One of many cleaner tells in crypto is when the outdated provide decides it’s time. Not “made a fast 20% and clipped it” time — years outdated.

That’s principally what Glassnode researcher CryptoVizArt flagged after an XRP pockets aged roughly 5–7 years (with a value foundation round $0.40) realized greater than $721.5 million in revenue on Dec. 11.

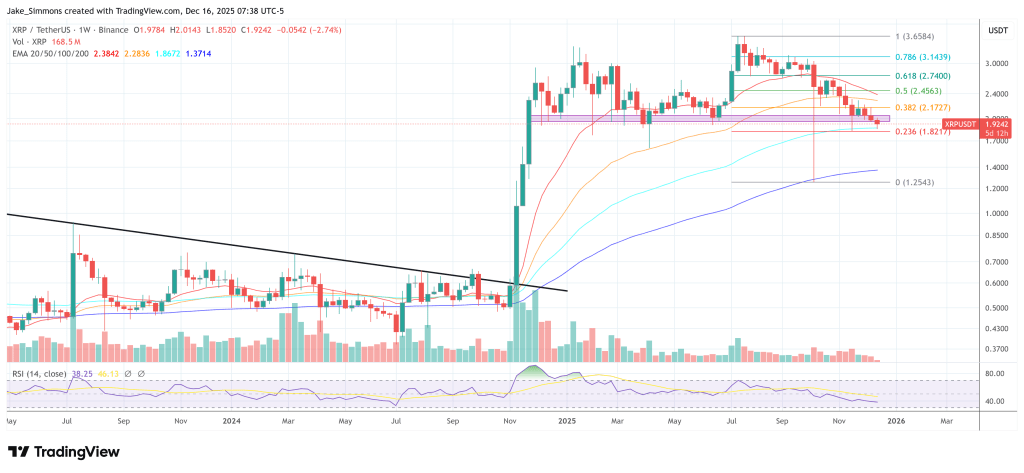

A single pockets doesn’t “break” a market by itself. However the timing is the purpose: this wasn’t profit-taking right into a rip. It landed whereas XRP was exhibiting weak spot proper on the $2.0 key stage.

Associated Studying

CryptoVizArt wrote through X: “On December eleventh, a 5-7 12 months outdated XRP pockets tackle (with a value foundation of $0.4) realized over $721.5M in revenue! A uncommon sizable profit-taking whereas the value exhibits weak spot proper on the $2.0 key stage.”

What This Means For XRP Value

That $2 deal with issues for the same old causes — spherical quantity, apparent chart magnet, psychological line within the sand — but in addition as a result of the market’s been treating it like a stay wire these days. Since early December final 12 months, the assist zone between $2 and $1.90 has been examined countless occasions. XRP bulls all the time managed to shut above the zone on the weekly timeframe.

So what does the $721M print imply? It’s a reminder that provide overhang isn’t theoretical. A 5–7 12 months pockets taking earnings will be learn as “de-risking,” certain. However in tape phrases, it’s additionally distribution that the market has to soak up whereas worth is already leaning. If bids are deep, it’s a shrug. If bids are skinny, it turns $2 right into a trapdoor.

And proper now, “skinny” is form of the vibe throughout crypto, not simply XRP.

Associated Studying

CryptoVizArt’s broader framing from Dec. 13 is that the $80K–$90K Bitcoin consolidation is producing stress “similar to late Jan 2022.” By way of X, he wrote: “The present $80K–$90K consolidation vary is producing a magnitude of stress similar to late January 2022, with Relative Unrealized Loss approaching ~10% of market cap. This locations the market in a regime the place liquidity is constrained, and sensitivity to macro shocks is elevated, but nonetheless beneath the degrees usually related to full bear-market capitulation.”

That backdrop issues as a result of alts don’t commerce in a vacuum. When the entire advanced is jumpy, massive promote occasions at key ranges have extra punch. Not as a result of each XRP holder instantly panics, however as a result of market-makers and discretionary merchants have a tendency to tug threat on the identical time. Spreads widen, depth thins, and “one-off” flows begin to transfer worth greater than they need to.

Nonetheless, it cuts each methods. A single, chunky realization will also be the market clearing an issue — outdated provide exiting, new demand stepping in, the form of switch that (finally) makes a base sturdier. The trick is whether or not $2 holds whereas that handoff occurs.

At press time, XRP was buying and selling at $1.89, which may make Sunday’s weekly shut one other extraordinarily necessary occasion.

Featured picture created with DALL.E, chart from TradingView.com