The Balancer Protocol introduced that hackers had focused its v2 swimming pools, with losses reportedly estimated to be greater than $128 million.

Balancer is a decentralized finance (DeFi) protocol constructed on the Ethereum blockchain as an automatic market maker and liquidity infrastructure layer.

It supplies versatile swimming pools with customized token mixes, permitting customers to deposit belongings, earn charges, and let merchants swap belongings, and it’s ruled by the BAL token, which had a market cap of $65 million proper earlier than the incident.

Balancer has not shared many particulars concerning the incident however warned customers to be cautious towards potential scams or phishing makes an attempt.

Balancer confirmed as we speak that an exploit affected its V2 Compostable Secure Swimming pools at 7:48 AM UTC and that the difficulty doesn’t influence every other Balancer swimming pools, together with V3.

“Our crew is working with main safety researchers to grasp the difficulty,” the firm mentioned in an replace just a few hours in the past.

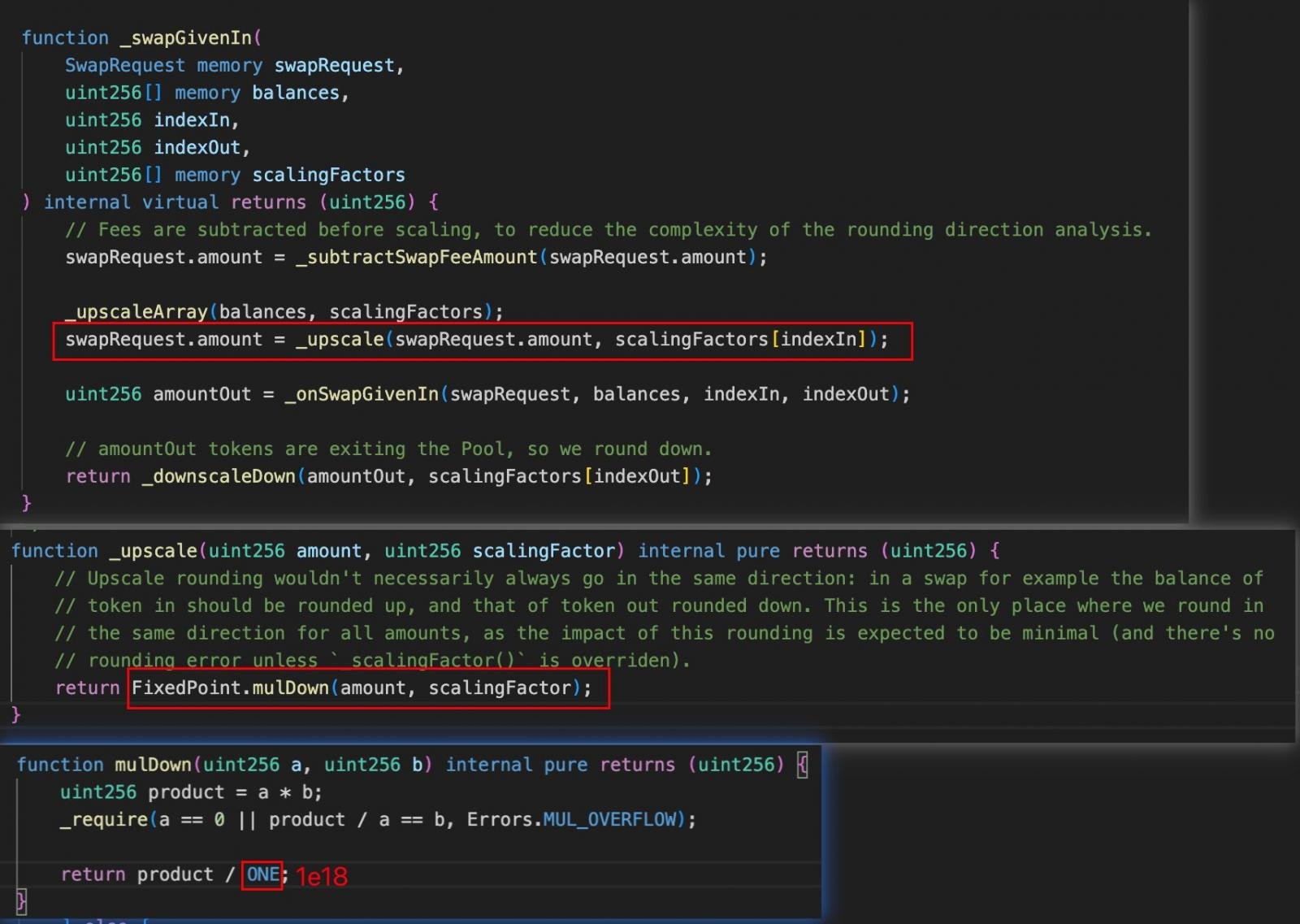

In keeping with GoPlus Safety, the Balancer V2 exploit stemmed from a precision rounding error within the Vault’s swap calculations.

Every swap operation rounded down token quantities, creating tiny discrepancies that the attacker may repeatedly exploit. By chaining a number of swaps by means of the batchSwap operate, these rounding losses compounded into a big worth distortion.

Supply: GoPlus Safety

Nonetheless, different customers claiming to know what occurred attribute the hack to improper authorization and callback dealing with inside Balancer’s V2 vaults.

In keeping with Aditya Bajaj, a maliciously deployed contract manipulated vault calls throughout pool initialization, successfully bypassing safeguards and enabling unauthorized swaps and stability manipulations throughout interconnected swimming pools.

Whereas there isn’t a settlement on the assault technique but, Balancer promised to share extra particulars concerning the hack “and a full autopsy as quickly as potential.”

It’s price noting that Balancer V2 has been audited 11 instances since 2021, with various examination scopes.

Try and trick the hacker

In the meantime, it seems that somebody tried to reap the benefits of the scenario by impersonating Balancer and providing the hacker a “white-hat bounty” of 20% of the stolen quantity in the event that they agreed to return the remainder of the funds to a particular tackle.

The phishing message is well-written and checks the methods to seem credible, together with the reward, a deadline, and a menace, all a part of a negotiation urgent for rapid cooperation.

If the hacker refuses the deal, the fraudster impersonating Balancer threatens to use all data they’ve from blockchain forensics consultants, regulation enforcement companies, and regulatory companions to determine and prosecute the attacker.

“Our companions have a excessive diploma of confidence you may be recognized from access-log metadata collected by our infrastructure, indicating connections from an outlined set of IP addresses/ASNs and related ingress timestamps that correlate with the transaction exercise on chain,” concludes the fraudulent message.

The Balancer hack is among the largest cryptocurrency heists in 2025. Though there isn’t a attribution, the best menace to DeFi entities is North Korean hackers.

As of October 3, the quantity of cryptocurrency linked to North Korean thefts this 12 months had exceeded $2 billion, with the biggest by far being the Bybit assault in February, once they stole $1.5 billion in cryptocurrency.