Bitcoin is struggling to reclaim the $90,000 degree as promoting stress continues to dominate throughout the crypto market. The sharp decline from the all-time excessive has fueled rising hypothesis that the present cycle could have already peaked, with many analysts now calling for the start of a bear market. Sentiment has shifted quickly, and worry is spreading as merchants query whether or not the bullish construction has been completely damaged.

Associated Studying

Nonetheless, not everybody agrees with the bearish outlook. A phase of market contributors nonetheless expects a rebound, arguing that the correction is a part of a broader continuation sample reasonably than the top of the cycle. These optimistic observers imagine that increased costs may nonetheless unfold as soon as promoting exhaustion units in.

In keeping with prime analyst Darkfost, the latest worth motion displays a notable behavioral shift in merchants. He explains that buyers who tried to lengthy the market all through the correction have lastly been squeezed out.

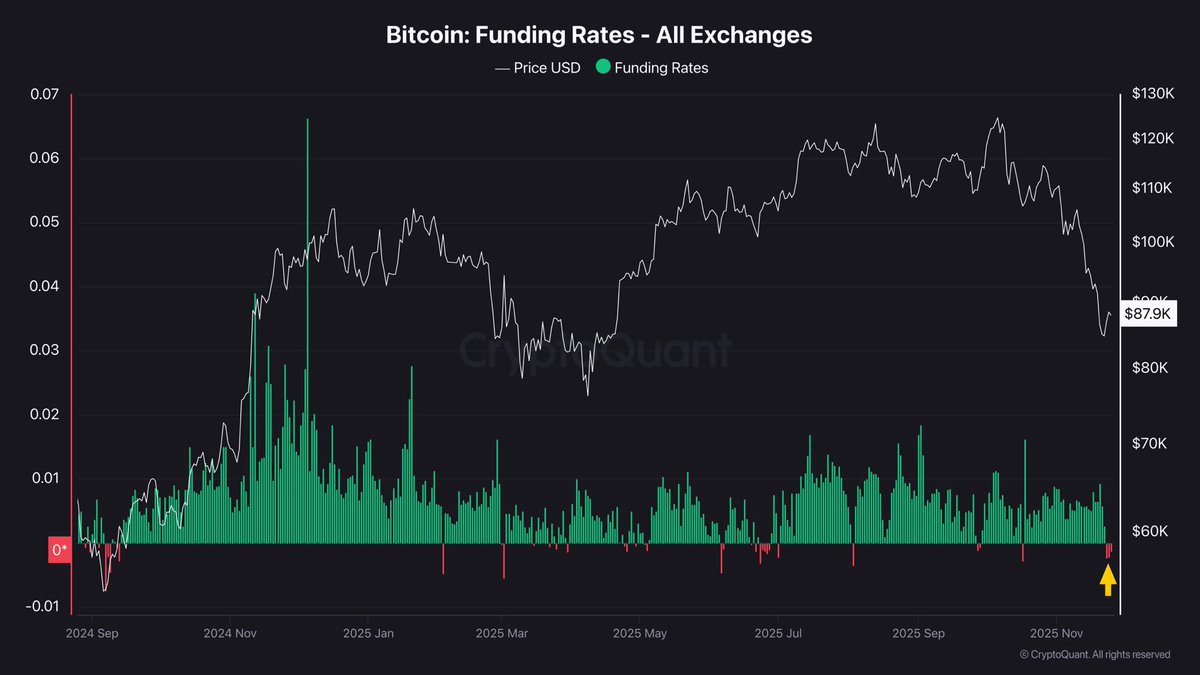

Funding charges, which had remained elevated in the course of the decline, have now cooled and even turned destructive — a powerful sign that sentiment has flipped. Darkfost notes that merchants waited for Bitcoin to appropriate greater than 30% earlier than shifting aggressively into quick positions, highlighting a delayed response that usually seems close to market inflection factors.

Funding Charges Flip Destructive as Brief Dominance Takes Over

Darkfost explains that the most recent shift in funding charges is extra significant than it seems on the floor. He notes that merchants typically assume the impartial funding degree is 0%, however that isn’t the case. Most exchanges — together with Binance — embed an curiosity element of roughly 0.01% into the funding calculation.

Which means when funding drops beneath 0.01%, it already displays short-side dominance. Subsequently, when funding turns destructive, it indicators a fair stronger tilt towards aggressive quick positioning. In keeping with Darkfost, this marks a transparent behavioral change amongst derivatives merchants, suggesting that the market has transitioned from compelled lengthy unwinds to conviction-based quick publicity.

Traditionally, these shifts are inclined to happen solely as soon as a correction is already deep into its development. Darkfost highlights that such funding transitions typically mirror dealer capitulation — the place contributors who fought the downtrend lastly flip and try to observe momentum, however solely after many of the transfer has already unfolded.

This phenomenon has appeared in earlier cycle retracements and has regularly coincided with late-stage bottoms. He provides that Bitcoin could now be getting into a disbelief section, the place worth begins climbing whereas shorts proceed to pile in. If this dynamic persists, it may act as gasoline for an upside reversal, particularly if spot demand wakes up and liquidations stress the quick aspect as an alternative.

Associated Studying

BTC Worth Testing Brief-Time period Provide

Bitcoin is trying to stabilize after a pointy decline, with the chart exhibiting worth at present buying and selling round $87,000 following a rebound from the latest plunge close to $80,000. The downtrend stays clearly outlined, as BTC continues to commerce beneath the 50-day, 100-day, and 200-day transferring averages, signaling persistent bearish momentum.

The slope of those transferring averages has turned downward, reinforcing the shift in pattern construction. Regardless of the bounce, the restoration lacks sturdy quantity assist, which means that patrons haven’t but returned with conviction.

Associated Studying

The chart reveals that earlier assist ranges round $95,000 and $100,000 have now grow to be resistance areas, making them key ranges to look at for any tried restoration. A failure to reclaim these zones may set off renewed promoting stress and a retest of the latest lows. Nonetheless, the wick beneath $80,000 signifies aggressive shopping for on the lows, which may sign {that a} short-term backside is forming if patrons proceed to defend increased lows within the coming days.

Market sentiment stays fragile, but the stabilization above $85,000 hints at a possible consolidation section reasonably than speedy continuation of the decline. A sustained transfer above the 100-day transferring common could be the primary significant sign of regained bullish momentum.

Featured picture from ChatGPT, chart from TradingView.com