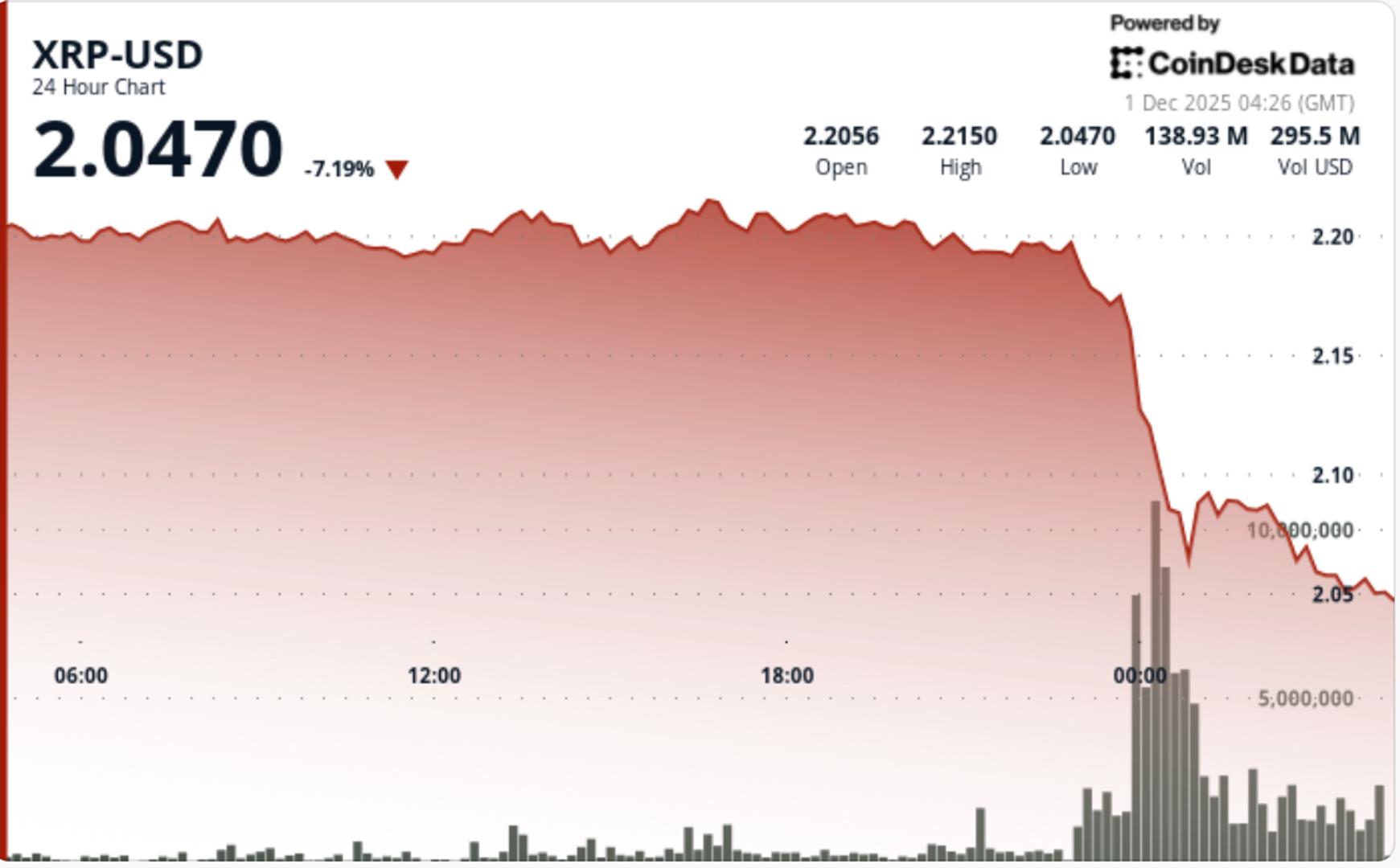

XRP plunged 7% to $2.05 as a violent wave of institutional promoting broke by means of essential help ranges, overpowering sturdy ETF inflows and forcing the token again into its November correction vary.

• XRP spot ETF inflows reached $666.6M this month, led by 21Shares’ new TOXR itemizing

• Alternate provide dropped 45% over 60 days, exhibiting large-scale accumulation

• Whale wallets added 150M XRP since Nov 25 regardless of the newest breakdown

• Promoting strain intensified Tuesday as threat property weakened broadly

Regardless of increasing institutional infrastructure round XRP, short-term flows turned sharply bearish. ETF demand appeared unable to counter heavy derivatives unwind and large-lot promoting by means of the afternoon session. Market liquidity thinned as broader crypto benchmarks softened, accelerating the draw back.

The breakdown beneath $2.16 marked a decisive failure of XRP’s latest consolidation construction. That stage served as a pivot over the past three weeks, making its loss a key sign that sellers regained momentum.

The transfer pushed XRP again right into a descending channel outlined by consecutive decrease highs from $2.38, $2.30, and $2.22. The construction displays growing management by bears, with every bounce producing diminishing follow-through.

Quantity confirmed the legitimacy of the breakdown—spiking to 309.2M, greater than 4.6× the rolling common. This stage of exercise usually alerts institutional exit flows quite than noise. A number of intraday retests of $2.05—every accompanied by 3M+ spikes—confirmed patrons defending the psychological flooring, however with no confirmed reversal.

Momentum indicators replicate deep short-term oversold circumstances, but not sufficient divergence to point a accomplished corrective wave. The $2.05–$2.00 zone stays pivotal; dropping it exposes the bigger November demand band between $1.80 and $1.87.

XRP fell from $2.21 to $2.05 throughout a steep 7.2% decline. Essentially the most aggressive promoting occurred after $2.16 gave means, triggering cascading liquidations into the shut. Quantity surged to 309.2M—up 464% from the every day common—confirming intense distribution.

Hourly candles shaped a descending channel with decrease highs and tightening vary conduct. A number of failed recoveries close to $2.12 indicated persistent promote strain. Consumers repeatedly absorbed dips at $2.05 however with out momentum sturdy sufficient to reclaim damaged help.

• Holding $2.05 is essential; a breakdown exposes $1.87–$1.80 subsequent

• Reclaiming $2.16 is required to invalidate the bearish construction

• ETF inflows help long-term outlook, however short-term tape stays heavy

• Look ahead to bullish divergence on hourly RSI and MACD as early reversal alerts

• A high-volume reclaim of $2.12–$2.16 would sign accumulation is resuming