In buying and selling, you’re typically instructed to “purchase low, promote excessive.”

However what if I instructed you a number of the most worthwhile merchants do precisely the alternative?

Welcome to the world of momentum buying and selling, the place you purchase shares which can be hovering, betting they’ll climb even greater. It sounds counterintuitive (and even reckless), however the information tells a unique story.

Over the previous 25 years, a easy momentum buying and selling system has returned a staggering 6837%—turning a $10,000 funding into practically $700,000. Wish to study extra?

That’s what at this time’s publish is all about.

You’ll uncover…

- What momentum buying and selling is about (how and why it really works)

- The ideas behind momentum buying and selling success

- A momentum buying and selling system that has generated 6837% over the past 25 years

- Information and backtest outcomes

- Execs and cons of momentum buying and selling (sure, there are cons—nothing’s excellent, identical to my hairline)

Sounds good?

Then let’s dive quicker than I dive right into a buffet line…

Momentum buying and selling defined

The thought behind momentum buying and selling is straightforward: an asset value that has momentum tends to proceed transferring in that path. Thus, a momentum buying and selling technique seems to purchase when the value is excessive, with the hopes of promoting it at a good greater value (purchase excessive and promote greater).

It’s the identical purpose why I can’t cease after consuming one potato chip.

So, why does momentum buying and selling work?

There are three predominant causes for it…

Submit-earning drift

When an organization posts nice earnings, the inventory may soar 10% in a day. Over the following few days, analysts improve the inventory to a “Robust Purchase” (which is analyst converse for “We completely missed this however will fake we knew all alongside”). This brings in additional capital from establishments and retail gamers and thus pushes the value even greater.

Concern of lacking out (FOMO)

When the inventory value strikes greater and will get talked about typically, extra individuals be a part of the bandwagon due to the worry of lacking out (FOMO). This provides extra shopping for stress and fuels the transfer additional.

Institutional flows

Huge institutional funds usually are not in a position to enter a place suddenly, or else they find yourself transferring the market. So, they scale their positions regularly over weeks (and generally even months). This creates persistent shopping for stress, like me persistently consuming chips—one after one other after one other…

Now, earlier than I provide the guidelines of the momentum buying and selling system, you first want to know the ideas behind it so you understand how it really works.

5 ideas of momentum buying and selling

1. The general market is bullish

Earlier than you establish the shares with momentum, be certain that the general market is bullish. That’s as a result of a rising tide lifts all boats. This implies in a bear market, even a robust momentum inventory is more likely to falter.

2. Establish shares with the strongest momentum

You is perhaps questioning: “How do I measure momentum?”

There are a number of methods to do it. The best is to calculate how a lot % the inventory value has elevated over a hard and fast interval. E.g. the inventory value elevated 20% over the past 20 days.

Primarily based on educational research (Jegadeesh & Titman, 1993), shares that exhibit the strongest momentum over the past 6 to 12 months are inclined to proceed transferring greater.

3. Exit when momentum will get weaker

Momentum doesn’t final without end (identical to my New 12 months’s decision).

Finally, the inventory “runs out of gasoline”, and that’s when the value stalls (or generally even reverses utterly). That is the place you exit the commerce.

Consider momentum buying and selling like onboarding a rocket ship. You stick with it when the momentum is robust. However when momentum stalls, it’s an indication the rocket ship has run out of gasoline. That’s while you hop off the rocket ship and discover the following finest one.

4. Change with sturdy momentum shares

After you exit the commerce, what’s subsequent? Properly, you establish new momentum shares and get on board the following rocket ship! It’s like relationship in my youthful days—at all times on the lookout for the following neatest thing.

Don’t inform my spouse I stated that.

Consider your portfolio like a sports activities staff: you at all times need your high gamers on the sphere, and also you sub out the weak ones. No one desires to maintain a goalkeeper who makes use of his face as a substitute of his arms to cease the ball.

This course of will repeat itself except it’s a bear market. When that occurs, you’ll keep in money so you may keep away from the nasty drawdowns. This implies you may sleep peacefully at evening whereas the remainder of the world is panicking with worry.

5. Commerce a number of shares

Something can occur to a inventory value. For all you recognize, the corporate is fraudulent, and the inventory value goes to zero. That’s why, as a dealer, you shouldn’t allocate all of your capital to a single inventory as a result of something may occur.

As an alternative, unfold your bets throughout a number of shares so that you cut back your threat and have a better likelihood of creating a revenue. It’s like having a number of youngsters—if one disappoints you, you’ve nonetheless bought backup.

Simply kidding, my kids are excellent… for those who’re studying this.

These 5 ideas kind the spine of momentum buying and selling. However ideas alone aren’t sufficient— you want clear goal buying and selling guidelines.

That’s why I’ll now stroll you thru the principles of a momentum buying and selling system (backed by information)…

A momentum buying and selling system that works

Markets traded:

Shares within the Russell 1000 index

Timeframe:

Month-to-month

Danger administration:

10% capital for every inventory and a most of 10 positions

Buying and selling guidelines

- The Russell 3000 index is above the 10-month transferring common (to know when the general market is bullish).

- Rank the highest 10 shares which have elevated probably the most in value over the past 40 weeks (to outline sturdy momentum shares).

- Purchase the highest 10 shares utilizing a market order (the entry).

- Promote the inventory when it falls out of the highest 30 rating and substitute it with the following strongest momentum inventory (the exit sign)

- Promote all positions when the Russell 3000 closes under the 10-month transferring common (to know when to remain in money)

Backtest outcomes: Momentum buying and selling system

Right here’s the consequence over the past 25 years…

- Whole return: 6837% (since 2000)

- Annual return: 18.47%

- Successful fee: 51.88%

- Dropping fee: 48.12%

- Payoff ratio: 2.12 (common revenue / common loss)

- Most drawdown: 49.44%

Right here’s the fairness curve of the buying and selling system…

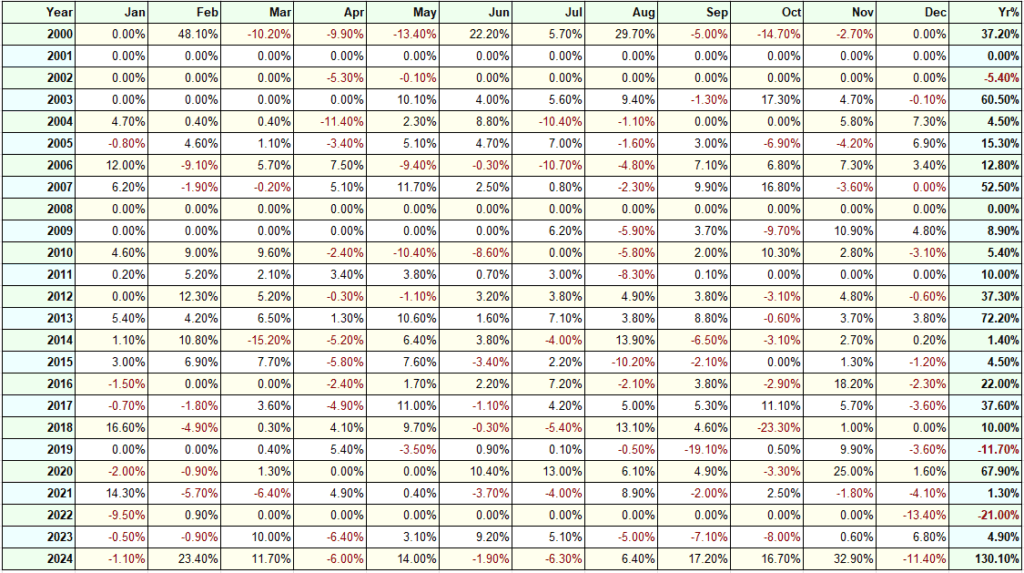

And the yearly returns…

Right here’s what one among my college students, Darren (from The Final Methods Dealer), has to say a couple of momentum buying and selling strategy…

“My MOMO portfolio is up greater than 40% since I began this method in June.” — Darren

Shifting on, let’s discuss in regards to the execs and cons of momentum buying and selling…

Execs and cons of momentum buying and selling

First, some great benefits of momentum buying and selling…

Benefits of momentum buying and selling

- Publicity to the best-performing shares

- Excessive revenue potential

- Minimal time required

Not like buyers who should analyse monetary experiences and observe the information to allow them to be uncovered to the perfect performing shares, a momentum buying and selling system means that you can mechanically get publicity to them with none of that “work”. That’s since you use value because the sign to inform you what’s sizzling and what’s not.

Since you’re at all times shopping for the strongest shares and promoting the weaker ones, you’ve gotten an enormous revenue potential. It’s not unusual to see your inventory rally 200%.

And at last, for this sort of momentum buying and selling system, you solely commerce as soon as per thirty days. This provides you the liberty to do the belongings you love with out having to analyse monetary experiences, examine chart patterns, or observe the information.

Subsequent, the disadvantages…

Disadvantages of momentum buying and selling

- Steep drawdown

- It is perhaps psychologically arduous to tug the set off

You solely commerce as soon as per thirty days (on the 1st buying and selling day of every month). This implies if the market makes a sudden decline throughout the month, you continue to have to carry your positions. If the market doesn’t get well, you may count on to endure a drawdown of 40 and even 50%.

As a momentum dealer, it may be psychologically arduous to tug the set off since you’re at all times shopping for at a “excessive value”.

I recalled that in March 2020, the inventory market tanked 30% due to COVID. Shortly, it bottomed out, and the inventory market climbed up in direction of the all-time excessive. At this level, are you able to think about having to purchase shares when the monetary information is full of negativity?

In occasions like this, you will need to tune out the noise, management your feelings, and observe the principles. If you are able to do it, you’d be up 67% for the yr. That’s the ability of methods buying and selling since you take away the guesswork and keep away from making emotional choices (which hardly ever finish properly).

So now the query is…

Is momentum buying and selling appropriate for you?

Right here’s my tackle it…

Momentum buying and selling is NOT for you if…

- You desire a excessive successful fee (60% or extra).

- You’re on the lookout for small and constant good points.

Momentum buying and selling is FOR you if…

- You need to spend minimal time on buying and selling.

- You need to catch huge strikes in shares.

- You need excessive returns and might embrace the volatility that comes together with it.

Now, you’ve gotten a good suggestion whether or not momentum buying and selling fits your persona and objectives.

Nonetheless, you might need a number of questions. So let’s sort out a number of the widespread ones I get from merchants quicker than I sort out the final slice of pizza…

Steadily requested questions

Can momentum buying and selling be utilized to different markets?

Sure. I’ve examined it on shares, ETFs, and even crypto.

How can I cut back the drawdown of a momentum buying and selling system?

You possibly can undertake a number of buying and selling methods. A very good complementary could be a imply reversion buying and selling system.

What’s the minimal capital requirement?

You will get began with $5000.

Can this work on the quick aspect?

I’ve not been in a position to make it work on the quick aspect and haven’t seen others speak about it both.

Conclusion

Momentum buying and selling works as a result of it exploits human psychology (FOMO) and the construction of the markets (earnings surprises and institutional flows).

Whenever you apply a rule-based strategy, you don’t have to predict or depend on intestine really feel; you merely observe the principles and let the system do the work. It’s like utilizing a GPS as a substitute of asking my spouse for instructions.

In fact, no buying and selling system is ideal. Momentum comes with volatility and drawdowns, and it requires the self-discipline to maintain shopping for when it feels uncomfortable. However for those who can embrace that, the rewards are price it since you get publicity to the strongest shares (the Usain Bolts of the market), outsized returns, and minimal time dedication.

So, if you wish to learn to implement a momentum inventory buying and selling system on your portfolio, then try The Final Methods Dealer. It’s a 1-year teaching program that exhibits you the way to earn an additional 15% a yr in quarter-hour a day, so you may generate one other supply of earnings. Particulars right here.