It is a weekly evaluate of my very own GOLD EA “Break Hunter KINAKO”, measured and tracked on Myfxbook.

Initially I constructed this EA for my private analysis, however after working a ahead take a look at for one week the outcomes had been extra steady than I anticipated, so I made a decision to maintain a public log right here.

1. Ahead-test surroundings

-

Account sort: Demo, HFM cent account

-

Preliminary stability: JPY 50,000

-

Preliminary lot: 0.10

-

Mode: 24h full auto

Myfxbook ahead take a look at:

BreakHunter KINAKO – Foreign exchange Buying and selling System by takoyakiEA

(Efficiency and detailed stats)

The EA has each “aggressive” and “defensive” parameter profiles, however on this demo it trades about 20 instances per day on common.

There may be some averaging / martingale logic inside, however it’s very restricted – a lot of the revenue really comes from the first breakout entry.

I can’t disclose each element of the logic, however in brief it’s:

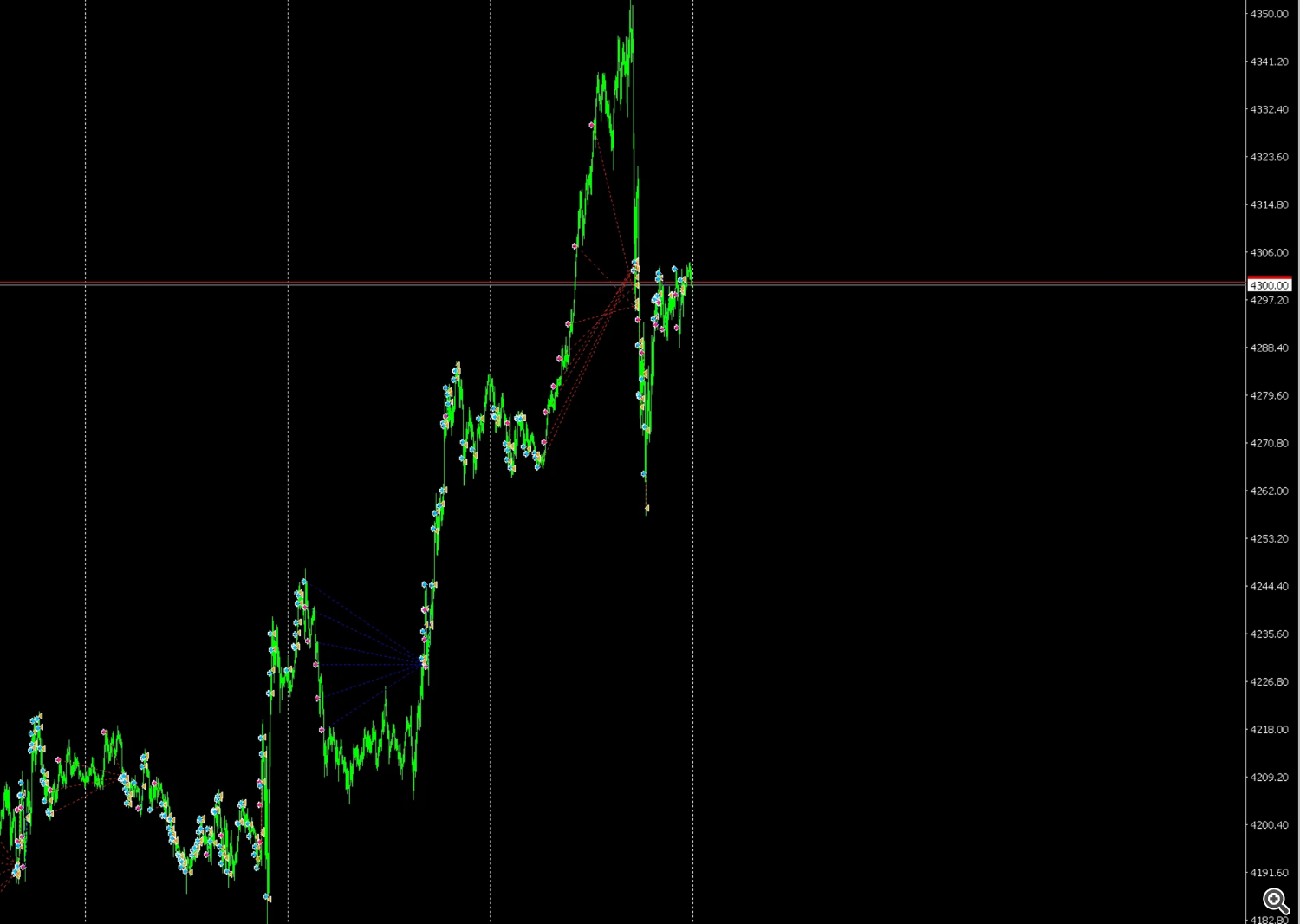

A breakout-following EA that rides the preliminary momentum,

whereas being tuned so it could tolerate a specific amount of pullback.

After making an attempt many concepts, I customised the components the place I felt

“if I modify this, the behaviour ought to turn out to be extra steady.”

That customised model is what I’m testing now.

In case you are focused on GOLD breakout methods, I hope this ahead log is helpful as a reference.

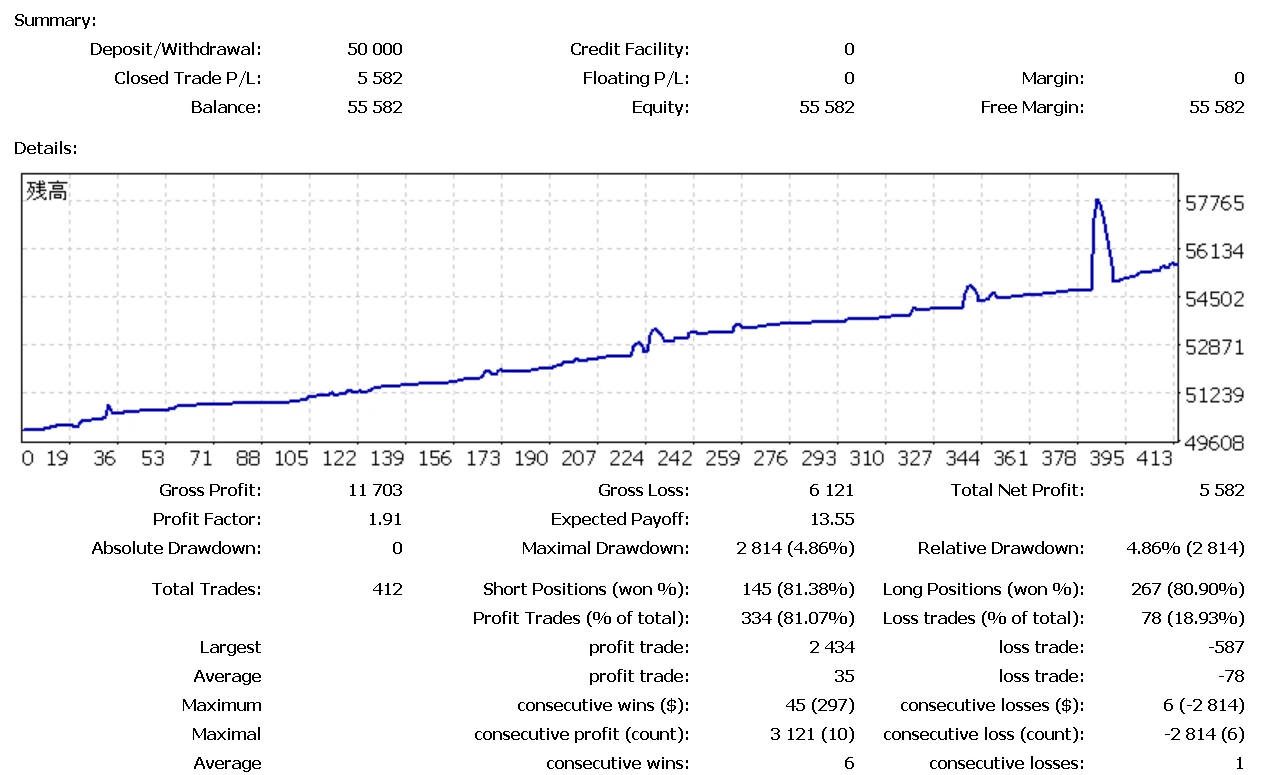

2. Two-week abstract (28 Nov – 12 Dec)

Throughout a lot of the interval the EA ran with lower than 10% drawdown.

Nevertheless, after the FOMC we noticed a powerful spike in GOLD and the most DD reached about 25%

(on a 50,000 JPY stability, the worst floating loss was round –15,000 JPY).

12 Dec – the powerful FOMC day

Volatility from the FOMC was nonetheless alive out there,

so worth was shaking up and down in a means that may be very demanding for a grid / averaging system.

-

Martingale depth briefly reached 8 steps

-

Floating loss expanded accordingly

-

Underneath regular circumstances, depth is often as much as 4 steps and DD stays under 10%

Even underneath these circumstances, the system did not collapse.

3. Why it survived the spike

The primary cause is that the EA doesn’t add reckless additional entries.

It retains the route of the first breakout order as its “anchor” and:

-

Picks up pullbacks within the route of that preliminary transfer

-

Avoids over-trading in the other way

-

Lets the common worth enhance as an alternative of speeding for tiny take-profits

Just a few behaviours that stood out:

-

The primary breakout entry usually “carries” the entire basket

-

Even when worth retraces, the EA retains holding so long as the unique momentum shouldn’t be utterly denied

-

It does not chase ultra-short TP; because of this, the common worth of the basket is well-balanced

That is very near what I imagined:

Conservative averaging × breakout follow-through

4. Numbers & danger impression

-

Non permanent DD does happen (outdoors the FOMC day it stayed principally inside 10%)

-

Martingale depth will be deeper than in my earlier variations

-

However there was no catastrophic collapse thus far

The previous two weeks had been undoubtedly not “straightforward mode” for GOLD,

however as a sturdiness stress take a look at the information seems to be encouraging.

5. Sincere emotions

To be sincere, throughout some trades I felt:

“That is now not simply day-scalping –

it’s extra like a day-swing endurance battle.”

Positions typically keep open longer than a typical scalper,

however in return the EA avoids loopy, unsustainable wins and as an alternative goals for a mode that can be utilized for a very long time.

Even with this conservative behaviour, the month-to-month achieve has already exceeded 10% on this demo.

I’ll preserve working the ahead take a look at and plan to put up weekly updates right here.

Should you’re focused on GOLD breakout methods that attempt to stability aggression and security,

please be at liberty to observe this ahead log and examine the Myfxbook stats.

Break Hunter KINAKO remains to be within the forward-testing stage, and I’m contemplating a public launch

on MQL5 sooner or later if the behaviour stays steady sufficient.

For now, my first revealed product on the MQL5 Market is

“GOLD ONLY WIN! – World Version”…