I’m nervous concerning the monetary nihilism creeping into Gen Z Canadians. To be honest, the deck is stacked towards them: housing prices are out of attain, employment markets are shaky, wages aren’t maintaining tempo with inflation, and scholar debt lingers for years.

However that’s no cause to throw up your arms and gamble on altcoins, penny shares, or choices. Too many individuals don’t notice simply how highly effective compounding might be in a tax-sheltered account if you merely earn the market common.

So, let’s take a look at a real-world historic instance, utilizing one in all my favorite investments: Vanguard S&P 500 ETF (NYSEMKT:VOO).

How compounding works

The S&P 500 is made up of 500 of the biggest American firms throughout all 11 inventory market sectors, and VOO tracks it passively. The index is weighted by market capitalization, which suggests the larger an organization grows, the extra of it you personal robotically.

This design makes the fund self-cleaning—winners rise to the highest, laggards get left behind, and also you don’t must predict which firms will succeed forward of time.

Over time, these 500 companies will promote extra merchandise, ship extra providers, purchase rivals, and generate rising income. That worth will get returned to traders both by way of quarterly dividends or share buybacks, each of which enhance your returns.

Reinvested dividends specifically create a snowball impact: the shares you purchase together with your dividends generate extra dividends in flip, and the cycle continues.

The proof for investing

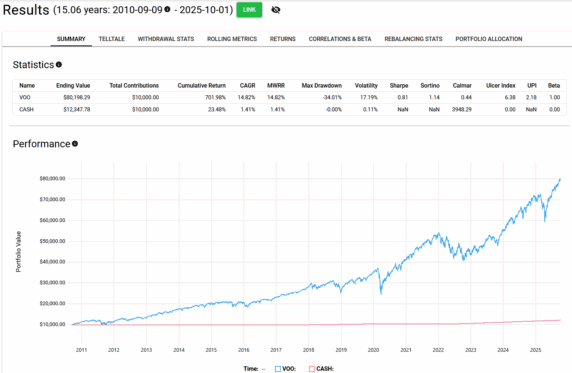

Don’t take it from me—take a look at the numbers. Over the previous 15 years, a $10,000 funding in VOO grew to greater than $80,000, whereas the identical cash left in money barely reached $12,000. That’s the distinction between a 701% cumulative return within the inventory market versus simply 23% in a financial savings account. The compound annual progress price (CAGR) for VOO was practically 15% versus simply over 1% for money.

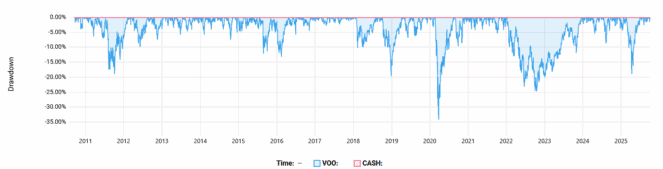

After all, this progress didn’t come free. VOO traders needed to stand up to volatility, together with a most drawdown of -34% in the course of the interval. The second chart exhibits simply how typically shares dip beneath earlier highs. However for many who stayed invested, the long-term pattern overwhelmingly rewarded endurance.

The Silly takeaway

The information makes one level crystal clear: the sooner and extra persistently you make investments, the larger the rewards of compounding. Even modest quantities, like $1,000, can snowball right into a life-changing sum over many years when left to develop in a low-cost broad-market index ETF like VOO. You don’t want to select shares, time the market, or gamble on high-risk trades—simply commit to purchasing steadily, reinvesting dividends, and letting time do the heavy lifting.