It’s been a turbulent and unstable fourth quarter for Bitcoin in 2025. BTC has endured a turbulent December, with costs dropping practically 9% and volatility spiking to ranges not seen since April 2025.

In its newest mid-December “ChainCheck” report, VanEck’s digital asset analysts painted a nuanced image: whereas on-chain exercise stays weak, liquidity situations are bettering, and speculative leverage seems to be resetting, providing cautious optimism for long-term holders.

The agency highlighted the contrasting behaviors between totally different investor teams. Digital Asset Treasuries (DATs) have been actively shopping for the dip, accumulating 42,000 BTC — their largest addition since July — bringing mixture holdings above a million BTC.

This contrasts with Bitcoin exchange-traded product (ETP) buyers, who’ve decreased publicity, underscoring a shift towards company accumulation over retail-led hypothesis.

Analysts at VanEck famous that some DATs are exploring different financing strategies, together with issuing most popular shares relatively than widespread inventory, to fund purchases and operations, reflecting a extra strategic, long-term strategy.

Onchain information additionally revealed a divergence between medium- and long-term holders. Tokens held for one to 5 years have seen important motion, suggesting profit-taking or portfolio rotation, whereas cash held for greater than 5 years stay largely untouched.

VanEck interprets this as a sign that cyclical or shorter-term members are offloading belongings, whereas the oldest cohorts preserve conviction in Bitcoin’s future.

Bitcoin miners are dealing with a falling hashrate

Miners, in the meantime, have confronted a very difficult surroundings. Community hash charges fell 4% in December, says VanEck — the sharpest decline since April 2024 — as high-capacity operations in areas comparable to Xinjiang decreased output amid regulatory pressures. Breakeven electrical energy prices for main mining rigs have additionally dropped, reflecting tighter revenue margins.

Traditionally, nevertheless, VanEck notes that falling hash charges can function a bullish contrarian indicator: durations of declining community energy have typically preceded constructive 90- to 180-day ahead returns.

The VanEck group frames its evaluation throughout the GEO (World Liquidity, Ecosystem Leverage, Onchain Exercise) framework, designed to evaluate Bitcoin’s structural well being past day by day worth fluctuations.

Below this lens, bettering liquidity and the buildup by DATs present a counterweight to softer on-chain metrics, together with stagnating new addresses and declining transaction charges.

Broader macro developments add complexity to Bitcoin’s outlook. The U.S. greenback has weakened to close three-month lows, rallying treasured metals, however Bitcoin and different crypto belongings have remained beneath strain.

In parallel, the evolving monetary ecosystem might supply new help. Market observers level to the rise of “all the pieces exchanges,” platforms aiming to combine shares, crypto, and prediction markets, leveraging AI-driven buying and selling and settlement methods.

Simply final week, Coinbase made an ‘all the pieces trade’ like transfer and launched an growth of its platform, introducing inventory buying and selling, prediction markets, futures, and different options. Corporations coming into this house — starting from conventional brokerages to crypto-native corporations — are vying for market share, doubtlessly rising Bitcoin’s liquidity and utility over time, VanEck says.

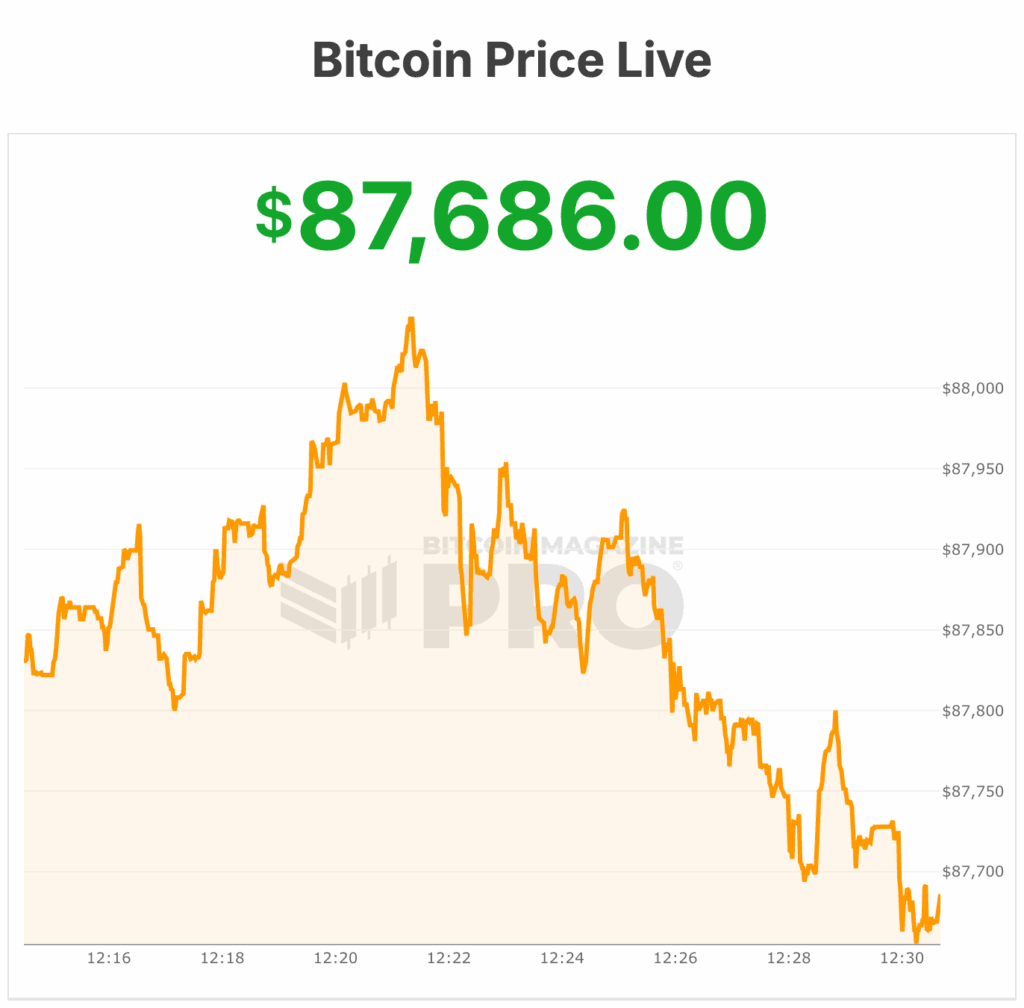

Bitcoin worth volatility

Regardless of this, volatility stays a defining characteristic. Whereas Bitcoin has doubled in worth over the previous two years and practically tripled over three, the absence of maximum blow-off tops or drawdowns has tempered expectations. Future bitcoin strikes could also be extra measured, with midterm buyers more likely to see smaller cyclical peaks and troughs relatively than the dramatic swings of prior cycles.

VanEck mentioned the broader market is in correction. Quick- to medium-term speculative exercise is retreating, long-term holders are holding regular, and institutional accumulation is rising. Coupled with indicators of miner capitulation, subdued volatility, and macroeconomic dynamics, the agency frames the present surroundings as certainly one of structural recalibration.

As 2025 attracts to a detailed, Bitcoin could also be in a interval of consolidation that displays broader market maturation, VanEck mentioned. This will lead to some sturdy constructive worth strikes within the first quarter of subsequent yr.