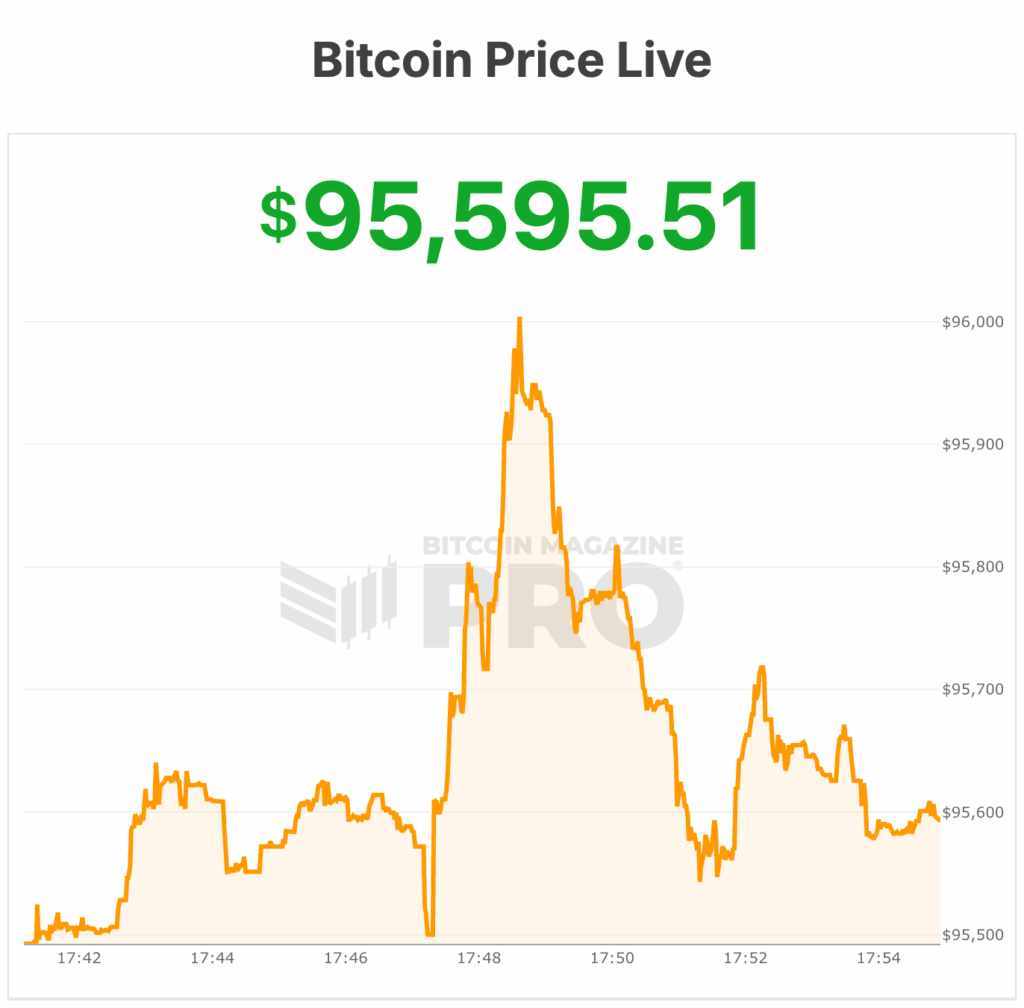

The Bitcoin worth surged by the $96,000 degree this afternoon, pushing decisively above a key resistance zone and signaling a renewed wave of bullish momentum after weeks of uneven, range-bound buying and selling.

On the time of writing, the bitcoin worth is buying and selling round $96,000 up roughly 4.4% over the previous 24 hours, in keeping with market knowledge.

The breakout marks a transparent transfer past the higher boundary of January’s consolidation vary. Bitcoin worth is now hovering close to its weekly highs, sitting roughly 5% above its seven-day low close to $91,700, as patrons regain management of short-term market construction.

All that is taking place because the US Senate Agriculture Committee has delayed its key markup of the Digital Asset Market Construction CLARITY Act till late January. The Senate’s Banking Committee markup is nonetheless scheduled for January 15.

Senate Agriculture Committee Chairman John Boozman introduced a timeline for advancing crypto market construction laws, with legislative textual content set for launch by the shut of enterprise on Wednesday, January 21, and a committee markup scheduled for Tuesday, January 27, at 3 p.m.

Boozman mentioned the schedule is designed to make sure transparency and thorough assessment whereas offering regulatory readability for crypto markets and supporting client safety and U.S. innovation.

The delay indicators that Senate leaders could lack the votes to advance the invoice amid disagreements over stablecoin rewards, DeFi oversight, and SEC–CFTC authority.

Though the Home handed its model in mid-2025, the invoice can’t transfer ahead until each Senate committees approve it.

Regardless of this, Bitcoin buying and selling exercise is rallying alongside the worth rally, with 24-hour quantity climbing to roughly $55 billion, reflecting renewed participation as worth accelerated greater.

Bitcoin’s complete market capitalization has risen to roughly $1.92 trillion, reinforcing its dominance throughout the digital asset market. Circulating provide at the moment stands at slightly below 19.98 million BTC, inching nearer to the protocol’s mounted 21 million coin cap.

Technique ($MSTR) inventory soars

Shares of Technique (MSTR) jumped sharply right now as properly, closing at $172.99 USD with a 6.63% acquire right now and lengthening energy in after-hours buying and selling as much as $177.00, up +2 after hours, as buyers proceed to cost within the firm’s high-risk, bitcoin-linked technique.

On January 12, Technique introduced they added 13,627 bitcoin for $1.25 billion, lifting its complete holdings to 687,410 BTC.

The purchases had been made between January 5 and January 11 and funded by the corporate’s at-the-market providing program, which included gross sales of Class A typical inventory (MSTR) and its 10.00% Collection A perpetual most well-liked inventory, Stretch (STRC).

Bitcoin worth outlook

Tuesday’s surge follows a number of failed breakout makes an attempt over the past couple of months, when bitcoin repeatedly examined resistance close to the mid-$94,000 vary earlier than pulling again.

For a lot of the previous month, worth motion remained compressed between roughly $85,000 and $94,000, prompting analysts to warn that bulls wanted a decisive transfer greater to reassert management. That transfer now seems to be underway.

If the bitcoin worth can maintain acceptance above $96,000, the following main resistance zones sit between $98,000 and $104,000, ranges that beforehand capped upside momentum. A failure to carry present ranges, nevertheless, might see worth retrace towards former resistance turned potential assist.

The breakout arrives as buyers proceed to weigh inflation tendencies, interest-rate expectations, and escalating political uncertainty tied to U.S. financial coverage.

On the political aspect, the Division of Justice has opened a legal investigation into Federal Reserve Chair Jerome Powell. The investigation is intensifying a months‑lengthy feud between the White Home and the U.S. central financial institution

In line with Powell, the DOJ served the Federal Reserve with grand jury subpoenas and threatened a legal indictment tied to his June 2025 testimony a few $2.5 billion plus renovation of Fed workplace buildings.

In latest months, the bitcoin worth has more and more traded in response to macro narratives, with many members viewing it as a hedge in opposition to coverage instability and long-term foreign money debasement.

On the time of publication, the bitcoin worth is close to $96,000.