Technical evaluation is the research of the worth motion or value motion of a market over time. Merchants make use of value charts and numerous technical indicators that include these charts to carry out their technical evaluation.

Technical evaluation is the research of the worth motion or value motion of a market over time. Merchants make use of value charts and numerous technical indicators that include these charts to carry out their technical evaluation.

Nonetheless, it’s my robust perception that merchants want solely analyze a market’s value motion for his or her technical evaluation. Not solely is the worth motion on a chart the purest and cleanest view of that market, however all indicators and different technical evaluation research are primarily based on value motion in any case. So, it ought to go with out saying that after we analyze a chart’s value motion with out added indicators, we’re analyzing probably the most pertinent and clearest view of that market. The rest is solely a by-product of value motion and solely works so as to add pointless variables {that a} dealer should make sense out of.

Technical evaluation is maybe the best and ‘best’ side of buying and selling, and certain because of that, it’s quite common for merchants to over-complicate it by masking their charts in pointless indicators. Primarily, all you’re doing if you add indicators on high of value motion is hiding the principle factor try to be analyzing; the worth knowledge.

Technical evaluation and value motion go hand-in-hand

{Many professional} merchants deal with value motion as their main type of technical evaluation. They do that as a result of they know that value is the final word main indicator of what value may do subsequent.

What number of occasions have you ever seen a market transfer the other way that you simply anticipated after a sure financial information launch got here out? They’re very probably have been robust value motion clues main as much as that information launch of what value was almost certainly to do. Worth usually leads the information and foreshadows fundamentals and any information outcomes and fundamentals are mirrored within the value motion. This is the reason many merchants solely use technical evaluation and lots of, together with myself, are ‘pure’ technical merchants, that means we primarily use solely value motion to make our buying and selling choices.

There are various explanation why value motion tends to steer the information and different market fundamentals; massive market gamers like banks and hedge funds who actually can transfer the market have entry to info and instruments that retail merchants such as you and I don’t. We are able to learn what they’re doing available in the market by studying to commerce primarily based on the worth motion imprint they depart behind on the charts. We don’t really want to know all of the ‘whys’ or ‘how’s’; all we have to know is WHAT they’re doing, and we will see that by analyzing the worth motion.

Worth motion permits us to seek out repeatable patterns, place trades, handle threat and revenue targets in a really straight-forward and logical method. By merely making use of assist and resistance ranges and the pure value knowledge on a chart, we will analyze and commerce a market efficiently if we all know what we’re doing.

Listed below are some well-known quotes from legendary merchants on technical evaluation vs. basic evaluation:

As Ed Seykota famously mentioned in Jack Schwager’s Market Wizards e-book:

Fundamentals that you simply examine are usually ineffective because the market has already discounted the worth, and I name them “funny-mentals.

I’m primarily a pattern dealer with touches of hunches primarily based on about twenty years of expertise. So as of significance to me are: (1) the long-term pattern, (2) the present chart sample, and (3) selecting a great spot to purchase or promote. These are the three main part of my buying and selling. Approach down in a really distant fourth place are my basic concepts and, fairly probably, on steadiness, they’ve value me cash.

One other Market Wizard, Marty Schwartz, mentioned:

I all the time snicker at individuals who say, “I’ve by no means met a wealthy technician.” I like that! It’s such an boastful, nonsensical response. I used fundamentals for 9 years and bought wealthy as a technician. – Marty Schwartz

The best way to use value motion on your technical evaluation…

Worth motion evaluation teaches a dealer the way to analyze the market construction; discover traits, assist and resistance ranges and customarily be taught to ‘learn’ the ebbs and flows of a market. There may be clearly discretion concerned right here and I would be the first individual to inform you that technical evaluation is extra of an artwork than a science. Nonetheless, it’s one thing you’re going to get extra comfy with and enhance at given schooling, time and follow.

Let’s check out some examples of basic technical evaluation value motion patterns…

Within the chart instance beneath, you’ll discover how nicely value is respecting the horizontal assist and resistance ranges. Studying to attract and commerce the important thing chart ranges is an important talent that any technical analyst must be taught early-on of their buying and selling profession. That is additionally a core side of value motion buying and selling as value motion is what ‘carves out’ the degrees available in the market…

Right here we will see the massive strikes that usually originate from main market tops and bottoms. The chart beneath is displaying a “double backside”, which is only a normal title for value testing a stage two occasions after which bouncing from it. You’ll then see a “triple high”, a normal title for a market that exams a resistance stage 3 times earlier than selling-off. Typically, these patterns are robust indicators of a pattern change…

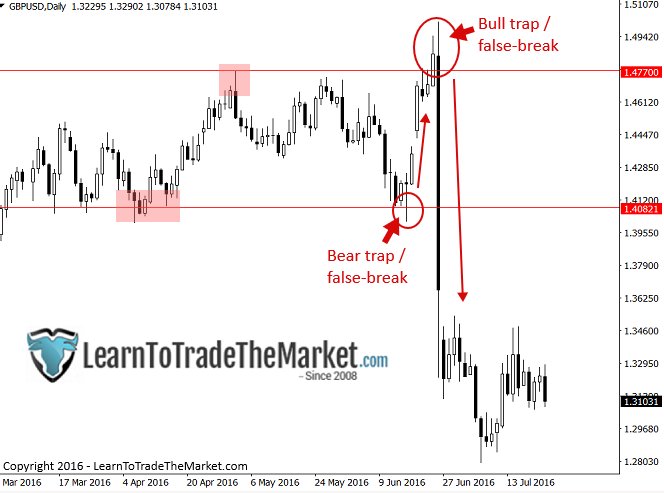

Within the chart picture beneath, we will see a few false breakout patterns that occurred within the GBPUSD lately. Once we get a false-break to the draw back that sucks all of the bears in earlier than capturing increased, it’s referred to as a ‘bear entice’. Once we get a false-break to the upside that sucks all of the bulls in earlier than reversing decrease, it’s referred to as a ‘bull entice’. Search for these particularly in range-bound markets the place value is oscillating between key assist and resistance ranges, as we see beneath:

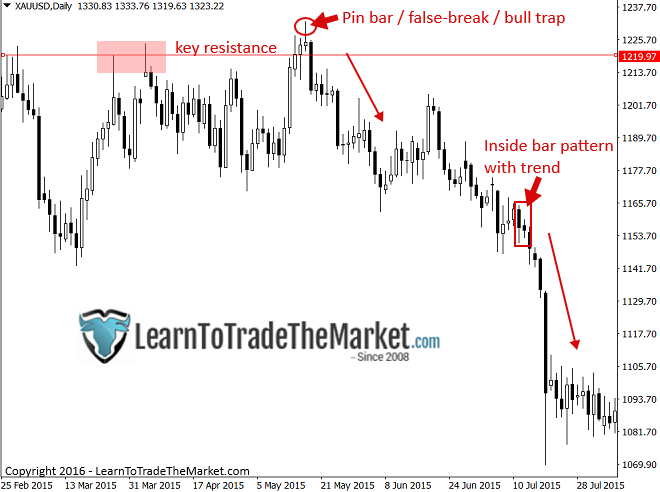

Once we mix value motion alerts at key chart ranges, as with the pin bar false-break at resistance we see beneath, or with a robust pattern, as with the inside bar sample we see beneath, we’ve a quite simple but high-probability commerce methodology at our disposal:

As we will see by the chart examples above, value motion is a quite simple but extremely efficient type of technical evaluation. As I like to inform my college students, the ability lies IN the simplicity. Buying and selling is tough sufficient as it’s, so there isn’t any must unnecessarily make it much more troublesome by plastering tons of complicated indicators throughout your charts. We have now all the pieces we want within the uncooked value knowledge of the charts.

Worth motion evaluation permits us to identify excessive chance buying and selling alternatives, simply outline our threat reward and carry out our evaluation end-of-day. This type of technical evaluation frees the thoughts of muddle and permits us to deal with studying the charts and value motion just by listening to the ‘language’ of the market. Worth motion is first-hand market knowledge, not wanting within the ‘assessment mirror’ as with most different strategies of technical evaluation.

Study To Commerce The Market programs are centered across the core philosophies mentioned in at this time’s lesson and deal with the ability of technical value motion buying and selling. Any severe dealer would profit from enterprise research of those teachings that are the surrounding beliefs of my 16 + years available in the market. To be taught extra, click on right here.