Bitcoin’s long-term holder cohort seems to have stopped web promoting, in line with a number of on-chain commentators, in a shift that would take away a key supply of structural provide stress heading into 2026.

The change hinges on a supply-change learn of long-term holders (cash held longer than six months), which had been destructive for months however has now turned modestly constructive, mentioned on-chain analyst Darkfost.

Is This The Bitcoin Backside Sign?

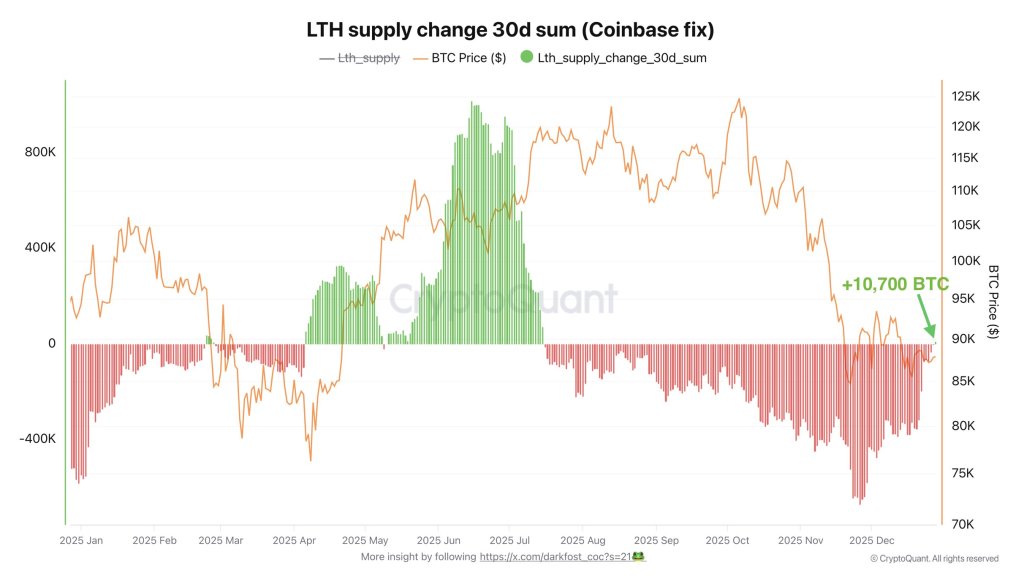

Darkfost argues that latest claims about long-term holders “promoting greater than ever” miss what the information is definitely exhibiting, particularly when giant, discrete exchange-related actions skew the image. “On this chart, which I adjusted to isolate the motion of almost 800,000 BTC from Coinbase that was distorting LTH information, we will observe a transparent shift in provide change,” Darkfost wrote. “Since July 16, the month-to-month LTH provide change (30 day sum) had been firmly anchored in a distribution section till just lately.”

Associated Studying

In plain phrases, that meant the share of provide held by long-term holders had been declining for a lot of the second half of 2025, a regime that tends to coincide with persistent promote stress as older cash rotate into the market. That section, Darkfost mentioned, has now ended, a minimum of for the second.

“We’ve now moved again into constructive territory, with round 10,700 BTC transitioning into long run held cash,” Darkfost wrote, calling it “a really modest change,” however “not insignificant.” The implication is that long-term holders have eased off distribution sufficient for his or her mixture holdings to begin rising once more, whilst short-term holders “proceed to carry their BTC,” in Darkfost’s framing.

CryptoQuant CEO Ki Younger Ju echoed the directional takeaway in a shorter submit, saying, “Bitcoin long-term holders stopped promoting.”

Associated Studying

VanEck’s head of digital analysis Matthew Sigel characterised the flip as a significant shift in positioning stress through X. “BTC: Lengthy-term holders flip web accumulators, easing a serious Bitcoin headwind and ending, for now, the largest promote stress occasion from this cohort since 2019,” Sigel wrote.

Famend professional James Van Straten added historic context to the size of the transfer, saying the magnitude of distribution “marked the 2019 backside as effectively,” suggesting the present inflection is notable even when it doesn’t, by itself, assure a repeat.

Darkfost additionally pointed to historic patterning round these flips. “Traditionally, such shifts have usually preceded the formation of consolidation phases and even bullish recoveries, relying on how the broader development evolves,” he wrote, emphasizing circumstances reasonably than certainty.

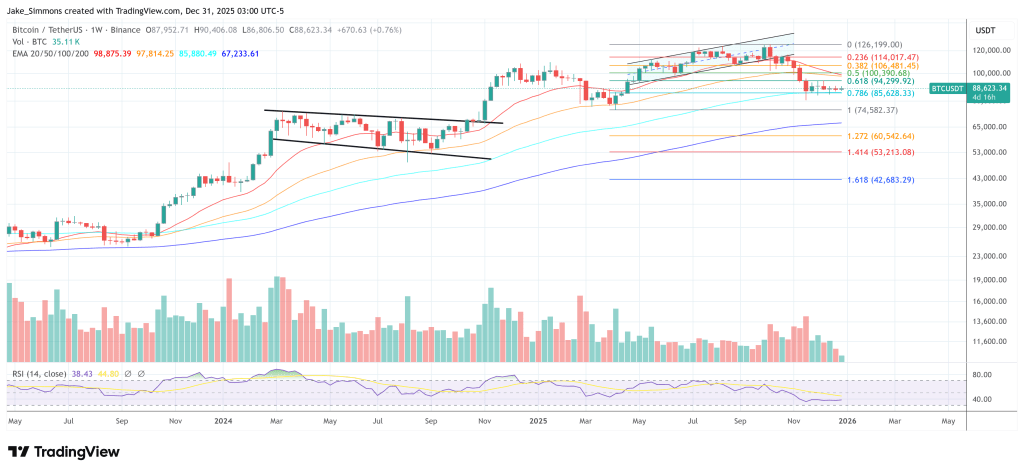

At press time, BTC traded at $88,623.

Featured picture created with DALL.E, chart from TradingView.com