In line with studies, a widely known crypto commentator/investor who goes by the deal with Crypto X AiMan has bought all his Bitcoin and moved the proceeds into XRP. He says 4 causes drove his resolution, and the transfer has stirred debate throughout buying and selling circles.

Associated Studying

Investor Dumps Bitcoin For XRP

AiMan, who says he first purchased Bitcoin when it traded at $3,000, instructed followers that authorized readability is the principle motive for his shift. He pointed to a July 2023 courtroom ruling by Choose Torres that discovered sure programmatic XRP gross sales weren’t securities.

In line with him, that courtroom resolution provides XRP a unique standing from many different tokens. He additionally famous that US regulators usually deal with Bitcoin as a commodity, a stance reiterated by former SEC Chair Gary Gensler. AiMan framed the courtroom consequence as a uncommon, express authorized check that favored XRP.

He highlighted one other issue: Ripple’s giant holdings. Based mostly on firm disclosures, Ripple holds near 40 billion XRP, practically 40% of the overall provide. AiMan argued these reserves might assist future use circumstances if Ripple or its companions selected to deploy the tokens for funds.

I simply bought ALL my Bitcoin.

Sure, you learn that proper.

I went 100% all-in on XRP.

Right here’s why:

XRP is the one crypto with authorized readability in the US (received the SEC case, not a safety).

Ripple owns ~40B XRP and is partnered with 300+ banks, central banks, and fee… pic.twitter.com/tRzpiKPas5

— Crypto X AiMan (@CryptoXAiMan) December 5, 2025

He referred to as XRP sooner and cheaper to maneuver than Bitcoin, saying it’s constructed for cross-border transfers — a degree he used to distinction XRP’s utility with Bitcoin’s position as a retailer of worth. He additionally ran by means of a market-size situation.

Market analysts have projected the cross-border funds market at $250 trillion by 2027, and AiMan advised that even a 1% share of that quantity might imply large good points for XRP.

He admitted the commerce is excessive: “If I’m flawed? XRP in all probability goes to zero, and I lose all the pieces,” he stated. He added that if he’s proper, the payoff could be large.

XRP’s Authorized Benefit

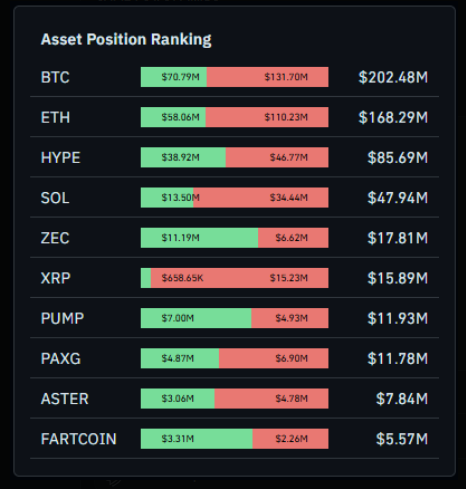

Market response has been combined. Based mostly on studies from knowledge suppliers, merchants are taking giant quick positions towards XRP. Coinglass figures present XRP with $15 million in shorts versus $0.6 million in longs — a roughly 96% quick allocation and a shorts-to-longs ratio close to 25 to 1.

For comparability, Bitcoin had $131 million in shorts and $70 million in longs; Ethereum confirmed $110 million shorts and $58 million longs. Regardless of heavy shorting, XRP has posted day by day good points at occasions, in line with current worth actions.

Aggressive Shorts Dominate Positioning

Analysts say heavy quick positions can point out weak near-term sentiment. Additionally they create technical dangers, as a result of a squeeze might push costs increased shortly if shorts are compelled to cowl.

Associated Studying

That doesn’t take away the core dangers AiMan flagged and others raised: a giant token allocation held by one firm raises centralization considerations, and banks haven’t broadly shifted settlement rails to public tokens.

Bitcoin nonetheless has a market cap close to $1.8 trillion and deeper liquidity, which many traders view as stability in a risky market.

Featured picture from Pexels, chart from TradingView