Markets ebb and circulate; they go up, they arrive down and so they transfer sideways. The first methods we make sense of those actions are analyzing the worth motion in addition to the degrees out there the place value bounced greater or rotated decrease, we name these ranges help and resistance.

Markets ebb and circulate; they go up, they arrive down and so they transfer sideways. The first methods we make sense of those actions are analyzing the worth motion in addition to the degrees out there the place value bounced greater or rotated decrease, we name these ranges help and resistance.

Assist and resistance ranges type the inspiration of technical evaluation and so they assist us construct a framework from which we are able to perceive the market. For value motion merchants, help and resistance ranges assist us plan our cease loss placements and revenue targets, however maybe extra importantly, these ranges give us a approach to make sense of the market by way of what it has performed, what it’s doing and what it’d do subsequent.

As I educate in a lot of my classes, my total buying and selling strategy will be summed up by the acronym T.L.S or Pattern – Degree – Sign. This lesson is primarily in regards to the L (ranges), I focus on the Pattern and Sign portion of T.L.S. in different classes, listed below are a pair:

A Full Information to Pattern Buying and selling

On this lesson, we is not going to simply be exhibiting you how to attract help and resistance ranges, however we are going to delve deeper and focus on how you can use these ranges to seek out high-probability trades in range-bound markets, decide traits, outline danger & targets and extra. I hope you take pleasure in this lesson and refer again to it usually, as it’s jam-packed with useful explanations and examples…

The 7 Most Necessary Kinds of Assist and Resistance & How you can Use Them…

- Conventional swing highs and lows

Maybe a very powerful help and resistance ranges are conventional swing highs and lows. These are ranges that we discover by zooming out to an extended time-frame, sometimes the weekly chart or probably even month-to-month. That is the place we get a ‘fowl’s eye view’ of the market and the key turning factors inside it. What we wish to do is solely determine the plain ranges that value both reversed greater or decrease at and draw horizontal traces at them. These ranges do not need to be ‘actual’, they might intersect value bars or they might be zones moderately than actual ranges. You may contemplate this step one with reference to help and resistance ranges and it’s the very first thing it is best to do when analyzing any chart.

Discover the ‘fowl’s eye view’ we get by zooming out to the weekly time-frame. Right here we are able to determine main help and resistance ranges, traits and buying and selling ranges…

Subsequent, we wish to zoom down a time-frame, to the day by day chart, to ‘high quality tune’ our ranges some extra. The day by day chart is the first time-frame for locating commerce setups, so it’s necessary we perceive the broader image on the weekly chart but in addition that we’ve got recognized the shorter-term ranges on the day by day. I’ve an excellent video on this subject of mapping the market from greater time frames to decrease, you should definitely test it out. One key level to recollect is that while you zoom into the day by day and even the 4 hour or 1 hour, you all the time go away the greater time-frame ranges in your chart as they’re crucial.

Subsequent, we wish to zoom down a time-frame, to the day by day chart, to ‘high quality tune’ our ranges some extra. The day by day chart is the first time-frame for locating commerce setups, so it’s necessary we perceive the broader image on the weekly chart but in addition that we’ve got recognized the shorter-term ranges on the day by day. I’ve an excellent video on this subject of mapping the market from greater time frames to decrease, you should definitely test it out. One key level to recollect is that while you zoom into the day by day and even the 4 hour or 1 hour, you all the time go away the greater time-frame ranges in your chart as they’re crucial.

Discover, by zooming into the day by day chart from the weekly instance above, a few of the identical weekly ranges are nonetheless in play in addition to some new shorter-term day by day chart ranges we couldn’t actually see on the weekly…

- Stepping swing level ranges in traits

Have you ever heard the saying “Outdated help turns into new resistance and outdated resistance turns into new help”? That is referring to the phenomenon of a market making greater highs and better lows or decrease highs and decrease lows, in an up or downtrend. We should always mark these ‘stepping’ ranges as they type, then when the market breaks down or up via them we are able to look to commerce on retracements again to these ranges, also referred to as buying and selling pull backs. This additionally provides us a approach to map the pattern of a market – while you see this stepping phenomenon you already know you might have a strong pattern in place.

These ranges are good entry factors in addition to factors to outline danger or cease loss factors. You may place your cease loss on different aspect of those ranges.

For instance, within the chart picture beneath, we see a transparent downtrend in place. As value broke down previous the earlier help degree, that degree ‘flipped’ to resistance ranges that act as high-probability entry ranges if value retraces again as much as them.

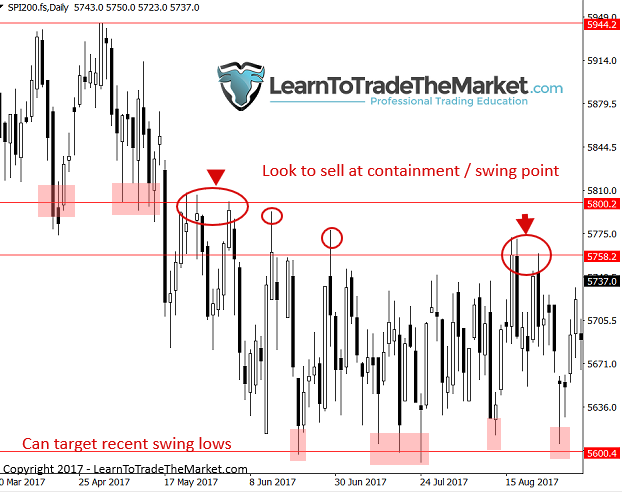

- Swing level ranges as containment and danger administration

We are able to look to promote or purchase at swing factors even when they don’t seem to be a part of a pattern. Markets spend a lot of their time consolidating and in buying and selling ranges, so we must always be capable of discover trades inside these market situations, not solely in traits.

We are able to merely use the latest swing excessive or low as a danger level to outline our subsequent commerce, which you’ll see within the chart instance beneath.

Within the picture beneath, discover that value broke decrease, down via help, then it stayed contained below that degree, which was then appearing as resistance. We might look to promote at that degree or simply beneath if value stayed contained beneath it. On this manner, that degree is defining the place we are going to look to take our subsequent commerce and we all know if value strikes past that degree our commerce thought is invalid, so putting our cease loss simply past that degree is clear. We are able to additionally use latest swing factors as revenue targets. Within the instance beneath, discover how we might use the latest swing lows as revenue targets.

- Dynamic help and resistance ranges

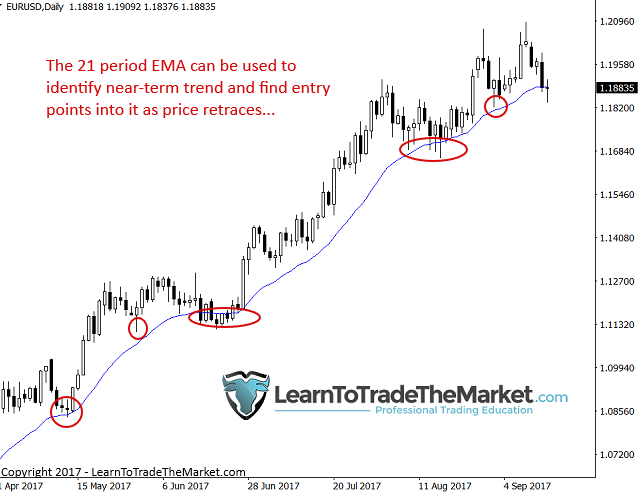

Subsequent, let’s speaking about dynamic help and resistance ranges. What I imply by dynamic is transferring ranges, in different phrases, transferring averages. A transferring common strikes up or down in line with what value is doing, and you’ll set it to think about a sure variety of bars or time intervals.

My private favorites are the 21 and 50 interval EMA or exponential transferring averages. I like to make use of them on the day by day chart time-frame largely, however they can be helpful on the weekly charts. These ema’s are good for rapidly figuring out the pattern of the market and for becoming a member of that pattern. We are able to look ahead to value to check the transferring common after breaking above or beneath it, after which look to enter at or close to that transferring common. Ideally, the market may have confirmed itself by testing the extent and bouncing beforehand, then you’ll be able to look to enter on that second retrace.

Right here is an instance of the 50 interval EMA getting used to determine a downtrend in addition to discover entry factors inside it. Ideally, we are going to search for a 1 hour, 4 hour or day by day chart value motion promote sign as value nears or hits that degree on a retrace again as much as it in a downtrend like this…

The 21 interval EMA can be utilized in the same method as we see beneath. Take note, the shorter the EMA interval the extra steadily value will work together with the EMA. So, in a much less unstable market it’s possible you’ll want to use a shorter interval ema just like the 21 moderately than an extended one just like the 50.

While I don’t use conventional Fibonacci retracements and all their many extension ranges, there’s a confirmed phenomenon that over time, markets usually maintain the midway level of a swing (circa 50 to 55% space), the place market makes big strikes, retraces, then bounces in authentic course. That is partly a self-fulfilling occasion and partly only a results of regular market dynamics. To be taught extra, checkout this lesson on How I Commerce 50% Retracements.

Have a look at this instance chart exhibiting a big up transfer that retraced roughly to the 50% degree on two completely different events, offering a really high-probability entry state of affairs, particularly on the second bounce…

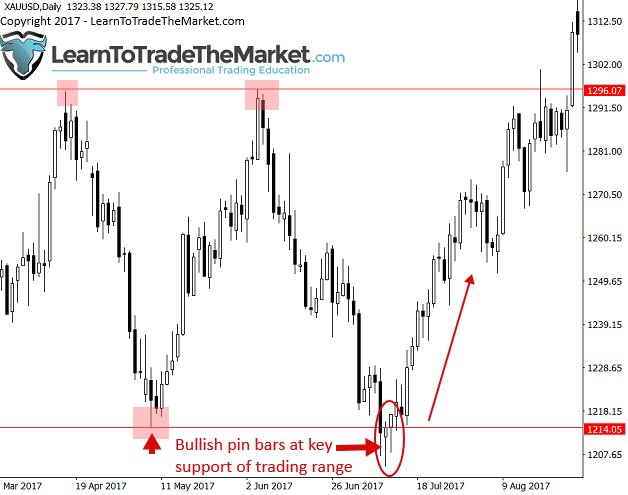

- Buying and selling vary help and resistance ranges

Buying and selling vary help and resistance ranges can present many high-probability entry alternatives for the savvy value motion dealer. The primary thought is to first determine a buying and selling vary, which is mainly simply value bouncing between two parallel ranges out there, after which search for value motion alerts at these ranges or look to fade the extent on a blind entry. By fade the extent, I imply if the market is transferring up and on the key resistance of the vary, look commerce the alternative manner, i.e. promote. Or, you look to purchase the help of the vary. You may actually do that till value clearly breaks and closes exterior of the vary. It is a MUCH higher strategy than the one most merchants absorb buying and selling ranges – making an attempt to foretell the breakout earlier than it occurs and always getting whipsawed as value reverses again into the vary.

Observe, within the instance picture beneath, we had a big buying and selling vary as value was clearly oscillating between resistance and help. We might have entered on the second check of resistance (brief) or on the second check of help (lengthy) both blindly or on a value motion sign just like the pin bar alerts we see on the help beneath.

- Occasion space help and resistance

The ultimate sort of help or resistance we’re going to focus on in the present day is occasion areas. Occasion areas are a proprietary type of help and resistance that I increase on intimately in my value motion buying and selling course, however, for now, let’s be sure to have an excellent primary understanding of them.

Occasion areas are key ranges out there the place a significant value motion occasion occurred. This could be a large reversal or clear value motion sign both of which led to a robust directional transfer.

Within the instance chart beneath, you’ll be able to see a transparent occasion degree that was fashioned after a robust bearish reversal bar on the weekly chart (there was additionally a big day by day chart bearish pin bar there). As value approached that degree on a retrace some months later, we’d have wished to you should definitely have that degree on our charts because it was a robust degree to look to promote at both on a blind entry or on a 1 hour, 4 hour or day by day chart promote sign.

Conclusion

I hope you might have loved this help and resistance tutorial. We’ve gone over the key varieties of help and resistance and the way I exploit them as indications of market situation (trending or vary certain), ranges to look to purchase or promote from, ranges to outline danger and as a framework to know what the market has performed, what it’s doing and what it’d do subsequent. Once you mix a strong understanding of help and resistance ranges with value motion and market traits, you might have the triumvirate of buying and selling: T.L.S, which you’ll be taught far more about in my Worth Motion Buying and selling Course.

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW 🙂

Any questions or suggestions? Contact me right here.