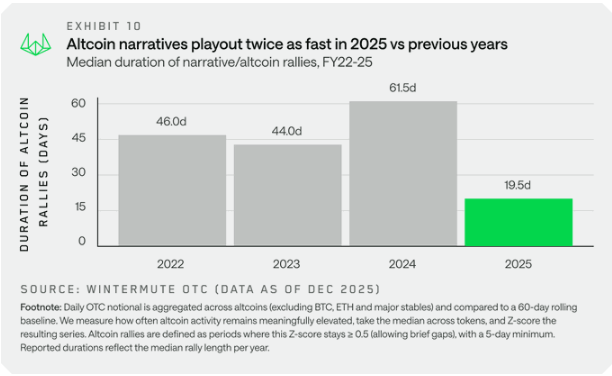

Based on Wintermute’s 2025 Digital Asset OTC Markets report, altcoin rallies final 12 months have been a lot shorter than merchants anticipated, averaging about 19–20 days. That could be a steep drop from the roughly 60-day runs seen in 2024.

Market flows tightened, and lots of smaller tokens noticed positive aspects vanish quicker than earlier than. The outcome: capital moved again into the massive names — Bitcoin and Ethereum — the place liquidity is deeper.

Associated Studying

Altcoin Open Curiosity Drops

Primarily based on reviews, one key set off was a pointy deleveraging on October 10, 2025, which pushed retail merchants to scale back danger and rotate out of smaller tokens.

Open curiosity in lots of altcoin futures contracts fell, with some protection noting a few 55% decline in altcoin futures open curiosity since October.

Buying and selling desks stated decrease liquidity made it more durable for rallies to maintain going past just a few weeks, turning what was multi-month strikes into quick bursts.

Main Cash Reclaimed Heart Stage

Institutional flows and product buildings performed a job. Stories have disclosed that ETFs and different institutional channels helped funnel funds towards Bitcoin and Ethereum. Consequently, the market’s consideration narrowed.

The place narratives as soon as pushed dozens of tokens into rallies, extra capital was now concentrated within the high tier. Merchants say they most popular property the place orders may very well be stuffed with out dramatically shifting the worth.

Brief, Intense Strikes Changed Lengthy Tendencies

Wintermute’s evaluation factors to a change in how momentum types. Rally drivers turned extra tactical and fewer about broad, lasting narratives. In follow, that meant memecoin pumps and exchange-themed rallies burned out rapidly.

Some merchants described these strikes as hair-trigger occasions: fast upswings adopted by equally fast retracements. Liquidity bands tightened and stops have been hit ahead of in previous cycles.

What Merchants And Companies Are Watching

Market members say the trail to a sustained altcoin season now requires just a few issues aligning. Stories point out renewed retail curiosity, clearer institutional assist for smaller tokens, and calmer macro markets may assist.

In any other case, rallies are more likely to stay quick. Execution desks reported that when large patrons reappeared for a token, it may run quick, however retaining that momentum proved troublesome with out deeper market participation.

Associated Studying

Outlook For 2026

Primarily based on the report and market commentary, a broader crypto rebound in 2026 is determined by a number of shifting components: curiosity from establishments, shifts in macro charges, and retail returning to risk-on methods.

If these components arrive, rallies would possibly last more than the 19–20 day common seen in 2025. If not, merchants say the sample of fast, sharp strikes into the majors will proceed.

Featured picture from Unsplash, chart from TradingView