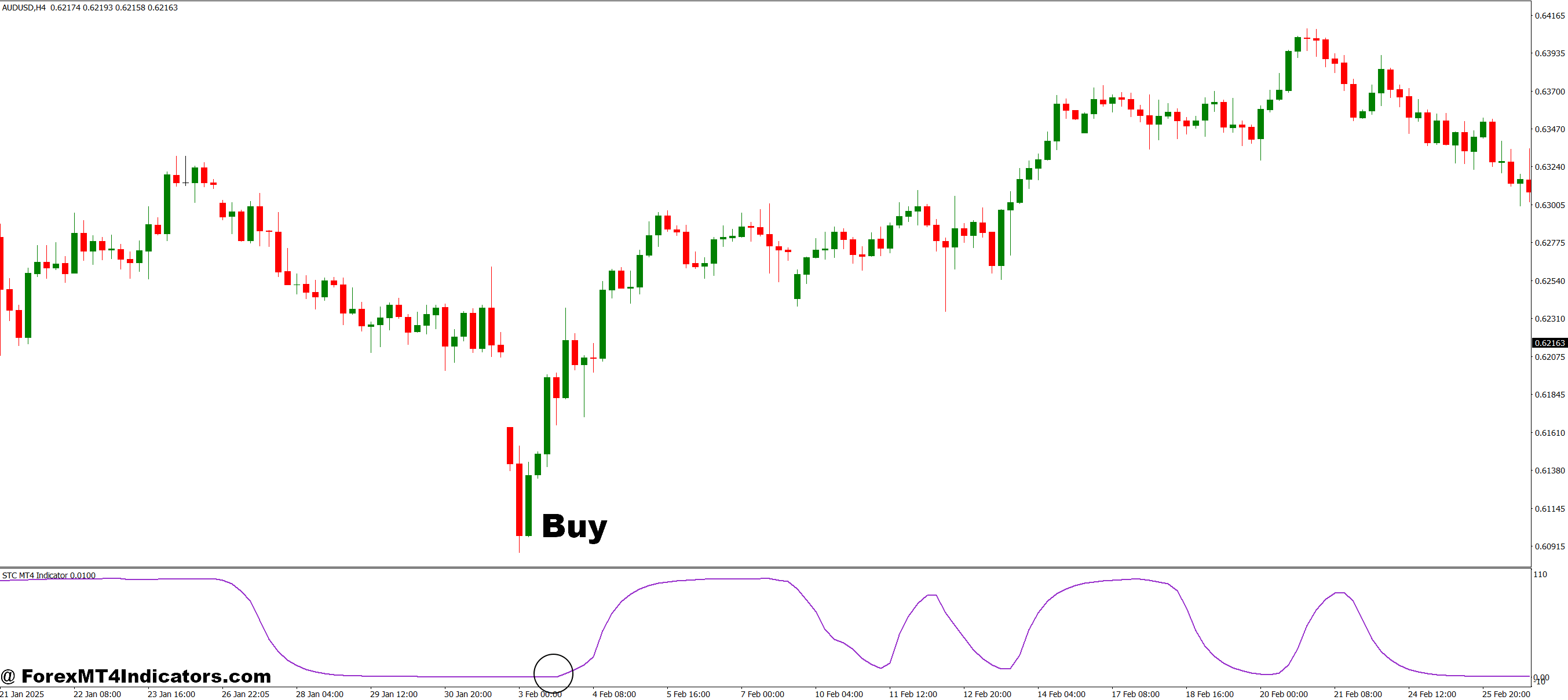

Purchase Entry

- STC crosses above 25 – Enter lengthy when the STC line crosses above 25 on EUR/USD 1-hour charts, however provided that value is above the 50 EMA and never inside 10 pips of main resistance.

- Bullish divergence at oversold ranges – When value makes decrease lows, however STC makes increased lows under 25, enter lengthy on the subsequent candle shut with a 20-30 pip cease under latest swing low.

- Re-entry on pullbacks – If STC drops to the 40-50 zone throughout an uptrend onthe GBP/USD 4-hour chart, enter lengthy when it bounces again above 50, confirming pattern continuation.

- Affirmation with help – Take purchase alerts solely when STC crosses 25 whereas value bounces off a examined help stage—watch for a bullish candle shut to verify.

- Keep away from information occasions – Don’t enter lengthy positions quarter-hour earlier than or after high-impact information releases, even when STC exhibits good purchase alerts—whipsaws will cease you out.

- A number of timeframe alignment – Verify 1-hour STC purchase alerts with the every day chart displaying STC above 50, growing the chance of sustained strikes of fifty+ pips.

- Set correct risk-reward – Solely take STC purchase alerts the place resistance is a minimum of 2x additional than your cease loss distance; if resistance is 30 pips away, cease needs to be 15 pips most.

- Skip uneven Asian periods – Ignore STC crossovers throughout low-volume Asian hours (usually 2-6 AM GMT) on pairs like EUR/USD—false alerts enhance by 40-50% throughout these occasions.

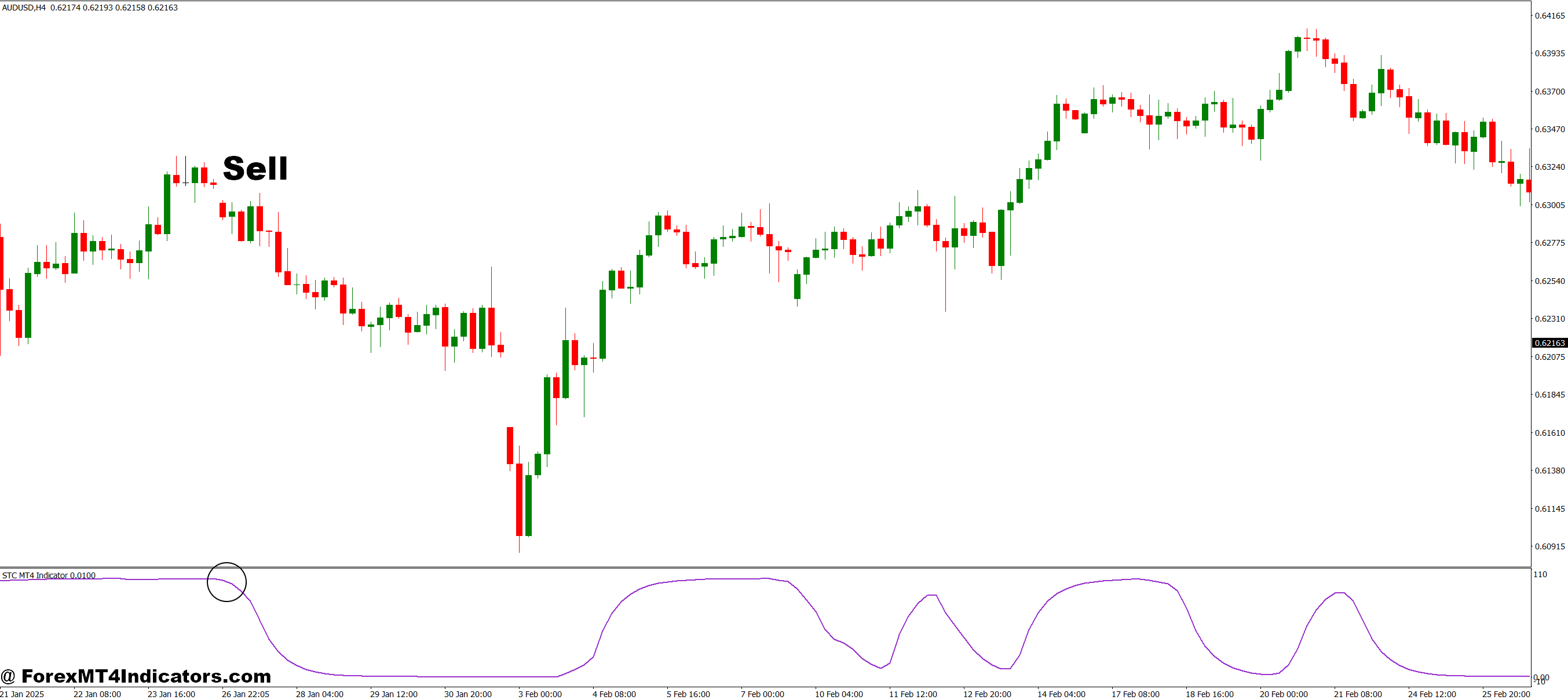

Promote Entry

- STC crosses under 75 – Enter quick when STC drops under 75 on EUR/USD 1-hour charts, however provided that value is buying and selling under the 50 EMA and a minimum of 15 pips away from main help.

- Bearish divergence at overbought – When value makes increased highs however STC makes decrease highs above 75, enter quick with stops 25-30 pips above the latest swing excessive.

- Failed breakout reversal – If value breaks resistance however STC stays under 75 or instantly reverses under it, enter quick concentrating on a 40-60 pip transfer again to breakout stage.

- Rejection from resistance – Take promote alerts when STC crosses under 75 whereas value varieties a bearish rejection candle at identified resistance—skip if rejection wick is lower than 5 pips.

- Pattern alignment on GBP/USD – Solely take 4-hour STC promote alerts when the every day chart STC can be under 50, filtering out counter-trend trades that hardly ever work.

- Don’t struggle robust traits – Skip promote alerts if value is in a powerful uptrend, making constant increased highs—watch for STC to drop under 25 first, indicating potential pattern exhaustion.

- Tighten stops in unstable pairs – On GBP/JPY, use 30-40 pip stops most for STC promote alerts as a substitute of the usual 50 pips on account of elevated intraday volatility.

- Keep away from range-bound circumstances – Don’t take STC promote alerts when ATR (14-period) on the every day chart is under 50 pips for EUR/USD—low volatility produces unreliable alerts and minimal revenue potential.

Conclusion

The Schaff Pattern Cycle indicator presents merchants a refined method to catching traits earlier and filtering false alerts. Its mixture of MACD logic with cycle evaluation creates a responsive but comparatively easy device that works throughout timeframes. Actual merchants have used it efficiently for all the things from 5-minute scalping to every day swing trades.

However right here’s the factor—this isn’t a magic answer. The STC nonetheless requires affirmation from value motion, correct danger administration, and practical expectations. It really works finest when merchants perceive its strengths (early pattern detection, clear alerts) and limitations (lag throughout breakouts, false alerts in chop). The merchants who revenue constantly with this indicator are those who view it as one piece of a bigger technique, not a standalone reply.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90