Are you listening to what the market is telling you or are you solely listening to your self? The market ‘speaks’ its personal language, that language is worth motion, and never solely do you want to be fluent within the language of worth motion, you additionally should be capable to apply what the value motion is telling you in an goal and impartial method.

Are you listening to what the market is telling you or are you solely listening to your self? The market ‘speaks’ its personal language, that language is worth motion, and never solely do you want to be fluent within the language of worth motion, you additionally should be capable to apply what the value motion is telling you in an goal and impartial method.

Watching the value charts of any given market is one thing you could do every single day if you wish to actually keep linked with that market and discover ways to commerce it. I like to consider following worth charts like studying a e-book – to grasp the story, you could learn every web page as a result of what occurred earlier than will enable you to make sense of what’s occurring now and the place the market may go subsequent.

The best way to ‘hear’ to what the market is telling you and apply it

Every day, on the shut of the market you must verify your favourite charts, it’s like studying a web page of the market’s story for that day. You’ll be able to see what occurred, who received the battle between the bulls and bears and whether or not any worth motion indicators fashioned in consequence. It’s necessary to make this a every day routine so that you simply don’t neglect what has occurred and what the market is doing, in any other case, it should take you a while to get again into sync with the market’s rhythm.

Whenever you have a look at a zoomed out every day worth chart or a weekly chart of any market, it’s not arduous to rapidly see the first route that market is headed. That is going to be the ‘proper’ route to commerce in, 90% of the time. But, time and time once more, merchants over-complicate this. Slightly than zooming out, and getting a really feel for the general dominant route of a market, many merchants wish to zoom in, additional and additional, right down to minute charts, the place they’re mainly seeing nothing however noise.

- The obvious route is normally the best route

For those who keep in mind nothing else from right this moment’s lesson, keep in mind this level: the obvious route is normally the best route. What meaning is mainly what I mentioned within the earlier paragraph – the first route, from left to proper {that a} zoomed out every day chart is transferring, is usually the route you wish to look to commerce. So, figuring out this route is step one of ‘listening’ to what the market is telling you. Don’t over-complicate it! Simply zoom the chart out and see which manner it’s usually transferring from left to proper.

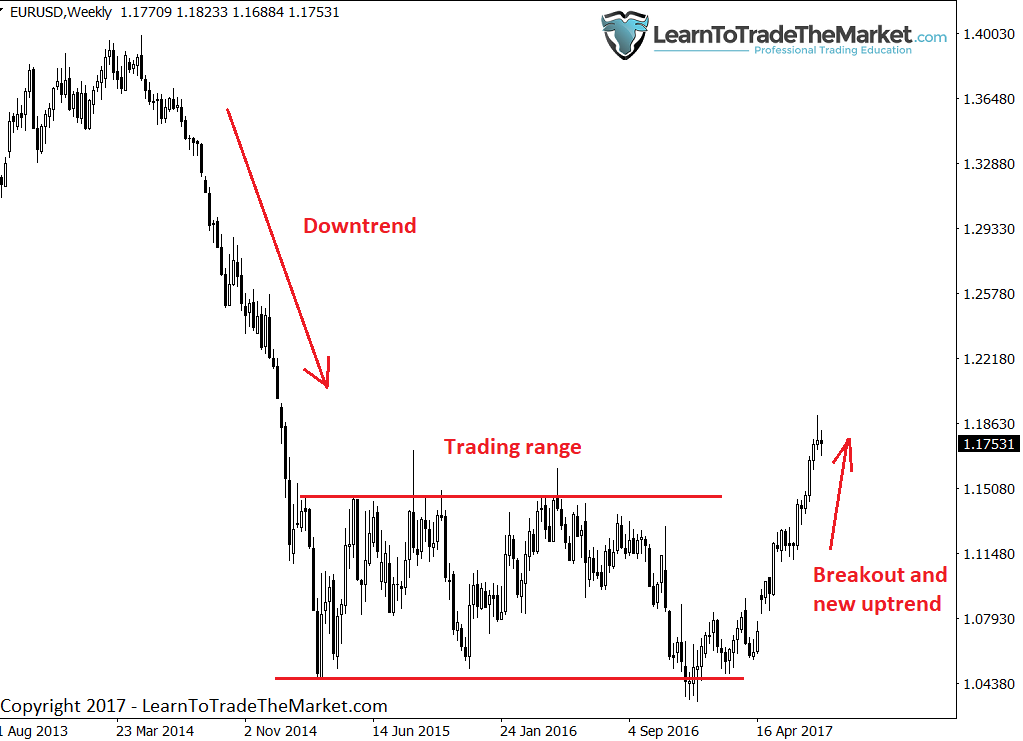

Have a look at the weekly EURUSD chart under, we’re trying again at about 4 years of worth information right here. That is the way you rapidly decide what the ‘story’ of a market is. On this chart, what I see is a big downtrend that unfolded, adopted by a big interval of consolidation inside a big buying and selling vary, and most just lately we will see worth broke up by that buying and selling vary and is now trending greater. So, the present most blatant route of this chart is up. You see how easy that is?

Subsequent, let’s transfer down one-time body, to the every day chart timeframe (my favourite). Right here, we will see the market discovered a variety of help at 1.0400 and has just lately taken out the highs at 1.1100 – 1.1300 and extra importantly, the highs of the earlier buying and selling vary up close to 1.1615.

That is the way you learn the market from left to proper. It’s not arduous, it’s similar to studying a e-book, you want to perceive the place the market has been and the place the important thing ranges are to grasp what is occurring now and what it might do subsequent…

We at all times wish to commerce in-line with the trail of least resistance. Within the EURUSD examples above, the present path of least resistance is up. So, meaning we are going to search for worth motion purchase indicators on pull backs to help or worth areas. The market will TELL YOU what the trail of least resistance is, all you could do is zoom out and ‘hear’.

- It solely pays to be contrarian generally, not at all times. Don’t let your ego take over.

While I’m a fan of contrarian pondering and contrarian buying and selling, the whole lot has its exceptions.

It’s necessary to not develop into so contrarian that you’re now not listening to what the market is telling you. For instance, in the event you get lengthy on a breakout that finally ends up changing into a failed breakout, don’t merely keep within the commerce since you really feel so strongly about it. For those who do, you might be now not listening to the market, you’re listening to solely your self. A false break is a like an enormous warning sign and you want to hear and take heed of that sign, not ignore it.

On this manner, worth motion may also help you exit unhealthy trades simply as it may well enable you enter a commerce. An enormous bearish or bullish tailed bar in opposition to your place or false breakout as simply talked about, can usually be a sign that the market goes to reverse, so in the event you arrogantly keep in a commerce even contemplating such a reversal sign, you aren’t listening to or buying and selling in-tune with the market, which is an excellent strategy to lose some huge cash, quick.

Bear in mind, commerce what you see, not simply what you assume, and don’t get emotionally hooked up to anybody commerce. Commerce in concord with the market, not in opposition to it.

- The significance of worth motion indicators

As we’re studying a market’s worth motion and ‘listening’ to what it’s making an attempt to inform us, one large apparent piece of knowledge that we have to pay particular consideration to, is a worth motion sign. Value motion indicators usually convey essential details about a market and so we have to not solely concentrate on them and looking out for them, however perceive what they may imply.

Maybe a very powerful factor about worth motion indicators, particularly these on the every day charts, is to not be the proverbial deer within the headlights once you see one. In different phrases, don’t freeze up and (or) panic once you see an apparent worth motion sign, don’t over-think. An apparent every day chart worth motion sign can act as both an entry sign or an exit sign and is one thing you must at all times be aware of both manner. They’re necessary clues within the ‘story’ the chart is making an attempt to inform you they usually can usually assist you determine what the market is more likely to do within the near-term.

- Confluence – once you see worth motion indicators at occasion areas or key ranges, the market is telling you one thing.

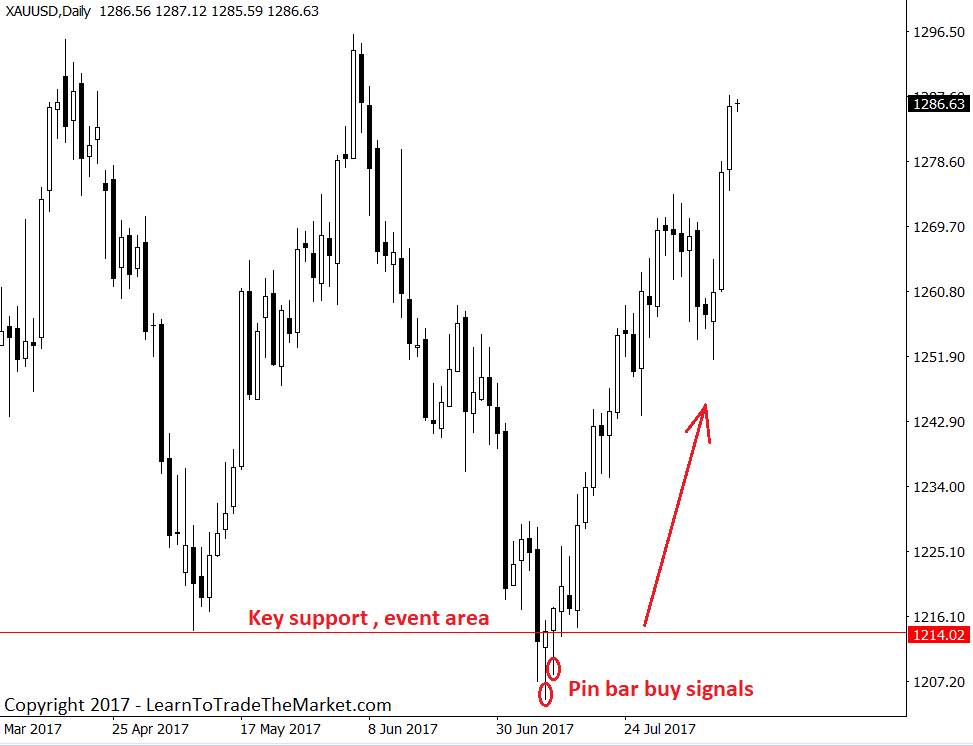

Let’s have a look at one other chart. You’ll discover within the Gold chart under, worth fashioned two bullish tailed pin bar indicators at a key help stage and occasion space down round $1215.00 – $1200.00; an space we had mentioned extensively in our members every day commerce setups commentary as a robust purchase space in early July. Whenever you get a transparent worth motion sign at a clearly apparent stage like this, you’re looking at a confluent worth motion sign and it is a core pillar of my buying and selling method…

Conclusion

As a starting dealer or as any dealer trying to be taught to commerce with worth motion, it’s vital you perceive learn and interpret the ‘story’ a chart is making an attempt to inform you. You do that by first studying to learn the chart from left to proper after which studying to interpret particular person worth bars. This will get simpler the extra you do it, however it can be crucial you verify in along with your favourite charts nearly every single day so that you simply keep linked and in-tune with the market.

Finally, you’ll start to develop a dealer’s instinct and once you see sure market situations or patterns, you’ll merely ‘know’ what the market is making an attempt to inform you, like a flashing mild saying, “I’ve seen this earlier than”. The journey of buying and selling by no means really ends, however if you’re keen about it, you’ll look ahead to studying learn the value motion and studying to ‘hear’ what the market is telling you.

I WOULD LOVE TO HEAR YOUR COMMENTS BELOW 🙂

QUESTIONS ? – CONTACT ME HERE