Right here’s the underside line up entrance: no, Algonquin Energy & Utilities Corp. (TSX:AQN) shouldn’t be a superb dividend inventory to purchase in case your objective is creating wealth out of your investments.

The corporate remains to be battling detrimental leveraged free money circulate, a dangerously excessive debt-to-equity ratio, and an unsustainable payout when measured towards distributable money circulate. On prime of that, administration has repeatedly diluted shareholders, treating them as a lifeline relatively than companions.

In case your cause for taking a look at AQN is to safe excessive dividend yields from utilities, there are higher decisions. One exchange-traded fund (ETF) that holds a basket of main utilities and pays a horny month-to-month yield is the Hamilton Enhanced Utilities ETF (TSX:HUTS). Right here’s why I prefer it.

How HUTS works

HUTS tracks the Solactive Canadian Utility Companies Excessive Dividend Index, however this index takes a broader, extra forward-looking view of “utilities” than conventional benchmarks.

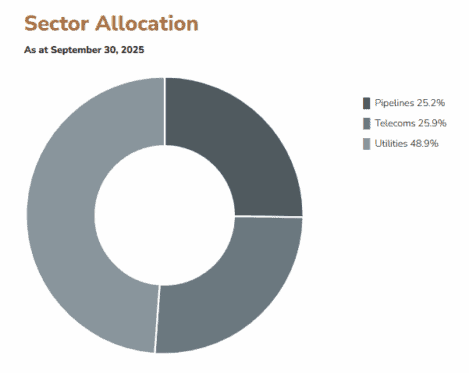

As an alternative of limiting itself to regulated energy and gasoline corporations, it additionally consists of pipelines – technically labeled below vitality – and telecom corporations, which fall below communications.

That issues as a result of pipelines behave very similar to utilities, with regulated, tollbooth-style money flows. Telecom corporations additionally match the profile, providing important providers with recurring revenues and powerful dividend histories.

By mixing utilities, pipelines, and telecoms, the index captures a wider set of important service suppliers, making a extra diversified and resilient portfolio than the normal S&P/TSX Capped Utilities Index, which is narrower and extra uncovered to energy and gasoline.

HUTS leveraged defined

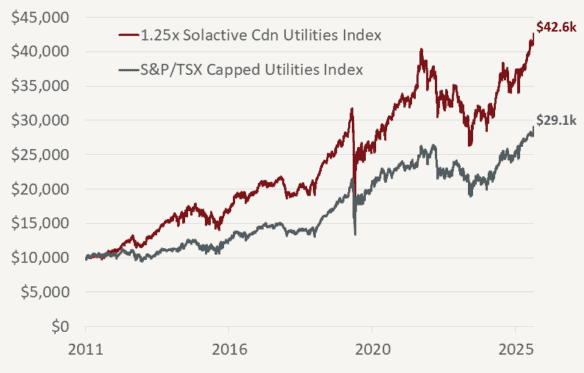

HUTS employs modest leverage of 1.25 instances. For each $100 invested, the fund borrows one other $25 at institutional charges. That leverage lets you personal extra of the underlying shares with out managing margin your self, and in contrast to borrowing straight, it may be held inside registered accounts like a TFSA or RRSP.

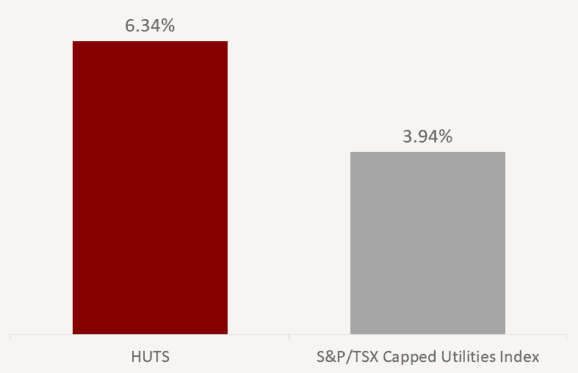

The impact is magnified publicity – each on the upside and draw back – but in addition increased yield. Proper now, HUTS pays a 6.3% distribution yield with month-to-month payouts.

Furthermore, the Solactive Index it tracks has traditionally outperformed the better-known S&P/TSX Capped Utilities Index in each yield and uncooked efficiency after factoring within the 1.25 instances leverage.

The Silly takeaway

Don’t pin your dividend revenue on a single, closely indebted, and poorly managed utility. An ETF like HUTS spreads threat throughout the sector and makes use of modest leverage to spice up revenue, supplying you with month-to-month yield with out the luggage of corporations like Algonquin.