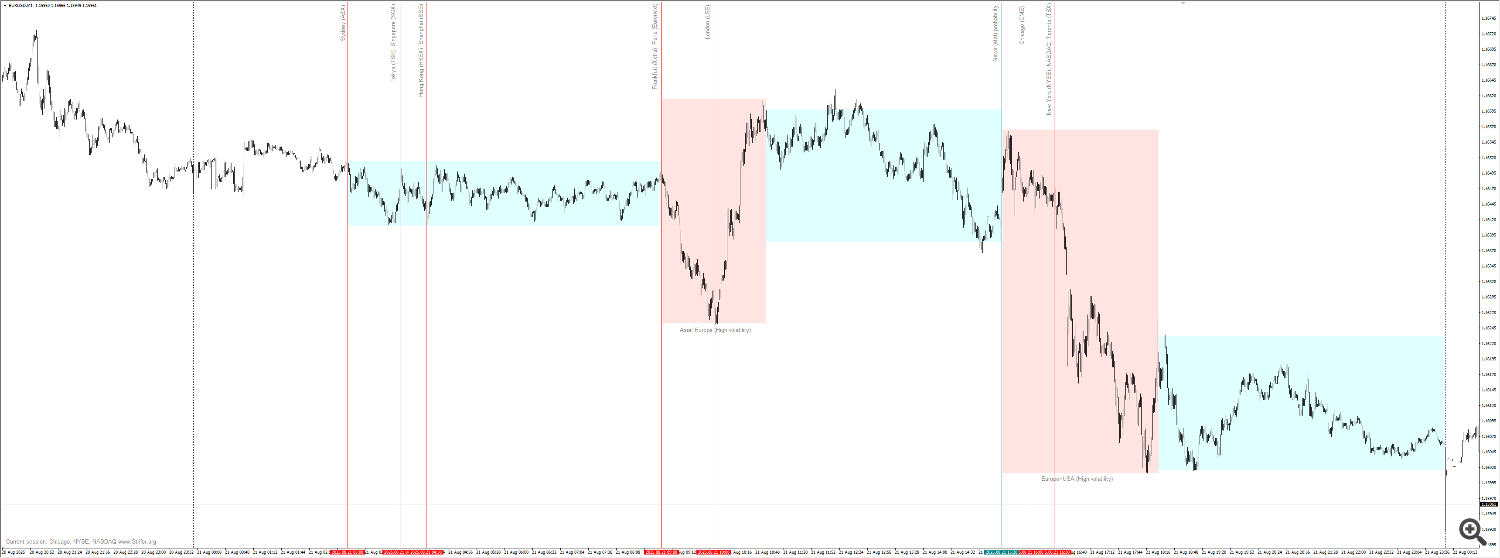

An asset’s worth motion usually peaks on the intersections of the primary buying and selling classes — Asian, European, and American. To assist merchants visualize these key time zones instantly on the chart, the Session Volatility Map indicator was created. This text explains its advantages and how one can use it successfully in buying and selling.

Background and Improvement

Beforehand, merchants needed to manually mark time zones for various classes — a course of that was time-consuming and susceptible to errors, particularly when brokers modified time zones.

The builders of Session Volatility Map got down to:

-

visually spotlight every session on the chart, exhibiting its title and the remaining time till it ends;

-

add versatile settings for time zones in addition to session begin and finish occasions;

-

make sure the indicator works appropriately throughout all timeframes.

Sensible Use and Advantages of Session Volatility Map

The indicator helps merchants to:

-

decide the optimum time to enter trades, when the probability of robust worth strikes is larger;

-

monitor highs and lows (Excessive / Low) of earlier classes, which frequently act as key assist and resistance ranges;

-

analyze volatility and assess the potential for worth motion;

-

handle timing — put together for information releases, lock in income earlier than market shut, or search for new entry alternatives;

-

filter trades — for instance, permit entries solely throughout particular hours or keep away from buying and selling throughout “useless zones.”

Session Volatility Map eliminates the necessity for guide session marking, reduces errors, and makes evaluation extra visible and intuitive. The indicator is particularly helpful for intraday merchants and scalpers, the place exact session consciousness instantly impacts outcomes.