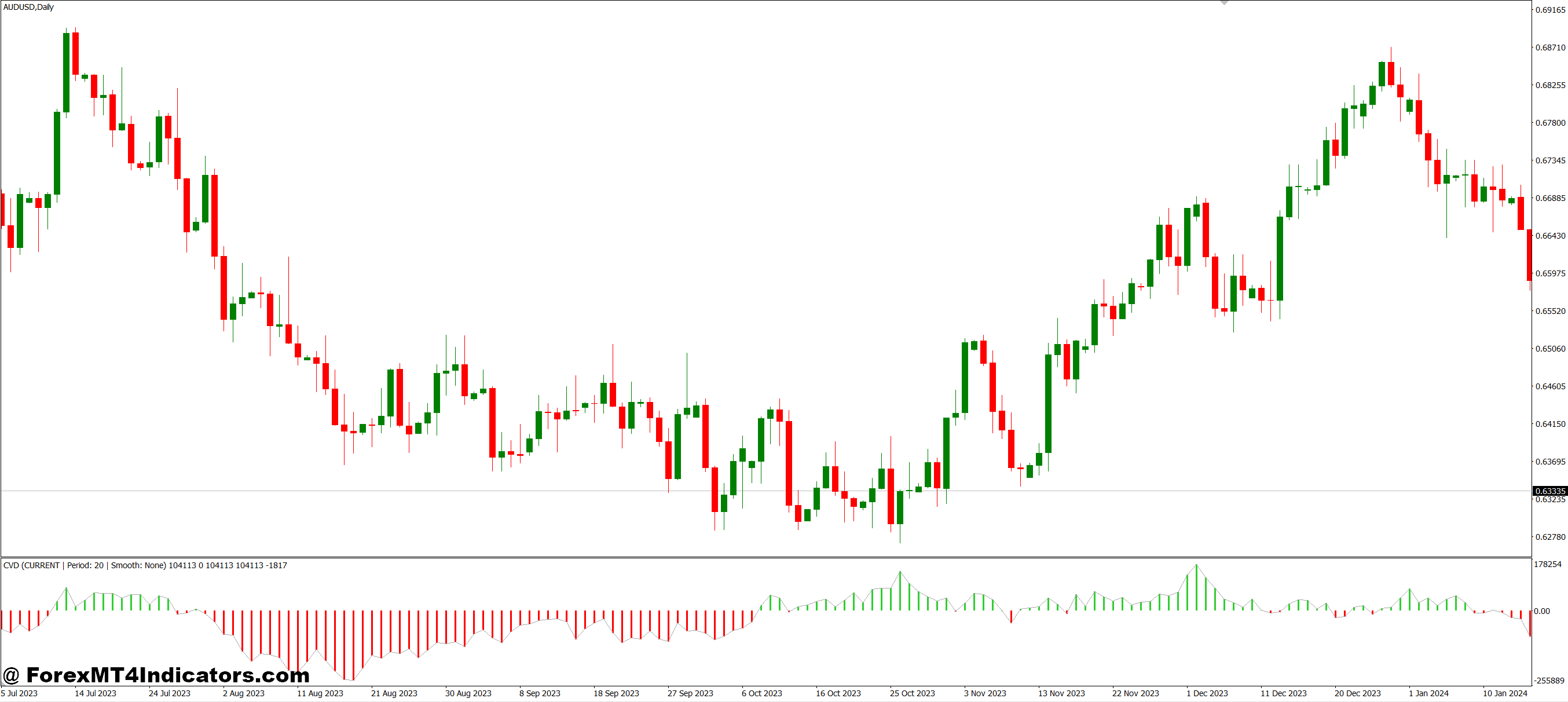

The CVD MT4 Indicator works by calculating the distinction between shopping for quantity and promoting quantity over time. Each time a commerce occurs on the ask value, it’s counted as shopping for quantity. When a commerce occurs on the bid value, it’s promoting quantity. The indicator provides up these variations constantly, making a working whole that exhibits whether or not consumers or sellers have been extra aggressive. When the CVD line goes up, consumers are in management. When it drops, sellers are taking up. This straightforward visible makes it manner simpler for merchants to know what’s actually taking place beneath the floor of value motion.

Recognizing Divergences for Higher Trades

What makes this indicator so worthwhile is the way it helps merchants spot divergences. Generally the worth retains climbing increased, however the CVD begins falling. That’s a pink flag. It means fewer consumers are supporting the transfer, and the rally could be working out of steam. The alternative works too—if the worth drops however CVD rises, it suggests sellers are shedding power and a reversal may very well be coming. These divergences give merchants an early warning system that value charts alone simply can’t present. It’s like having X-ray imaginative and prescient into market sentiment.

Simple Setup and Customization

Establishing the CVD indicator on MT4 is fairly easy. Merchants obtain the indicator file, drop it into their indicators folder, and restart their platform. As soon as it’s loaded on a chart, they’ll customise the settings to match their buying and selling model. Day merchants may use shorter timeframes to catch fast strikes, whereas swing merchants follow longer intervals for the larger image. The indicator works on any foreign money pair, inventory, or commodity that exhibits quantity information. Many merchants mix it with different instruments like help and resistance ranges or shifting averages to create an entire buying and selling system.

Combining CVD with Value Motion

The true energy comes from utilizing CVD alongside value motion. Let’s say a dealer sees the worth breaking above a key resistance degree. They test the CVD indicator and see it’s surging upward too. That confirms robust shopping for stress, making the breakout extra dependable. On the flip facet, if the worth breaks out however CVD stays flat or drops, that breakout might be weak and may fail rapidly. This affirmation course of helps merchants keep away from fake-outs and give attention to high-probability setups. It turns guesswork right into a extra calculated method the place the quantity information backs up what the worth is doing.

Tips on how to Commerce with CVD MT4 Indicator

Purchase Entry

- CVD line crosses above zero – When the indicator strikes from damaging to optimistic territory, it exhibits consumers are beginning to take management of the market

- Bullish divergence seems – Value makes a decrease low, however CVD makes a better low, signaling that promoting stress is weakening and a reversal upward could be coming.

- CVD confirms an uptrend – The CVD line retains making increased highs together with the worth, confirming robust shopping for momentum that merchants can experience.

- Sharp upward spike in CVD – A sudden soar within the CVD line signifies aggressive shopping for exercise, usually earlier than a major value transfer increased.

- CVD breaks above earlier resistance – When the indicator pushes previous its current excessive level, it exhibits renewed purchaser power price leaping on.

- Value pullback with rising CVD – When value dips barely however CVD retains climbing, it suggests consumers are accumulating, and the dip is a shopping for alternative.

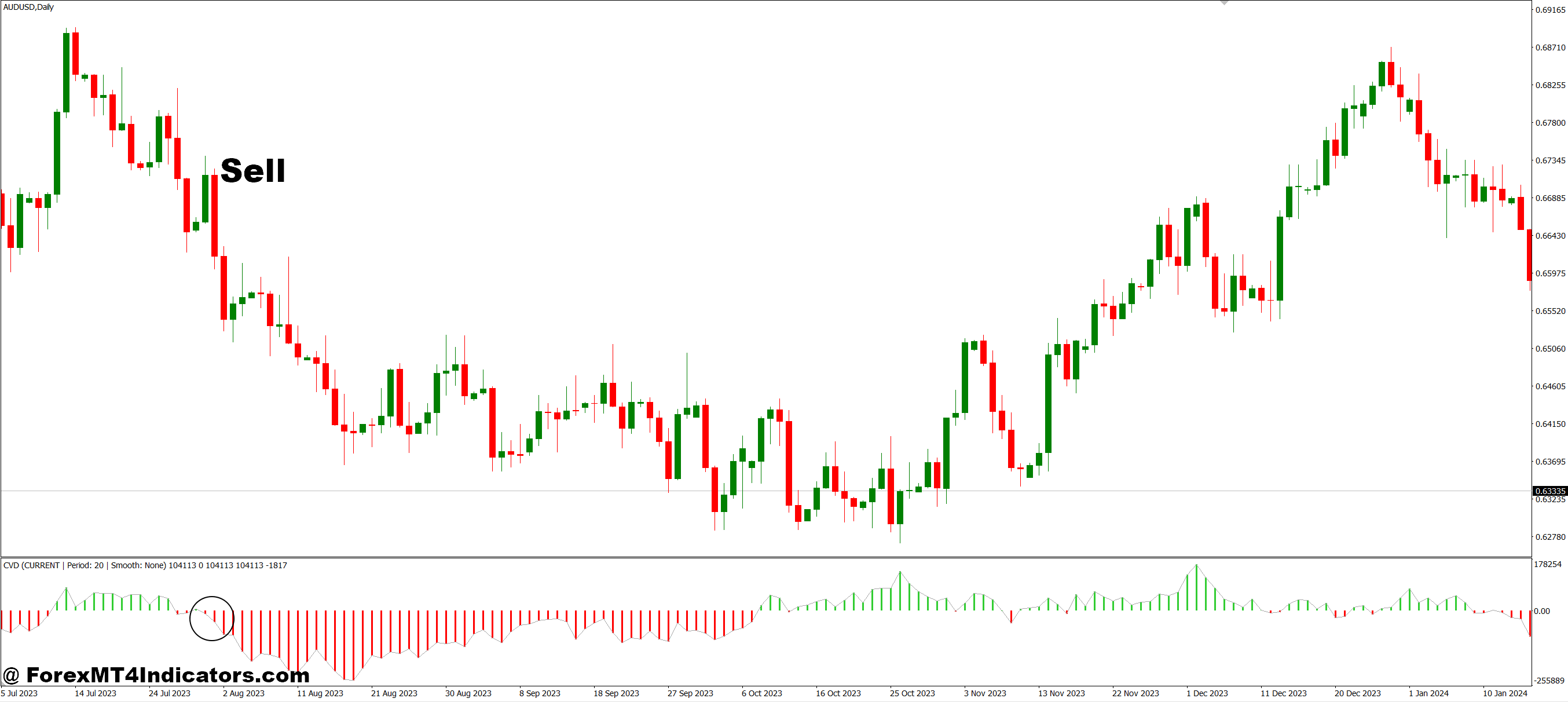

Promote Entry

- CVD line crosses under zero – When the indicator drops from optimistic to damaging, it means sellers are gaining management and pushing the market down.

- Bearish divergence exhibits up – Value makes a better excessive, however CVD makes a decrease excessive, warning that the uptrend is shedding steam and a reversal might occur quickly.

- CVD confirms a downtrend – The CVD line retains making decrease lows alongside falling costs, proving robust promoting stress is in cost.

- Sharp downward drop in CVD – A fast plunge within the CVD line reveals aggressive promoting exercise, often earlier than a serious value drop.

- CVD breaks under earlier help – When the indicator falls previous its current low, it alerts elevated vendor dominance and a great alternative to go quick.

- Value rally with falling CVD – When value strikes up barely however CVD retains dropping, it suggests sellers are distributing, and the rally is a promoting alternative.

Conclusion

The CVD MT4 Indicator offers merchants one thing they desperately want—readability. As an alternative of guessing whether or not consumers or sellers are profitable, they’ll see the proof proper on their charts. It helps them catch divergences earlier than reversals occur, affirm breakouts earlier than leaping in, and perceive the true power behind value actions. For anybody bored with getting caught on the mistaken facet of trades, this indicator gives a sensible technique to learn market stress and make extra knowledgeable selections. It’s not magic, however it’s positively a type of instruments that may degree up somebody’s buying and selling recreation.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90