This text explains what harmonic patterns are, how merchants use them in several markets (particularly Foreign exchange), and the way they join with Fibonacci ratios, all based mostly on the work of Scott M. Carney.

Who’s Scott M. Carney?

Scott M. Carney is the president and founding father of HarmonicTrader.com.

He developed a full buying and selling strategy based mostly on worth sample recognition and Fibonacci measurements, generally known as Harmonic Buying and selling.

He launched and named a number of common harmonic patterns akin to:

-

The Bat Sample

-

The Gartley Sample

-

The Crab Sample

Carney additionally launched key ideas just like the Potential Reversal Zone (PRZ) and essential Fibonacci ranges akin to 0.886 and 38.2% retracements.

He’s a member of the Market Technicians Affiliation (MTA) and the American Affiliation of Skilled Technical Analysts (AAPTA).

He has printed 4 books on harmonic buying and selling:

-

The Harmonic Dealer (1999)

-

Harmonic Buying and selling of the Monetary Markets, Quantity 1 (2004)

-

Harmonic Buying and selling of the Monetary Markets, Quantity 2 (2007)

-

Harmonic Buying and selling, Quantity 3: Response vs Reversal (2016)

What Are Harmonic Patterns?

Harmonic buying and selling helps merchants establish high-probability reversal factors out there.

This strategy assumes that market actions — like many pure cycles — are likely to repeat themselves.

The aim is to establish these recurring worth patterns and commerce them when the chance of a pattern change is excessive.

Harmonic patterns work on all timeframes — from intraday charts (1H, 4H) to each day and weekly charts.

Swing merchants typically choose each day charts, whereas short-term merchants discover many alternatives on decrease timeframes.

The Core Concept

A very powerful a part of harmonic buying and selling is recognizing particular worth cycles that comply with exact Fibonacci ratios.

These ratios assist merchants establish potential reversal zones (PRZ) — areas the place the pure rhythm of the market is more likely to change route.

These reversals occur due to crowd psychology — merchants are likely to react in related methods at sure Fibonacci ranges.

Nonetheless, not all PRZ zones work completely.

It’s essential to analyze worth motion round these zones and search for affirmation indicators akin to candlestick patterns, quantity, or divergences.

If robust continuation candles or gaps seem, the sample could be invalid.

All the time watch for affirmation earlier than coming into a commerce.

Validating Harmonic Patterns

Every sample has strict guidelines based mostly on Fibonacci ratios.

Even small variations could make a sample invalid.

For instance:

The B level is crucial — it helps distinguish between similar-looking patterns just like the Bat and the Gartley.

On the PRZ (Potential Reversal Zone), merchants can use quantity or divergence indicators to verify whether or not the worth is able to reverse.

The Core AB=CD Sample

The AB=CD sample is the inspiration of most harmonic buildings.

It represents a measured and symmetrical transfer in worth that completes contained in the PRZ.

The Principal Harmonic Patterns by Scott Carney

Under are probably the most well-known harmonic patterns, their traits, and what they inform merchants.

1. The Gartley Sample

Found by H.M. Gartley, that is the unique harmonic sample.

It indicators potential reversals utilizing Fibonacci retracements and extensions.

Key options:

-

5 factors (X, A, B, C, D)

-

AB = 61.8% retracement of XA

-

BC = 38.2% or 88.6% of AB

-

CD = 127.2% (if BC = 38.2%) or 161.8% (if BC = 88.6%) of BC

-

CD = 78.6% retracement of XA

-

D = PRZ (Potential Reversal Zone)

📈 Instance: Bullish and Bearish Gartley patterns on EUR/USD (H4)

📈 Instance: Bearish Gartley patterns on EUR/USD (H4)

2. The ABCD Sample

The only harmonic sample with 4 factors and three worth swings.

As soon as legs AB and BC are outlined, the size of AB is projected from level C to seek out level D.

Key options:

-

BC = 61.8% or 78.6% of AB

-

CD = equal to AB (AB=CD)

-

Extensions could be 127.2% or 161.8%

-

D = completion level and PRZ

📈 Instance: Bullish AB=CD on EUR/JPY (H1)

📈 Instance: Bearish AB=CD on Gold Day by day.

3. The Bat Sample

Found by Scott Carney in 2001, this is among the most correct harmonic setups with a excessive success price.

Key options:

-

B level retracement: 38.2%–50% of XA (beneath 0.618)

-

BC retracement: 38.2%–88.6% of AB

-

CD retracement: as much as 88.6% of XA

-

CD extension: 161.8%–261.8% of AB

-

D = PRZ for potential reversal

📈 Instance: Bullish Bat on SP500 (Day by day)

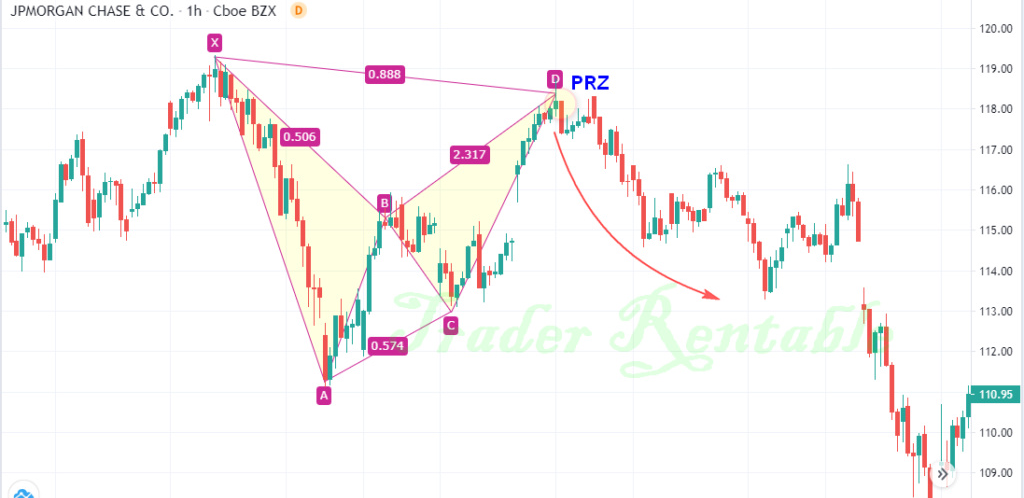

📈 Instance: The Bearish Bat on JP MOrgan Chase (H1)

4. The Crab Sample

One other exact sample from Scott Carney (2000).

It typically reveals very sharp reversals close to the PRZ.

Key options:

-

AB = ≤ 61.8% of XA

-

BC = 38.2% or 88.6% of AB

-

CD = 161.8% extension of XA

-

CD extension: 224%–361.8% of BC

-

D = PRZ (Potential Reversal Zone)

📈 Instance: Bullish Crab on Fb (15min)

📈 Instance: Double Bearish Crab Dow jones (M15).

5. The Butterfly Sample

Found by Bryce Gilmore and refined by Scott Carney.

It appears to be like just like the Gartley sample however has completely different Fibonacci ratios.

Key options:

📈 Instance: Bullish Butterfly on GBP/USD (H1)

📈 Instance: Bearish Butterfly on NETFLIX (M30)

6. The 5-0 Sample

Launched in Harmonic Buying and selling Quantity 2 by Carney.

It’s a retracement-based sample that focuses on the 50% stage of the BC leg.

Key options:

-

AB = 113%–161.8% extension of XA

-

BC = 161.8%–224% extension of AB

-

CD ends close to 50% retracement of BC

-

D = PRZ (entry level)

📈 Instance: Bullish 5-0 on EUR/USD (15min)

📈 Instance: Bearish 5-0 sample on AUD/USD (H1) .

7. The Shark Sample

Found by Scott Carney in 2011, the Shark sample is just like the Crab however consists of an prolonged C leg.

Key options:

📈 Instance: Bullish Shark on Nikkei 225 (5min)

📈 Instance: Bearish Shark, Bitcoin (M30).

Conclusion

Harmonic buying and selling is a sophisticated technical evaluation technique that mixes chart patterns with Fibonacci ratios to establish potential turning factors out there.

It may be utilized to Foreign exchange, shares, crypto, and commodities — on any timeframe.

Nonetheless, it requires persistence, apply, and strict cash administration.

Invalid ratios imply invalid patterns — and that’s the place many new merchants make errors.

All the time verify with candlestick indicators, quantity, or momentum indicators like MACD earlier than coming into a commerce.

Combining harmonic patterns with affirmation instruments helps you’re taking high-probability trades with minimal danger and robust revenue potential.

Our Weblog posts

Excel ProTrading Analytics Template